Earnings summaries and quarterly performance for Ryerson Holding.

Executive leadership at Ryerson Holding.

Edward Lehner

President & Chief Executive Officer

James Claussen

Executive Vice President & Chief Financial Officer

Mark Silver

Executive Vice President, General Counsel & Chief Human Resources Officer

Molly Kannan

Chief Accounting Officer and Corporate Controller

Srini Sundarrajan

Chief Information Officer

Board of directors at Ryerson Holding.

Research analysts who have asked questions during Ryerson Holding earnings calls.

Katja Jancic

BMO Capital Markets

6 questions for RYI

Samuel McKinney

KeyBanc Capital Markets

6 questions for RYI

Alan Weber

Robotti & Company, Inc.

3 questions for RYI

Alan W. Weber

BMO Capital Markets

1 question for RYI

Curtis Jensen

Robotti & Company, Incorporated

1 question for RYI

Konner Reed

Integrity Asset Management

1 question for RYI

Philip Gibbs

KeyBanc Capital Markets

1 question for RYI

Tariq Ali

Invenire Capital

1 question for RYI

Recent press releases and 8-K filings for RYI.

- Ryerson Holding Corporation has successfully closed its merger with Olympic Steel, establishing the combined entity as the second largest metals service center in North America.

- The merged company is projected to process approximately 2.9 million tons and generate over $6.5 billion in annual revenue.

- The transaction is expected to yield ~$120 million in annual run-rate synergies, with 33% realization anticipated by the end of Year 1 and full implementation by the end of Year 2.

- The merger is expected to be immediately accretive pre-synergies, with a pro forma combined revenue of $6.5 billion+ and an EBITDA margin of ~6% for 2024, including forecasted run-rate synergies.

- For Q1 2026, Ryerson expects revenue to be in the range of $1.52 billion to $1.58 billion and Adjusted EBITDA, excluding LIFO, in the range of $63 million to $67 million.

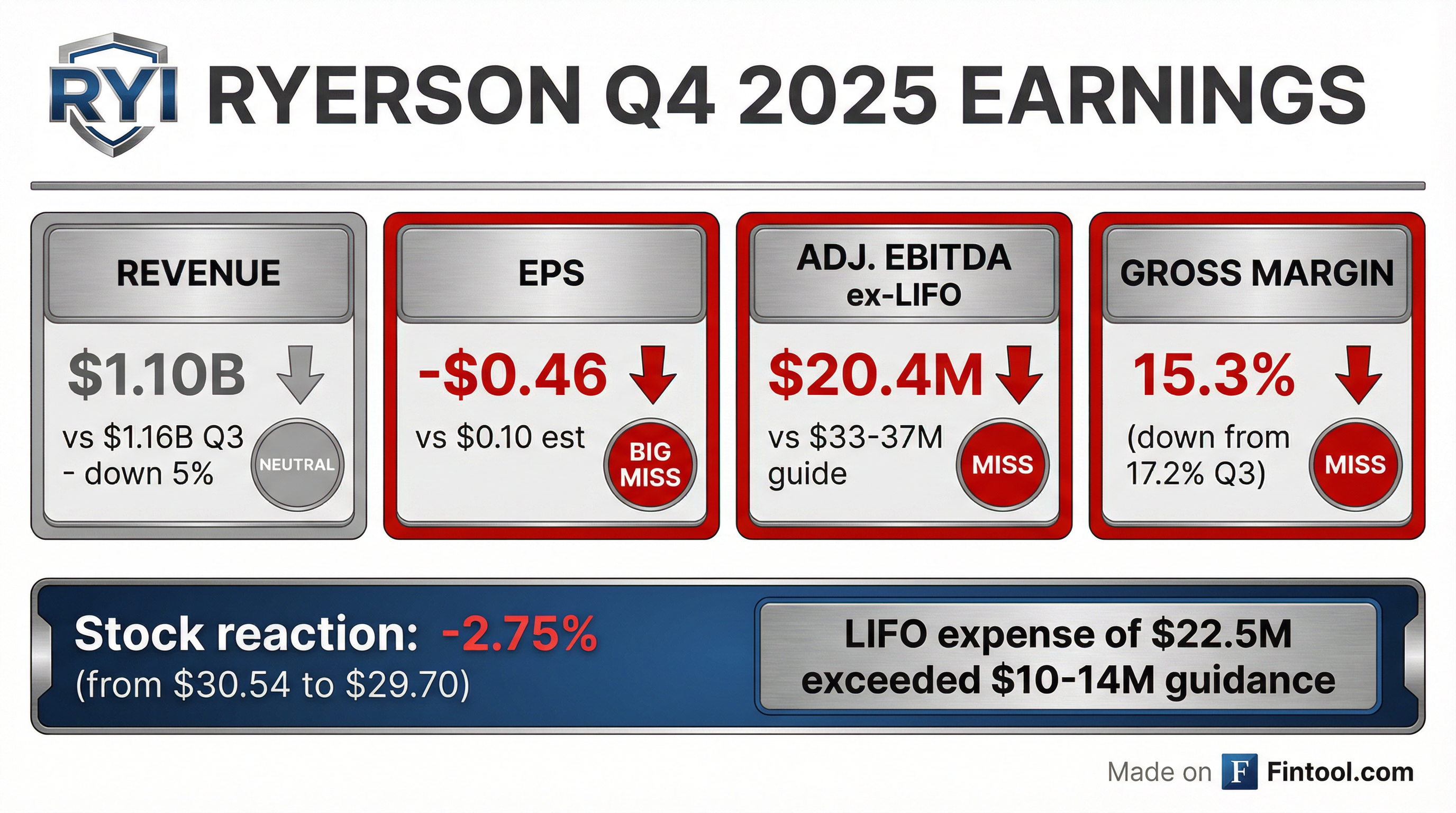

- Ryerson Holding reported Q4 2025 revenue of $1.10 billion, a net loss of $37.9 million, and a diluted loss per share of $1.18. Adjusted EBITDA, excluding LIFO, was $20.4 million for the quarter.

- The company successfully closed its merger with Olympic Steel, creating the second largest metals service center in North America with an expected annual revenue of over $6.5 billion and processing approximately 2.9 million tons based on 2024 company results.

- The merger is expected to generate approximately $120 million in annual synergies by the end of year two.

- For Q1 2026, Ryerson expects net sales between $1.52 billion and $1.58 billion, net income between $10 million and $12 million, and Adjusted EBITDA, excluding LIFO, between $63 million and $67 million. This guidance includes Olympic Steel's pro-rated revenue of $260-$280 million and Adjusted EBITDA, excluding LIFO of $12-$13 million.

- The company's Q4 2025 leverage decreased to 3.1x, and a Q1 2026 dividend of $0.1875 per share was declared.

- For Q4 2025, Ryerson reported net sales of $1.1 billion, a net loss of $37.9 million or $1.18 per diluted share, and adjusted EBITDA, excluding LIFO, of $20.4 million.

- The company recently completed its merger with Olympic Steel, expecting $120 million in annual run rate synergies over the next two years.

- For Q1 2026, the combined company anticipates revenue in the range of $1.52 billion-$1.58 billion and adjusted EBITDA, excluding LIFO, between $63 million and $67 million.

- Ryerson's strategic priorities include integrating the combined organization, realizing merger synergies, improving earnings quality, and reducing leverage to within its targeted range of 0.5-2 times.

- The company noted encouraging strength in customer quote and order activity in Q1 2026, indicating signs of an improving manufacturing economy.

- Ryerson Holding Corporation successfully closed its merger with Olympic Steel, with expectations to achieve $120 million in annual run rate synergies over the next two years.

- For Q4 2025, the company reported a net loss of $38 million or $1.18 per share and adjusted EBITDA, excluding LIFO, of $20 million.

- For Q1 2026, the combined company forecasts revenue between $1.52 billion and $1.58 billion, net income of $10 million to $12 million (before merger-related fees), and adjusted EBITDA, excluding LIFO, between $63 million and $67 million.

- The company maintained $502 million in liquidity at the end of Q4 2025 and expanded its revolving credit facility to $1.8 billion.

- Management observed improving market conditions, with encouraging customer activity and anticipated sequential and year-over-year gross margin expansion and operating income improvements in Q1 2026.

- Ryerson Holding reported Q4 2025 net sales of $1.1 billion and a net loss of $38 million, with adjusted EBITDA, excluding LIFO, of $20 million, as gross margins contracted due to rising material costs.

- The company completed its merger with Olympic Steel just prior to the earnings call, anticipating $120 million in annual run rate synergies over the next two years.

- For Q1 2026, the combined company projects revenue between $1.52 billion and $1.58 billion and adjusted EBITDA, excluding LIFO, between $63 million and $67 million, expecting a 13%-15% sequential increase in tons shipped.

- Ryerson ended Q4 2025 with $502 million in liquidity and reduced its leverage ratio to 3.1 times, while expanding its revolving credit facility to $1.8 billion.

- Ryerson Holding Corporation reported Q4 2025 revenue of $1.10 billion and a net loss of $(37.9) million, with full-year 2025 revenue reaching $4.57 billion and a net loss of $(56.4) million.

- The company successfully completed its merger with Olympic Steel on February 13, 2026, which is projected to generate $120 million in annual run-rate synergies over the next two years.

- Ryerson also extended and expanded its credit facility from $1.3 billion to $1.8 billion and declared a Q1 2026 dividend of $0.1875 per share.

- For Q1 2026, the combined company anticipates revenue between $1.52 billion and $1.58 billion and Adjusted EBITDA, excluding LIFO, in the range of $63 million to $67 million.

- Ryerson Holding Corporation reported Q4 2025 revenue of $1.10 billion and a net loss of $37.9 million, resulting in a diluted loss per share of $1.18. For the full year 2025, revenue was $4.57 billion with a net loss of $56.4 million and a diluted loss per share of $1.76.

- Subsequent to quarter-end, on February 13, 2026, Ryerson completed its merger with Olympic Steel, forming North America's second-largest metals service center and projecting $120 million in annual run-rate synergies over the next two years.

- The company also extended and expanded its credit facility from $1.3 billion to $1.8 billion, providing enhanced financial flexibility.

- Ryerson's Board of Directors declared a quarterly cash dividend of $0.1875 per share for Q1 2026, payable on March 19, 2026.

- For Q1 2026, the combined company (Ryerson and Olympic Steel) anticipates revenue in the range of $1.52 to $1.58 billion and Adjusted EBITDA, excluding LIFO, between $63 and $67 million.

- Ryerson Holding Corporation and Olympic Steel, Inc. successfully completed their merger on February 13, 2026, with Ryerson issuing 1.7105 shares of its common stock for each Olympic Steel share, leading to former Olympic Steel shareholders holding approximately 37% of Ryerson.

- The combined entity will begin trading on the NYSE under the new ticker "RYZ" on February 24th and anticipates achieving approximately $120 million in annual synergies by early 2028.

- This merger positions Ryerson as the second-largest North American metals service center.

- Eddie Lehner continues as CEO, while Richard T. Marabito (former Olympic Steel CEO) is appointed President and COO, and Michael D. Siegal (former Olympic Steel Executive Chairman) becomes chairman of the Ryerson Board of Directors, which now includes three additional former Olympic Steel board members.

- Shareholders of Ryerson Holding Corporation and Olympic Steel, Inc. have approved the merger and the related issuance of Ryerson stock.

- The closing of the merger is expected to occur on February 13, 2026, subject to customary closing conditions.

- Upon closing, Olympic Steel will merge with Ryerson, and Olympic Steel shares will cease trading and be delisted from the NASDAQ exchange.

- Olympic Steel shareholders will receive 1.7105 shares of Ryerson common stock for each share of Olympic Steel common stock.

- Ryerson Holding Corporation reported a net loss attributable to Ryerson of $37.9 million, or $1.18 per diluted share, on $1.10 billion in revenue for the fourth quarter of 2025, with Adjusted EBITDA, excluding LIFO, totaling $20.4 million.

- Gross margins compressed to 15.3% in Q4 2025, down from 17.2% in Q3, and the company recorded a higher-than-anticipated LIFO expense of $22.5 million.

- For the first quarter of 2026, Ryerson expects net sales between $1.26 billion and $1.30 billion and net income between $10 million and $12 million (before merger-related fees), with Adjusted EBITDA, excluding LIFO, in the range of $51 million to $54 million.

- The merger with Olympic Steel is anticipated to close in Q1 2026, with stockholder meetings scheduled for February 12, 2026. Pro forma Q1 2026 guidance, including Olympic Steel, projects total revenue of $1.52 billion to $1.58 billion and Adjusted EBITDA, excluding LIFO, of $63 million to $67 million.

Quarterly earnings call transcripts for Ryerson Holding.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more