Earnings summaries and quarterly performance for Roivant Sciences.

Executive leadership at Roivant Sciences.

Board of directors at Roivant Sciences.

Research analysts who have asked questions during Roivant Sciences earnings calls.

Brian Cheng

JPMorgan Chase & Co.

8 questions for ROIV

Douglas Tsao

H.C. Wainwright & Co.

8 questions for ROIV

David Risinger

Leerink Partners

7 questions for ROIV

Yaron Werber

TD Cowen

7 questions for ROIV

Corinne Johnson

Goldman Sachs

5 questions for ROIV

Dennis Ding

Jefferies Financial Group Inc.

5 questions for ROIV

Thomas Smith

Leerink Partners

5 questions for ROIV

Yatin Suneja

Guggenheim Partners

5 questions for ROIV

Derek Archila

Wells Fargo

4 questions for ROIV

Prakhar Agrawal

Cantor Fitzgerald

4 questions for ROIV

Samantha Semenkow

Citigroup Inc.

4 questions for ROIV

Yasmeen Rahimi

Piper Sandler & Co.

4 questions for ROIV

Anthea Li

Jefferies

3 questions for ROIV

Alexander Thompson

Stifel

2 questions for ROIV

Andy Chen

Wolfe Research, LLC

2 questions for ROIV

Ashwani Verma

UBS Group AG

2 questions for ROIV

Brandon Frith

Wolfe Research, LLC

2 questions for ROIV

Emma Gutstein

Wolfe Research

2 questions for ROIV

Sam Sliski

Lifesize Capital

2 questions for ROIV

Sam Slutsky

LifeSci Capital, LLC

2 questions for ROIV

Craig McLean

Goldman Sachs

1 question for ROIV

Joyce Zhou

TD Cowen

1 question for ROIV

Louise Chen

Cantor Fitzgerald

1 question for ROIV

Recent press releases and 8-K filings for ROIV.

- Roivant Sciences announced a $2.25 billion global settlement with Moderna to resolve patent litigation concerning the COVID vaccine.

- The settlement includes a $950 million upfront payment expected in July, with an additional $1.3 billion contingent payment based on a legal appeal regarding Section 1498.

- Roivant expects to receive 60%-70% of the upfront payment after an effective tax rate of 10%-15%.

- The company plans to use the settlement proceeds to invest in its pipeline and upcoming launches, and has expanded its share buyback program up to $1 billion.

- Additionally, brepocitinib's NDA filing was accepted by the FDA with priority review, with a potential commercial launch anticipated by the end of September 2026.

- Roivant, Genevant, and Arbutus announced a $2.25 billion global settlement with Moderna resolving patent litigation related to COVID vaccines, comprising a $950 million upfront payment in July 2026 and a $1.3 billion contingent payment based on a legal appeal.

- Roivant anticipates receiving 60%-70% of the settlement proceeds after an effective tax rate of 10%-15%, which will be used to invest in its pipeline and launches, and to expand its share buyback program to $1 billion.

- The Pfizer-BioNTech patent case remains outstanding and will be aggressively pursued, while the NDA for brepocitinib was accepted by the FDA with priority review for a potential commercial launch by the end of September 2026.

- Roivant Sciences announced a $2.25 billion global settlement with Moderna to resolve patent litigation related to the COVID vaccine.

- The settlement includes a $950 million upfront payment expected in July 2026, with 60%-70% of that amount attributable to Roivant.

- An additional $1.3 billion payment is contingent on the resolution of a legal appeal concerning Section 1498, an issue that has previously been decided in Roivant's favor.

- Roivant is expanding its share buyback program up to $1 billion and intends to be aggressive in returning capital to shareholders.

- The Pfizer-BioNTech case remains outstanding, and Roivant intends to pursue it aggressively, while the NDA for brepocitinib was accepted by the FDA with priority review for a potential commercial launch by the end of September 2026.

- Roivant Sciences Ltd. announced a $2.25 billion global settlement between its subsidiary Genevant Sciences and Arbutus Biopharma Corp. with Moderna, Inc. to resolve patent infringement litigation over LNP delivery technology in Moderna's COVID-19 vaccines.

- The settlement includes a $950.0 million noncontingent lump sum payment from Moderna by July 8, 2026, and an additional $1.3 billion contingent lump sum payment based on the outcome of Moderna's appeal regarding 28 U.S.C. §1498.

- Roivant's board of directors has approved a $1 billion share repurchase program, inclusive of a previously authorized $500 million, to be funded with available cash and cash equivalents.

- The PDUFA date for brepocitinib in dermatomyositis is in Q3, with a planned launch by the end of September.

- Phase III CLARITY-1 and CLARITY-2 studies for brepocitinib in non-infectious uveitis (NIU) and the Phase IIb PHocus study for mosliciguat in PH-ILD are both expected to read out data in the second half of this year.

- Following "unprecedented" Phase II data, Roivant plans to start Phase III for brepocitinib in cutaneous sarcoidosis in the second half of the year.

- A trial concerning Moderna is scheduled to begin on March 9th and is anticipated to last a couple of weeks.

- Roivant Sciences' dermatomyositis (DM) drug has a PDUFA date in the third quarter of 2026, with a planned launch by the end of September following priority review from FDA.

- Key clinical trial data readouts are anticipated in the second half of this year for non-infectious uveitis (NIU) studies (CLARITY-1 and CLARITY-2) and the PHOCUS study for mosliciguat in PH-ILD.

- Data from IMVT-1402 studies (FORWARD-1 and FORWARD-2) for Graves' disease are expected next year.

- A trial involving Moderna is scheduled to commence on March 9th and is expected to run for a couple of weeks.

- Roivant Sciences Ltd.'s subsidiary, Priovant Therapeutics, announced that the FDA has accepted its New Drug Application (NDA) for brepocitinib for the treatment of dermatomyositis (DM) and granted it Priority Review.

- The FDA has assigned a PDUFA target action date in the third quarter of calendar year 2026, with an expected U.S. launch at the end of September 2026.

- This Priority Review was supported by positive Phase 3 VALOR results, positioning brepocitinib as a potential first targeted therapy approved for dermatomyositis if cleared by the FDA.

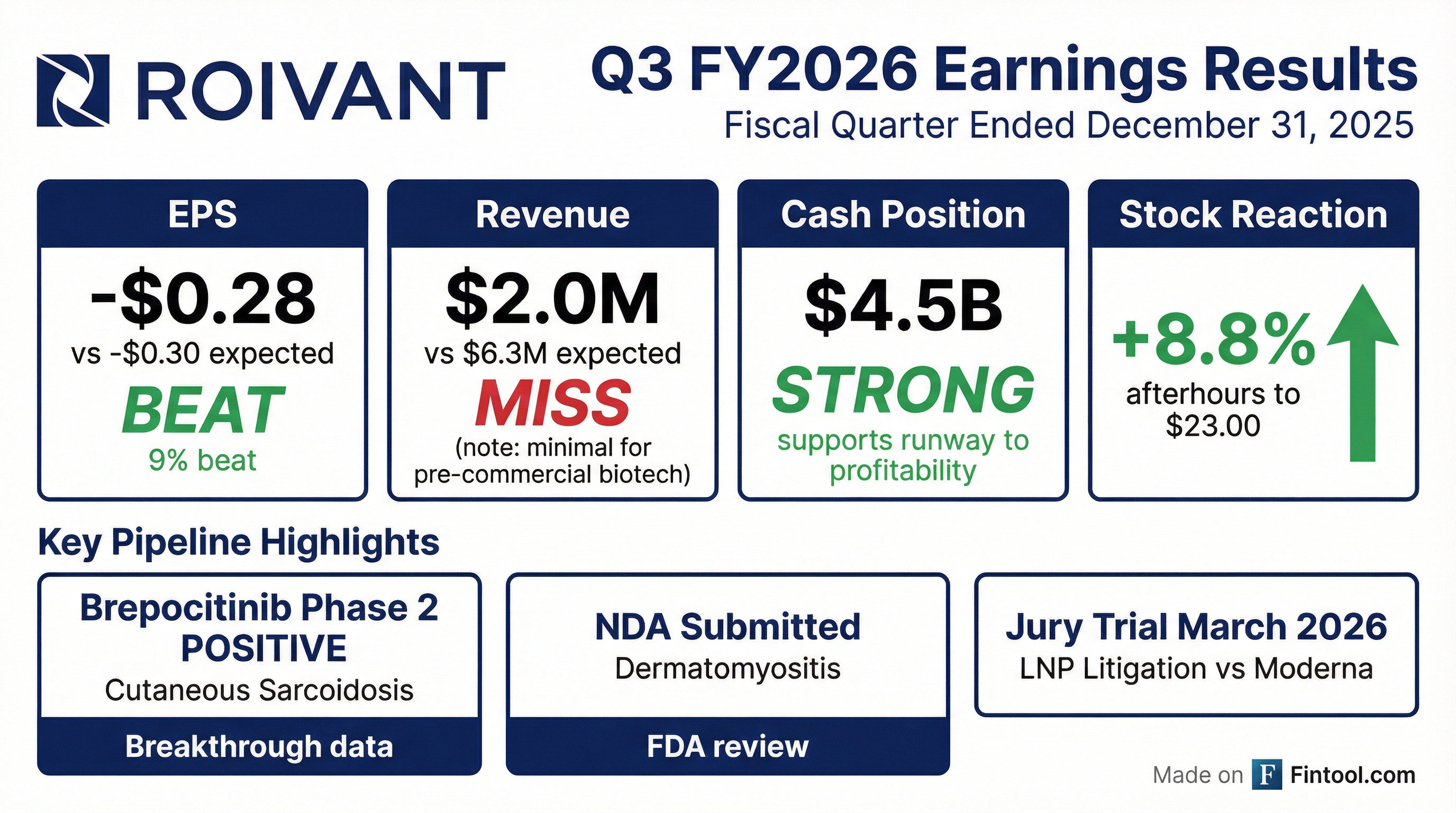

- Roivant Sciences reported a non-GAAP net loss of $167 million for Q3 2026, with $147 million in adjusted non-GAAP R&D expense and $71 million in adjusted non-GAAP G&A expense, while maintaining $4.5 billion in consolidated cash.

- The company announced positive Phase 2 results for brepocitinib in cutaneous sarcoidosis, demonstrating a statistically significant 21.6-point placebo-adjusted delta in CSAMI, and 100% of patients on the high dose achieved at least a 10-point improvement.

- An NDA for brepocitinib in dermatomyositis has been filed, and a Phase 3 study for brepocitinib in cutaneous sarcoidosis is scheduled to commence in 2026.

- Key clinical trials, including the Phase 2b study for IMVT-1402 in D2T-RA and the Phase 2 study for mosliciguat in PH-ILD, have fully enrolled, with data for both expected in the second half of 2026.

- A jury trial against Moderna is set to begin on March 9th, following a favorable decision on Section 1498.

- Roivant reported a non-GAAP net loss of $167 million for the third quarter ended December 31, 2025, and holds $4.5 billion in consolidated cash.

- The company announced positive Phase 2 results for brepocitinib in cutaneous sarcoidosis, demonstrating a 21.6-point placebo-adjusted delta and a 100% response rate for the 45mg dose, with the drug being very well tolerated. A Phase 3 study for this indication is set to begin in 2026.

- The New Drug Application (NDA) for brepocitinib in dermatomyositis has been filed.

- Studies for 1402 in D2T-RA and mosliciguat in PH-ILD are fully enrolled, with data expected in the second half of 2026.

- The jury trial against Moderna is scheduled for March 9th, following a favorable decision on Section 1498.

- Roivant Sciences reported positive Phase II results for brepocitinib in cutaneous sarcoidosis, showing a 21.6-point placebo-adjusted delta in CSAMI and 100% of patients on the 45mg dose achieving a 10-point improvement.

- The company announced an NDA filing for brepocitinib in dermatomyositis and plans to initiate a Phase III study for brepocitinib in cutaneous sarcoidosis in 2026.

- Key clinical trials, including the Phase IIb study for IMVT-1402 in D2T-RA and the Phase II study for mosliciguat in PH-ILD, have fully enrolled, with data readouts anticipated in the second half of 2026 for both.

- For the third quarter ended December 31, 2025, Roivant reported a non-GAAP net loss of $167 million, with adjusted non-GAAP R&D expenses of $147 million and G&A expenses of $71 million.

- A jury trial against Moderna is scheduled to commence on March 9th.

Quarterly earnings call transcripts for Roivant Sciences.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more