Earnings summaries and quarterly performance for Udemy.

Executive leadership at Udemy.

Board of directors at Udemy.

Research analysts who have asked questions during Udemy earnings calls.

Devin Au

KeyBanc Capital Markets Inc.

4 questions for UDMY

Josh Baer

Morgan Stanley

4 questions for UDMY

Ryan MacDonald

Needham & Company

4 questions for UDMY

Yi Fu Lee

Cantor Fitzgerald

4 questions for UDMY

Jason Tilchen

Canaccord Genuity Group Inc.

3 questions for UDMY

Nafeesa Gupta

Bank of America

2 questions for UDMY

Noah Herman

JPMorgan Chase & Co.

2 questions for UDMY

Stephen Sheldon

William Blair & Company

2 questions for UDMY

Terrell Tillman

Truist Securities

2 questions for UDMY

Connor Passarella

Truist Securities, Inc.

1 question for UDMY

Curtis Nagle

Bank of America

1 question for UDMY

Jason Tilton

Canaccord Genuity Inc.

1 question for UDMY

Jeff Meuler

Robert W. Baird & Co.

1 question for UDMY

Patrick McIlwee

William Blair

1 question for UDMY

Steven Pawlak

Baird

1 question for UDMY

Recent press releases and 8-K filings for UDMY.

- Udemy has partnered with Google to launch the "Learn AI with Google" plan, making Google's newly launched AI Professional Certificate available to Udemy's 84 million learners.

- This offering is Udemy's first comprehensive AI subscription for individual learners, providing access to Google's AI curriculum, expert-led instruction, and three months of Google AI Pro.

- The partnership aims to address the growing demand for AI skills, with nearly 70% of employee upskilling efforts globally focused on AI.

- Udemy (UDMY) announced a new integration with OpenAI, embedding its comprehensive skills content directly into ChatGPT through a dedicated app.

- This integration combines Udemy's over 290,000 courses from 90,000 expert instructors with ChatGPT's AI capabilities, offering features such as smart course discovery, in-chat video learning, and an interactive learning companion.

- The app is available to approximately 800 million weekly active users of ChatGPT across Free, Go, Plus, and Pro plans, aiming to expand access to skills training and professional development opportunities.

- The initiative focuses on building real expertise through trusted content, practical assessments, and validated skill development, distinguishing it from traditional AI tutoring.

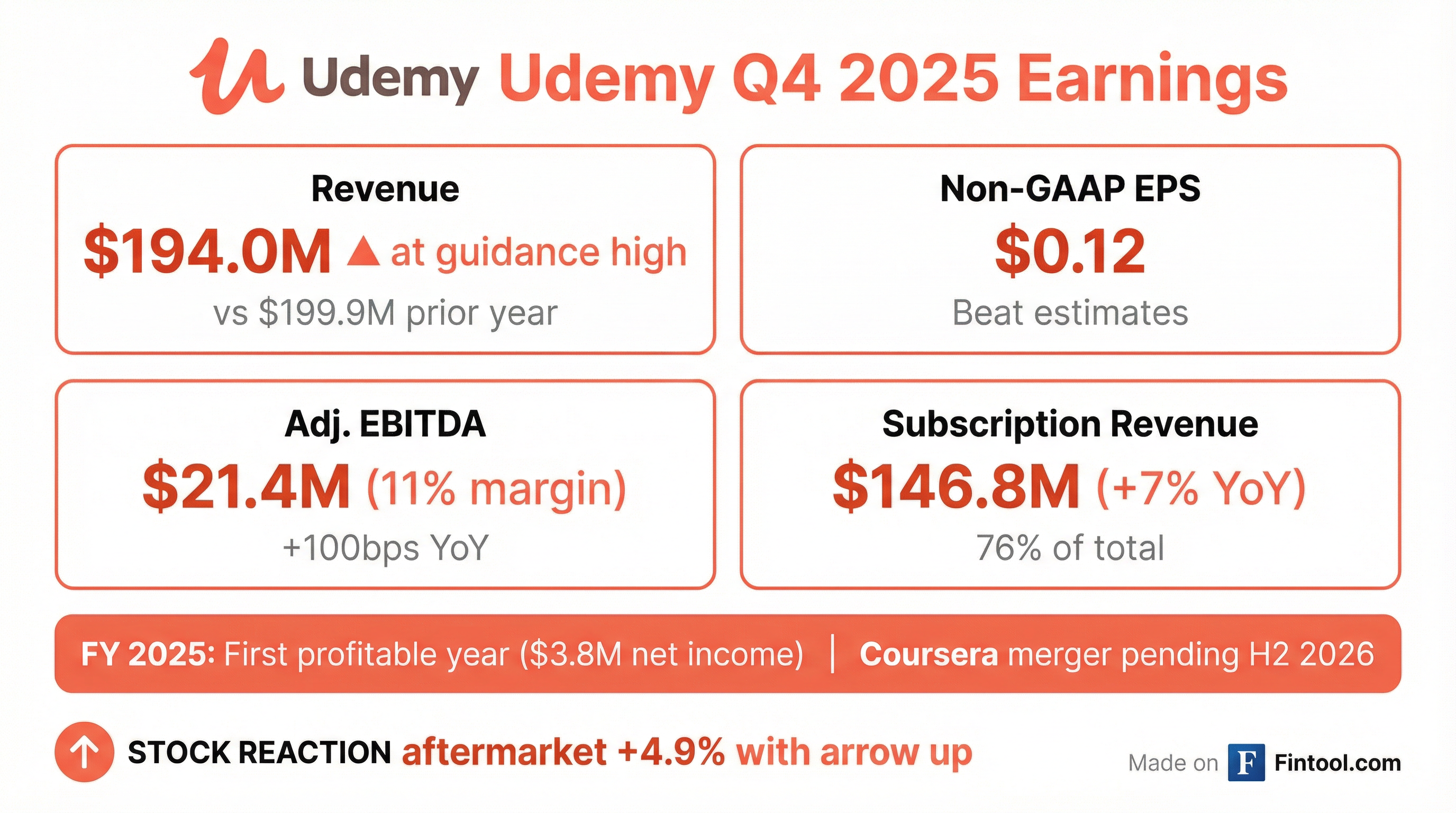

- Udemy reported its first full year of positive net income at $3.8 million for fiscal year 2025, a significant improvement from a net loss of $85.3 million in the prior year.

- For full year 2025, consolidated subscription revenue increased 8% year-over-year to $566.0 million, and Adjusted EBITDA Margin expanded by 700 basis points to 12%, reaching $95.3 million.

- In Q4 2025, Udemy added $13 million in Net New Annual Recurring Revenue, and the Net Dollar Retention Rate stabilized at 97% for Large Customers and 93% overall.

- Udemy entered into a definitive merger agreement with Coursera on December 17, 2025, where its stockholders will receive 0.800 shares of Coursera common stock for each Udemy share. The transaction is expected to close by the second half of 2026, and as a result, Udemy will not provide financial guidance.

- Udemy reported full year 2025 total revenue of $789.8 million and achieved net income of $3.8 million, a significant improvement from a net loss of $85.3 million in the prior year.

- Consolidated subscription revenue for full year 2025 increased 8% year-over-year to $566.0 million, while Adjusted EBITDA expanded by 700 basis points to $95.3 million or 12% of revenue.

- The company added $13 million in Net New Annual Recurring Revenue in Q4 2025, and the Net Dollar Retention Rate stabilized at 97% for Large Customers and 93% overall.

- Udemy announced a pending all-stock combination with Coursera, where Udemy stockholders will receive 0.800 shares of Coursera common stock for each Udemy share, with the transaction expected to close by the second half of 2026.

- Due to the pending combination with Coursera, Udemy will not host a conference call or provide financial guidance.

- Wohl & Fruchter LLP is investigating the fairness of the proposed all-stock merger of Udemy (UDMY) with Coursera, which was announced on December 17, 2025.

- Under the terms, Udemy stockholders are slated to receive 0.800 shares of Coursera common stock for each Udemy share.

- Since the merger announcement, Udemy's stock price has declined from $6.05 per share on December 17, 2025, to $5.12 per share on January 13, 2026, making the transaction less appealing to shareholders.

- Prior to the merger announcement, Wall Street analysts had higher price targets for Udemy, including $11.00 from Needham and $8.00 from J.P. Morgan.

- Kahn Swick & Foti, LLC (KSF) is investigating the proposed sale of Udemy, Inc. (NasdaqGS: UDMY) to Coursera, Inc. (NYSE: COUR).

- Under the terms of the proposed transaction, Udemy shareholders will receive 0.800 shares of Coursera common stock for each share of Udemy they own.

- KSF is seeking to determine whether the consideration and the process in the proposed sale are adequate.

- Udemy, Inc. entered into a Merger Agreement with Coursera, Inc. and Chess Merger Sub, Inc. on December 17, 2025.

- Upon the effective time of the merger, Udemy will survive as a wholly owned subsidiary of Coursera.

- Each outstanding share of Udemy Common Stock will be converted into the right to receive 0.800 shares of Coursera Common Stock.

- Both the Udemy Board and the Coursera Board have unanimously approved the Merger Agreement and recommended the transaction to their respective stockholders.

- Certain Udemy Stockholders and Coursera Stockholders have entered into Voting Agreements to support the merger, which was a material inducement and condition for the Merger Agreement.

- Coursera has entered into a definitive agreement to combine with Udemy, aiming to create a leading technology platform for skills discovery, development, and mastery.

- The all-stock transaction will result in existing Coursera shareholders owning approximately 59% and Udemy shareholders approximately 41% of the combined company, with Udemy stockholders receiving 0.8 shares of Coursera Common Stock for each Udemy share.

- The combined entity is projected to have an annual revenue run rate exceeding $1.5 billion and a trailing 12-month pro forma adjusted EBITDA of over $150 million (10% margin) before synergies.

- $115 million in annualized run rate cost synergies have been identified, expected to be fully realized within 24 months of closing.

- The transaction is anticipated to close by the second half of 2026, and Coursera plans a sizable share repurchase program post-close.

- Udemy, Inc. and Coursera, Inc. have announced a proposed business combination, which will be a tax-free, stock-for-stock transaction.

- Each Udemy share will be exchanged for 0.800 Coursera shares, resulting in pro-forma ownership of approximately 59% for Coursera shareholders and 41% for Udemy shareholders.

- The transaction is anticipated to close by the second half of 2026, subject to shareholder and regulatory approvals.

- The combined company is projected to have a total revenue of $1,536 million and Adjusted EBITDA of $155 million for the last twelve months ended September 30, 2025, with anticipated annual run-rate cost synergies of $115 million within 24 months of closing.

- The combined entity will operate under the name Coursera, Inc. (NYSE: COUR), with Greg Hart as CEO and Andrew Ng serving as Chairman of the 9-member Board of Directors.

- Coursera has entered into a definitive agreement to combine with Udemy in an all-stock transaction. Upon closing, existing Coursera shareholders are expected to own approximately 59% and Udemy shareholders approximately 41% of the combined company on a fully diluted basis.

- The combined company is projected to have a pro forma annual revenue run rate exceeding $1.5 billion and more than $150 million of adjusted EBITDA (representing a 10% adjusted EBITDA margin) on a trailing 12-month basis, before synergies.

- The transaction is expected to generate $115 million of annualized run rate cost synergies, which are anticipated to be fully realized within 24 months of closing, primarily from operational efficiencies.

- The strategic rationale for the combination includes creating a leading technology platform for skills, accelerating AI-native innovation, and enhancing global reach. The transaction is expected to close by the second half of 2026.

Quarterly earnings call transcripts for Udemy.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more