Earnings summaries and quarterly performance for Pagaya Technologies.

Executive leadership at Pagaya Technologies.

Gal Krubiner

Chief Executive Officer

Avital Pardo

Chief Technology Officer

Cory Vieira

Chief Accounting Officer

Evangelos Perros

Chief Financial Officer

Sanjiv Das

President

Tami Rosen

Chief Development Officer

Yahav Yulzari

Chief Business Officer

Board of directors at Pagaya Technologies.

Research analysts who have asked questions during Pagaya Technologies earnings calls.

John Hecht

Jefferies

7 questions for PGY

David Scharf

Citizens Capital Markets and Advisory

5 questions for PGY

Hal Goetsch

B. Riley Securities

4 questions for PGY

Kyle Joseph

Jefferies

4 questions for PGY

Peter Christiansen

Citigroup Inc.

4 questions for PGY

Joseph Vafi

Canaccord Genuity - Global Capital Markets

3 questions for PGY

Rayna Kumar

Oppenheimer & Co. Inc.

3 questions for PGY

Sanjay Sakhrani

Keefe, Bruyette & Woods (KBW)

3 questions for PGY

Harold Goetsch

B. Riley Securities

1 question for PGY

Mark Palmer

The Benchmark Company, LLC

1 question for PGY

Steven Kwok

Keefe, Bruyette & Woods

1 question for PGY

Recent press releases and 8-K filings for PGY.

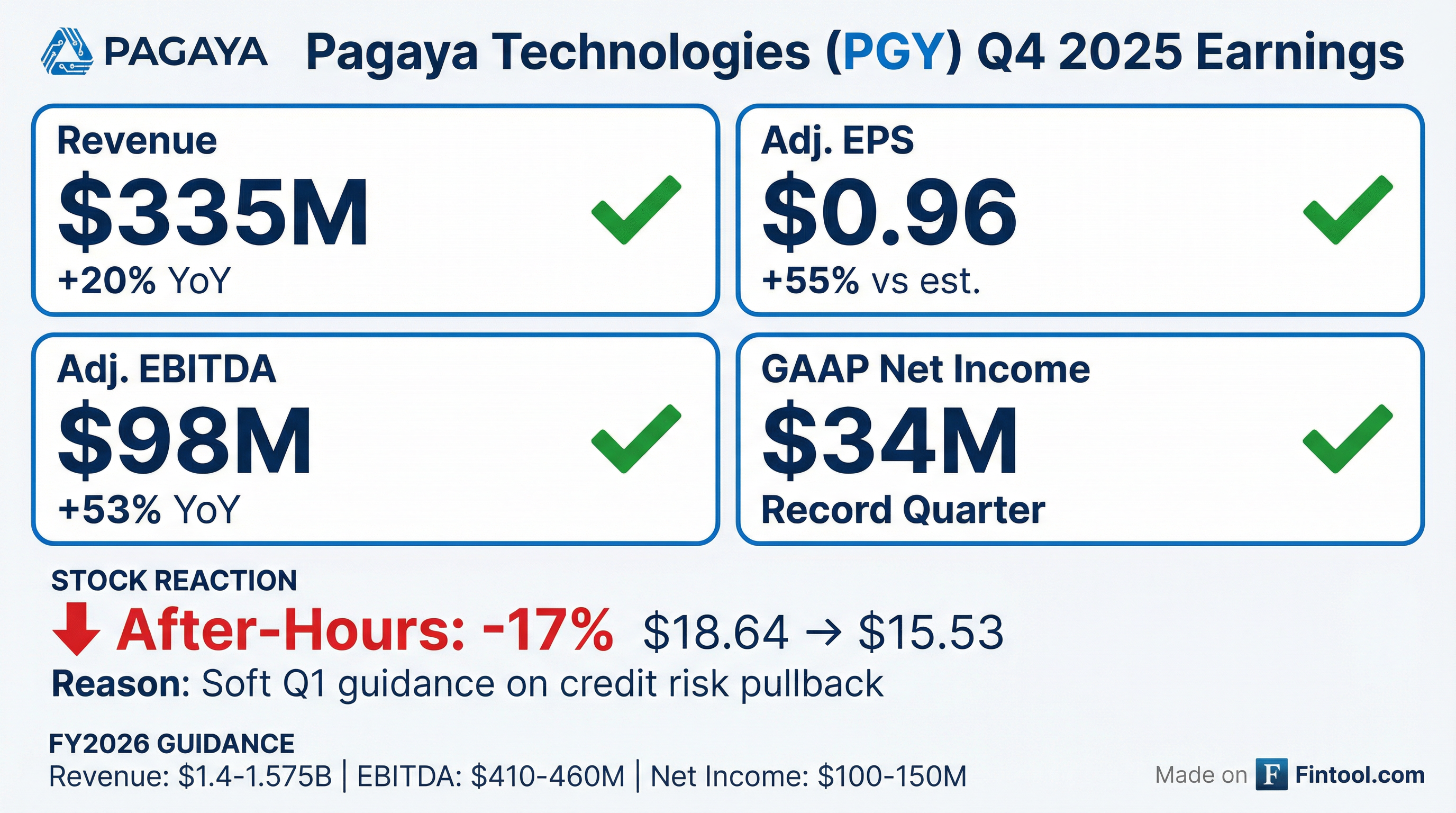

- Pagaya Technologies reported Total revenue & other income of $335 million in Q4 2025, marking a 20% increase compared to Q4 2024.

- The company achieved Net Income of $34 million in Q4 2025, a significant improvement from a loss of ($238 million) in Q4 2024, with Adjusted EBITDA growing 53% year-over-year to $98 million.

- Network Volume for Q4 2025 reached $2,684 million, an increase of 3% from Q4 2024.

- For the full year 2025, ABS issuance totaled $8.5 billion, and the ABS investor base expanded to 158 by the end of Q4 2025.

- Pagaya Technologies achieved GAAP net income of $34 million and $80 million in operating cash flow in Q4 2025, marking its fourth consecutive quarter of GAAP profitability.

- For the full year 2025, the company reported $1.3 billion in revenue, a 26% year-over-year increase, and $81 million in GAAP net income, significantly improving by $483 million compared to 2024, with an EPS of $0.93.

- Management emphasized a strategic shift towards disciplined risk management and profitability, proactively reducing exposure to higher-risk credit yields in Q4 2025 due to persistent consumer uncertainty, which impacted network volumes but not profitability targets.

- The company provided full year 2026 guidance, expecting network volume between $11.25 billion and $13 billion, total revenue and other income between $1.4 billion and $1.575 billion, and GAAP net income between $100 million and $150 million.

- Pagaya is expanding its partner network by onboarding new partners like Achieve and GLS, deepening existing relationships, and diversifying into more profitable products such as the Direct Marketing Engine and Affiliate Optimizer Engine.

- Pagaya Technologies reported Q4 2025 GAAP net income of $34 million and full-year 2025 GAAP net income of $81 million, marking its fourth consecutive quarter of profitability.

- For the full year 2025, revenues reached $1.3 billion (up 26% year-over-year) and Adjusted EBITDA was $371 million (up 76% year-over-year), with an EPS of $0.93.

- In Q4 2025, the company proactively reduced exposure to higher-risk credit yields due to market uncertainty, which decreased network volume by approximately $100 million-$150 million but did not impact profitability targets.

- Pagaya provided full-year 2026 guidance, projecting network volume between $11.25 billion and $13 billion, total revenue and other income between $1.4 billion and $1.575 billion, and GAAP net income between $100 million and $150 million.

- The company continues to diversify its funding structures and onboard new partners, including Achieve, GLS, and a leading buy-now-pay-later provider, with a robust pipeline.

- Pagaya Technologies achieved its fourth consecutive quarter of GAAP net income profitability in Q4 2025, reporting $34 million for the quarter and $81 million for the full year 2025.

- The company reported Q4 2025 revenue of $335 million and full-year 2025 revenue of $1.3 billion, representing a 26% year-over-year increase. Adjusted EBITDA for Q4 2025 was $98 million, and for the full year 2025, it was $371 million, up 76% year-over-year.

- Pagaya is prioritizing prudent risk management over short-term growth, proactively reducing exposure to higher volatility segments, which impacted Q4 volume by $100 million-$150 million and is expected to reduce annualized volume by $1.5 billion in 2026.

- For full year 2026, the company expects network volume between $11.25 billion-$13 billion, total revenue between $1.4 billion-$1.575 billion, and GAAP net income between $100 million-$150 million.

- Pagaya expanded its partner network by adding three new partners and diversified its funding sources with forward-flow arrangements and revolving ABSs, creating almost $3 billion of revolving capacity.

- Pagaya Technologies reported strong financial performance for Q4 2025, with GAAP net income of $34 million (up $272 million year-over-year) and total revenue and other income of $335 million (up 20% year-over-year).

- For the full year 2025, the company achieved GAAP net income of $81 million (up $483 million year-over-year) and total revenue and other income of $1.3 billion (up 26% year-over-year).

- Adjusted EBITDA reached $98 million in Q4 2025 (up 53% year-over-year) and $371 million for the full year 2025 (up $161 million year-over-year).

- Pagaya provided an optimistic outlook, projecting Q1 2026 total revenue and other income between $315 million and $335 million and full-year 2026 total revenue and other income between $1.4 billion and $1.575 billion.

- Pagaya Technologies Ltd. reported a record GAAP net income of $34 million for Q4 2025, an increase of $272 million year-over-year, and a full-year GAAP net income of $81 million, up $483 million from 2024.

- Total revenue and other income for Q4 2025 reached $335 million, a 20% year-over-year increase, contributing to a full-year total of $1.3 billion, up 26% year-over-year.

- Adjusted EBITDA for Q4 2025 was $98 million, a 53% year-over-year increase, with the full year 2025 Adjusted EBITDA at $371 million, up 76% compared to the prior year.

- Network volume for Q4 2025 grew 3% year-over-year to $2.7 billion, and full-year network volume increased 9% to $10.5 billion.

- The company provided an outlook for Q1 2026, expecting GAAP net income between $15 million and $35 million, and for the full year 2026, GAAP net income is projected to be between $100 million and $150 million.

- Pagaya Technologies closed an $800 million AAA rated, personal loan ABS transaction (PAID 2026-1).

- This transaction marks Pagaya's 85th ABS transaction and represents its largest securitization since November 2024.

- The transaction saw significant investor demand, leading to a 33% upsize from its initial $600 million target, with 32 unique investors participating.

- Since 2018, Pagaya has issued more than $34.5 billion across 85 ABS transactions.

- Pagaya Technologies has entered into a new forward flow agreement with Sound Point Capital Management for the purchase of up to $720 million of point-of-sale (POS) loans sourced through Pagaya’s platform.

- This agreement marks Pagaya’s first forward flow transaction for its POS program, highlighting continued strong institutional demand and diversifying its funding.

- The partnership supports the expansion of Pagaya's rapidly-growing POS business, contributing to its multi-billion-dollar forward flow capacity across Personal Loans, Auto Loans, and Point-of-Sale, and has raised more than $3 billion in prospective funding capacity for POS since May 2025.

- Pagaya Technologies announced the closing of PAID 2025-REV1, an inaugural $350 million revolving asset-backed securitization (ABS) backed by consumer loans.

- This new structure provides long-term funding capacity over a two-year revolving period, effectively doubling the total transaction funding capacity to up to $700 million over the life of the deal.

- Completed in partnership with 26North Partners LP, this initiative diversifies Pagaya's asset funding platform and creates a scalable, long-term source of capital to support expected expansion in 2026.

- Pagaya Technologies has partnered with Achieve, a digital personal finance company, to expand consumers' access to personal loans on Achieve's platform.

- Achieve will integrate Pagaya's AI-powered underwriting technology and data network to provide responsible access to personal loans for an expanded mix of consumers.

- Achieve will serve as the end-to-end relationship manager and servicer for the loans offered through this partnership.

- The partnership is expected to expand collaboration beyond personal loan decisioning to include Pagaya's full suite of capabilities, such as prescreen and affiliate marketing products.

Quarterly earnings call transcripts for Pagaya Technologies.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more