Earnings summaries and quarterly performance for PennyMac Mortgage Investment Trust.

Executive leadership at PennyMac Mortgage Investment Trust.

David A. Spector

Chairman and Chief Executive Officer

Abbie Tidmore

Senior Managing Director and Chief Revenue Officer

Daniel S. Perotti

Senior Managing Director and Chief Financial Officer

Derek W. Stark

Senior Managing Director, Chief Legal Officer and Secretary

Doug Jones

President and Chief Mortgage Banking Officer

James Follette

Senior Managing Director and Chief Digital Officer

Mark Elbaum

Senior Managing Director and Chief Capital Markets Officer

Board of directors at PennyMac Mortgage Investment Trust.

Research analysts who have asked questions during PennyMac Mortgage Investment Trust earnings calls.

Bose George

Keefe, Bruyette & Woods

7 questions for PMT

Douglas Harter

UBS

7 questions for PMT

Eric Hagen

BTIG

6 questions for PMT

Jason Weaver

Unaffiliated Analyst

6 questions for PMT

Trevor Cranston

Citizens JMP

4 questions for PMT

Crispin Love

Piper Sandler

2 questions for PMT

Jake Katsikas

BTIG, LLC

1 question for PMT

Matthew Erdner

JonesTrading Institutional Services

1 question for PMT

Matthew Howlett

B. Riley Securities

1 question for PMT

Recent press releases and 8-K filings for PMT.

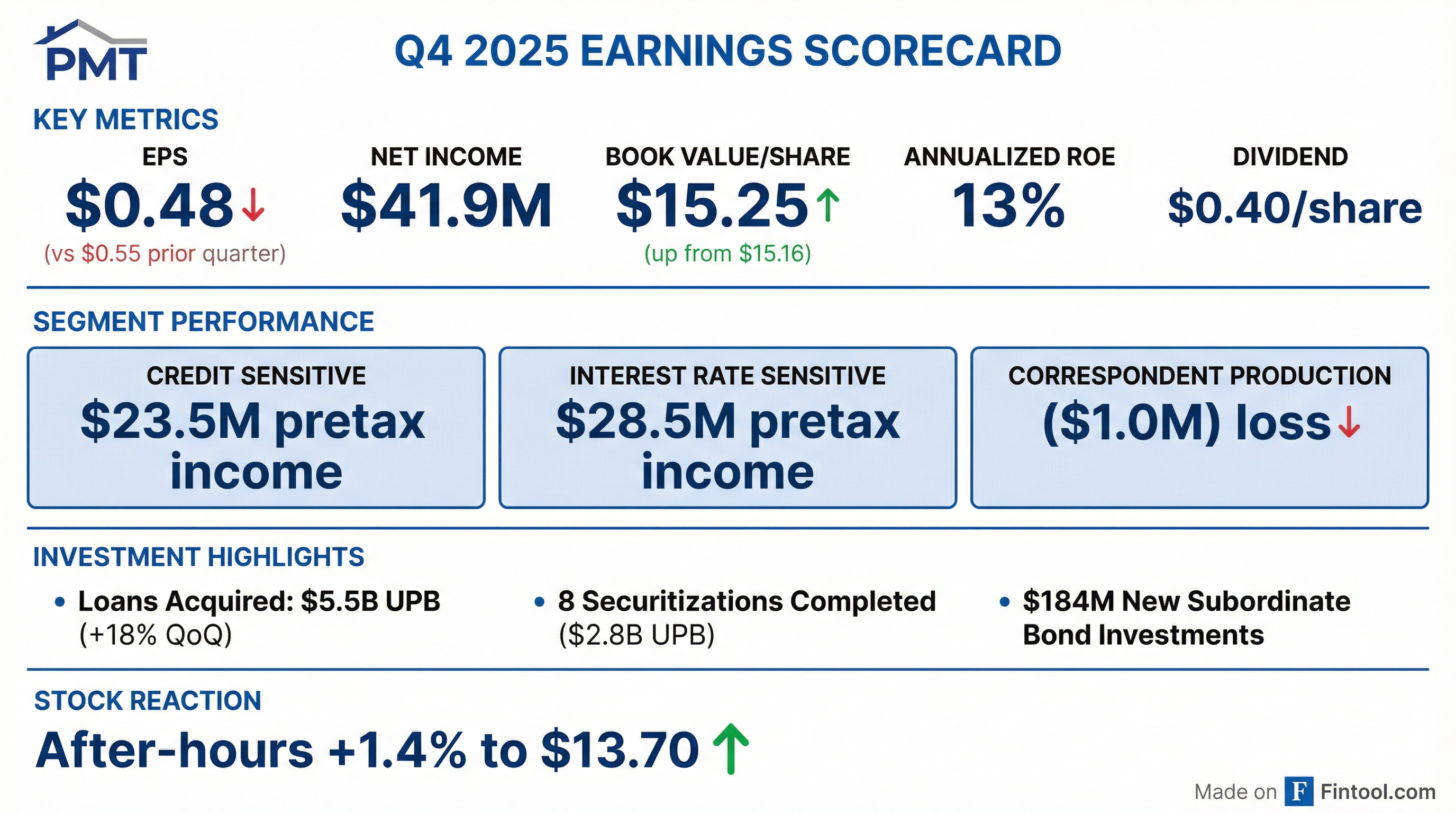

- PennyMac Mortgage Investment Trust (PMT) reported net income to common shareholders of $42 million and diluted earnings per share of $0.48 for the fourth quarter of 2025, exceeding its $0.40 per share quarterly dividend.

- The company achieved a 13% annualized return on common equity and increased book value per share to $15.25 at year-end 2025, up from $15.16 on September 30.

- PMT significantly accelerated its private label securitization activities in 2025, completing 19 securitizations totaling $6.7 billion in UPB for the full year and 8 securitizations totaling $2.8 billion in UPB in Q4 alone. The company expects to complete approximately 30 securitizations in 2026.

- The total debt-to-equity ratio increased to approximately 10-to-1 from 9-to-1 at September 30, primarily due to growth in non-recourse debt associated with securitizations, while the debt-to-equity ratio excluding non-recourse debt remained at 6-to-1.

- PennyMac Mortgage Investment Trust (PMT) reported net income to common shareholders of $42 million and diluted earnings per share of $0.48 for Q4 2025, exceeding its $0.40 per share quarterly dividend.

- PMT significantly ramped up its private label securitization activity in 2025, completing 19 securitizations totaling $6.7 billion in UPB and retaining $528 million in new investments, a nearly tenfold increase from 2024. The company expects to complete approximately 30 securitizations in 2026.

- The company strategically managed its portfolio, purchasing $876 million of Agency floating rate MBS and selling $195 million of opportunistic GSE-issued CRT investments to optimize returns. Approximately 60% of shareholders' equity is deployed in seasoned MSRs and GSE credit risk transfer investments.

- Segment performance in Q4 2025 included $24 million pre-tax income from credit-sensitive strategies (27% annualized ROE) and $28 million from interest rate-sensitive strategies (10% annualized ROE), while the correspondent production segment reported a $1 million pre-tax loss.

- PMT's total debt-to-equity ratio increased to approximately 10-to-1 from 9-to-1 at September 30, 2025, primarily due to non-recourse debt from securitizations, with the core debt-to-equity (excluding non-recourse debt) remaining at 6-to-1.

- PennyMac Mortgage Investment Trust (PMT) reported net income attributable to common shareholders of $42 million and diluted EPS of $0.48 for Q4 2025.

- For Q4 2025, the company declared a dividend of $0.40 per common share and reported a book value per share of $15.25.

- Credit Sensitive Strategies generated pretax income of $24 million and Interest Rate Sensitive Strategies contributed $28 million in pretax income, while Correspondent Production recorded a pretax loss of $(1) million in Q4 2025.

- PMT made net new investments of $184 million in credit sub-bonds from its securitizations during Q4 2025 and anticipates completing approximately 30 securitizations in 2026.

- PennyMac Mortgage Investment Trust (PMT) reported net income to common shareholders of $42 million and diluted earnings per share of $0.48 for Q4 2025, achieving a 13% annualized return on common equity. The book value per share increased to $15.25 at year-end 2025.

- The company significantly accelerated its organic investment creation in 2025, completing 19 securitizations totaling $6.7 billion in UPB and growing retained investments to $528 million. In Q4 2025, 8 securitizations were completed, totaling $2.8 billion in UPB.

- Looking ahead, PMT expects to complete approximately 30 securitizations in 2026, targeting low to mid-teens returns on equity for these retained investments.

- PMT's total debt-to-equity ratio increased to approximately 10-to-1 at Q4 2025, primarily due to growth in non-recourse debt from securitizations, while the debt-to-equity ratio excluding non-recourse debt remained at 6-to-1. The company also raised $150 million of new unsecured financing.

- PennyMac Mortgage Investment Trust reported net income attributable to common shareholders of $41.9 million and diluted earnings per common share of $0.48 for the fourth quarter of 2025.

- The company declared a cash dividend of $0.40 per common share for Q4 2025 and reported a book value per common share of $15.25 as of December 31, 2025, up from $15.16 at September 30, 2025.

- For the full year 2025, net income attributable to common shareholders was $86.1 million, with diluted earnings per share of $0.99.

- In Q4 2025, PMT acquired $5.5 billion in unpaid principal balance (UPB) of loans, created $53 million in new mortgage servicing rights (MSRs), and generated $184 million of net new investments in non-Agency subordinate bonds.

- PennyMac Mortgage Investment Trust (PMT) reported net income attributable to common shareholders of $41.9 million, or $0.48 per common share, for the fourth quarter of 2025.

- For the full year 2025, PMT's net income attributable to common shareholders was $86.1 million, with diluted earnings per share of $0.99, which is a decrease from $119.2 million net income and $1.37 diluted EPS in 2024.

- The company declared a cash dividend of $0.40 per common share for Q4 2025, resulting in total dividends of $1.60 per common share for the full year 2025.

- PMT's book value per common share was $15.25 at December 31, 2025, an increase from $15.16 at September 30, 2025.

- Investment activity in Q4 2025 included acquiring $5.5 billion in unpaid principal balance (UPB) of loans and creating $53 million in new mortgage servicing rights (MSRs). The company also raised $150 million through exchangeable senior notes.

- PennyMac Corp. (PMC), an indirect wholly-owned subsidiary of PennyMac Mortgage Investment Trust (PMT), priced an offering of $75 million aggregate principal amount of its 8.500% Exchangeable Senior Notes due 2029.

- This offering is a further reopening of the same series of notes, with the issuance and sale expected to close on December 22, 2025, and the notes maturing on June 1, 2029.

- The initial exchange price is approximately $15.79 per Common Share, which is about 20% above PMT's Common Shares' closing price on December 18, 2025. Net proceeds of approximately $75.6 million are intended for debt repayment and general corporate purposes.

- PennyMac Mortgage Investment Trust's (PMT) indirect wholly-owned subsidiary, PennyMac Corp. (PMC), priced a $75 million reopening of its 8.500% Exchangeable Senior Notes due 2029.

- These Notes are part of the same series as the $216.5 million originally issued in May 2024, with the current offering expected to close on December 15, 2025.

- The initial exchange price is approximately $15.79 per Common Share, representing a 25% premium over PMT's closing share price of $12.61 on December 11, 2025.

- The net proceeds, estimated at approximately $75.5 million, are intended for repaying existing borrowings and for general corporate purposes.

- PennyMac Mortgage Investment Trust (PMT) reported net income to common shareholders of $48 million and earnings per share of $0.55 for Q3 2025, delivering a 14% annualized return on common equity.

- The company declared a Q3 common dividend of $0.40 per share and saw its book value per share increase to $15.16 as of September 30, 2025, up from $15 at June 30, 2025.

- PMT actively managed its investment portfolio, completing three securitizations of agency-eligible investor loans totaling $1.2 billion and a jumbo loan securitization of $300 million in Q3 2025, retaining $93 million and $45 million in new investments, respectively.

- To optimize returns, PMT sold $195 million of opportunistic investments in GSE-issued CRT and acquired $877 million of agency floating-rate MBS.

- The company expects a run-rate return potential of $0.42 per share over the next four quarters, an increase from $0.38 per share in the prior quarter, with a strategic focus on credit-sensitive investment strategies.

- PennyMac Mortgage Investment Trust (PMT) reported net income to common shareholders of $48 million and earnings per share of $0.55 for Q3 2025, achieving a 14% annualized return on common equity. The company declared a common dividend of $0.40 per share, and book value per share increased to $15.16 as of September 30, up from $15 at June 30.

- PMT actively managed its portfolio by completing three securitizations of agency eligible investor loans totaling $1.2 billion in UPB and a jumbo loan securitization of $300 million UPB, retaining $93 million and $45 million in new investments, respectively.

- The company's run rate earnings potential increased to a quarterly average of $0.42 per share, up from $0.38 per share in the prior quarter, driven by increased returns in credit-sensitive strategies and deployment into agency floating rate MBS.

- PMT's investment strategy focuses on leveraging its synergistic relationship with PFSI to create high-quality assets, with MSR investments accounting for approximately 46% of deployed equity and credit risk transfer investments representing 14%.

Quarterly earnings call transcripts for PennyMac Mortgage Investment Trust.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more