Earnings summaries and quarterly performance for VALLEY NATIONAL BANCORP.

Executive leadership at VALLEY NATIONAL BANCORP.

Board of directors at VALLEY NATIONAL BANCORP.

Eric Edelstein

Lead Independent Director

Eyal Efrat

Director

Jeffrey Wilks

Director

Jennifer Steans

Director

Kathleen Perrott

Director

Lisa Schultz

Director

Nitzan Sandor

Director

Peter Maio

Director

Sidney Williams, Jr.

Director

Suresh Sani

Director

Research analysts who have asked questions during VALLEY NATIONAL BANCORP earnings calls.

Matthew Breese

Stephens Inc.

12 questions for VLY

Christopher McGratty

Keefe, Bruyette & Woods

11 questions for VLY

Manan Gosalia

Morgan Stanley

11 questions for VLY

David Smith

Truist Securities

9 questions for VLY

Anthony Elian

JPMorgan

7 questions for VLY

Jon Rau

Barclays

7 questions for VLY

Jon Arfstrom

RBC Capital Markets

6 questions for VLY

Feddie Strickland

Hovde Group

4 questions for VLY

Janet Lee

TD Cowen

4 questions for VLY

Steve Moss

Raymond James

4 questions for VLY

Dave Rochester

Cantor Fitzgerald

2 questions for VLY

David Chiaverini

Wedbush Securities Inc.

2 questions for VLY

Frank Schiraldi

Piper Sandler

2 questions for VLY

Jared David Shaw

Barclays Capital

2 questions for VLY

Jared Shaw

Barclays

2 questions for VLY

Benjamin Gerlinger

Citigroup Inc.

1 question for VLY

Brian Mozenski

Morgan Stanley

1 question for VLY

Chris McGratty

KBW

1 question for VLY

Stephen Moss

Raymond James Financial, Inc.

1 question for VLY

Recent press releases and 8-K filings for VLY.

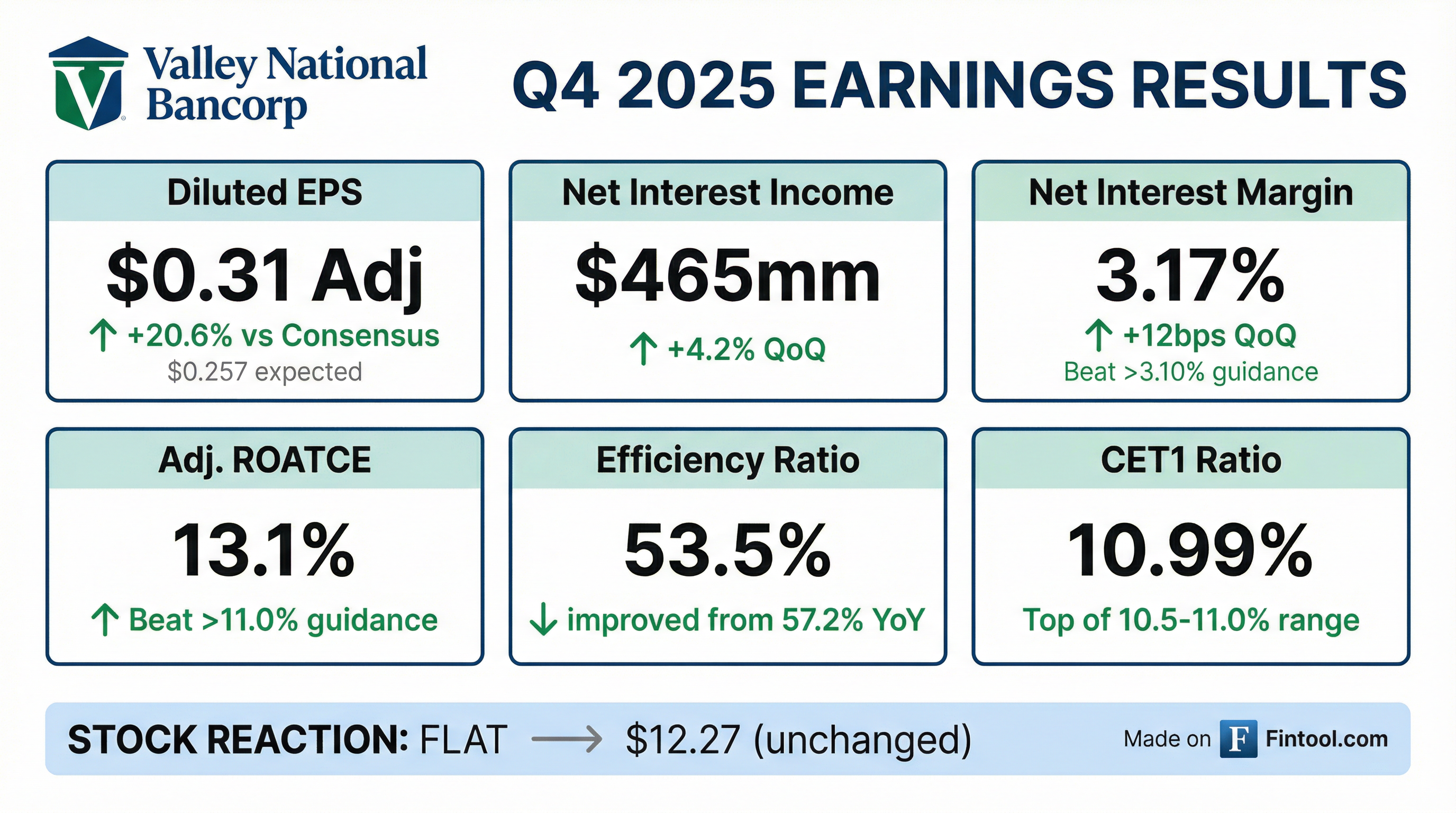

- Valley National Bancorp reported record earnings in the fourth quarter of 2025, with net income of approximately $195 million or $0.33 per diluted share, and an adjusted net income of $180 million or $0.31 per diluted share. The adjusted return on average assets reached 1.14%, the highest since Q4 2022.

- For the full year 2025, the company achieved $598 million of net income or $585 million on an adjusted basis, reflecting disciplined balance sheet management, a stronger funding mix, and strategic investments.

- The company provided a positive outlook for 2026, anticipating mid-single-digit loan growth, with deposit growth expected to outpace loans. Net interest income is projected to grow between 11%-13%, and the net interest margin is expected to expand by an additional 15-20 basis points from Q4 2025 to Q4 2026.

- Valley's core deposits grew by nearly $4 billion or 9% year-over-year , and in Q4 2025 alone, core deposits increased by approximately $1.5 billion. The company also saw sequential growth in total commercial real estate loans for the first time since Q2 2024.

- In Q4 2025, Valley generated $188 million of net income to common shareholders, returning $109 million through cash dividends and share repurchases, while maintaining its CET1 ratio within the 10.5%-11% target range.

- Valley National Bancorp (VLY) reported record earnings in Q4 2025, with net income of approximately $195 million or $0.33 per diluted share, and adjusted net income of $180 million or $0.31 per diluted share. For the full year 2025, net income was $598 million or $585 million on an adjusted basis.

- The company's improved 2025 performance was significantly driven by nearly $4 billion (9%) year-over-year core deposit growth and a stronger funding mix. In Q4 2025 alone, core deposits increased by $1.5 billion, leading to a 24 basis point sequential decrease in total deposit costs.

- For 2026, VLY anticipates mid-single-digit loan growth and net interest income growth between 11%-13%. The company expects an additional 15-20 basis points of margin expansion from Q4 2025 to Q4 2026, and high single-digit growth in fee income.

- The 2026 outlook also projects a loan loss provision of around $100 million and low single-digit expense growth, aiming for an efficiency ratio decline towards 50%. Valley repurchased over 6 million shares in 2025, including 4 million in Q4 2025, and expects continued repurchase activity.

- Valley National Bank (VLY) delivered record earnings in Q4 2025, with net income of approximately $195 million or $0.33 per diluted share, and an adjusted net income of $180 million or $0.31 per diluted share. For the full year 2025, net income was $598 million.

- The company achieved substantial core deposit growth, increasing by nearly $4 billion or 9% year-over-year and about $1.5 billion in Q4 2025, which contributed to a 24 basis point sequential reduction in total deposit costs.

- VLY provided a strong 2026 outlook, projecting net interest income growth of 11%-13%, an additional 15-20 basis points of margin expansion from Q4 2025 to Q4 2026, and mid-single-digit loan growth.

- The company actively managed capital, repurchasing over 6 million shares in 2025, including 4 million in Q4 2025, and returned $109 million to common shareholders in Q4 2025 through dividends and buybacks.

- VLY reported strong Q4 2025 financial results, with Net Income of $195.4 million and Diluted Earnings Per Share of $0.33, reflecting a Return on Average Assets of 1.24% and Annualized ROATCE of 14.2%.

- The company maintained a strong balance sheet as of December 31, 2025, with a CET 1/RWA ratio of 10.99% and a Loans / Deposits ratio of 96.1%.

- Profitability metrics exceeded expectations in Q4 2025, with a Net Interest Margin (FTE) of 3.17% and Adjusted Return on Average Assets of 1.14%.

- For 2026, VLY projects Gross Loans to grow 4% - 6% and Total Deposits to grow 5% - 7%, with Net Interest Income expected to increase by 11% - 13%.

- VLY returned $109 million to shareholders in Q4 2025 through buybacks and dividends, while keeping its CET1 / RWA ratio at 10.99%, at the high end of its target range.

- Valley National Bancorp reported net income of $195.4 million, or $0.33 per diluted common share, for the fourth quarter 2025, marking record quarterly earnings. Adjusted net income was $180.2 million, or $0.31 per diluted common share.

- Net interest income on a tax equivalent basis increased to $466.1 million in Q4 2025, up $18.7 million from Q3 2025, with the net interest margin rising 12 basis points to 3.17 percent.

- The company experienced strong balance sheet growth, with total loans increasing $863.9 million (7.0% annualized) to $50.1 billion and total deposits increasing $1.0 billion to $52.2 billion at December 31, 2025.

- Credit quality metrics showed some changes, with net loan charge-offs totaling $22.6 million for Q4 2025 compared to $14.6 million in Q3 2025, and non-accrual loans at $433.9 million, or 0.87 percent of total loans, at December 31, 2025.

- The efficiency ratio improved to 53.49 percent for Q4 2025, compared to 53.37 percent in Q3 2025 and 57.21 percent in Q4 2024.

- Valley National Bancorp reported net income of $195.4 million, or $0.33 per diluted common share, for the fourth quarter 2025.

- The company's adjusted net income for the fourth quarter 2025 was $180.2 million, or $0.31 per diluted common share.

- The net interest margin on a tax equivalent basis increased to 3.17 percent in the fourth quarter 2025, up from 3.05 percent in the third quarter 2025.

- Total loans increased by $863.9 million, or 7.0 percent on an annualized basis, reaching $50.1 billion at December 31, 2025.

- During the fourth quarter 2025, Valley repurchased 4.3 million shares of its common stock at an average price of $10.93.

- Valley National Bancorp reported net income of approximately $163 million or $0.28 per diluted share for Q3 2025, marking its highest quarterly profitability since the end of 2022.

- The company achieved robust core customer deposit growth, with nearly 10% growth over the past 12 months and $1 billion gathered in Q3 2025, contributing to a 56 basis point reduction in average cost of deposits since Q3 2024.

- Net interest margin (NIM) improved for the sixth consecutive quarter in Q3 2025, with expectations to reach above 3.1% in Q4 2025 and further expand into 2026, targeting a normalized range of 3.20%-3.40%.

- Credit performance showed a significant reduction in net charge-offs and provisions in Q3 2025, with normalized charge-off rates anticipated around 15 basis points in 2026.

- Valley is targeting a 15% return on equity (ROE) by late 2027 or early 2028, driven by net income expansion, mid-single-digit loan growth, margin expansion, high single-digit fee income growth, and low single-digit operating expense growth.

- Valley National Bancorp reported strong Q3 2025 net income of approximately $163 million or $0.28 per diluted share, representing its highest quarterly profitability since the end of 2022 and achieving an annualized return on average assets above 1%.

- The company demonstrated significant operating momentum with nearly 10% core deposit growth over the past 12 months, adding approximately $1 billion in core deposits during Q3 2025, and reducing its average cost of deposits by 56 basis points since Q3 2024.

- Management anticipates continued financial improvement, projecting net interest income to grow another 3% sequentially in Q4 2025, with a Net Interest Margin (NIM) target above 3.1% for Q4 2025, and expects mid-single-digit loan growth (range of 4% to 6%) for 2026.

- VLY is focused on organic growth, with a loan pipeline of $3.3 billion, and aims to achieve a 15% return on average tangible assets (ROAT) by late 2027 or early 2028, supported by strategic hires and investments in commercial and consumer banking.

Quarterly earnings call transcripts for VALLEY NATIONAL BANCORP.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more