Earnings summaries and quarterly performance for Oscar Health.

Executive leadership at Oscar Health.

Mark Bertolini

Chief Executive Officer

Adam McAnaney

Chief Legal Officer

Janet Liang

President of Oscar Insurance

Joshua Kushner

Vice Chair of the Board

Mario Schlosser

President of Technology and Chief Technology Officer

R. Scott Blackley

Chief Financial Officer

Board of directors at Oscar Health.

Research analysts who have asked questions during Oscar Health earnings calls.

Jessica Tassan

Piper Sandler

6 questions for OSCR

Joshua Raskin

Nephron Research

6 questions for OSCR

John Ransom

Raymond James

5 questions for OSCR

Jonathan Yong

UBS

4 questions for OSCR

Stephen Baxter

Wells Fargo & Company

4 questions for OSCR

Adam Ron

Bank of America Corporation

2 questions for OSCR

Craig Jones

Stifel Financial Corp.

2 questions for OSCR

Michael Ha

Robert W. Baird & Co.

2 questions for OSCR

Olivia

Morgan Stanley

2 questions for OSCR

Raj Kumar

Stephens

2 questions for OSCR

Stephen Baxter

Wells Fargo

2 questions for OSCR

Tiffany Anand

Barclays

2 questions for OSCR

Andrew Mok

Barclays

1 question for OSCR

Dave Windley

Jefferies LLC

1 question for OSCR

David Windley

Jefferies Financial Group Inc.

1 question for OSCR

Hua Ha

Robert W. Baird & Co. Incorporated

1 question for OSCR

Joanna Deetrup

Bank of America

1 question for OSCR

John W. Young

UBS

1 question for OSCR

Michael Halloran

Baird

1 question for OSCR

Sam Beckeron

Goldman Sachs

1 question for OSCR

Sam Begren

Goldman Sachs

1 question for OSCR

Recent press releases and 8-K filings for OSCR.

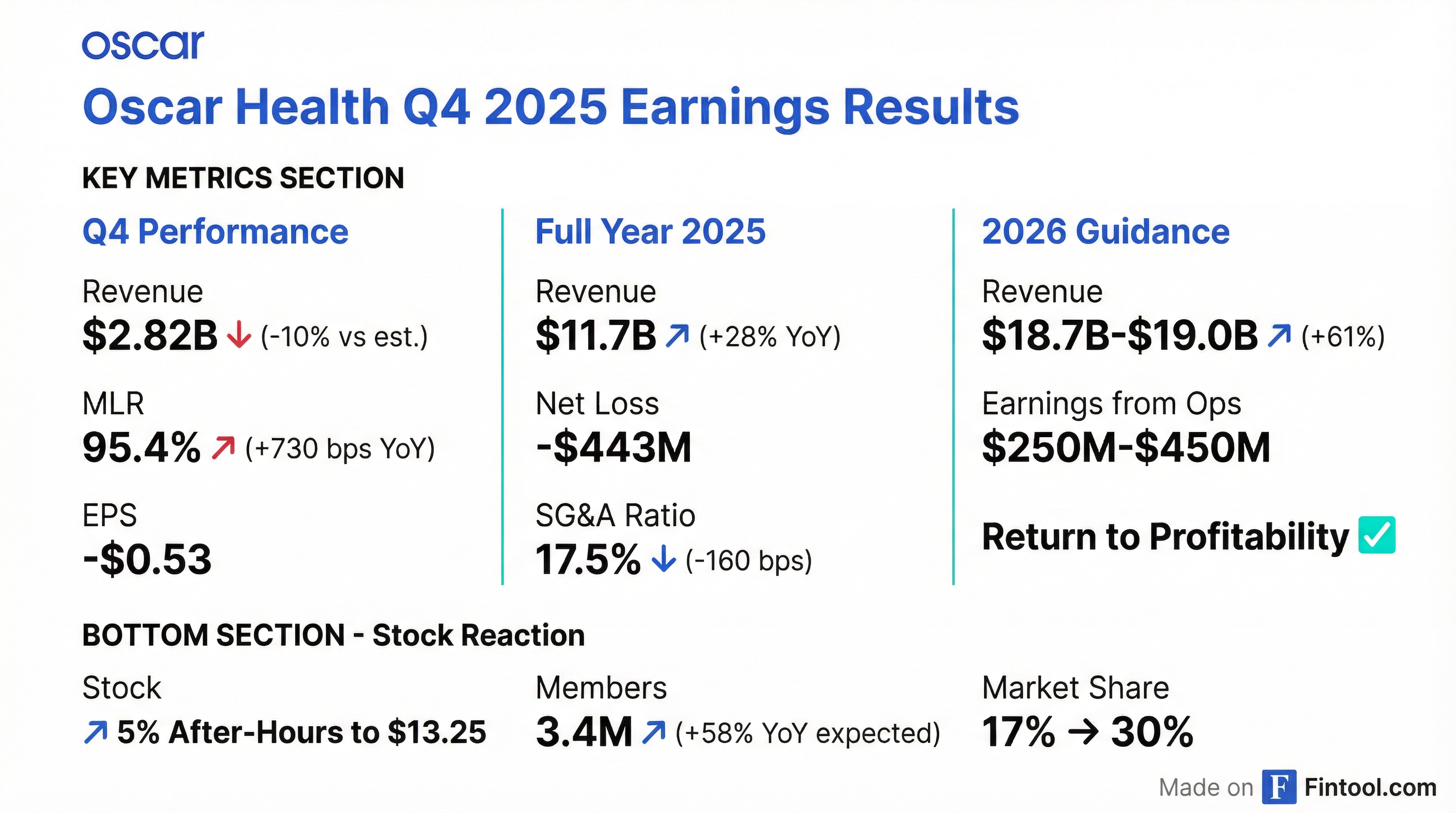

- Oscar Health reported Q4 and Full Year 2025 total revenue of $11.7 billion, marking a 28% increase year-over-year, and a 2025 loss from operations of $396 million.

- For 2026, the company projects total revenues between $18.7 billion and $19 billion, representing a 61% year-over-year increase at the midpoint, and anticipates returning to profitability with earnings from operations in the range of $250 million to $450 million.

- Membership grew significantly, reaching 3.4 million members as of February 1, 2026, with an expectation of approximately 3 million paid members by the start of Q2 2026, a 58% year-over-year increase.

- The company anticipates improved financial metrics in 2026, with the Medical Loss Ratio (MLR) projected between 82.4%-83.4% (a 450 basis point improvement) and the SG&A expense ratio between 15.8%-16.3% (a 140 basis point improvement).

- Oscar Health noted a significant shift in its membership mix, with Bronze plans increasing to 39% (from ~25%) and Gold plans to 25% (from 3-4%), while Silver plans decreased to 36% (from ~71%).

- Oscar Health reported Full Year 2025 total revenue of $11.7 billion, a 28% increase year-over-year, but incurred a loss from operations of $396 million and an Adjusted EBITDA loss of $280 million.

- The company anticipates a return to profitability in 2026, projecting total revenues between $18.7 billion and $19 billion, a 61% year-over-year increase at the midpoint, and expects earnings from operations of $250 million-$450 million.

- Oscar Health forecasts significant improvements in efficiency for 2026, with the Medical Loss Ratio (MLR) expected to be 82.4%-83.4% (a 450 basis point improvement at the midpoint) and the SG&A expense ratio projected at 15.8% to 16.3% (a 140 basis point improvement at the midpoint).

- Membership reached 3.4 million as of February 1, 2026, with an expectation of 3 million paid members by the start of Q2, representing a 58% increase year-over-year, and market share grew from 17% in 2025 to 30% in 2026.

- Oscar Health reported $11.7 billion in total revenue for Full Year 2025, a 28% year-over-year increase, but recorded a $396 million loss from operations, primarily due to higher market morbidity.

- Membership grew to 3.4 million as of February 1, 2026, with an expectation of 3 million paid members by Q2 2026, representing a 58% year-over-year increase.

- The company's market share expanded from 17% in 2025 to 30% in 2026, driven by strategic pricing, product innovation, and increased broker partnerships.

- For 2026, Oscar Health projects a return to profitability, with total revenues expected to be between $18.7 billion and $19 billion, a 61% increase year-over-year at the midpoint.

- The 2026 outlook includes anticipated earnings from operations of $250 million to $450 million, alongside an improved Medical Loss Ratio of 82.4%-83.4% and an SG&A expense ratio of 15.8%-16.3%, reflecting efficiency gains and AI advancements.

- Oscar Health, Inc. reported full-year 2025 total revenue of $11.7 billion and a net loss attributable to Oscar Health, Inc. of $443.2 million.

- The company reported 2.0 million members as of December 31, 2025, and announced achieving record membership of approximately 3.4 million.

- For full-year 2026, Oscar Health provided guidance projecting total revenue between $18.7 billion and $19.0 billion and Earnings from Operations between $250 million and $450 million.

- On February 6, 2026, Oscar Health entered into a $475.0 million secured three-year revolving credit facility for general corporate purposes.

- Oscar Health reported a net loss attributable to Oscar Health, Inc. of $(443.2) million for the full year 2025, compared to a net income of $25.4 million for the full year 2024, on total revenue of $11.7 billion.

- The company provided a full-year 2026 revenue outlook of $18.7 billion to $19.0 billion and anticipates earnings from operations between $250 million and $450 million.

- Membership reached approximately 2.0 million as of December 31, 2025.

- Oscar Health secured a $475 million secured three-year revolving credit facility on February 6, 2026.

- Oscar Health reported Q4 2025 revenue of $2.81 billion, missing forecasts, and a GAAP loss of $1.24 per share.

- The company faced surging medical costs, with a Q4 medical loss ratio (MLR) of 95.4% and a full-year MLR of 87.4%, contributing to a full-year net loss of $443.2 million and negative Adjusted EBITDA.

- Management provided 2026 guidance targeting total revenue between $18.7 billion and $19.0 billion, an MLR of 82.4%–83.4%, and an SG&A expense ratio of 15.8%–16.3%, with a goal of achieving profitability in 2026.

- Despite profitability deterioration, free cash flow margin improved materially to 23.6% year-over-year from 14.2%.

- Oscar Health has become more competitive in its 2026 pricing, now being the lowest cost in 30% of its markets, an increase from 15% in 2025. The company anticipates a 20-30% market contraction in 2026 due to the expiration of enhanced subsidies, but has prepared its pricing and strategy for this scenario.

- Early open enrollment results are "really going well" with "strong outcomes", and the company is "incredibly pleased" with the traction of its plan designs, despite expecting historically low retention due to subsidy loss.

- The company maintains a strong capital position with over $1 billion in excess capital and parent cash, and utilizes quota share arrangements to reduce its capital burden, positioning it well for potential growth.

- The primary risk identified for 2026 is the accurate pricing of market morbidity by the company and its competitors.

- Oscar Health is launching affordable, tech-powered health plans for individuals, families, and businesses in Southern Florida (Broward, Martin, Miami-Dade, Palm Beach, and Saint Lucie counties), with coverage beginning January 1, 2026.

- Enrollment for these new plans will open on November 1, 2025.

- The new offerings include Oscar Bronze, Silver, and redesigned Gold Plans, a personal health AI agent named Oswell, HelloMeno (a menopause plan), and condition-focused plans for chronic diseases, offering benefits like $0 virtual urgent and primary care visits and potential annual savings of up to $900.

- As of September 30, 2025, Oscar Health served approximately 2.1 million members.

- Oscar Health reported Q3 2025 total revenue of approximately $3 billion, marking a 23% increase year over year, alongside a net loss of $137 million and an adjusted EBITDA loss of $101 million.

- The Medical Loss Ratio (MLR) for Q3 2025 was 88.5%, an increase of approximately 380 basis points year over year, while the SG&A expense ratio improved by approximately 150 basis points to 17.5%.

- The company reaffirmed its full-year 2025 guidance, expecting total revenue towards the low end of $12 billion-$12.2 billion and a full-year MLR in the range of 86.0%-87.0%.

- Oscar ended Q3 2025 with 2.1 million members, a 28% increase year over year, and strengthened its capital position by completing a $410 million convertible notes offering and entering an agreement to redeem $305 million convertible senior notes.

- For 2026, Oscar anticipates returning to profitability and has implemented a weighted average rate increase of approximately 28% in its rate filings, while also eliminating approximately $60 million in administrative costs.

- Oscar Health reported total revenue of $2,985,984 thousand for the third quarter ended September 30, 2025, with a net loss attributable to Oscar Health, Inc. of $(137,450) thousand and an Adjusted EBITDA loss of $(101,453) thousand.

- The company reaffirmed its full year 2025 outlook, projecting total revenue between $12.0 billion and $12.2 billion, and CEO Mark Bertolini stated confidence in returning to profitability in 2026.

- Total membership increased to 2,116,904 as of September 30, 2025, compared to 1,654,284 members as of September 30, 2024.

- Oscar Health completed a partial settlement of $187,500,000 aggregate principal amount of its 7.25% convertible senior notes due 2031, exchanging them for 23,273,179 shares of Class A common stock on November 5, 2025.

Quarterly earnings call transcripts for Oscar Health.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more