Earnings summaries and quarterly performance for PATRICK INDUSTRIES.

Executive leadership at PATRICK INDUSTRIES.

Andrew Roeder

Executive Vice President—Finance, Chief Financial Officer and Treasurer

Andy Nemeth

Chair of the Board

Hugo Gonzalez

Executive Vice President—Operations and Chief Operating Officer

Jake Petkovich

President—Marine

Jeff Rodino

President

Joel Duthie

Executive Vice President, Chief Legal Officer and Secretary

Kip Ellis

President—Powersports, Technology, and Housing

Matthew Filer

Senior Vice President of Finance and Chief Accounting Officer

Board of directors at PATRICK INDUSTRIES.

Research analysts who have asked questions during PATRICK INDUSTRIES earnings calls.

Daniel Moore

CJS Securities, Inc.

6 questions for PATK

Noah Zatzkin

KeyBanc Capital Markets

6 questions for PATK

Craig Kennison

Robert W. Baird & Co. Incorporated

5 questions for PATK

Tristan Thomas-Martin

BMO Capital Markets

5 questions for PATK

Alexander Perry

Bank of America

3 questions for PATK

Joseph Altobello

Raymond James & Associates, Inc.

3 questions for PATK

Michael Swartz

Truist Securities

3 questions for PATK

Scott Stember

ROTH MKM

3 questions for PATK

Jack Weisberger

Roth Capital Partner, LLC

2 questions for PATK

Joe Altobello

Raymond James

2 questions for PATK

Michael Albanese

The Benchmark Company, LLC

2 questions for PATK

Mike Albanese

EF Hutton

2 questions for PATK

Alice Wycklendt

Robert W. Baird & Co.

1 question for PATK

Brandon Rollé

D.A. Davidson

1 question for PATK

Tristan Thomas Martin

BMO Capital Markets

1 question for PATK

Recent press releases and 8-K filings for PATK.

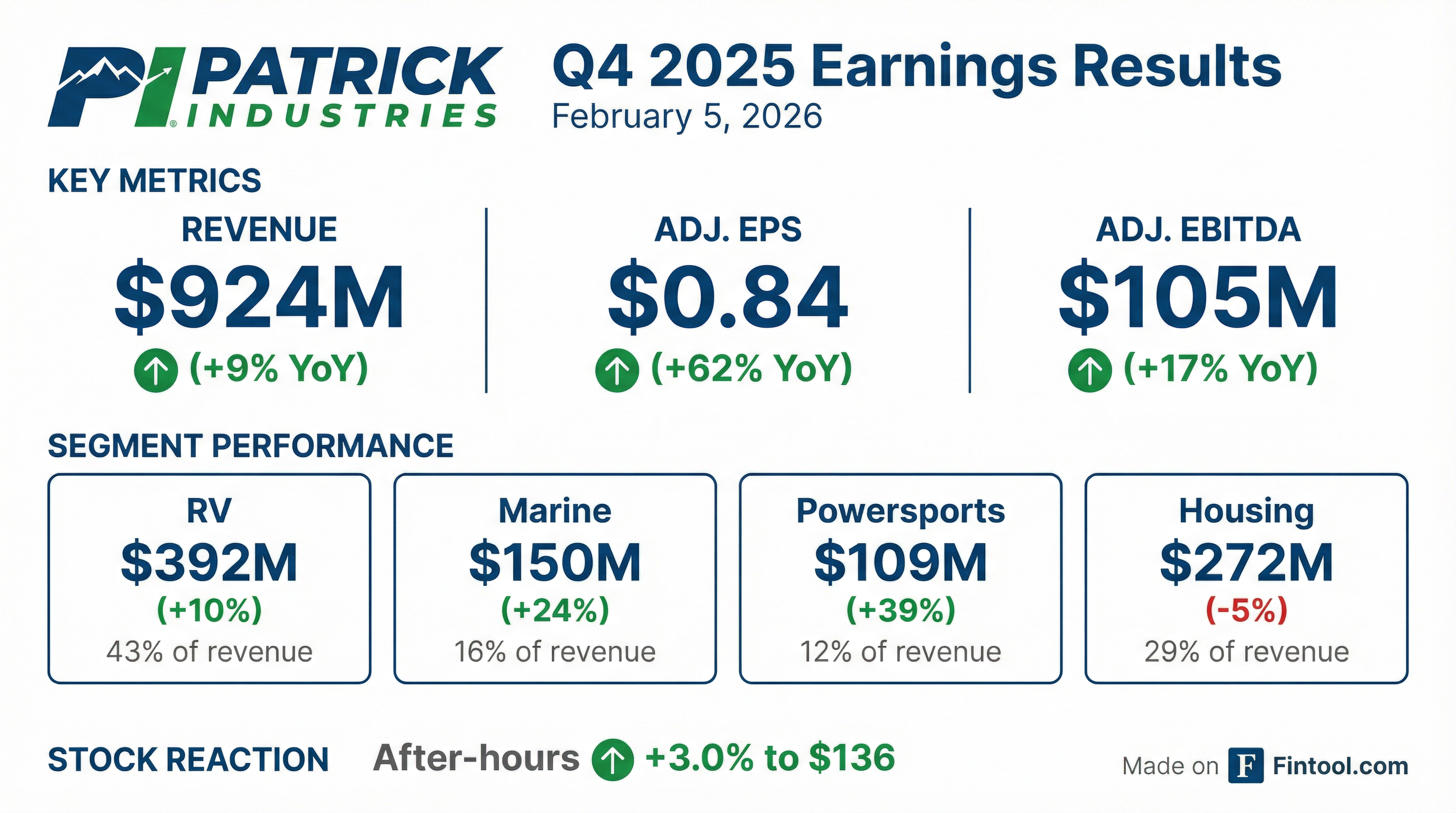

- For Q4 2025, Patrick Industries reported net sales of $924 million, a 9% increase, and Adjusted Earnings Per Diluted Share of $0.84. For the full year 2025, net sales increased 6% to approximately $4 billion, with Adjusted Earnings Per Diluted Share at $4.44.

- The company achieved $246 million in free cash flow for the full year 2025 and ended Q4 2025 with $818 million in available liquidity. Net leverage was 2.6 times at the end of Q4 2025, down from 2.8 times at the end of Q3 2025.

- In 2025, Patrick Industries invested $122 million in acquisitions, including Medallion Instrumentation Systems, Quality Engineered Services, Egis Group, LilliPad Marine, and Elkhart Composites, enhancing its Marine full solutions platform and composite capabilities. The company also returned $87 million to shareholders through dividends and share repurchases.

- For 2026, the company estimates its adjusted operating margin will improve by 70 to 90 basis points versus 2025, with estimated operating cash flow between $380 million and $400 million, and free cash flow of approximately $300 million or more.

- Matthew Filer assumed the role of CFO, succeeding Andy Roeder.

- Patrick Industries reported Q4 2025 net sales of $924 million, a 9% increase, and full-year 2025 net sales of approximately $4 billion, up 6%.

- Adjusted Earnings Per Diluted Share were $0.84 for Q4 2025 and $4.44 for the full year 2025.

- In 2025, the company completed several strategic acquisitions, including Medallion Instrumentation Systems, Quality Engineered Services, Egis Group, LilliPad Marine, and Elkhart Composites, investing $122 million in M&A.

- Patrick Industries generated $246 million in free cash flow for 2025, increased its dividend by 17.5%, and repurchased approximately 377,600 shares for $32 million.

- For 2026, the company projects an improvement in adjusted operating margin by 70 to 90 basis points and anticipates free cash flow of approximately $300 million or more.

- Patrick reported Q4 2025 net sales of $924 million, an increase of 9% year-over-year, with an Adjusted Operating Margin of 6.3% and Adjusted Diluted EPS of $0.84.

- The growth in Q4 2025 net sales was primarily driven by the Outdoor Enthusiast markets, with RV revenue up 10%, Marine revenue up 24%, and Powersports revenue expanding 39% to $109 million.

- Conversely, Housing revenue decreased 5% to $272 million in Q4 2025, reflecting softer manufactured housing wholesale unit shipments.

- For the full year 2025, Patrick achieved Net Sales of $3,951 million, Adjusted Diluted EPS of $4.44, and Free Cash Flow of $246 million.

- The company projects a FY 2026 Adjusted Operating Margin increase of 70-90 basis points and Free Cash Flow of $300 million+.

- Patrick Industries reported net sales of $924 million for Q4 2025, a 9% increase, and approximately $4 billion for the full year 2025, a 6% increase. Adjusted Earnings Per Diluted Share was $0.84 for Q4 2025 and $4.44 for the full year.

- The company achieved a gross margin of 23% in Q4 2025 and 23.1% for the full year, with adjusted operating margin expanding 110 basis points to 6.3% in Q4 2025 and reaching 7% for the full year.

- In 2025, Patrick Industries generated $246 million in free cash flow, invested $122 million in acquisitions, and returned $87 million to shareholders through dividends and share repurchases, while reducing net leverage to 2.6 times.

- Strategic acquisitions in 2025 included Medallion Instrumentation Systems, Quality Engineered Services, Egis Group, and LilliPad Marine to bolster its Marine platform, and Elkhart Composites to enhance composite investments. Aftermarket sales grew approximately 30% year-over-year, now comprising 10% of total revenues.

- For 2026, the company anticipates an improvement in adjusted operating margin by 70 to 90 basis points and projects free cash flow of approximately $300 million or more. Additionally, Matt Filer has been appointed as the new CFO.

- Patrick Industries, Inc. reported strong financial results for Q4 and full year 2025, with net sales increasing 9% to $924 million in Q4 and 6% to $4.0 billion for the full year, driven by organic content gains and acquisitions.

- Diluted EPS for Q4 2025 was $0.83 and $3.90 for the full year. Adjusted diluted EPS increased 62% to $0.84 in Q4 and 2% to $4.44 for the full year. Operating income also saw significant growth, up 45% to $57 million in Q4 and 7% to $276 million for the full year.

- The company returned $87 million to shareholders in 2025, including a 17.5% increase in its quarterly dividend, and completed five acquisitions totaling $122 million. Patrick maintained a strong financial position with $818 million in total net liquidity and a 2.6x total net leverage ratio at year-end 2025.

- Patrick Industries reported net sales of $924 million for the fourth quarter of 2025, a 9% increase compared to the prior year, and $4.0 billion for the full year 2025, up 6%.

- Adjusted diluted EPS for Q4 2025 increased 62% to $0.84, and for the full year 2025, it increased 2% to $4.44.

- The company generated $246 million in free cash flow for 2025 and returned $87 million to shareholders through dividends and share repurchases, including a 17.5% increase in its regular quarterly dividend in Q4.

- Patrick Industries completed two acquisitions in Q4 2025 and deployed $122 million for acquisitions in FY 2025, ending the year with $818 million in total net liquidity and a net leverage ratio of 2.6x.

- Patrick Industries, Inc. (PATK) has completed the acquisitions of Quality Engineered Services (QES) and Egis Group, LLC (Egis).

- QES manufactures wire harnesses and electrical systems, while Egis develops engineered electrical components and system-level solutions for the marine and RV industries.

- The combined revenue for QES and Egis on a trailing 12-month basis through November 2025 was approximately $39 million.

- These acquisitions are expected to advance Patrick's strategy to expand component solutions for OEMs in the Outdoor Enthusiast space and the aftermarket.

- Patrick Industries, Inc. announced that its Board of Directors approved an increase in the quarterly cash dividend on November 19, 2025.

- The quarterly cash dividend will increase from $0.40 per share to $0.47 per share.

- The dividend is payable on December 15, 2025, to shareholders of record at the close of business on December 1, 2025.

- Patrick Industries delivered solid third quarter performance in 2025, with net sales increasing 6% to $976 million, driven by over 4% organic growth, and reported diluted earnings per share of $1.01.

- The company saw strong revenue execution in its primary end markets, with RV revenue increasing 7% to $426 million and marine revenue increasing 11% to $150 million in Q3 2025, achieving content gains across all outdoor enthusiast and MH markets.

- Patrick Industries maintained a strong balance sheet with $779 million in total net liquidity at the end of Q3 2025 and repurchased approximately 377,600 shares for $32 million year-to-date through the third quarter.

- For the full year 2025, the company expects an adjusted operating margin of approximately 7%, and anticipates a meaningful improvement of an estimated 70 to 90 basis points in operating margin for 2026.

- Dealer inventory levels remain lean, with RV at 14 to 16 weeks on hand and marine at 16 to 18 weeks on hand in Q3 2025, both significantly below pre-pandemic historical averages, indicating a potential need for restock.

- Patrick reported $976 million in net sales for Q3 2025, representing a 6% year-over-year increase.

- The company achieved $112 million in Adjusted EBITDA with an 11.5% margin, and $1.01 in Adjusted Diluted EPS for Q3 2025.

- All key segments contributed to revenue growth: RV revenue increased 7% to $426 million, Marine revenue grew 11% to $150 million, Powersports revenue rose 12% to $98 million, and Housing revenue was up 1% to $302 million.

- Patrick generated $134 million in free cash flow year-to-date and maintained $778.7 million in total available liquidity, while also completing the acquisition of LilliPad Marine, LLC.

Quarterly earnings call transcripts for PATRICK INDUSTRIES.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more