Earnings summaries and quarterly performance for VIAVI SOLUTIONS.

Executive leadership at VIAVI SOLUTIONS.

Oleg Khaykin

President and Chief Executive Officer

Gary Staley

Senior Vice President, Global Sales, Network and Service Enablement

Ilan Daskal

Executive Vice President and Chief Financial Officer

Kevin Siebert

Senior Vice President, General Counsel and Secretary

Luke Scrivanich

Senior Vice President and General Manager, Optical Security & Performance Products (OSP)

Mike Petrucci

Chief Operations Officer

Paul McNab

Executive Vice President and Chief Marketing and Strategy Officer

Board of directors at VIAVI SOLUTIONS.

Research analysts who have asked questions during VIAVI SOLUTIONS earnings calls.

Ruben Roy

Stifel Financial Corp.

6 questions for VIAV

Ryan Koontz

Needham & Company, LLC

6 questions for VIAV

Andrew Spinola

UBS

5 questions for VIAV

Tim Savageaux

Northland Capital Markets

5 questions for VIAV

Meta Marshall

Morgan Stanley

3 questions for VIAV

Mehdi Hosseini

Susquehanna Financial Group

2 questions for VIAV

Michael Genovese

Rosenblatt Securities Inc.

2 questions for VIAV

Mary Lenox

Morgan Stanley

1 question for VIAV

Recent press releases and 8-K filings for VIAV.

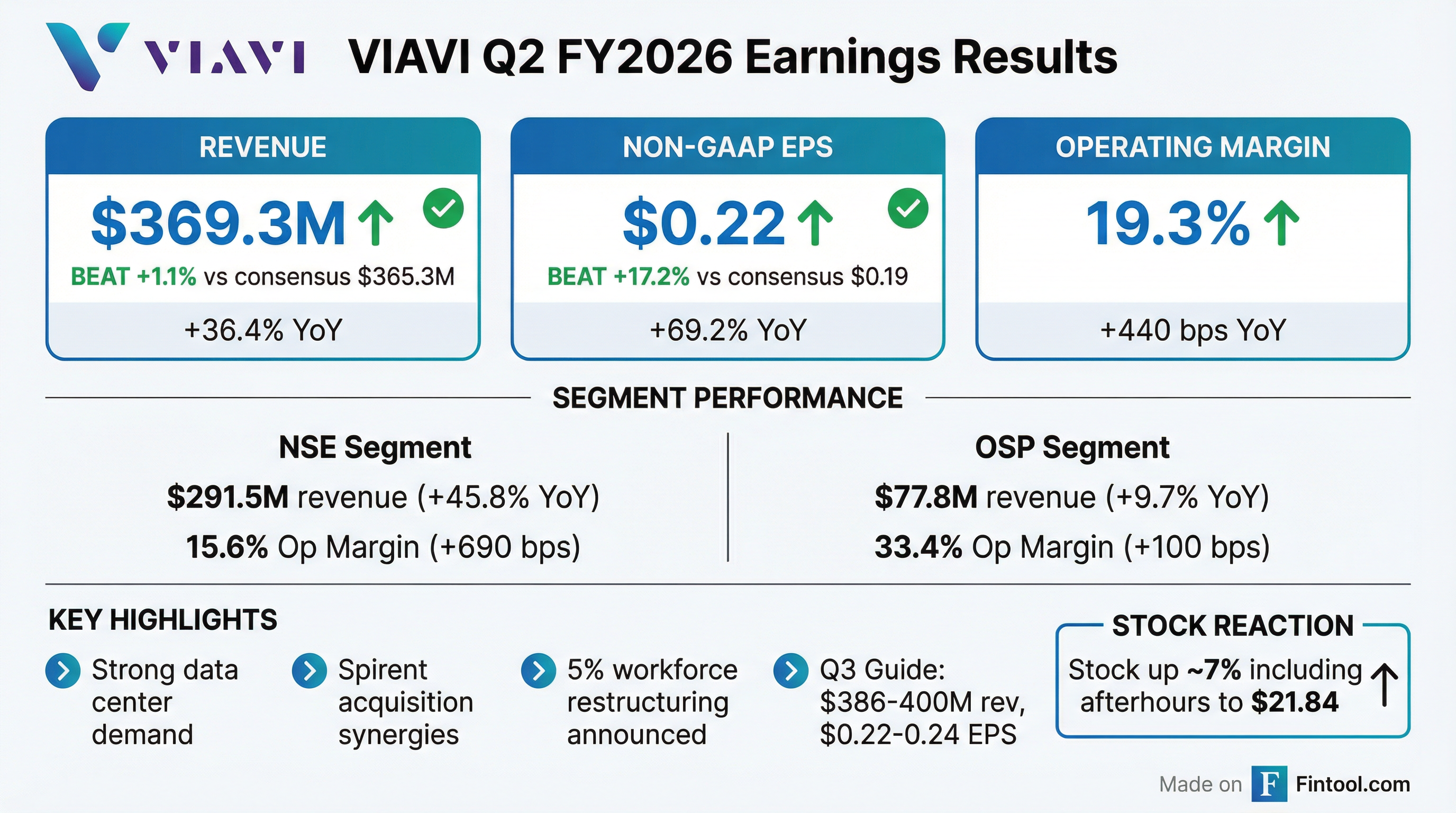

- VIAVI Solutions reported Q2 Fiscal 2026 net revenue of $369.3 million, an increase of 36.4% year-over-year, and EPS of $0.22, with both metrics exceeding the high end of their guidance ranges.

- The company provided Q3 Fiscal 2026 revenue guidance of $386-$400 million and EPS guidance of $0.22-$0.24.

- Growth was primarily driven by strong demand in the data center ecosystem and aerospace and defense segments, with the data center ecosystem now accounting for approximately 45% of NSE revenue.

- VIAVI approved a restructuring and workforce reduction plan impacting about 5% of its global workforce, expecting to incur approximately $32 million in charges and achieve $30 million in annual savings.

- The company ended Q2 with $772.1 million in cash and short-term investments and prepaid $100 million of its Term Loan B.

- Viavi Solutions reported Q2 FY2026 net revenue of $369.3 million, an increase of 36.4% year-over-year, and EPS of $0.22, with both figures exceeding the high end of guidance ranges.

- The company provided Q3 FY2026 revenue guidance of $386-$400 million and EPS guidance of $0.22-$0.24, anticipating continued sequential growth driven by strength in its end markets.

- Growth is primarily fueled by the data center ecosystem and aerospace and defense segments, which now constitute approximately 60% of the NSE business, helping to offset traditional service provider seasonality.

- Viavi approved a restructuring and workforce reduction plan impacting about 5% of its global workforce, expecting to incur approximately $32 million in charges and achieve $30 million in annual savings, while also prioritizing debt management by prepaying $100 million of its Term Loan B.

- VIAVI reported strong Fiscal Q2 2026 Non-GAAP results, with revenue of $369.3 million, operating margin of 19.3%, and EPS of $0.22, all above the high end of guidance.

- The company approved a restructuring and workforce reduction plan on January 23, 2026, impacting approximately 5% of its global workforce, expecting to incur ~$32 million in charges and achieve ~$30 million in annual cost savings.

- VIAVI engaged in significant debt management, exchanging approximately $103.5 million of 1.625% Convertible Notes for common stock and prepaying $100 million of its Term Loan B on January 5, 2026.

- For Fiscal Q3 2026, VIAVI provided an outlook of revenue between $386 million and $400 million and Non-GAAP EPS between $0.22 and $0.24.

- VIAVI Solutions reported Q2 fiscal year 2026 net revenue of $369.3 million, a 36.4% year-over-year increase, and EPS of $0.22, both exceeding guidance.

- The company provided Q3 fiscal year 2026 guidance, expecting revenue between $386 million and $400 million and EPS between $0.22 and $0.24.

- A restructuring and workforce reduction plan was announced, affecting approximately 5% of the global workforce, with expected $32 million in charges and $30 million in annual savings.

- The NSE business mix has shifted, with the data center ecosystem now comprising about 45% and aerospace and defense around 15%, driven by strong demand in these areas.

- VIAVI reported net revenue of $369.3 million and non-GAAP diluted EPS of $0.22 for its fiscal second quarter ended December 27, 2025.

- The company's non-GAAP operating margin was 19.3% for Q2 FY2026, while it recorded a GAAP net loss of $48.1 million.

- For the third quarter of fiscal 2026, VIAVI expects net revenue between $386 million to $400 million and non-GAAP EPS between $0.22 to $0.24.

- VIAVI approved a restructuring plan on January 23, 2026, affecting approximately 5% of its global workforce, with estimated total charges of $32 million and anticipated $30 million in annualized cost savings.

- VIAVI reported net revenue of $369.3 million for its fiscal second quarter ended December 27, 2025, an increase of 36.4% year-over-year.

- For the same quarter, non-GAAP diluted EPS was $0.22, up 69.2% year-over-year, while GAAP diluted EPS was $(0.21).

- A restructuring plan was approved on January 23, 2026, which is expected to affect approximately 5% of the global workforce, incur charges of about $32 million, and generate approximately $30 million in annualized cost savings.

- For the third quarter of fiscal 2026, the company anticipates net revenue between $386 million and $400 million and non-GAAP EPS between $0.22 and $0.24.

- As of December 27, 2025, VIAVI held $772.1 million in total cash, short-term investments, and short-term restricted cash.

- The Assured Positioning, Navigation, and Timing (PNT) market is projected to grow from $1.35 billion in 2025 to $1.74 billion in 2026, exhibiting a compound annual growth rate (CAGR) of 28.9%, and is forecasted to reach $4.83 billion by 2030 with a CAGR of 29.1%.

- Viavi Solutions Inc. introduced SecurePNTT 6200 in May 2024, providing comprehensive anti-spoofing, authentication, and encryption capabilities with timing accuracy below 5 nanoseconds.

- This market growth is driven by increasing reliance on GNSS receiver systems, rising GPS signal interference, advancements in inertial navigation systems, and the adoption of multi-source PNT architectures, particularly for autonomous vehicles and unmanned platforms.

- VIAVI Solutions Inc. announced a share exchange for an aggregate principal amount of $103.463 million of its 1.625% Convertible Senior Notes due 2026.

- In exchange, the company will issue 7,871,043 shares of its common stock at a price of $17.88 per share.

- The exchange is expected to close on or about December 22, 2025, and will result in approximately $49.037 million in aggregate principal amount of the 2026 Notes remaining outstanding.

- This transaction is intended to facilitate the prepayment of a minimum of $100 million of the $600 million Term Loan Credit Facility over the next twelve months.

- VIAVI Solutions entered into agreements to exchange an aggregate principal amount of $103.463 million of its 1.625% Convertible Senior Notes due 2026 for an aggregate of 7,871,043 shares of VIAVI's common stock at a price per share of $17.88.

- The exchange is expected to close on or about December 22, 2025.

- Immediately following the exchange, approximately $49.037 million in aggregate principal amount of the 2026 Notes will remain outstanding.

- This exchange facilitates VIAVI's plan to prepay a minimum of $100 million of its $600 million Term Loan Credit Facility, executed in October 2025, over the next twelve months.

- VIAV reported Q1 2026 revenue of $299.1 million, marking a 25.6% year-over-year increase, and Non-GAAP EPS of $0.15, which is a 150.0% year-over-year increase.

- The company successfully closed the acquisition of Spirent's high-speed ethernet, network security, and channel emulation business lines, which is anticipated to add approximately $200 million to the annual revenue run rate.

- VIAV generated $31.0 million in operating cash flow and $22.5 million in free cash flow during Q1 2026.

- The company refinanced $250 million of its 2026 convertible notes with new 2031 convertible notes and repurchased $30 million of its stock.

Quarterly earnings call transcripts for VIAVI SOLUTIONS.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more