Earnings summaries and quarterly performance for Tenable Holdings.

Executive leadership at Tenable Holdings.

Board of directors at Tenable Holdings.

A. Brooke Seawell

Director

Arthur W. Coviello, Jr.

Chair of the Board

George Alexander Tosheff

Director

John C. Huffard, Jr.

Director

Linda Zecher Higgins

Director

Margaret Keane

Director

Niloofar Razi Howe

Director

Raymond Vicks, Jr.

Director

Research analysts who have asked questions during Tenable Holdings earnings calls.

Brian Essex

JPMorgan Chase & Co.

6 questions for TENB

Saket Kalia

Barclays Capital

6 questions for TENB

Jonathan Ho

William Blair & Company

5 questions for TENB

Rudy Kessinger

D.A. Davidson & Co.

5 questions for TENB

Shaul Eyal

TD Cowen

5 questions for TENB

Patrick Colville

Scotiabank

4 questions for TENB

Rob Owens

Piper Sandler Companies

4 questions for TENB

Joseph Gallo

Jefferies & Company Inc.

3 questions for TENB

Michael Cikos

Needham & Company

3 questions for TENB

Roger Boyd

UBS

3 questions for TENB

Abhishek Murali

Morgan Stanley

2 questions for TENB

Andrew Nowinski

Wells Fargo

2 questions for TENB

Gray Powell

BTIG

2 questions for TENB

Hamza Fodderwala

Morgan Stanley

2 questions for TENB

Mike Cikos

Needham & Company, LLC

2 questions for TENB

Shrenik Kothari

Robert W. Baird & Co.

2 questions for TENB

William Kingsley Crane

Canaccord Genuity

2 questions for TENB

Adam Borg

Stifel Financial Corp.

1 question for TENB

Andres Miranda Lopez

D.A. Davidson & Co.

1 question for TENB

Joel Fishbein

Truist Securities

1 question for TENB

Joe Vander

Scotiabank

1 question for TENB

Joe Vandrick

Scotiabank

1 question for TENB

Jonathan Ruykhaver

Cantor Fitzgerald

1 question for TENB

Joshua Tilton

Wolfe Research

1 question for TENB

Junaid Siddiqui

Truist Securities

1 question for TENB

Matt Pers

Stifel Financial Corp.

1 question for TENB

Oscar Saver

Morgan Stanley

1 question for TENB

Patrick

Wolfe Research

1 question for TENB

Rankin Kothari

Robert W. Baird & Co.

1 question for TENB

Trevor Rambo

BTIG

1 question for TENB

Recent press releases and 8-K filings for TENB.

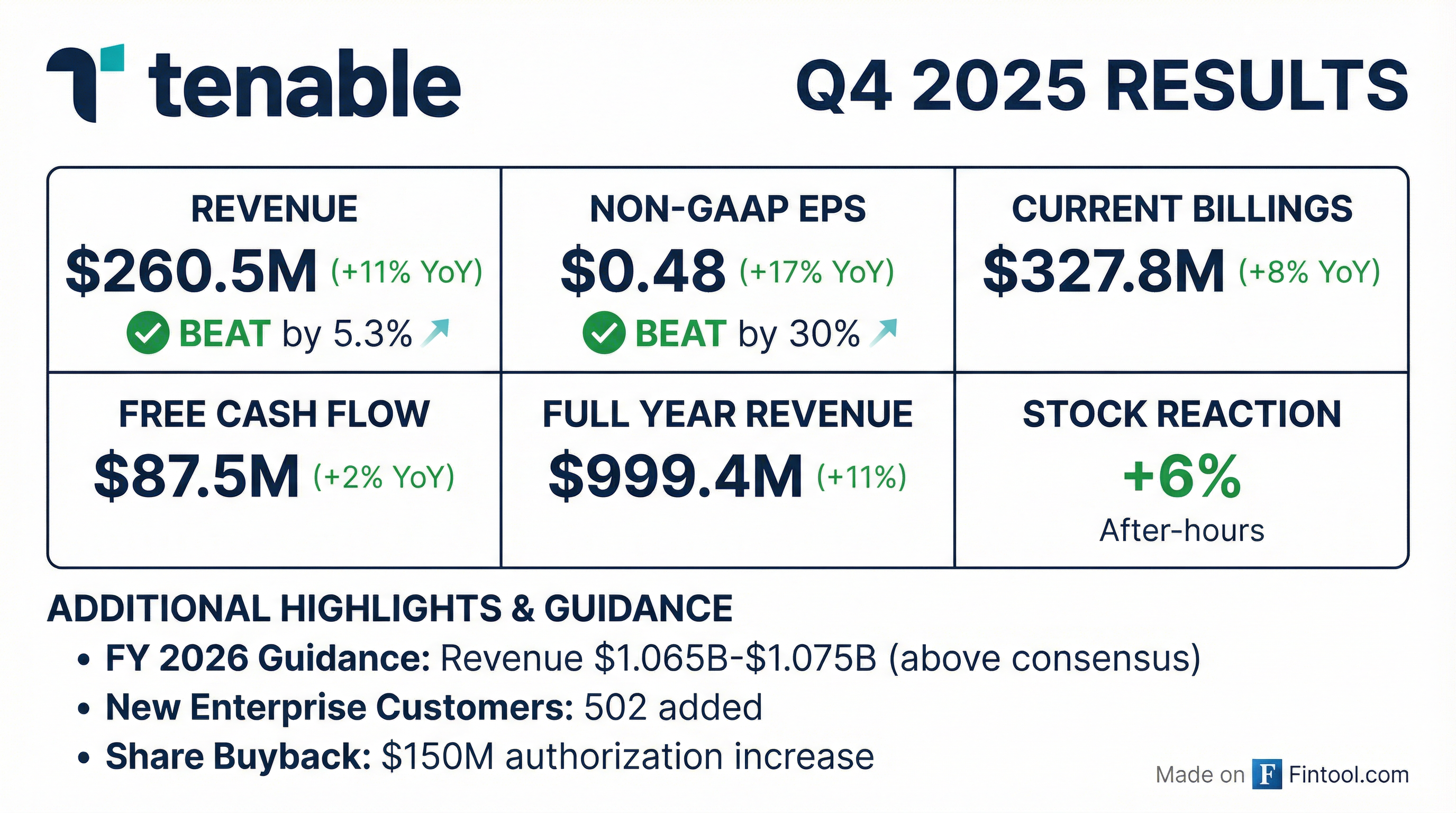

- Tenable Holdings reported Q4 2025 revenue of $260.5 million, an 11% year-over-year growth, and Non-GAAP EPS of $0.48.

- The company achieved 82.7% Non-GAAP Gross Margin and 24.4% Non-GAAP Operating Margin in Q4 2025.

- For full-year 2026, Tenable forecasts revenue between $1.065 billion and $1.075 billion, with Non-GAAP Diluted EPS projected to be between $1.81 and $1.90.

- Tenable One, the AI-powered exposure management platform, accounted for ~46% of new business in Q4 2025, contributing to the company's #1 market share of 26.6% in the Exposure Management market.

- Tenable reported strong Q4 2025 results, with revenue of $260.5 million, a 10.5% year-over-year increase, and non-GAAP EPS of $0.48, up 17.1%. For the full year 2025, non-GAAP operating income grew to $219.0 million, or 21.9% of revenue.

- The company issued a positive outlook for 2026, projecting full year revenue between $1.065 billion and $1.075 billion and non-GAAP operating income between $245 million and $255 million, representing a 150 basis point increase year-over-year at the midpoint.

- Tenable One platform adoption is gaining momentum, accounting for 46% of new and expansion business in Q4 2025, and the company closed its first seven-figure deal driven by AI exposure.

- The board approved a $150 million increase to the share repurchase authorization, bringing the total to $338 million as of year-end, with 2.3 million shares repurchased for $62.5 million in Q4 2025.

- Management announced that Calculated Current Billings (CCB) will no longer be a key financial metric or guided in 2026 and beyond, due to diverging growth rates caused by changes in billing patterns and contract durations.

- Tenable exceeded all guided metrics in Q4 2025, with revenue of $260.5 million, representing 10.5% year-over-year growth, and a non-GAAP operating margin of 24.4%.

- For the full year 2025, revenue grew 11.0% year-over-year, and non-GAAP earnings per share increased 23.3% to $1.59 compared to 2024.

- The Tenable One exposure management platform achieved a record, accounting for 46% of new business in Q4 2025, driven by strong demand for preemptive security and AI exposure management.

- The company's board approved a $150 million increase to its share repurchase authorization, bringing the total authorization to $338 million as of year-end 2025, with $62.5 million used to repurchase 2.3 million shares in Q4 2025.

- For full year 2026, Tenable expects revenue in the range of $1.065 billion to $1.075 billion and non-GAAP earnings per share in the range of $1.81 to $1.90, while discontinuing specific guidance for Calculated Current Billings (CCB) due to changes in upfront billing patterns and increasing contract durations.

- Tenable reported strong Q4 2025 financial results, with revenue of $260.5 million (10.5% year-over-year growth) and non-GAAP EPS of $0.48 (17.1% increase year-over-year). For the full year 2025, non-GAAP income from operations reached $219.0 million, or 21.9% of revenue.

- The company issued Q1 2026 revenue guidance of $257 million to $260 million and full year 2026 revenue guidance of $1.065 billion to $1.075 billion, which would be the first time exceeding $1 billion. Non-GAAP operating income for full year 2026 is projected to be $245 million to $255 million, representing 23.4% of revenue at the midpoint.

- Tenable One, the AI-powered exposure management platform, drove significant momentum, representing 46% of new and expansion business in Q4 2025 and contributing to the addition of over 500 new enterprise platform customers. The company also secured its first seven-figure deal driven by AI exposure.

- Tenable announced that Calculated Current Billings (CCB) will no longer be a key financial metric for management, though full year 2026 CCB is expected to be in line with current consensus. Additionally, the board approved a $150 million increase to the share repurchase authorization, bringing the total to $338 million as of year-end 2025.

- Tenable reported fourth quarter 2025 revenue of $260.5 million, an 11% increase year-over-year, and full year 2025 revenue of $999.4 million, also up 11% year-over-year.

- Calculated current billings for Q4 2025 were $327.8 million (up 8% year-over-year) and $1.049 billion for the full year 2025 (up 8% year-over-year).

- The company achieved non-GAAP diluted earnings per share of $0.48 for Q4 2025 and $1.59 for the full year 2025.

- For the full year 2025, Tenable generated net cash provided by operating activities of $266.8 million and unlevered free cash flow of $277.0 million.

- Tenable's Board of Directors approved an increase of $150 million to the existing share repurchase program.

- Tenable exceeded all guided metrics for the fourth quarter and full year 2025, reporting Q4 2025 revenue of $260.5 million (up 11% year-over-year) and full year 2025 revenue of $999.4 million (up 11% year-over-year).

- For Q4 2025, Non-GAAP diluted earnings per share was $0.48, and for the full year 2025, it was $1.59. The company also reported full year 2025 net cash provided by operating activities of $266.8 million and unlevered free cash flow of $277.0 million.

- The company announced an increase of $150 million to its share repurchase authorization, raising the total remaining authorization to $338 million.

- Tenable issued Q1 2026 revenue guidance in the range of $257.0 million to $260.0 million and full year 2026 revenue guidance between $1.065 billion and $1.075 billion.

- Tenable® Holdings, Inc. announced the general availability of Tenable One AI Exposure, which unifies AI protection, discovery, and usage governance across the enterprise, including SaaS platforms, cloud services, APIs, and agents.

- This new offering aims to address the "AI Exposure Gap" by providing continuous discovery of sanctioned and shadow AI, contextualized exposure insight, and actionable exposure reduction and governance.

- Gartner recently named Tenable the "company to beat" for AI-Powered Exposure Assessment and a Leader in the 2025 Gartner Magic Quadrant for Exposure Assessment Platforms, recognizing its strong asset and attack surface discovery capabilities, third-party telemetry ingestion, and AI integration.

- Tenable Holdings, Inc. announced the appointment of Vlad Korsunsky as Chief Technology Officer (CTO) and Managing Director of Tenable Israel on December 15, 2025.

- Korsunsky brings over 25 years of leadership experience in software engineering and cybersecurity, including more than a decade at Microsoft where he served as Corporate Vice President of Cloud and Enterprise Security.

- In his new role, Korsunsky will be responsible for Tenable's technical vision, platform strategy, and innovation, with a focus on scaling the Tenable One Exposure Management Platform and advancing the company's AI strategy.

- Tenable® (NASDAQ: TENB) announced a OneGov agreement with the U.S. General Services Administration (GSA).

- This agreement will deliver Tenable's FedRAMP-authorized Cloud Security solution to U.S. federal agencies, including the Department of Defense (DoD).

- The solution will be provided at a discount through March 31, 2027, aiming to accelerate secure cloud adoption and enable agencies to protect sensitive data.

- Tenable reported strong Q3 2025 results, exceeding top and bottom line expectations and providing a strong outlook for the year.

- The company achieved 11% revenue growth and a 350 basis point increase in operating margin year-over-year in Q3, despite increasing R&D spend by 18%.

- Tenable's exposure management platform, Tenable One, is gaining significant traction, adding over 300 new customers and driving significantly higher average selling prices (ASPs).

- Tenable One currently represents approximately one-third of the enterprise business and offers a 50%-80% price uplift for customers transitioning from standalone vulnerability management (VM).

- The company is seeing a secular shift towards proactive security and exposure management, with Tenable One customers experiencing 30% less downtime from exploited vulnerabilities compared to VM-only users.

Quarterly earnings call transcripts for Tenable Holdings.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more