Earnings summaries and quarterly performance for Prestige Consumer Healthcare.

Executive leadership at Prestige Consumer Healthcare.

Ronald M. Lombardi

Chief Executive Officer

Adel Mekhail

Executive Vice President, Marketing & Sales

Christine Sacco

Chief Financial Officer and Chief Operating Officer

Jeffrey Zerillo

Executive Vice President, Operations

William C. P’Pool

Senior Vice President, General Counsel and Corporate Secretary

Board of directors at Prestige Consumer Healthcare.

Research analysts who have asked questions during Prestige Consumer Healthcare earnings calls.

Rupesh Parikh

Oppenheimer & Co. Inc.

6 questions for PBH

Susan Anderson

Canaccord Genuity Group

6 questions for PBH

Anthony Lebiedzinski

Sidoti & Company, LLC

4 questions for PBH

Carla Casella

JPMorgan Chase & Co.

2 questions for PBH

Douglas Lane

Water Tower Research

2 questions for PBH

Glenn West

William Blair & Company

2 questions for PBH

Jon Anderson

William Blair

2 questions for PBH

Keith Davos

Jefferies

2 questions for PBH

Keith Devas

Jefferies Financial Group Inc.

2 questions for PBH

Mitchell Pinheiro

Sturdivant & Company

2 questions for PBH

David Shakno

William Blair & Company

1 question for PBH

Linda Bolton-Weiser

D.A. Davidson & Co.

1 question for PBH

Recent press releases and 8-K filings for PBH.

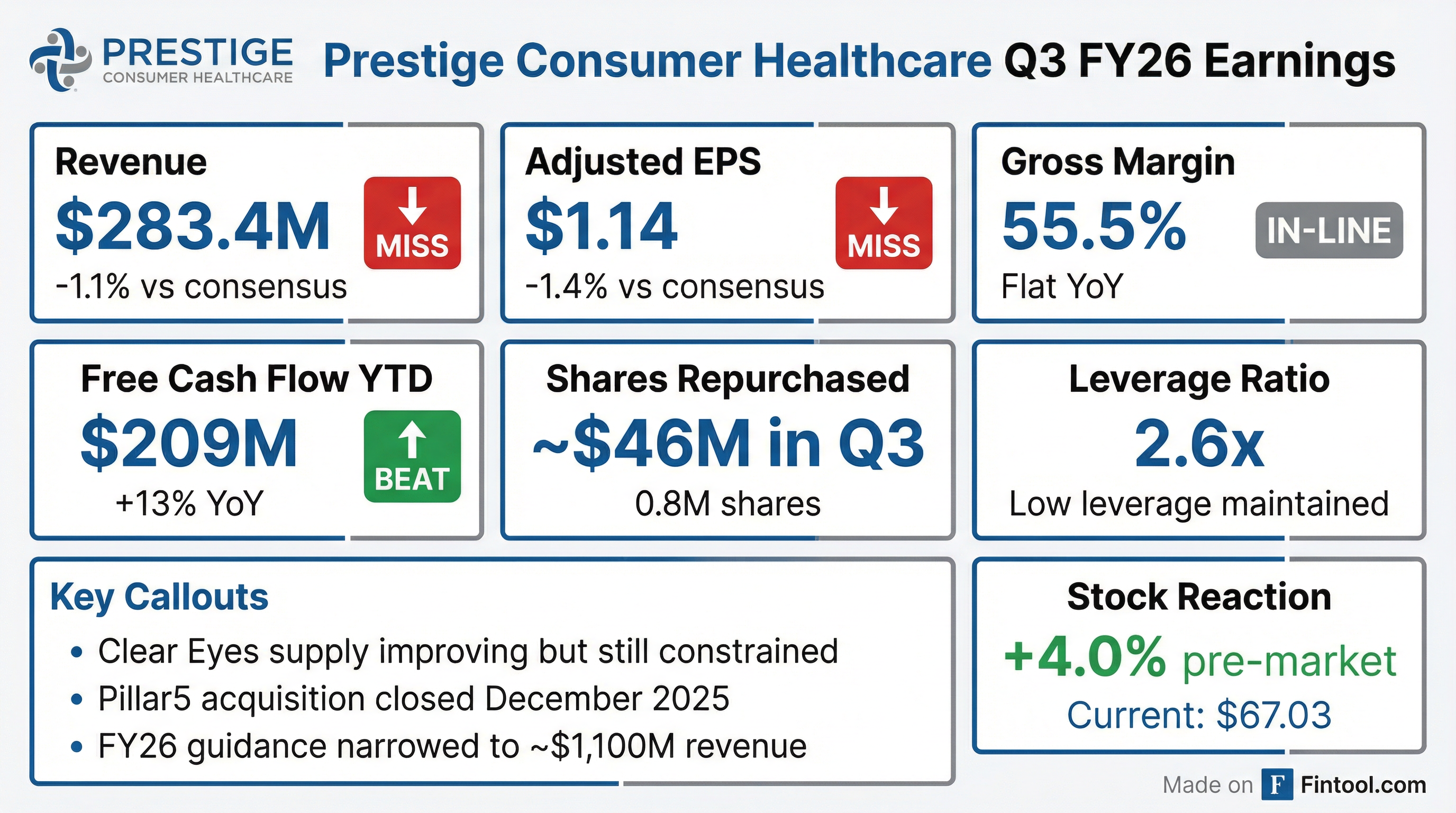

- Prestige Consumer Healthcare reported Q3 Fiscal 2026 sales of $283 million and adjusted EPS of $1.14, both aligning with expectations, despite a 2.4% decline in revenue year-over-year.

- The company updated its Fiscal 2026 outlook, narrowing sales to approximately $1.1 billion and adjusted diluted EPS to approximately $4.54, while reaffirming its free cash flow target of $245 million or more.

- Strategic initiatives in Q3 included the acquisition of Pillar5 for over $110 million to improve Clear Eyes supply, which is expected to see sequential improvements through calendar 2026.

- Prestige Consumer Healthcare repurchased approximately $46 million in stock during Q3, contributing to over $150 million in share repurchases year-to-date, and maintained a net debt leverage ratio of 2.6x.

- Prestige Consumer Healthcare reported Q3 fiscal 2026 sales of $283 million and adjusted EPS of $1.14, both aligning with expectations.

- The company updated its full-year fiscal 2026 sales outlook to approximately $1.1 billion and projects adjusted diluted EPS of approximately $4.54, while maintaining its free cash flow outlook of $245 million or more.

- Key strategic moves in Q3 included the acquisition of Pillar Five for over $110 million to enhance eye care supply and repurchasing approximately $46 million in stock, contributing to over $150 million in share repurchases year-to-date.

- The company also recorded a $10 million write-off of a supplier loan in Q3.

- Prestige Consumer Healthcare (PBH) reported Q3 2026 revenue of $283.4 million, a 2.4% decline year-over-year, and adjusted EPS of $1.14, slightly down from the prior year.

- The company generated $208.8 million in free cash flow year-to-date, an increase of 12.9% compared to the prior year, and maintains its full-year outlook of $245 million or more.

- Capital allocation in Q3 included the acquisition of Pillar Five for over $110 million and opportunistic share repurchases of approximately $46 million, contributing to over $150 million in repurchases year-to-date.

- PBH updated its full-year fiscal 2026 guidance, narrowing its sales outlook to approximately $1.1 billion and adjusted diluted EPS to approximately $4.54.

- The company continues to see sequential improvement in Clear Eyes supply for the second consecutive quarter and anticipates further improvements through calendar 2026.

- PBH updated its FY 2026 outlook, revising Adjusted Diluted EPS to $3.85 to $3.95 (previously $3.95 to $4.05) and Organic Revenue Growth to down low-single digits (previously flat to down low-single digits).

- The company reaffirmed its Free Cash Flow outlook for FY 2026 at $245 million or more.

- For Q4 FY 2026, PBH anticipates Organic Revenue Growth to be down mid-single digits, primarily due to continued eye care supply constraints, though an improvement in Clear Eyes® shipments is expected sequentially.

- PBH reported $155 million in share repurchases year-to-date FY 2026, which represents approximately 5% of shares outstanding.

- Q3 FY26 revenue was $283.4 million, a 2.4% decrease year-over-year, primarily attributed to limited Clear Eyes® supply. Adjusted Diluted EPS for the quarter was $1.14.

- The company successfully closed the acquisition of eye care supplier Pillar5 Pharma, Inc. in December 2025.

- Prestige Consumer Healthcare repurchased approximately 0.8 million shares for $45.8 million in Q3 FY26, contributing to $155.6 million in share repurchases year-to-date FY26.

- The fiscal 2026 outlook was narrowed, with net sales now expected to be approximately $1.1 billion (an approximate 3.0% decrease in organic revenue growth), while the Free Cash Flow outlook remains $245 million or more and Adjusted Diluted EPS is approximately $4.54.

- Prestige Consumer Healthcare reported Q3 Fiscal 2026 revenue of $283.4 million and adjusted diluted EPS of $1.14, with revenue decreasing 2.4% from the prior year.

- The company repurchased approximately 0.8 million shares in Q3 Fiscal 2026 and successfully closed the acquisition of eye care supplier Pillar5 Pharma, Inc. in December.

- The Fiscal 2026 outlook was narrowed, projecting revenue of approximately $1.1 billion and adjusted diluted EPS of approximately $4.54, while maintaining a free cash flow outlook of $245 million or more.

- Prestige Consumer Healthcare (PBH) successfully navigated a "crazy year" in 2025, managing external events like tariffs and inflation, with its diverse portfolio of essential health products providing resilience.

- The company is focused on brand building and innovation, exemplified by Dramamine's expansion into nausea with ginger chews, and aims to grow categories rather than just steal market share.

- The Clear Eyes recovery is progressing through three stages (supply, retailers, consumer reconnection), supported by the acquisition of Pillar Five in December and new suppliers, with sequential shipment improvements expected in fiscal Q3 and Q4, targeting full consumer reconnection by late fiscal 2027.

- PBH maintains a strong financial profile with 33%-34% EBITDA margin and the lowest leverage in its history, prioritizing capital allocation towards M&A, opportunistic share repurchases, and debt reduction, expecting to generate $1 billion in free cash flow over the next four years.

- The international business accounts for over 10% of total revenue and has been growing well above the long-term outlook of 5%+, with key brands like Hydralite, FESS, and Murine.

- Prestige Consumer Healthcare (PBH) navigated 2025 with a diverse portfolio of essential health products, which helped offset various external disruptions, and focuses on building categories through new products and innovation.

- The company is actively recovering its Clear Eyes brand through a three-stage process, including the recent acquisition of Pillar Five in December 2025 and securing two additional suppliers, with expected sequential improvement in shipments in fiscal Q3 and Q4.

- PBH maintains a strong financial profile with a 33%-34% EBITDA margin and anticipates generating $1 billion in free cash flow over the next four years, prioritizing M&A, share repurchases, and debt management.

- The company's M&A strategy focuses on acquiring ROIC-accretive, traditional OTC brands with long-term growth potential from public companies, private equity, and family-owned businesses.

- International business, comprising 12% or more of total revenue, has consistently grown well above the long-term outlook of 5%+.

- Prestige Consumer Healthcare (PBH) demonstrated resilience in 2025 amidst external challenges, leveraging its diverse portfolio of essential health products.

- The company is implementing a three-stage recovery plan for its Clear Eyes brand, with supply secured through new suppliers and the Pillar5 acquisition, anticipating sequential shipment improvements in fiscal Q3 and Q4.

- PBH's capital allocation strategy prioritizes M&A and share repurchases, with a projection to generate $1 billion in free cash flow over the next four years.

- The international business accounts for over 12% of total revenue and has consistently grown above the long-term outlook of 5%.

- Prestige Consumer Healthcare (PBH) expects to generate $1 billion in free cash flow over the next four years and maintains a 33%-34% EBITDA margin. Its capital allocation strategy prioritizes M&A, opportunistic share repurchases (executed in Q3 this fiscal year), and debt reduction, leveraging historically low debt levels.

- The company's business demonstrated resilience in 2025, supported by a diverse portfolio where no single category exceeds 20% of revenue. PBH focuses on category growth through innovation and new product development, exemplified by Dramamine's expansion.

- The Clear Eyes brand recovery is progressing, with new suppliers and the Pillar Five acquisition completed in December, expecting sequential shipment improvements in fiscal Q3 and Q4. Gross margin is anticipated to improve in fiscal 2027 through cost savings and innovation, offsetting a $5 million tariff impact in fiscal 2026.

- PBH actively pursues M&A opportunities from public companies, private equity, and family-owned businesses, applying disciplined criteria to acquire ROIC-accretive traditional OTC products with long-term growth potential.

Quarterly earnings call transcripts for Prestige Consumer Healthcare.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more