Earnings summaries and quarterly performance for PEOPLES BANCORP.

Executive leadership at PEOPLES BANCORP.

Tyler J. Wilcox

President and Chief Executive Officer

Douglas V. Wyatt

Executive Vice President, Chief Commercial Banking Officer

Hugh J. Donlon

Executive Vice President, Community Banking

Jason M. Eakle

Executive Vice President, Chief Credit Officer

Kathryn M. Bailey

Executive Vice President, Chief Financial Officer and Treasurer

M. Ryan Kirkham

Executive Vice President, General Counsel and Corporate Secretary

Mark J. Augenstein

Executive Vice President, Operations

Matthew J. Macia

Executive Vice President, Chief Risk Officer

Matthew M. Edgell

Executive Vice President, Chief of Staff

Board of directors at PEOPLES BANCORP.

Brooke W. James

Director

Carol A. Schneeberger

Director

David F. Dierker

Director

Dwight E. Smith

Director

Frances A. Skinner

Director

Kevin R. Reeves

Director

Michael N. Vittorio

Director

S. Craig Beam

Director

Susan D. Rector

Chairman of the Board

W. Glenn Hogan

Director

Research analysts who have asked questions during PEOPLES BANCORP earnings calls.

Daniel Tamayo

Raymond James Financial, Inc.

8 questions for PEBO

Manuel Navas

D.A. Davidson & Co.

8 questions for PEBO

Adam Kroll

Piper Sandler Companies

5 questions for PEBO

Brandon Rud

Stephens Inc.

5 questions for PEBO

Dan Cardenas

Janney Montgomery Scott

5 questions for PEBO

Tim Switzer

Keefe, Bruyette & Woods (KBW)

5 questions for PEBO

Daniel Cardenas

Janney Montgomery Scott LLC

4 questions for PEBO

Brendan Nosal

Hovde Group, LLC

3 questions for PEBO

Nathan Race

Piper Sandler & Co.

3 questions for PEBO

Terence McEvoy

Stephens Inc.

3 questions for PEBO

Timothy Switzer

KBW

3 questions for PEBO

Brandon Root

Stephens Inc.

1 question for PEBO

Recent press releases and 8-K filings for PEBO.

- Peoples Bancorp Inc. reported net income of $107 million and diluted EPS of $2.99 for FY 2025, with a Return on Average Assets of 1.13% and an Efficiency Ratio of 58.7% for the same period.

- As of December 31, 2025, the company maintained strong capital and credit quality with a Tier 1 capital ratio of 12.73%, tangible book value per share of $22.77, and non-performing assets at 0.44% of total assets.

- The company has an attractive dividend opportunity, having increased its dividend for 10 straight years, with an annualized yield of 5.25% based on the January 16, 2026 stock price.

- For 2026, Peoples Bancorp Inc. anticipates loan growth between 3% and 5%, fee-based income between $28 million and $30 million quarterly, and a Net Interest Margin between 4.00% and 4.20%.

- The company's unique community banking model includes a top 10 bank-owned insurance agency and wealth management with $4.1 billion in assets under administration and management as of December 31, 2025, contributing to a 24% fee income ratio in 2025.

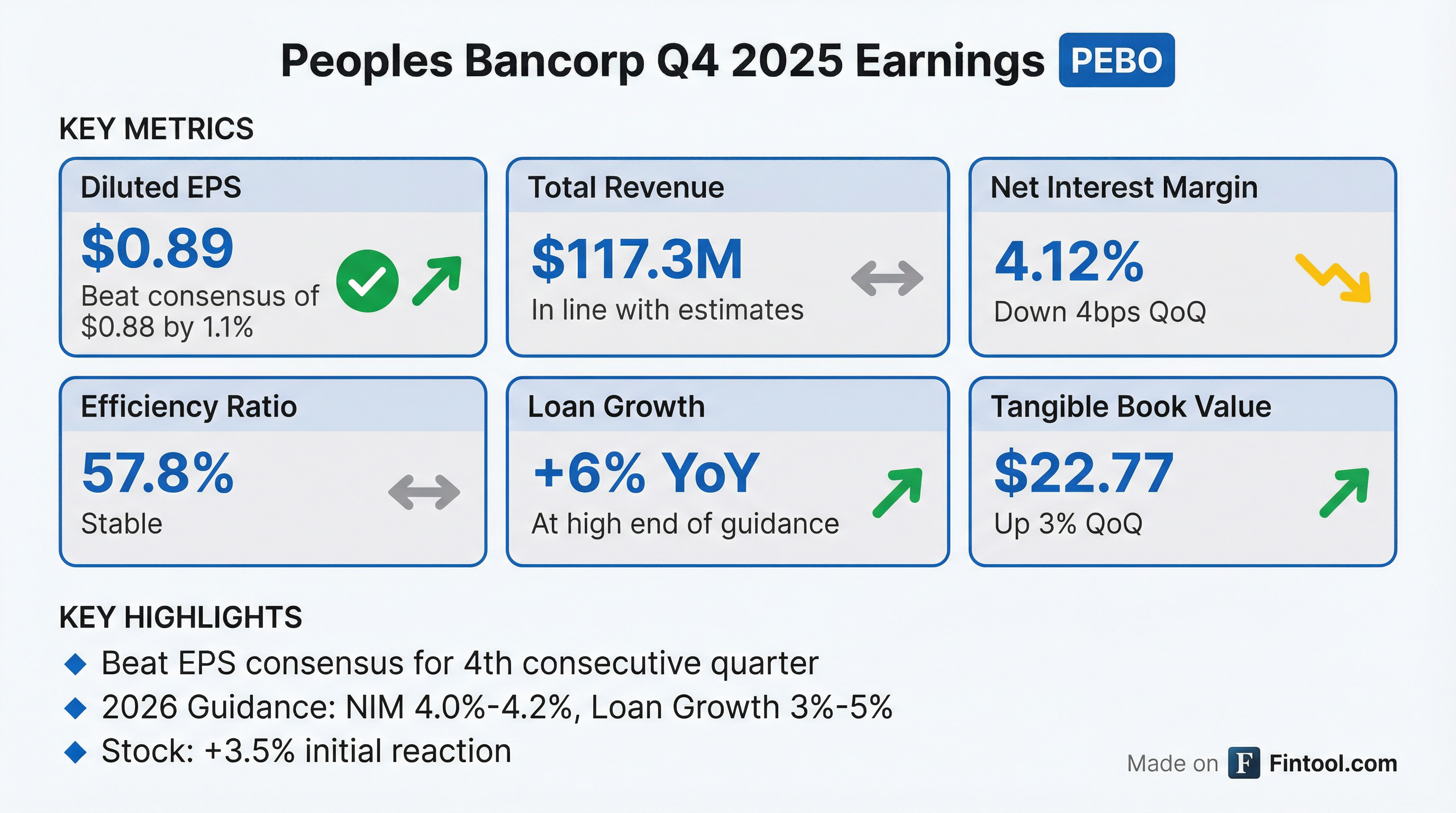

- Peoples Bancorp Inc. (PEBO) reported diluted earnings per share of $0.89 for the fourth quarter of 2025, marking a 7% increase compared to the linked quarter and exceeding consensus analyst estimates of $0.88. The efficiency ratio was stable at 57.8% for the quarter.

- For the full year 2025, PEBO achieved 6% loan growth and a 6% improvement in fee-based income compared to 2024. The tangible equity to tangible assets ratio improved 26 basis points to 8.8% at year-end.

- Management projects loan growth between 3% and 5% for 2026 compared to 2025, anticipates a slight reduction in net charge-offs for 2026, and expects to achieve positive operating leverage in 2026 even with a 25-basis point rate cut.

- Peoples Bancorp (PEBO) reported diluted earnings per share of $0.89 for Q4 2025, a 7% increase from the linked quarter, surpassing consensus analyst estimates of $0.88.

- For the full year 2025, PEBO achieved 6% loan growth and a 6% improvement in fee-based income over the prior year, generating positive operating leverage excluding accretion income.

- The company redeemed subordinated debt, expecting annual savings of approximately $1 million in funding costs. For 2026, PEBO anticipates positive operating leverage, with a net interest margin between 4% and 4.2%, and 3% to 5% loan growth.

- Asset quality improved, with non-performing assets declining and criticized loans reducing to 3.5% of total loans at year-end 2025 from 3.99% in the prior quarter.

- Peoples Bancorp Inc. (PEBO) reported diluted earnings per share of $0.89 for Q4 2025, a 7% increase from the linked quarter, exceeding consensus analyst estimates of $0.88.

- For the full year 2025, the company achieved 6% loan growth and a 6% improvement in fee-based income compared to 2024.

- The tangible equity to tangible assets ratio grew 26 basis points to 8.8%, and tangible book value per share improved 3% to $22.77 at year-end.

- For 2026, PEBO anticipates a net interest margin between 4% and 4.2%, loan growth between 3% and 5%, and quarterly fee-based income ranging from $28 million to $30 million.

- The company maintains a strategic patience for M&A, preferring deals in the $3-$5 billion range within its existing or adjacent footprints, while also considering smaller opportunities.

- Peoples Bancorp Inc. (PEBO) reported diluted earnings per share of $0.89 for Q4 2025, a 7% increase compared to the linked quarter, surpassing consensus estimates of $0.88.

- For the full year 2025, the company achieved 6% loan growth and a 6% improvement in fee-based income compared to 2024, resulting in positive operating leverage when excluding accretion income.

- Key Q4 2025 metrics included a stable efficiency ratio of 57.8%, a tangible equity to tangible assets ratio of 8.8% (up 26 basis points), and a 3% improvement in tangible book value per share. The allowance for credit losses increased to 1.12% of total loans from 1% at prior year-end.

- PEBO redeemed a tranche of subordinated debt, incurring a nearly $800,000 loss in Q4 2025, but this action is projected to yield annual savings of approximately $1 million in funding costs.

- For 2026, the company anticipates achieving positive operating leverage, a net interest margin between 4% and 4.2% (including one 25 basis point rate cut), and loan growth ranging from 3% to 5% compared to 2025.

- Peoples Bancorp Inc. (PEBO) reported diluted earnings per share of $0.89 and net income of $31.8 million for the fourth quarter of 2025.

- Fee-based income grew 5% compared to the linked quarter, and total loan balances increased 2% annualized compared to September 30, 2025.

- The company's tangible equity to tangible assets ratio improved 26 basis points to 8.79% at December 31, 2025.

- For the full year 2026, Peoples Bancorp Inc. anticipates its net interest margin will be between 4.00% and 4.20%, with loan growth projected between 3% and 5%.

- Non-interest income (excluding gains and losses) is expected to be between $28 million and $30 million per quarter in 2026, and quarterly non-interest expense is anticipated to be between $72 million and $74 million for the second, third, and fourth quarters of 2026.

- Peoples Bancorp Inc. reported net income of $31.8 million and diluted earnings per common share of $0.89 for the fourth quarter of 2025, compared to $29.5 million and $0.83, respectively, in the prior quarter.

- Net interest income was $91.0 million for Q4 2025, a slight decrease of $0.3 million from the linked quarter, with the net interest margin decreasing to 4.12% from 4.16%.

- The provision for credit losses increased to $8.1 million in Q4 2025 from $7.3 million in Q3 2025, primarily due to net charge-offs, loan growth, and a slight deterioration in economic forecasts.

- Period-end total loan and lease balances increased by $28.2 million (2% annualized), while period-end total deposit balances decreased by $22.0 million at December 31, 2025, compared to September 30, 2025.

- The Board of Directors declared a quarterly dividend of $0.41 per common share on January 19, 2026.

- Peoples Bancorp Inc. (PEBO) declared a quarterly cash dividend of $0.41 per common share on January 19, 2026.

- The dividend is payable on February 17, 2026, to shareholders of record on February 2, 2026.

- This dividend represents a payout of 46.1% of Peoples' reported fourth quarter 2025 earnings.

- Based on the closing stock price of $31.21 on January 16, 2025, the quarterly dividend produces an annualized yield of 5.25%.

- Peoples Bancorp Inc. reported net income of $31.8 million and diluted earnings per common share of $0.89 for the fourth quarter of 2025, an increase from $29.5 million and $0.83, respectively, in the third quarter of 2025.

- Net interest income for the fourth quarter of 2025 decreased $0.3 million to $91.0 million, with the net interest margin declining to 4.12% from 4.16% in the linked quarter.

- The company recorded a provision for credit losses of $8.1 million for the fourth quarter of 2025, compared to $7.3 million for the third quarter of 2025.

- Total non-interest income, excluding net gains and losses, increased $1.4 million (5%) for the fourth quarter of 2025, while total non-interest expense also increased $1.4 million compared to the linked quarter.

- Asset quality metrics largely improved, with total nonperforming assets decreasing by $2.2 million (5%) and criticized loans decreasing by $31.9 million (12%) compared to the linked quarter. Period-end total loan and lease balances increased by $28.2 million (2% annualized), while total deposit balances decreased by $22.0 million at December 31, 2025, compared to September 30, 2025.

- For Q3 2025, Peoples Bancorp Inc. reported net income of $29 million or $0.83 per diluted common share, with a Return on Average Assets of 1.22%, a Net Interest Margin of 4.16%, and an Efficiency Ratio of 57.1%.

- The company demonstrated strong asset quality and capital as of September 30, 2025, with non-performing assets at 0.47% of total assets, a Tier 1 capital ratio of 12.54%, and a tangible book value per share of $22.05.

- Peoples Bancorp Inc. has a history of 10 straight years of increasing dividends, offering an annualized yield of 5.83% based on the closing stock price of $28.15 on October 17, 2025.

- For 2025, the Net Interest Margin is anticipated to be between 4.00% and 4.20%, and for 2026, loan growth is expected between 3% and 5%, with fee-based income growth projected between 4% and 6% compared to 2024.

Quarterly earnings call transcripts for PEOPLES BANCORP.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more