Earnings summaries and quarterly performance for SUNCOR ENERGY.

Research analysts who have asked questions during SUNCOR ENERGY earnings calls.

Dennis Fong

CIBC World Markets

6 questions for SU

Greg Pardy

RBC Capital Markets

6 questions for SU

Manav Gupta

UBS Group

6 questions for SU

Menno Hulshof

TD Cowen

6 questions for SU

Neil Mehta

Goldman Sachs

5 questions for SU

Doug Leggate

Wolfe Research

2 questions for SU

Patrick O'Rourke

ATB

2 questions for SU

Patrick O'Rourke

ATB Capital Markets

2 questions for SU

Adam Alexander Wijaya

Goldman Sachs

1 question for SU

Douglas George Blyth Leggate

Wolfe Research

1 question for SU

John Abbott

Wolfe Research

1 question for SU

John Royall

JPMorgan Chase & Co.

1 question for SU

Roger Read

Wells Fargo & Company

1 question for SU

Recent press releases and 8-K filings for SU.

- Suncor Energy filed its 2025 Annual Report, 2025 Annual Information Form, and 2026 Management Proxy Circular on February 26, 2026.

- The company renewed its Normal Course Issuer Bid (NCIB), authorizing the purchase of up to 118,700,000 common shares for cancellation, effective from March 3, 2026, to March 2, 2027. This amount is approximately 10% of Suncor's public float as of February 18, 2026.

- Under the prior NCIB, Suncor repurchased 54,150,911 shares for approximately $3.075 billion at a weighted average price of $56.79 per share between March 3, 2025, and February 24, 2026.

- Suncor Energy Inc. achieved record-breaking operational and strong financial performance in 2025, reporting $12.8 billion in Adjusted Funds From Operations and $6.9 billion in Free Funds Flow.

- The company returned $5.8 billion to shareholders in 2025, including $2.8 billion in dividends (a 5% increase from 2024) and $3.0 billion in share repurchases.

- CEO Rich Kruger's 2025 compensation included a $1,350,000 salary, a $3,908,250 annual incentive payment, and a $10,125,000 annual equity award.

- The Board of Directors experienced changes with Mr. Romasko's resignation effective August 8, 2025, and Ms. Kneale joining the Board effective February 3, 2026; the Board currently has 45% women representation.

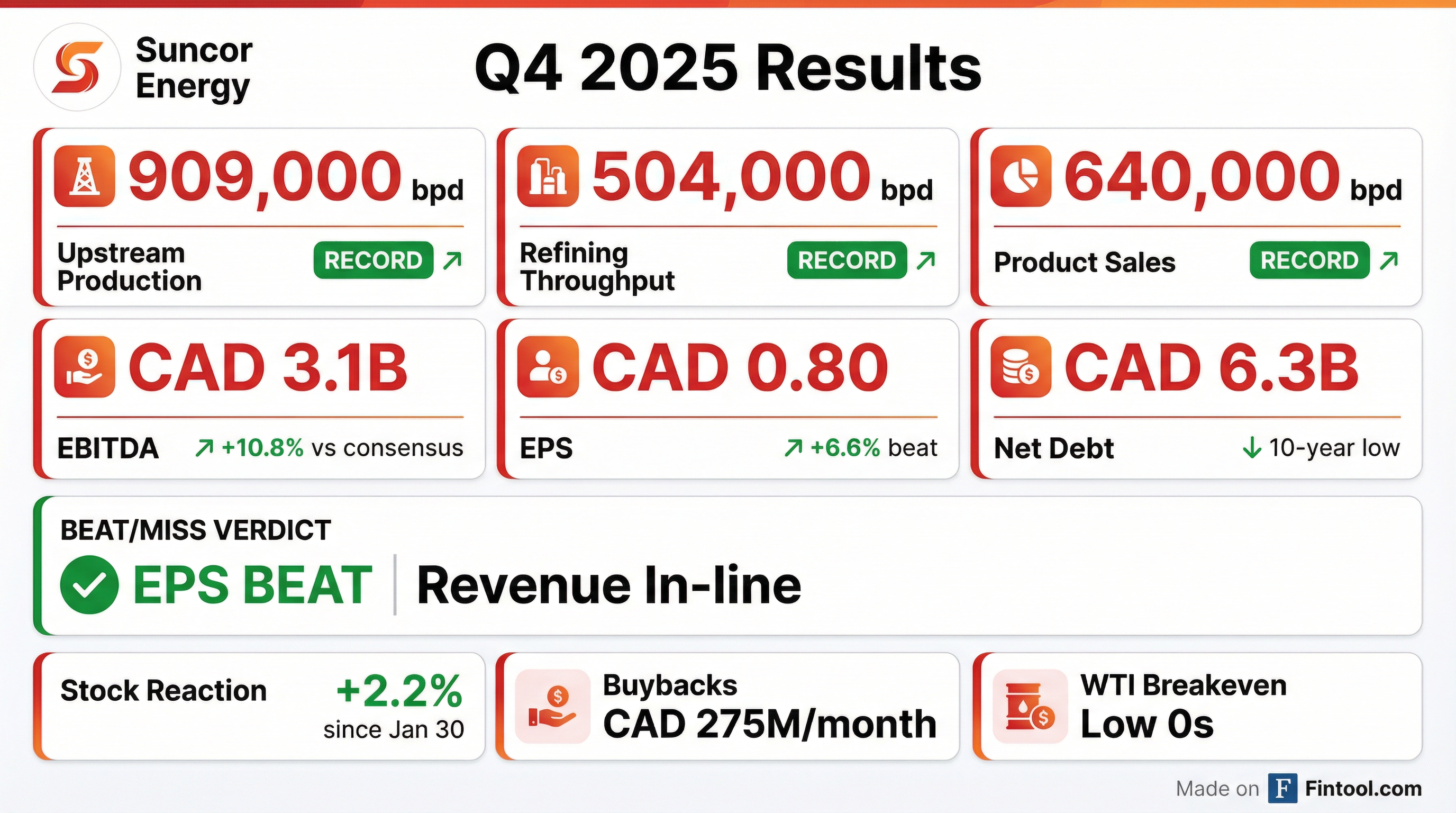

- Suncor Energy reported record-breaking operational performance for Q4 and full year 2025, including its safest year ever, with upstream production reaching 909,000 barrels a day in Q4 and 860 KBD for the full year, alongside record refining throughput and product sales.

- The company achieved its three-year performance improvement commitments (2024-2026 plan) two years early, surpassing targets for production growth, breakeven reduction, and free funds flow increase.

- Net debt significantly decreased to $6.3 billion, marking its lowest level in over a decade and achieved nine months ahead of schedule.

- Suncor returned over CAD 3 billion to shareholders through buybacks in 2025 and plans to continue at an increased rate of CAD 275 million per month in 2026, complementing increased dividends.

- A new value improvement plan will be unveiled on March 31st, detailing future strategies and capital allocation, with capital expenditures anticipated to remain around or below the $6 billion level.

- Suncor Energy reported record operational performance in Q4 and full year 2025, with Q4 upstream production reaching 909,000 barrels a day and refining throughput at 504 KBD, both marking best-ever quarterly results.

- The company met or exceeded all its 3-year performance improvement commitments (including production growth, breakeven reduction, and free funds flow increase) in just two years, ahead of the original 2024-2026 schedule.

- Net debt closed 2025 at a 10-year low of CAD 6.3 billion, and Suncor returned over CAD 3 billion to shareholders through buybacks in 2025, with plans to continue at an increased rate of CAD 275 million per month in 2026.

- A new value improvement plan, outlining short-term and long-term strategies, will be detailed at an Investor Day on March 31st.

- Suncor reported record operational performance for Q4 and full-year 2025, including 909,000 barrels a day in upstream production for Q4, 106% upgrader utilization, 504 KBD refining throughput, and 640,000 barrels a day in product sales for Q4.

- The company achieved its 3-year performance improvement commitments in 2 years, exceeding targets for production growth, breakeven reduction, and annual free funds flow increase, while reducing capital spend.

- Net debt closed the year at a greater than 10-year low of CAD 6.3 billion.

- Suncor returned over CAD 3 billion to shareholders through share buybacks in 2025, increasing to CAD 275 million per month in December and planning to continue at this level in 2026.

- Management emphasized a strategy of continued organic growth from existing assets, maintaining capital expenditures at or below $6 billion, and providing stable, predictable shareholder returns regardless of commodity cycles.

- Suncor Energy Inc. reported $3.2 billion in adjusted funds from operations and $1.7 billion in free funds flow for Q4 2025, contributing to annual figures of $12.8 billion and $6.9 billion, respectively, for the full year 2025.

- The company achieved record quarterly upstream production of 909,000 barrels per day and record quarterly refining throughput of 504,000 barrels per day in Q4 2025.

- Suncor returned approximately $1.5 billion to shareholders in Q4 2025 through $775 million in share repurchases and $719 million in dividends, and increased its quarterly dividend by approximately 5% to $0.60 per common share.

- Suncor achieved its 2024 Investor Day targets a full year early and projects $3.3 billion in share repurchases for 2026.

- Suncor Energy Inc. achieved its 2024 Investor Day performance targets one year ahead of schedule in 2025, driven by record operational performance in both the fourth quarter and full year.

- The company reported record upstream production of 860,000 bbls/day and record refining throughput of 480,000 bbls/day for the full year 2025.

- Key commitments delivered include an increase in normalized free funds flow of $3.3 billion per year, a reduction in corporate WTI breakeven of US$10 per barrel, and a reduction in net debt to $8 billion.

- Suncor Energy returned $11.5 billion to shareholders through dividends and share buybacks over the past two years.

- Suncor Energy's 2026 corporate guidance projects annual upstream production between 840,000 and 870,000 bbls/d and refining utilization averaging 99% to 102%.

- The company expects total capital expenditures of $5.7 billion at the midpoint for 2026.

- Suncor plans to return $3.3 billion to shareholders through share repurchases in 2026, increasing monthly buybacks to $275 million.

- Suncor Energy announced a $1 billion medium term note offering, comprised of two tranches.

- The offering includes $500 million in Series 11 Notes due November 14, 2027, with a 2.95% coupon, and $500 million in Series 12 Notes due November 14, 2030, with a 3.55% coupon.

- The offering is expected to close on November 14, 2025, with the net proceeds intended to repay existing debt.

- Suncor reported strong Q3 2025 financial results, including Adjusted Funds Flow from Operations (AFFO) of $3.8 billion or $3.16 per share, marking the second highest Q3 AFFO in the company's history. The company also announced a 5% dividend raise for an annualized dividend of CAD 2.40 per share and returned CAD 1.4 billion to shareholders in Q3 2025, comprising CAD 688 million in dividends and CAD 750 million in share buybacks, repurchasing 3.4% of its equity float.

- The company achieved record operational performance in Q3 2025, with 870,000 barrels a day in upstream production, 492,000 barrels a day in refining throughput (106% utilization), and 647,000 barrels a day in product sales. These records were supported by historically low-cost and best-ever duration turnarounds, and extended maintenance intervals.

- Suncor raised its 2025 volume guidance across the board, with production now expected between 845,000-855,000 barrels a day, refining at 470,000-475,000 barrels a day, and refined product sales at 610,000-620,000 barrels a day, anticipating new annual bests for all categories. The company also expects to come in at the low end of its revised capital guidance of CAD 5.7 billion to CAD 5.9 billion for 2025.

Fintool News

In-depth analysis and coverage of SUNCOR ENERGY.

Quarterly earnings call transcripts for SUNCOR ENERGY.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more