Earnings summaries and quarterly performance for RESIDEO TECHNOLOGIES.

Executive leadership at RESIDEO TECHNOLOGIES.

Jay Geldmacher

President and Chief Executive Officer

Jeannine Lane

Executive Vice President, General Counsel & Corporate Secretary

Jeffrey Kutz

Senior Vice President, Chief Accounting Officer

Michael Carlet

Executive Vice President, Chief Financial Officer

Robert Aarnes

President, ADI Global Distribution

Stephen Kelly

Executive Vice President and Chief Human Resources Officer

Tom Surran

President, Products & Solutions

Board of directors at RESIDEO TECHNOLOGIES.

Andrew Teich

Chairman of the Board

Brian Kushner

Director

Cynthia Hostetler

Director

Jack Lazar

Director

John Stroup

Director

Kareem Yusuf

Director

Nathan Sleeper

Director

Nina Richardson

Director

Paul Deninger

Director

Sharon Wienbar

Director

Research analysts who have asked questions during RESIDEO TECHNOLOGIES earnings calls.

Erik Woodring

Morgan Stanley

8 questions for REZI

Ian Zaffino

Oppenheimer & Co. Inc.

4 questions for REZI

Dan Stratemeier

Jefferies

2 questions for REZI

Ian A. Zaffino

Oppenheimer

2 questions for REZI

Neil Metellia

Jefferies

2 questions for REZI

Amit Daryanani

Evercore

1 question for REZI

Chan Park

Evercore ISI

1 question for REZI

Cory Carpenter

JPMorgan Chase & Co.

1 question for REZI

Isaac Sellhausen

Oppenheimer & Co. Inc.

1 question for REZI

Michael Fisher

Evercore ISI

1 question for REZI

Recent press releases and 8-K filings for REZI.

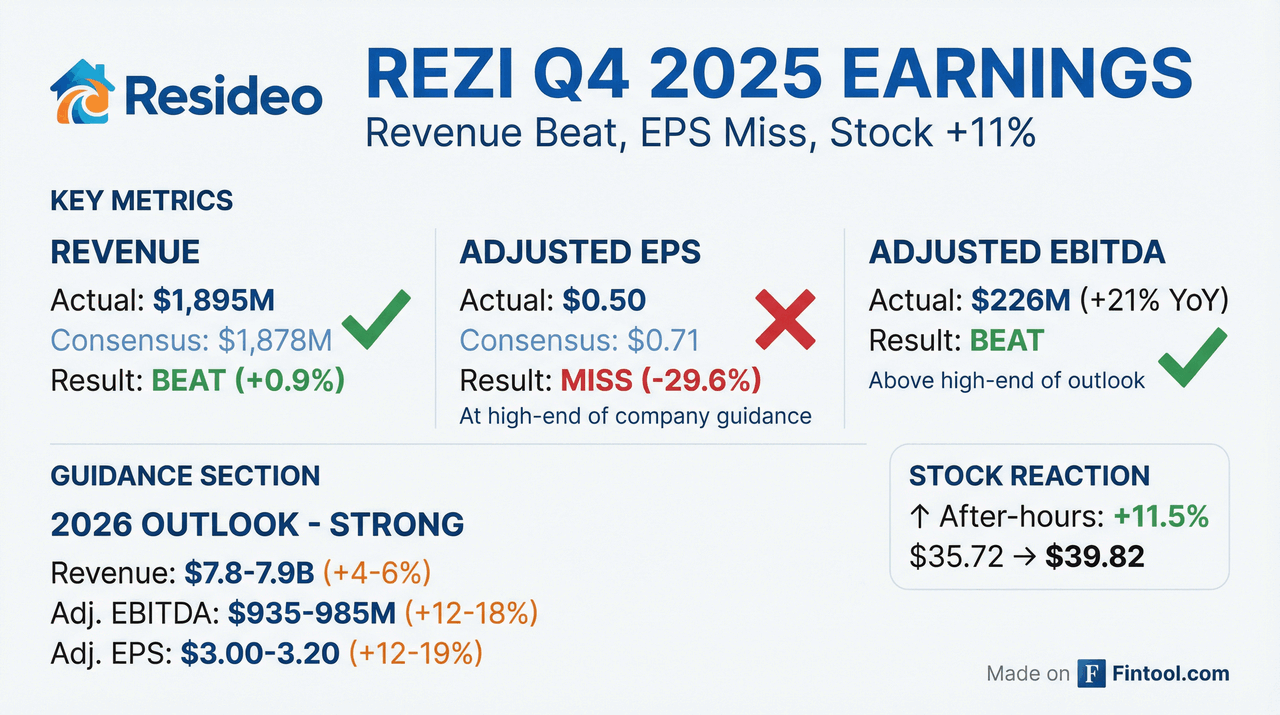

- Resideo Technologies reported record highs in net revenue, Adjusted EBITDA, and Adjusted EPS for the full year 2025, exceeding its outlook ranges. For Q4 2025, total net revenue was $1.895 billion, up 2% year-over-year, and Adjusted EBITDA was $226 million, up 21% year-over-year.

- The Products and Solutions (P&S) segment grew organic net revenue by 4% in 2025 and Q4 net revenue by 6% year-over-year, marking its 11th consecutive quarter of gross margin expansion.

- The ADI Global Distribution (ADI) segment grew organic net revenue by 3% in 2025, despite a 50 basis point decline in Q4 net revenue year-over-year, and achieved operational stabilization with its new ERP system. ADI also reported its seventh consecutive quarter of year-over-year gross margin expansion.

- The company is progressing with its anticipated business separation into two standalone companies in the second half of 2026, with plans to provide more details and file a public Form 10.

- The 2026 financial outlook is based on a cautious global macroeconomic environment, assuming little growth in the U.S. residential housing market and low single-digit growth in the repair and remodel market, with both segments expected to achieve year-over-year net revenue growth.

- Resideo Technologies achieved record highs in net revenue, adjusted EBITDA, and adjusted EPS for full-year 2025, with net revenue reaching $7.5 billion (up 11%), adjusted EBITDA at $833 million (up 20%), and adjusted EPS at $2.68 (up 17%).

- For Q4 2025, the company reported total net revenue of $1.895 billion (up 2% year-over-year) and adjusted EBITDA of $226 million (up 21% year-over-year).

- The company is progressing towards an anticipated business separation in the second half of 2026, which it believes will unlock significant shareholder value.

- For 2026, Resideo expects modest total company gross margin expansion and year-over-year net revenue growth for both business segments, with ADI's growth rate projected to be higher than Products and Solutions, despite a cautious macroeconomic outlook.

- The integration of Snap One has delivered $75 million in synergies 18 months ahead of schedule, with ongoing plans for operational optimization and new product introductions targeting the light commercial market.

- Resideo Technologies reported FY 2025 Net Revenue of $7,472 million and Adjusted EPS of $2.68, representing year-over-year increases of 11% and 17%, respectively. For Q4 2025, Net Revenue reached $1,895 million and Adjusted EPS was $0.50.

- The company completed the termination of the Honeywell Indemnification Agreement in August 2025 with a $1.59 billion one-time cash payment, which is expected to immediately unlock $35 million of quarterly EBITDA.

- Resideo announced its plan to separate its Products & Solutions and ADI Global Distribution businesses into two independent publicly traded companies.

- For full year 2026, Resideo anticipates total net revenue between $7,800 million and $7,900 million, Adjusted EBITDA between $935 million and $985 million, and Adjusted EPS between $3.00 and $3.20.

- Resideo Technologies achieved record highs in net revenue ($7.5 billion), adjusted EBITDA ($833 million), and adjusted EPS ($2.68) for the full year 2025, surpassing its outlook ranges.

- For the fourth quarter of 2025, total net revenue was $1.895 billion, an increase of 2% year-over-year, and adjusted EBITDA grew 21% to $226 million, with both metrics exceeding the high end of the company's outlook range.

- The company issued a full-year 2026 financial outlook, projecting net revenue between $7.8 billion and $7.9 billion, adjusted EBITDA between $935 million and $985 million, and diluted EPS between $3.00 and $3.20.

- Operationally, the ADI Global Distribution business is now fully operational on its new ERP system, and the integration of Snap One has already achieved approximately $75 million in synergies, 18 months ahead of schedule.

- The anticipated business separation is progressing well and is expected to occur in the second half of 2026.

- Resideo reported record high full year 2025 net revenue of $7.47 billion, an 11% increase year-over-year, and record high Adjusted EBITDA of $833 million, up 20% year-over-year.

- The company recorded a full year 2025 GAAP net loss of $527 million, primarily driven by the expense associated with terminating the Indemnification Agreement, compared to net income of $116 million in 2024.

- For the fourth quarter of 2025, net revenue was $1.895 billion, up 2% year-over-year, with net income of $136 million and Adjusted EBITDA of $226 million.

- Resideo provided its full year 2026 outlook, forecasting net revenue between $7,800 million and $7,900 million and Adjusted EPS between $3.00 and $3.20.

- Full year 2025 cash used in operating activities was $1,137 million, largely due to a $1,590 million payment to terminate the Indemnification Agreement, while adjusted cash provided by operating activities was $453 million.

- Resideo Technologies, Inc. achieved record high full year 2025 net revenue of $7.47 billion, an 11% increase year-over-year, and record high Adjusted EBITDA of $833 million, up 20% year-over-year.

- The company reported a full year 2025 net loss of $527 million, primarily driven by the expense associated with terminating the Indemnification Agreement.

- For the fourth quarter of 2025, net revenue was $1.895 billion, a 2% increase year-over-year, with net income of $136 million and Adjusted EBITDA of $226 million, up 21% year-over-year.

- Resideo provided a full year 2026 outlook, projecting net revenue between $7.800 billion and $7.900 billion, and Non-GAAP Adjusted EPS between $3.00 and $3.20.

- The company is planning to separate its Products & Solutions and ADI Global Distribution businesses into two independent publicly traded companies.

- Spruce Point Capital Management has issued a "Strong Sell" research opinion on Resideo Technologies, Inc. (REZI), estimating a 25% – 50% potential long-term downside risk to approximately $17.64 – $26.45 per share.

- The report highlights long-term management failures to achieve organic growth, margin, or cash flow targets, and expresses concerns about a revolving door at the CFO and CAO roles and problematic financial reporting for recent M&A transactions like First Alert and Snap One Holdings.

- Spruce Point believes that dubious recurring restructuring add-backs and questionable tax maneuvers may be inflating financial results, and notes that REZI's operating cash flow has markedly deteriorated.

- Resideo settled its Indemnification and Reimbursement Agreement (IRA) liability with Honeywell for $1.625 billion, converting it into a Term Loan B and removing a significant financial burden and investor concern.

- The company announced the planned spin-off of its ADI distribution segment, expected by the second half of 2026, to allow both the Products and Solutions (P&S) and ADI businesses to operate independently and attract distinct investor bases.

- Upon separation, Rob Aarnes will become CEO of ADI and Tom Surran will become CEO of Products and Solutions, while current CEO Jay intends to retire.

- The Products and Solutions segment targets low-to-mid single-digit organic revenue growth and expects 300-500 basis points gross margin expansion (from 43%) and a 25% Adjusted EBITDA margin. The ADI segment aims for mid-to-high single-digit organic growth and a 10% Adjusted EBITDA margin (from 6%-7%).

- Integration of the Snap One acquisition is ahead of schedule, with the company on track to achieve $75 million in run-rate synergies by the end of year three (around 2027).

- Resideo settled its Indemnification and Reimbursement Agreement (IRA) with Honeywell for $1.625 billion, converting the complex liability into a Term Loan B.

- The company announced the spinoff of its ADI distribution segment, with the separation expected by the second half of 2026.

- Upon separation, current ADI leader Rob Aarnes and P&S leader Tom Surran will become CEOs of their respective businesses, while current CEO Jay is set to retire.

- The Products & Security (P&S) segment is projected for low single-digit to mid-single-digit organic revenue growth with a path to 300-500 basis points gross margin expansion from its current 43%. The ADI segment targets mid-single-digit to high-single-digit organic growth and aims for a 10% adjusted EBITDA margin from its current 6%-7%.

- The integration of the Snap One acquisition is progressing well, with ADI tracking ahead of its $75 million run rate synergy target by the exit of year three (2027).

- Resideo settled its Indemnification and Reimbursement Agreement (IRA) with Honeywell for $1.625 billion, converting the liability into a Term Loan B.

- The company announced the spinoff of its ADI distribution segment from its Products & Security (P&S) business, with the separation targeted for the second half of 2026.

- Upon separation, current segment leaders Rob Aarnes (ADI) and Tom Surran (P&S) will become CEOs of their respective businesses, and current CEO Jay intends to retire.

- The Products & Security business is projected for low to mid-single-digit organic revenue growth and aims for 300-500 basis points of gross margin expansion over the next three to five years from its current 43% gross margin.

- The ADI distribution business is expected to achieve mid to high-single-digit organic growth and targets a 10% adjusted EBITDA margin from its current 6%-7%.

Quarterly earnings call transcripts for RESIDEO TECHNOLOGIES.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more