Earnings summaries and quarterly performance for STANLEY BLACK & DECKER.

Executive leadership at STANLEY BLACK & DECKER.

Christopher J. Nelson

President and Chief Executive Officer

Donald Allan, Jr.

Executive Chairman

Janet M. Link

Senior Vice President, General Counsel and Secretary

Patrick D. Hallinan

Executive Vice President, Chief Financial Officer

Tamer K. Abuaita

Global Chief Supply Chain Officer and President, Industrial

Board of directors at STANLEY BLACK & DECKER.

Adrian V. Mitchell

Director

Andrea J. Ayers

Lead Independent Director

Debra A. Crew

Director

Jane M. Palmieri

Director

John L. Garrison, Jr.

Director

Mary A. Laschinger

Director

Michael D. Hankin

Director

Robert J. Manning

Director

Susan K. Carter

Director

Research analysts who have asked questions during STANLEY BLACK & DECKER earnings calls.

Nigel Coe

Wolfe Research, LLC

8 questions for SWK

Christopher Snyder

Morgan Stanley

7 questions for SWK

Julian Mitchell

Barclays Investment Bank

7 questions for SWK

Michael Rehaut

JPMorgan Chase & Co.

5 questions for SWK

Tim Wojs

Robert W. Baird & Co. Incorporated

5 questions for SWK

Adam Baumgarten

Zelman & Associates

4 questions for SWK

Jonathan Matuszewski

Jefferies Financial Group Inc.

3 questions for SWK

Rob Wertheimer

Melius Research LLC

3 questions for SWK

Timothy Wojs

Robert W. Baird & Co.

3 questions for SWK

Jeffrey Sprague

Vertical Research Partners

2 questions for SWK

Joe Nolan

Longbow Research

2 questions for SWK

Joe O'Dea

Wells Fargo

2 questions for SWK

Joe Ritchie

Goldman Sachs

2 questions for SWK

Nicole DeBlase

BofA Securities

2 questions for SWK

Robert Wertheimer

Melius Research

2 questions for SWK

Brett Linzey

Mizuho Securities

1 question for SWK

Eric Bosshard

Cleveland Research Company

1 question for SWK

Joseph O'Dea

Wells Fargo & Company

1 question for SWK

Joseph Ritchie

Goldman Sachs

1 question for SWK

Recent press releases and 8-K filings for SWK.

- Three strategic pillars: brand activation, operational excellence (including $2.1 billion of cost-out and 3% annual productivity), and accelerated innovation (20% reduction in cycle time) to drive growth and margins.

- Tariff mitigation and pricing: implemented two sizable price increases to achieve cash-neutral tariff relief; expects a more stable 2026 pricing environment with competitors aligning and tactical repricing on entry-level SKUs.

- Brand investments: DEWALT continues market-share gains; STANLEY is receiving a full product refresh and dedicated European sales resources; CRAFTSMAN® is being retooled as a DIY line with a new five-tool suite launching, targeting an inflection to growth in late 2026.

- Portfolio and divestiture: CAM sale will strengthen the balance sheet; remaining Auto and Engineered Fastening businesses are positioned for organic volume growth; outdoor gas walk-behinds shift to a licensing model to focus on electrification.

- Margin and financial targets: on track for 34–35% gross margin by year-end 2026 through capacity actions, lean productivity, and USMCA qualification; medium-term goal of mid-high teens EBITDA margin by 2028.

- CEO Chris Nelson emphasized strategic priorities: brand activation across DEWALT, STANLEY and CRAFTSMAN; operational excellence with $2.1 billion in cost savings and ongoing 3% annual gross productivity; and accelerated innovation yielding a 20% cycle-time reduction

- In response to last year’s tariff shock, the company implemented two price increases to remain cash neutral, and is now recalibrating entry-level SKUs and promotional levels to ensure a stable pricing environment in 2026

- The pending divestiture of CAM will bolster the balance sheet, enabling sharper focus on the remaining auto and industrial fastening segments, which are targeting organic volume growth through enhanced application-engineering support

- Gross margin is projected at 34–35% by year-end 2026, with a mid-high-teens EBITDA margin aspiration by 2028, driven by capacity realignment, continued lean productivity, USMCA qualification, and reduced China exposure

- Brand revitalization efforts include DEWALT’s ongoing share gains, a major STANLEY hand-tool refresh and expanded European sales resources, and a new CRAFTSMAN DIY platform launching late 2026 with an expected growth inflection

- CEO Chris Nelson reaffirmed the company’s three-pillar growth strategy—brand activation, operational excellence and accelerated innovation—targeting 3% annual gross productivity improvement and having cut product development cycle time by 20%.

- Stanley Black & Decker has taken $2.1 billion out of its cost structure, implemented proactive price increases to remain dollar-for-dollar cash neutral against tariffs, and is shifting production to achieve >75% USMCA qualification and reduce China-sourced output to <5% by year-end.

- The company is confident in reaching 34–35% gross margin in FY 2026, with a medium-term goal of 35–37%, driven by capacity optimization, lean-driven productivity and ongoing tariff mitigation.

- Major product investments include a full refresh of STANLEY hand-tool ranges in Europe—backed by ~100 dedicated field resources by end-2026—and a new five-tool CRAFTSMAN DIY platform launching this year, with growth expected to inflect in late 2026.

- Following the pending CAM divestiture to strengthen the balance sheet, the outdoor business will focus on electrification; gas-powered walk-behinds will move to a licensing model to reallocate resources to higher-margin growth areas.

- Tools & Outdoor comprises 87% of revenue (Power Tools ~49%, Hand Tools ~28%, Outdoor Power Equipment ~23%), while Engineered Fastening represents 13% of sales.

- Adjusted gross margin rose to 33.3% in Q4 2025 (vs. 31.2% in Q4 2024) and 30.7% for FY 2025, as net debt/EBITDA leverage improved to 3.4x at Dec 2025 from 5.9x at Dec 2023.

- By 2028, targets include 35–37% adjusted gross margin, mid-to-high-teens adjusted EBITDA margin, and low-to-mid-teens CFROI, with mid-single-digit organic growth in a low-single-digit market.

- 2026 outlook: low single-digit net sales growth; adjusted EPS of $4.90–$5.70; free cash flow of $700–$900 million; CAM divestiture in H1 2026 expected to net $1.525–$1.6 billion for debt reduction.

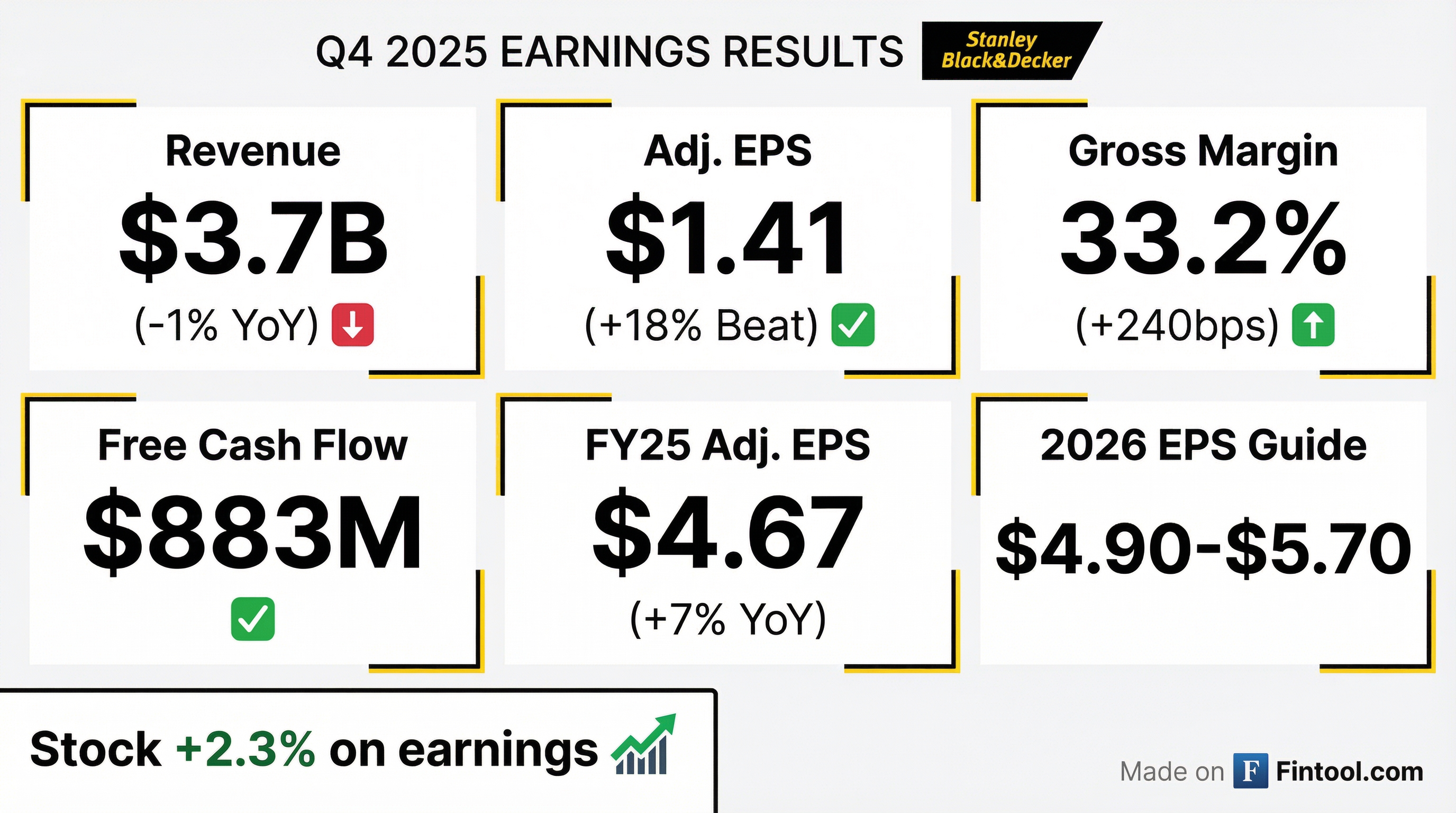

- Stanley Black & Decker reported Q4 net sales of $3.7 billion, down 1% YoY and 3% organically, driven by price (+4%) offset by volume (−7%).

- Adjusted gross margin expanded to 33.3%, up 210 bps YoY from higher pricing, tariff mitigation, and supply chain efficiencies.

- Adjusted EPS was $1.41, and Q4 free cash flow totaled $883 million, supporting a year-end leverage ratio of 3.4x.

- For 2026, the company projects low single-digit net sales growth, Adjusted EPS of $4.90–$5.70, and free cash flow of $700–$900 million.

- Full-year 2025 revenues of $15.1 billion; organic sales down 1%; DEWALT up low single digits, Aerospace Fasteners up 25%; adjusted gross margin 30.7% (+70 bps); adjusted EBITDA +5%; adjusted EPS $4.67; free cash flow $688 million

- Q4 2025 revenue down 1% (organic −3%); achieved adjusted gross margin 33.3% (+210 bps), adjusted EBITDA margin 13.5% (+330 bps), adjusted EPS $1.41, and free cash flow $883 million

- Generated $883 million of Q4 free cash flow and $688 million for 2025; reduced debt by $240 million; returned $500 million in dividends; announced sale of Aerospace Fasteners with net proceeds >$1.5 billion to reduce debt

- 2026 guidance: adjusted EPS $4.90–$5.70, free cash flow $700–$900 million, revenue and organic growth in low single digits; Q1 sales ~ $3.7 billion, EPS $0.55–$0.60, flat gross margin

- Full-year 2025: revenues of $15.1 billion (organic –1%), Adjusted Gross Margin 30.7% (+70 bps), Adjusted EBITDA up 5%, Adjusted EPS $4.67 (+7%), and free cash flow of $688 million.

- Q4 2025: revenue down 1% (organic –3%; pricing +4%, FX +2%, volume –7%), Adjusted Gross Margin 33.3%, Adjusted EBITDA margin 13.5% (+330 bps), Adjusted EPS $1.41, and free cash flow of $883 million.

- Tools & Outdoor Q4: revenue of $3.2 billion (–2% y/y; organic –4%; pricing +5%, volume –9%), segment margin 13.6% (+340 bps); Power Tools organic –8%, Hand Tools flat, Outdoor organic +2%.

- 2026 outlook: Adjusted EPS of $4.90–$5.70, revenue growth in low single digits, and free cash flow of $700–$900 million.

- Adjusted gross margin of 33.3%, adjusted EBITDA margin of 13.5%, adjusted EPS of $1.41, and Q4 free cash flow of $883 million

- Tools & Outdoor Q4 revenue of $3.2 billion (–2% y/y; organic –4%) with segment margin up 340 bps to 13.6%

- Engineered Fastening Q4 revenue grew 6% (8% organic), led by 35% organic growth in aerospace, achieving a 12.1% segment margin

- Full-year free cash flow of $688 million, debt reduced by $240 million, net debt/EBITDA leverage cut by 2.5 turns, and $2.1 billion of run-rate cost savings delivered

- 2026 outlook: adjusted EPS of $4.90–$5.70, revenue up low single digits, and free cash flow of $700–$900 million

- Stanley Black & Decker delivered Q4 2025 net sales of $3.7 billion, down 1% year-over-year (organic –3%), with gross margin expanding to 33.2% (+240 bps).

- Full-year 2025 net sales were $15.1 billion (–2%; organic –1%) with gross margin of 30.3% (+90 bps); GAAP EPS was $2.65 and adjusted EPS $4.67.

- Q4 free cash flow reached $883 million and full-year free cash flow was $688 million, enabling approximately $240 million of debt reduction and continued dividend support.

- The company signed a definitive agreement to divest its Consolidated Aerospace Manufacturing business for $1.8 billion in cash, expected to close in H1 2026 to accelerate leverage reduction.

- For 2026, management forecasts GAAP EPS of $3.15–$4.35, adjusted EPS of $4.90–$5.70, and free cash flow of $700–$900 million.

- 4Q 2025 net sales of $3.7 billion (-1% YoY), gross margin of 33.2%, GAAP EPS of $1.04 and adjusted EPS of $1.41; free cash flow of $883 million

- FY 2025 net sales of $15.1 billion (-2% YoY), adjusted EPS of $4.67, free cash flow of $688 million, enabling ~$240 million of debt reduction

- Announced agreement to divest the Consolidated Aerospace Manufacturing (CAM) business for $1.8 billion in cash, with proceeds to reduce net debt

- 2026 planning: GAAP EPS guidance of $3.15–$4.35, adjusted EPS of $4.90–$5.70 and free cash flow targeted at $700–$900 million

Fintool News

In-depth analysis and coverage of STANLEY BLACK & DECKER.

Quarterly earnings call transcripts for STANLEY BLACK & DECKER.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more