Earnings summaries and quarterly performance for QCR HOLDINGS.

Executive leadership at QCR HOLDINGS.

Todd Gipple

President and Chief Executive Officer

Brittany Whitfield

Chief Accounting Officer

James Klein

Chief Executive Officer, Cedar Rapids Bank and Trust

Kurt Gibson

Chief Executive Officer, Community State Bank

Laura Ekizian

Chief Executive Officer, Quad City Bank and Trust

Monte McNew

Chief Executive Officer, Guaranty Bank

Nick Anderson

Chief Financial Officer

Nicole Lee

Chief Human Resources Officer

Reba Winter

Chief Operating Officer

Board of directors at QCR HOLDINGS.

Amy Reasner

Director

Brent Cobb

Director

Elizabeth Jacobs

Director

James Batten

Director

James Field

Vice Chair of the Board

John Griesemer

Director

John-Paul Besong

Director

Marie Ziegler

Chair of the Board

Mark Kilmer

Director

Mary Kay Bates

Director

Research analysts who have asked questions during QCR HOLDINGS earnings calls.

Daniel Tamayo

Raymond James Financial, Inc.

10 questions for QCRH

Nathan Race

Piper Sandler & Co.

10 questions for QCRH

Brian Martin

Janney Montgomery Scott

9 questions for QCRH

Damon Del Monte

Keefe, Bruyette & Woods

9 questions for QCRH

Jeff Rulis

D.A. Davidson & Co.

5 questions for QCRH

Ryan Payne

D.A. Davidson & Co.

2 questions for QCRH

Damon Del Monte

Keefe, Bruyette & Woods (KBW)

1 question for QCRH

Jeffrey Allen Rulis

D.A. Davidson

1 question for QCRH

Ryan Pan

D.A. Davidson & Co.

1 question for QCRH

Recent press releases and 8-K filings for QCRH.

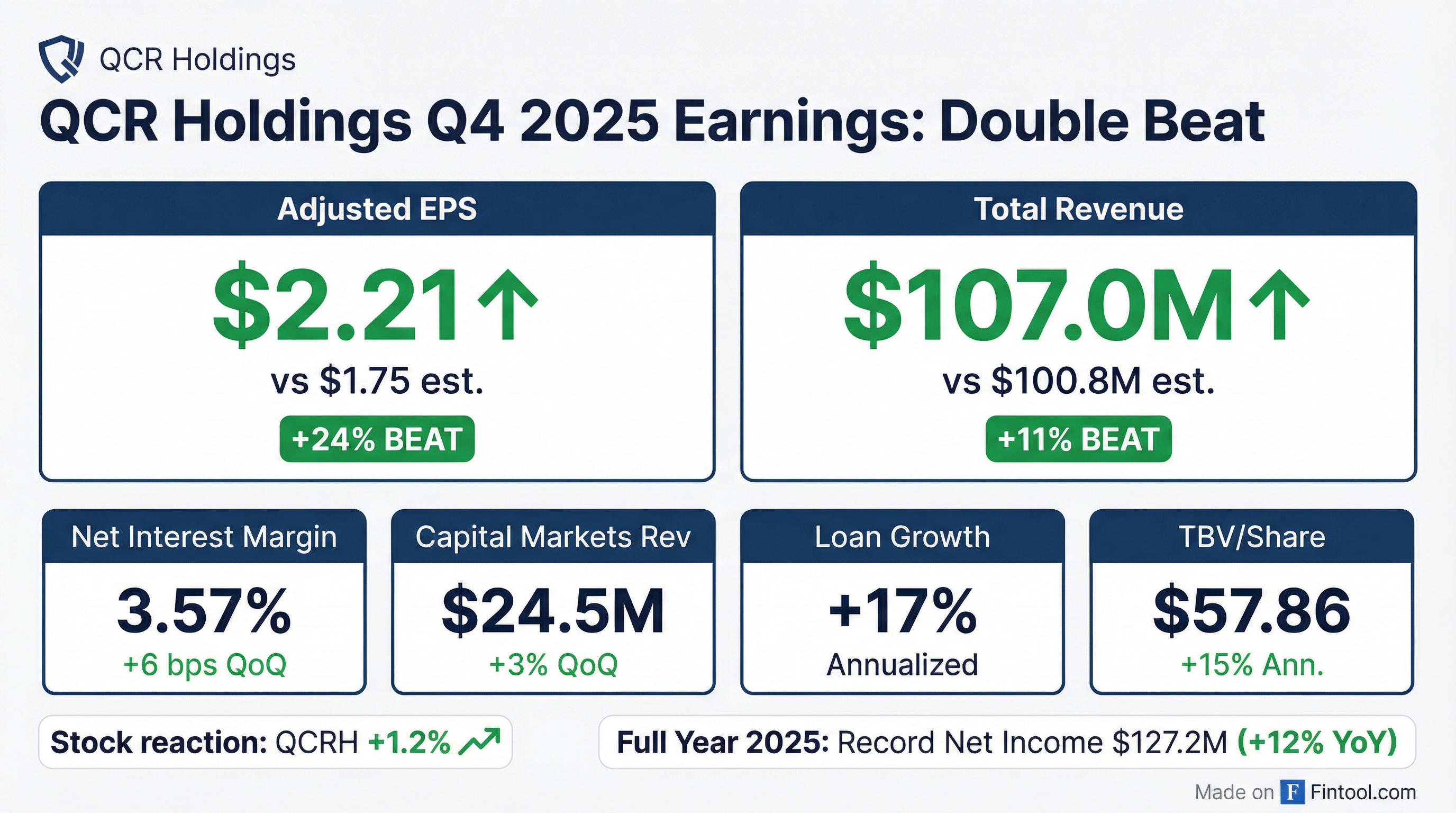

- QCRH reported record adjusted net income of $37 million, or $2.21 per diluted share, for Q4 2025, and $130 million, or $7.64 per diluted share, for the full year 2025.

- The company raised its capital markets revenue guidance to a range of $55 million-$70 million over the next four quarters and successfully sold $285 million of LIHTC construction loans in Q4 2025, with plans for a $300 million-$350 million perm loan securitization by mid-2026.

- Asset quality remained strong, with total criticized loans declining to 1.94% of total loans and leases, the lowest in over five years, while capital ratios improved, including a tangible common equity to tangible assets ratio of 10.24%.

- QCRH repurchased approximately 163,000 shares for $13 million in Q4 2025, contributing to a full-year total of nearly $22 million in share repurchases, and plans to remain opportunistic with future buybacks.

- The company anticipates 8%-10% gross loan growth in Q1 2026, accelerating throughout the year, and expects to manage its asset base to stay under the $10 billion asset threshold through the end of 2026.

- QCRH delivered record adjusted net income of $37 million ($2.21 per diluted share) for Q4 2025 and $130 million ($7.64 per diluted share) for the full year 2025, driven by significant net interest margin expansion, robust loan and deposit growth, and strong capital markets revenue.

- The company achieved a 6 basis point increase in Net Interest Margin (NIM) from Q3 2025 and expects further core margin expansion of 3-7 basis points in Q1 2026, assuming no further federal rate cuts.

- QCRH raised its capital markets revenue guidance to $55 million-$70 million over the next four quarters, following the successful sale of $285 million of LIHTC construction loans in Q4 2025 to enhance capital efficiency.

- Tangible book value per share grew $2.08 to approximately $58 in Q4 2025, representing 15% annualized growth, and the company repurchased approximately 163,000 shares for $13 million in the quarter.

- Strategic initiatives include advancing digital transformation, expanding the wealth management business (adding over $1 billion in new assets under management in 2025), and growing the LIHTC lending platform, with plans to cross the $10 billion asset threshold in 2027.

- QCR Holdings reported record adjusted net income of $37 million or $2.21 per diluted share for Q4 2025, and $130 million or $7.64 per diluted share for the full year 2025, driven by significant growth in net interest income and strong capital markets revenue.

- The company successfully sold $285 million of LIHTC construction loans at par in Q4 2025, which enhances capital markets revenue opportunities and strengthens regulatory capital. Capital markets revenue guidance was raised to $55 million-$70 million over the next four quarters.

- QCRH achieved strong loan growth, with total loans increasing $304 million (17% annualized) in Q4 before the loan sale, and core deposits growing $474 million (7%) for the full year 2025. For 2026, they guide to gross annualized loan growth of 8%-10% in Q1, accelerating to 10%-15% thereafter.

- Asset quality remains excellent, with total criticized loans decreasing to their lowest level since June 2022. The company also returned capital to shareholders by repurchasing approximately 163,000 shares for $13 million in Q4, contributing to a 15% annualized growth in tangible book value per share.

- QCR Holdings, Inc. reported $9.6 billion in total assets and $7.1 billion in Wealth Management Assets Under Management (AUM) as of December 31, 2025.

- The company achieved Adjusted Earnings Per Share (EPS) of $7.64 and Tangible Book Value Per Share (TBVPS) of $57.86 in 2025, reflecting a 14% CAGR for EPS and 13% CAGR for TBVPS from 2020.

- Noninterest income accounted for 36% of total revenue in Q4 2025, totaling $39 million, supported by its Specialty Finance Group and Wealth Management services.

- QCR Holdings maintains a strong credit culture with Non-Performing Assets (NPAs) at 0.05% of total assets in 2025 and a liability-sensitive balance sheet well-positioned for the current rate environment.

- QCR Holdings, Inc. reported record annual net income of $127.2 million, or $7.49 per diluted share, and record adjusted net income of $129.6 million, or $7.64 per diluted share, for the full year 2025.

- For the fourth quarter of 2025, net income was $35.7 million, or $2.12 per diluted share, with adjusted net income of $37.3 million, or $2.21 per diluted share.

- The company achieved robust net interest income of $68.4 million in Q4 2025, with a Net Interest Margin (NIM) TEY expansion of six basis points to 3.57%. They are guiding to an increase in first quarter NIM TEY ranging from 3 to 7 basis points.

- QCRH reported strong capital markets revenue of $24.5 million in Q4 2025 and $64.7 million for the full year 2025, with guidance for $55 to $70 million over the next four quarters.

- Loan growth was significant, with 17% annualized growth in Q4 2025 (excluding the LIHTC construction loan sale and m2 runoff) and 12% for the full year 2025. The company repurchased 162,777 shares at an average price of $77.62 per share in Q4 2025.

- QCR Holdings reported record annual net income of $127.2 million, or $7.49 per diluted share, for the full year 2025, and net income of $35.7 million, or $2.12 per diluted share, for the fourth quarter of 2025.

- The company achieved net interest income of $68.4 million in Q4 2025, with a Net Interest Margin (TEY) expanding by six basis points to 3.57%.

- Capital markets revenue was $24.5 million in Q4 2025, contributing to a full-year total of $64.7 million.

- QCR Holdings experienced annualized loan growth of 17% in Q4 2025 (prior to certain sales and runoffs) and 12% loan growth for the full year 2025 (prior to certain sales and runoffs), alongside 7% core deposit growth for the full year.

- The company repurchased 162,777 shares during Q4 2025, returning $12.6 million of capital to shareholders.

- QCR Holdings, Inc. reported $9.6 billion in total assets and $7.0 billion in Wealth Management Assets Under Management (AUM) as of September 30, 2025.

- For Q3 2025, noninterest income represented 36% of total revenue, totaling $37 million.

- The company achieved an annualized Adjusted Earnings Per Share of $7.24 and a Tangible Book Value per Share of $55.78 as of September 30, 2025.

- Loans reached $7.2 billion and Core Deposits were $7.1 billion as of September 30, 2025.

- QCR Holdings achieved record quarterly net income and 26% earnings per share growth in Q3 2025, driven by a rebound in capital markets revenue, robust loan growth, and continued net interest margin expansion.

- For Q4 2025, the company guides for 10% to 15% annualized gross loan growth and 3 to 7 basis points of Net Interest Margin (TEY) expansion.

- QCR Holdings increased its guidance for capital markets revenue to a range of $55 million to $65 million over the next four quarters.

- Wealth Management revenue grew 8% to $5 million in Q3 2025, with assets under management increasing by $316 million, or 5%, during the quarter.

- The board approved a new share repurchase program, authorizing the repurchase of up to 1.7 million shares of outstanding common stock.

- QCR Holdings achieved record quarterly net income and $2.17 per diluted share in Q3 2025, driven by a rebound in capital markets revenue, robust loan growth, and continued net interest margin expansion.

- Loan growth accelerated significantly by $286 million, or 17% annualized (15% net of M2 Equipment Finance runoff), with Q4 guidance for gross annualized loan growth in a range of 10%-15%.

- Capital markets revenue rebounded to $24 million in Q3, exceeding guidance, and the company increased its guidance for capital markets revenue to be in a range of $55 million-$65 million over the next four quarters.

- Net interest margin (NIM) on a tax-equivalent yield basis increased by five basis points from Q2, exceeding guidance, with anticipated continued core margin expansion of three to seven basis points for Q4.

- The company announced a new share repurchase program authorizing the repurchase of up to 1.7 million shares of common stock and reported a $2.50 increase in tangible book value per share, approaching $56 per share.

- QCR Holdings, Inc. reported record quarterly net income of $36.7 million and diluted earnings per share of $2.16 for the third quarter of 2025, compared to net income of $29.0 million and diluted EPS of $1.71 for the second quarter of 2025.

- The Board of Directors authorized a new share repurchase program on October 20, 2025, permitting the repurchase of up to 1,700,000 shares of its outstanding common stock, which is approximately 10% of outstanding shares as of September 30, 2025.

- In the third quarter of 2025, the Company's total loans and leases held for investment grew by $253.7 million, reaching $7.2 billion, representing a 15% annualized loan growth.

- For the fourth quarter of 2025, the Company anticipates noninterest expense to be between $52 million and $55 million.

Quarterly earnings call transcripts for QCR HOLDINGS.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more