Earnings summaries and quarterly performance for PITNEY BOWES INC /DE/.

Executive leadership at PITNEY BOWES INC /DE/.

Kurt Wolf

President and Chief Executive Officer

Deborah Pfeiffer

Executive Vice President and President, Presort Services

Lauren Freeman-Bosworth

Executive Vice President, General Counsel and Corporate Secretary

Paul Evans

Executive Vice President, Chief Financial Officer and Treasurer

Todd Everett

Executive Vice President and President, Sending Technology Solutions

Board of directors at PITNEY BOWES INC /DE/.

Research analysts who have asked questions during PITNEY BOWES INC /DE/ earnings calls.

Anthony Lebiedzinski

Sidoti & Company, LLC

6 questions for PBI

Justin Dopierala

DOMO Capital Management, LLC

6 questions for PBI

David Steinhardt

Contrarian Capital Management, L.L.C.

4 questions for PBI

Kartik Mehta

Northcoast Research

4 questions for PBI

Aaron Kimson

JMP Securities LLC

2 questions for PBI

Curtis Nagle

Bank of America

2 questions for PBI

Dillon Bandi

Northcoast Research

2 questions for PBI

George Tong

Goldman Sachs

2 questions for PBI

Jasper Bibb

Truist Securities

2 questions for PBI

Peter Sakon

CreditSights

2 questions for PBI

Matthew Swope

Robert W. Baird & Co. Incorporated

1 question for PBI

Matt Swope

Robert W. Baird & Co

1 question for PBI

Recent press releases and 8-K filings for PBI.

- Pitney Bowes reported strong Q4 2025 results, reflecting progress in its transformation, which included upgrading leadership, simplifying structure, streamlining processes, and eliminating costs in 2025.

- The company is pivoting to profitable growth and plans to begin an external review with qualified advisors during the second quarter of 2026.

- In the Presort business, Pitney Bowes is implementing an aggressive pricing strategy to win new customers and targets EBIT margins in the low-to-mid 20% range. Easier year-over-year comparisons are anticipated in the second half of 2026.

- For the SendTech business, a top-line decline is expected for 2026, but the second half of the year is projected to be stronger due to recovery from IMI migration headwinds.

- Pitney Bowes maintains an opportunistic capital allocation strategy, including share and debt buybacks, and is committed to a net debt to EBITDA ratio around 3x. The company views its stock as undervalued.

- Pitney Bowes reported strong financials for Q4 2025, demonstrating progress in its transformation, which involved upgrading leadership, simplifying structure, streamlining processes, and eliminating costs in 2025.

- The company plans to begin an external strategic review with qualified advisors during the second quarter of 2026.

- In the Presort business, Pitney Bowes is being more aggressive with pricing to win new customers, targeting low-to-mid 20% EBIT margins, and expects easier year-over-year comparisons in the second half of 2026.

- For the SendTech business, a top-line decline is expected for 2026, but the second half of the year is anticipated to be stronger than the first half, driven by recovery from the IMI migration.

- Pitney Bowes remains opportunistic with capital allocation, including share and debt buybacks, and is committed to maintaining a net debt to EBITDA ratio around 3x, having ended 2025 slightly below this target.

- Pitney Bowes reported strong financials for the fourth quarter of 2025, reflecting progress in its transformation efforts, which included strengthening the business foundation, upgrading leadership, simplifying structure, streamlining processes, and eliminating costs in 2025.

- The company is pivoting to profitable growth and plans to begin an external review with qualified advisors during the second quarter. For 2026, a top-line decline is expected in the SendTech business, with the second half anticipated to be stronger than the first. The Presort business is pursuing an aggressive pricing strategy to win new customers, targeting low-to-mid 20% EBIT margins.

- Pitney Bowes is committed to maintaining a net debt to EBITDA ratio around 3x, having ended 2025 slightly below this target. The company plans to continue opportunistic share buybacks and debt buybacks, as it views its stock as undervalued.

- Identified growth opportunities include aggressive pricing in Presort, potential acquisition opportunities, efforts to slow the decline in the mail business, evolving shipping solutions, and growth in the bank.

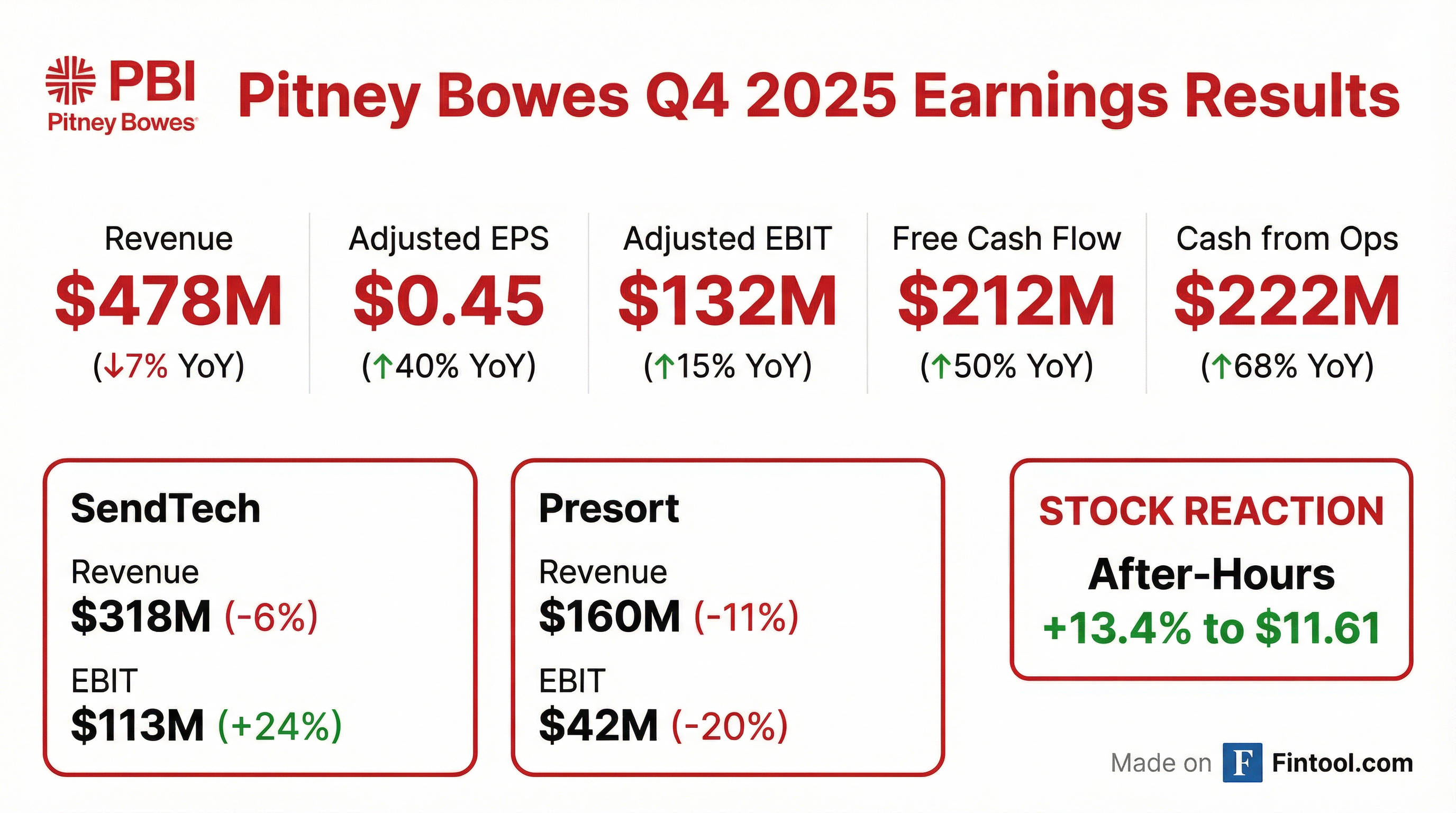

- For Q4 2025, Pitney Bowes reported revenue of $478 million, a 7% year-over-year decrease, with Adjusted EPS of $0.45, an improvement of $0.13 year over year.

- Full year 2025 revenue was $1,893 million and Adjusted EBIT was $461 million.

- In Q4 2025, SendTech Solutions revenue declined 6% to $318 million, and Presort Services revenue declined 11% to $160 million.

- The company provided Full Year 2026 guidance, projecting revenue between $1,760 million and $1,860 million, Adjusted EBIT between $410 million and $460 million, and Adjusted EPS between $1.40 and $1.60.

- As of December 31, 2025, total debt stood at $2,026,212 thousand.

- Pitney Bowes reported Q4 2025 revenue of $478 million and full-year 2025 revenue of $1,893 million, both representing a 7% decrease year-over-year. The company achieved Q4 2025 Adjusted EPS of $0.45 (up 40%) and full-year 2025 Adjusted EPS of $1.35 (up 64%).

- In Q4 2025, Pitney Bowes repurchased 12.6 million shares for $127 million and reduced $114 million of principal debt. The Board also approved an additional $250 million share repurchase authorization and a regular quarterly dividend of $0.09 per share.

- For 2026, the company's strategic objectives include revitalizing Presort through competitive pricing and acquisitions, reimaging SendTech to stem revenue declines and resume growth, and optimizing PB Bank for profitable growth.

- Pitney Bowes delivered strong earnings and cash flow performance in 2025, with full-year Adjusted EPS of $1.35 and Free Cash Flow of $358 million, despite revenue declining 7% to $1,893 million. For the fourth quarter of 2025, Adjusted EPS was $0.45 and Free Cash Flow was $212 million, with revenue at $478 million.

- In Q4 2025, the company repurchased 12.6 million shares for $127 million and reduced $114 million of principal debt, with an additional $250 million authorized for share repurchases as of February 13, 2026.

- Pitney Bowes provided its full-year 2026 guidance, projecting Revenue between $1,760 million and $1,860 million, Adjusted EPS between $1.40 and $1.60, and Free Cash Flow between $340 million and $370 million.

- Pitney Bowes reported fourth-quarter revenue of roughly $477.6–$478 million, missing analyst expectations, while posting adjusted EPS of $0.45 that beat estimates.

- The company's operating margins expanded to 19.7%, though net margin remains low at about 4.1%, and three-year revenue growth has declined approximately 18.5%.

- For FY2026, Pitney Bowes provided guidance ranges for adjusted EPS of $1.40–$1.60 and sales of $1.76 billion–$1.86 billion.

- The stock traded near $10.25 with a market capitalization around $1.65 billion, and the company showed a negative return on equity of 38.38%.

- Pitney Bowes has appointed Steve Fischer as the new President of The Pitney Bowes Bank (PB Bank), effective immediately.

- Mr. Fischer, who previously served as CEO of TIAA Bank, brings three decades of experience and is expected to help realize the full potential of PB Bank, which holds over $575 million in deposits and is crucial for the company's profitable growth strategy.

- The company also announced four additional executive appointments, including Benoit Robinot as SVP, Head of Shipping (formerly of Amazon) and David Cossitt-Levy as VP, FP&A (formerly of IQVIA), to drive strategic initiatives across its SendTech, Presort, and Corporate Finance segments.

- Pitney Bowes Inc. completed its cash tender offers for its 6.70% Notes due 2043 and 5.250% Medium-Term Notes due 2037, which expired on December 19, 2025.

- The company increased the Maximum Tender Amount from $75,000,000 to $80,000,000 to accept all validly tendered notes.

- A total of approximately $79.9 million in aggregate principal amount of Notes were tendered and accepted, with no proration required.

- Specifically, $75,721,375 of the 6.70% Notes due 2043 and $4,175,000 of the 5.250% Medium-Term Notes due 2037 were accepted for purchase.

- Pitney Bowes Inc. announced the commencement of cash tender offers for two series of notes.

- The company is offering to purchase up to $75,000,000 in aggregate principal amount of its 6.70% Notes due 2043 and 5.250% Medium-Term Notes due 2037.

- The tender offers are scheduled to expire on December 19, 2025, at 11:59 p.m., New York City time.

- The purchase of notes will be financed with cash on hand.

Quarterly earnings call transcripts for PITNEY BOWES INC /DE/.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more