Earnings summaries and quarterly performance for Phillips Edison & Company.

Executive leadership at Phillips Edison & Company.

Board of directors at Phillips Edison & Company.

Research analysts who have asked questions during Phillips Edison & Company earnings calls.

Caitlin Burrows

Goldman Sachs

4 questions for PECO

Floris van Dijkum

Compass Point Research & Trading

4 questions for PECO

Michael Mueller

JPMorgan Chase & Co.

4 questions for PECO

Todd Thomas

KeyBanc Capital Markets

4 questions for PECO

Dori Kesten

Wells Fargo & Company

3 questions for PECO

Haendel St. Juste

Mizuho Financial Group

3 questions for PECO

Juan Sanabria

BMO Capital Markets

3 questions for PECO

Omotayo Okusanya

Deutsche Bank AG

3 questions for PECO

Paulina Rojas Schmidt

Green Street Advisors

3 questions for PECO

Ronald Kamdem

Morgan Stanley

3 questions for PECO

Jeffrey Spector

BofA Securities

2 questions for PECO

Samir Khanal

Bank of America

2 questions for PECO

Cooper Clark

Wells Fargo

1 question for PECO

Daniel Purpura

Green Street

1 question for PECO

Kenneth Billingsley

Compass Point Research & Trading LLC

1 question for PECO

Ravi Vaidya

Mizuho

1 question for PECO

Rich Hightower

Barclays

1 question for PECO

Recent press releases and 8-K filings for PECO.

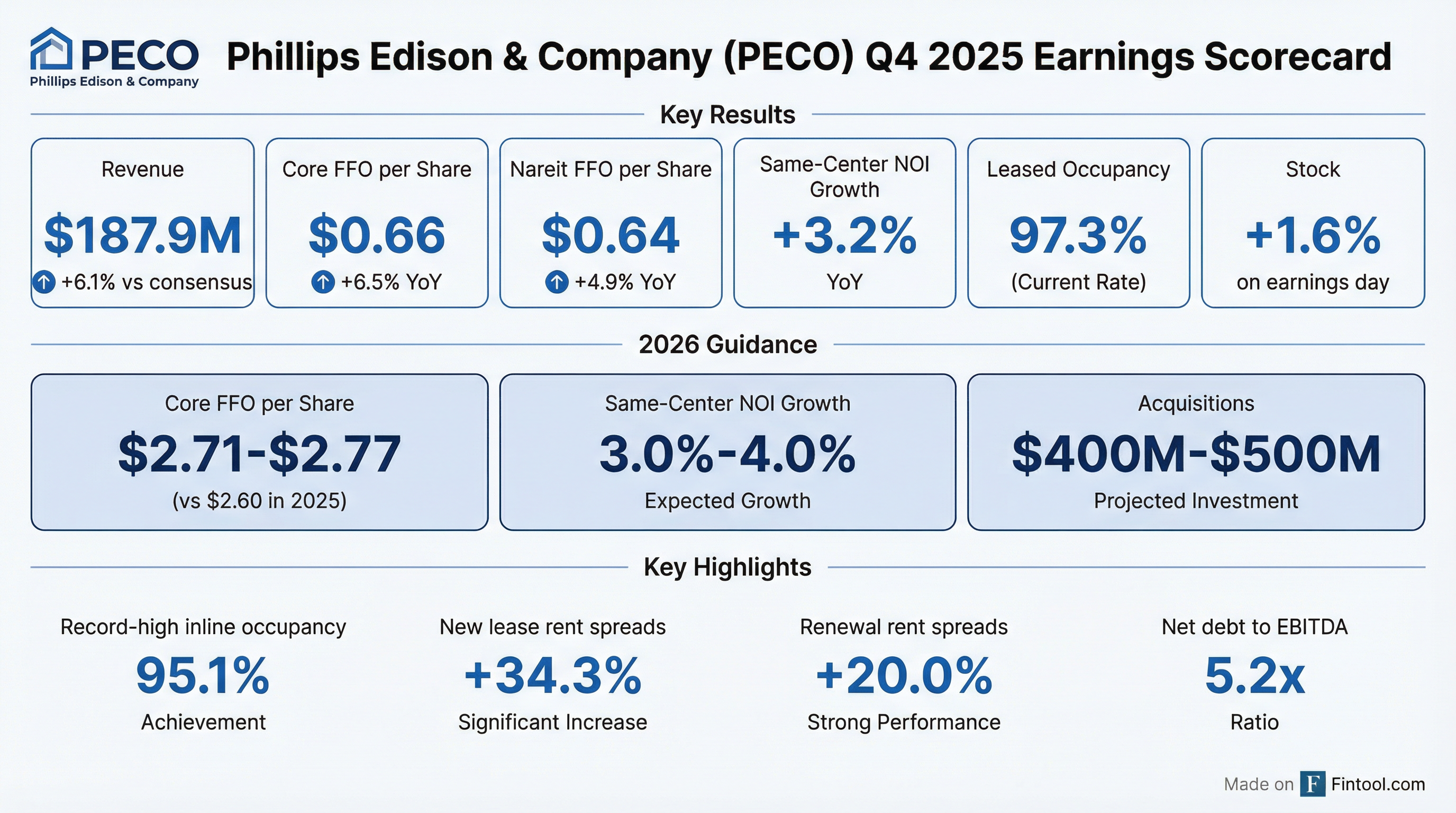

- Phillips Edison & Company (PECO) reported strong 2025 results, including Nareit FFO per share growth of 7.2%, Core FFO per share growth of 7%, and same-center NOI growth of 3.8%. For Q4 2025, Nareit FFO increased to $88.8 million or $0.64 per diluted share, and Core FFO increased to $91.1 million or $0.66 per diluted share.

- The company provided robust 2026 guidance, projecting mid-single digit growth for Nareit FFO and Core FFO per share, with net income guidance in a range of $0.74-$0.77 per share and same-center NOI growth projected at 3%-4%.

- Operational highlights for 2025 include a record high inline leased occupancy of 95.1% and a portfolio occupancy of 97.3%, with comparable renewal rent spreads of 20% and new leasing rent spreads of 34.3% in the fourth quarter.

- PECO plans gross acquisitions of $400 million-$500 million and dispositions of $100 million-$200 million in 2026, supported by approximately $925 million of liquidity as of December 31, 2025.

- Phillips Edison & Company (PECO) reported strong 2025 results, including Nareit FFO per share growth of 7.2% and Core FFO per share growth of 7%, with same-center NOI growth of 3.8%. For Q4 2025, Nareit FFO was $0.64 per diluted share and Core FFO was $0.66 per diluted share.

- The company provided strong 2026 guidance, projecting Nareit FFO per share growth of 5.5% and Core FFO per share growth of 5.4% at the midpoint over 2025, with same-center NOI growth of 3%-4%.

- PECO plans gross acquisitions of $400-$500 million at PECO share in 2026, following approximately $400 million in 2025 acquisitions. Dispositions are planned between $100-$200 million in 2026, with $145 million sold in 2025.

- The portfolio ended 2025 with high occupancy rates, including 97.3% leased overall and a record high 95.1% inline leased occupancy. Comparable renewal rent spreads were 20% and new leasing rent spreads were 34.3% in Q4 2025.

- As of December 31, 2025, PECO had approximately $925 million of liquidity and a net debt to trailing 12-month annualized adjusted EBITDA of 5.2 times.

- Phillips Edison & Company (PECO) reported strong 2025 results, including 7.2% Nareit FFO per share growth, 7% core FFO per share growth, and 3.8% same-center NOI growth.

- For 2026, PECO provided guidance for Nareit FFO per share to increase by 5.5% and core FFO per share by 5.4% year-over-year at the midpoint, with net income projected between $0.74-$0.77 per share. Same-center NOI growth for 2026 is projected at 3%-4%.

- The company ended 2025 with a high portfolio occupancy of 97.3% leased, including a record high inline leased occupancy of 95.1%. Q4 2025 saw strong comparable renewal rent spreads of 20% and new leasing rent spreads of 34.3%, with a 93% retention rate.

- PECO acquired approximately $400 million in assets in 2025 and targets $400-$500 million in gross acquisitions for 2026. The company plans to sell between $100-$200 million in assets in 2026, with these dispositions factored into the guidance.

- As of December 31, 2025, PECO maintained approximately $925 million of liquidity. The company has 20 projects under active construction with an estimated total investment of $70 million, expecting yields between 9%-12%.

- PECO reported a 97% leased portfolio occupancy as of December 31, 2025, with comparable new rent spreads of 30.9% and renewal rent spreads of 20.7% for the year.

- The company provided Full Year 2026 guidance, projecting Nareit FFO per share between $2.65 and $2.71 (5.5% growth at midpoint) and Core FFO per share between $2.71 and $2.77 (5.4% growth at midpoint).

- For 2026, PECO anticipates Same-Center NOI growth of 3.00% to 4.00% and plans for gross acquisitions between $400.0 million and $500.0 million.

- In 2025, PECO completed $395.5 million in acquisitions and $145.4 million in dispositions, reflecting its portfolio recycling strategy.

- The portfolio maintains a strong focus on grocery-anchored centers, with 95% of ABR from grocery-anchored centers and 83% from #1 or #2 grocer by sales in the market.

- Phillips Edison & Company reported net income attributable to stockholders of $47.5 million ($0.38 per diluted share) for Q4 2025 and $111.3 million ($0.89 per diluted share) for the full year 2025.

- Nareit FFO per diluted share was $0.64 for Q4 2025 and $2.54 for the full year 2025, while Core FFO per diluted share was $0.66 for Q4 2025 and $2.60 for the full year 2025.

- The company achieved Same-Center Net Operating Income (NOI) growth of 3.2% for Q4 2025 and 3.8% for the full year 2025, with a leased portfolio occupancy of 97.3%.

- For the full year 2025, PECO acquired $395.5 million in assets and sold $145.4 million in assets at its total prorated share.

- For 2026, Phillips Edison & Company provided guidance for Nareit FFO per share between $2.65 and $2.71, Core FFO per share between $2.71 and $2.77, and Same-Center NOI growth between 3.00% and 4.00%.

- For the fourth quarter ended December 31, 2025, net income attributable to stockholders was $47.5 million, or $0.38 per diluted share, and for the full year 2025, it was $111.3 million, or $0.89 per diluted share.

- Nareit FFO per diluted share was $0.64 for the fourth quarter 2025 and $2.54 for the full year 2025, marking 7.2% growth over 2024.

- Same-center NOI increased 3.2% year-over-year for the fourth quarter 2025 and 3.8% for the full year 2025.

- The company maintained a strong leased portfolio occupancy of 97.3% and executed portfolio comparable new leases at a rent spread of 34.3% during the fourth quarter 2025.

- For the full year 2026, PECO provided guidance for Nareit FFO per share in the range of $2.65 - $2.71 and Same-Center NOI growth between 3.00% - 4.00%.

- PECO increased the midpoint of its full-year 2025 guidance for NAREIT FFO per share by 7% and core FFO per share by 6.8%.

- For 2026, preliminary guidance includes NAREIT FFO per share of $2.65-$2.71 and core FFO per share of $2.71-$2.77, representing increases of 5.7% and 5.6% respectively over 2025 midpoints.

- The company projects 3%-4% same-center NOI growth for 2026 and long-term. PECO plans $400-$500 million in gross acquisitions at PECO share in 2026, targeting an unlevered IRR of 9% for core acquisitions.

- PECO is expanding into everyday retail, having invested approximately $181 million in nine centers since 2023, with a goal to scale this segment to $700 million-$1 billion over the next five years, targeting unlevered IRRs of 10% and higher.

- PECO increased its dividend rate by 5.7% this year and targets total shareholder returns of 10% or higher on a long-term basis, supported by a strong investment-grade balance sheet.

- Phillips Edison & Company (PECO) increased its full-year 2025 guidance for NAREIT FFO and core FFO per share, projecting 7% and 6.8% growth respectively at the midpoint.

- For 2026, PECO provided preliminary guidance, estimating NAREIT FFO per share between $2.65-$2.71 and Core FFO per share between $2.71-$2.77, reflecting mid-single-digit growth over 2025.

- The company targets long-term annual growth of 3-4% same-center NOI and mid- to high single-digit core FFO per share , with $400 million-$500 million in gross acquisitions projected for 2026.

- PECO plans to invest approximately $70 million in development projects in 2025 and 2026 , and increased its dividend rate by 5.7% this year.

- PECO updated its Full Year 2025 guidance as of December 17, 2025, projecting Net income per share between $0.80 and $0.81, Nareit FFO per share between $2.53 and $2.54, and Core FFO per share between $2.59 and $2.60.

- The company also issued Preliminary Full Year 2026 guidance, with Net income per share expected between $0.74 and $0.77, Nareit FFO per share between $2.65 and $2.71, and Core FFO per share between $2.71 and $2.77.

- PECO maintains a strategic focus on grocery-anchored centers, with 95% of ABR from such properties and a 98% leased portfolio occupancy as of September 30, 2025.

- The company reported a trailing 12-month net debt to adjusted EBITDAre of 5.3x as of September 30, 2025, and holds investment grade ratings of 'BBB' from S&P and 'Baa2' from Moody's.

- For 2026, PECO targets $400 million to $500 million in gross acquisitions with a targeted unlevered IRR of 9%+.

- PECO increased the midpoint of its full-year 2025 guidance for NAREIT and core FFO per share, representing 7% and 6.8% growth, respectively.

- For 2026, PECO projects same-center NOI growth of 3%-4% and estimates Core FFO per share in the range of $2.71-$2.77, representing a 5.6% increase over the 2025 midpoint.

- The company targets long-term annual growth of 3-4% in same-center NOI and mid- to high single-digit core FFO per share, aiming for total shareholder returns of 10% or higher.

- PECO plans $400-$500 million in gross acquisitions for 2026 and expects to sell $100-$200 million in assets in the same year. The company is also expanding into everyday retail, having invested approximately $181 million in nine centers since 2023, with plans to scale this segment to $700 million-$1 billion over the next five years.

Quarterly earnings call transcripts for Phillips Edison & Company.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more