Earnings summaries and quarterly performance for Voya Financial.

Executive leadership at Voya Financial.

Heather Lavallee

Chief Executive Officer

Brannigan Thompson

Executive Vice President, Chief Human Resources Officer

Jay Kaduson

Chief Executive Officer, Workplace Solutions

Matthew Toms

Chief Executive Officer, Investment Management

Michael Katz

Executive Vice President and Chief Financial Officer

My Chi To

Executive Vice President, Chief Legal Officer

Rachel Tressy

Executive Vice President, Chief Auditor

Santhosh Keshavan

Executive Vice President and Global Head of Technology and Operations

Trevor Ogle

Executive Vice President, Chief Strategy, M&A and Corporate Transactions Officer

Board of directors at Voya Financial.

Aylwin Lewis

Director

Hikmet Ersek

Director

Joseph Tripodi

Director

Kathleen DeRose

Director

Lynne Biggar

Director

Robert Leary

Director

Ruth Ann Gillis

Non-Executive Chairperson of the Board

S. Biff Bowman

Director

William Mullaney

Director

Yvette Butler

Director

Jane Chwick

Director

Research analysts who have asked questions during Voya Financial earnings calls.

John Barnidge

Piper Sandler

6 questions for VOYA

Suneet Kamath

Jefferies

6 questions for VOYA

Joel Hurwitz

Dowling & Partners Securities, LLC

5 questions for VOYA

Alex Scott

Barclays PLC

4 questions for VOYA

Ryan Krueger

KBW

4 questions for VOYA

Thomas Gallagher

Evercore

4 questions for VOYA

Wesley Carmichael

Autonomous Research

4 questions for VOYA

Elyse Greenspan

Wells Fargo

3 questions for VOYA

Kenneth Lee

RBC Capital Markets

3 questions for VOYA

Wilma Burdis

Raymond James Financial

3 questions for VOYA

Jimmy Bhullar

JPMorgan Chase & Co.

2 questions for VOYA

Taylor Scott

BofA Securities

2 questions for VOYA

Wes Carmichael

Wells Fargo

2 questions for VOYA

Wilma Jackson Burdis

Raymond James

2 questions for VOYA

Bob Huang

Morgan Stanley

1 question for VOYA

Jamminder Bhullar

JPMorgan Chase & Co.

1 question for VOYA

Josh Shanker

Bank of America

1 question for VOYA

Joshua Shanker

Bank of America Merrill Lynch

1 question for VOYA

Michael Ward

Citi Research

1 question for VOYA

Mike Ward

UBS

1 question for VOYA

Tom Gallagher

Evercore ISI

1 question for VOYA

Recent press releases and 8-K filings for VOYA.

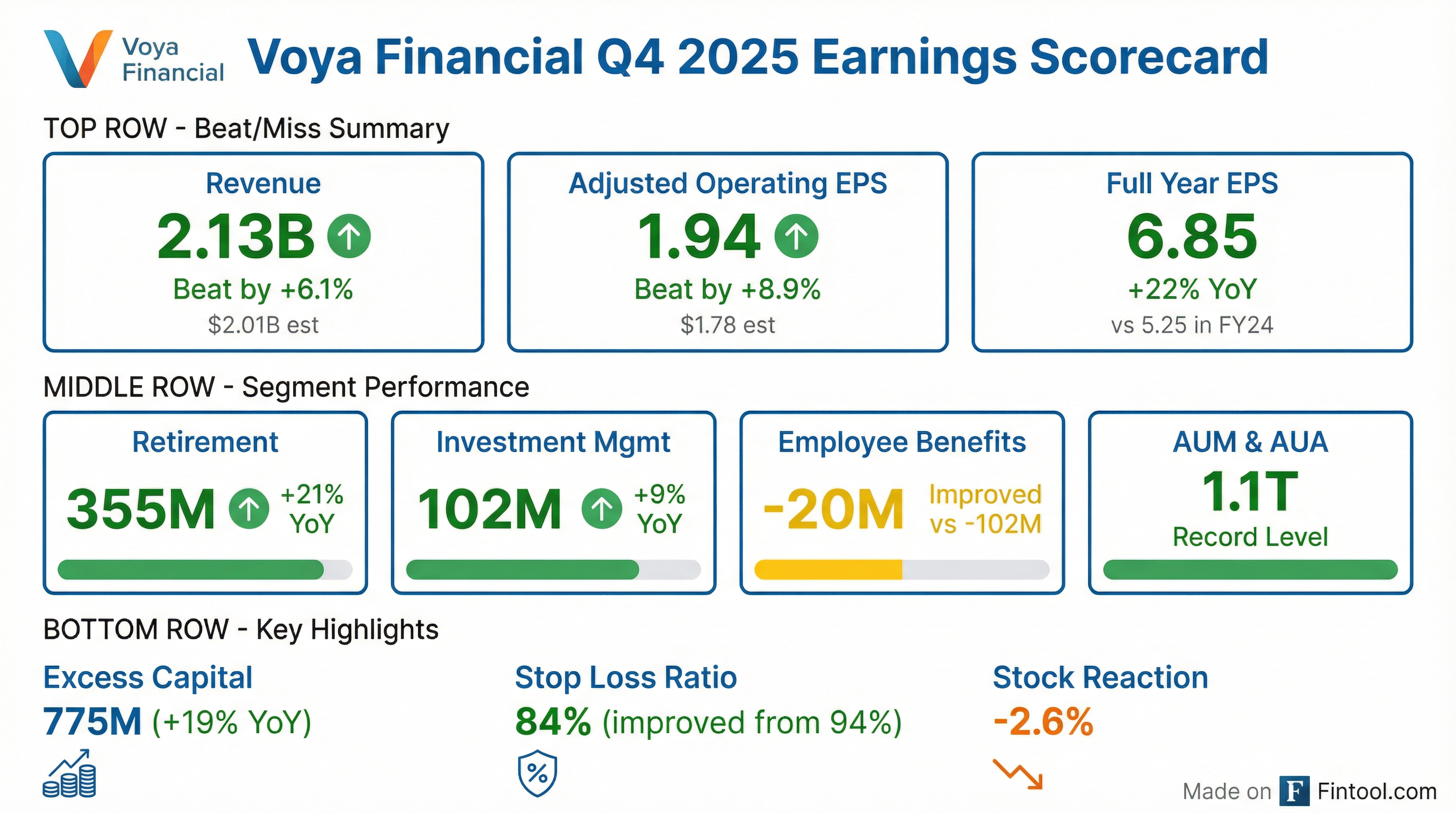

- Voya Financial reported an exceptional year in 2025, achieving $775 million in cash generation and growing combined assets in its Retirement and Investment Management businesses to $1 trillion.

- The company plans to return capital to shareholders through $300 million in share repurchases during the first half of 2026, split equally between Q1 and Q2, while maintaining flexibility for potential bolt-on acquisitions.

- The Retirement business achieved a 40% margin in 2025, exceeding its target, and saw record organic growth of $28 billion in flows, further boosted by $60 billion from the OneAmerica acquisition.

- The OneAmerica acquisition exceeded revenue and earnings targets, delivering over 30% unlevered returns for shareholders and solidifying Voya's position as a consolidator in the retirement market.

- In the Employee Benefits (Stop Loss) business, Voya secured a 24% rate increase for the January 2026 block, following a 21% increase in January 2025, as it prioritizes margin over growth amidst expected market volatility and higher claims costs.

- Voya Financial reported an exceptional 2025, achieving $775 million in cash generation and growing combined assets in its Retirement and Investment Management businesses to $1 trillion.

- The company expects significant growth in cash generation into 2026, driven by commercial growth in Retirement and Investment Management, and continued margin improvement in Employee Benefits.

- Voya plans to deploy $300 million towards share repurchases in the first half of 2026, split equally between Q1 and Q2, while maintaining optionality for future retirement roll-up acquisitions.

- The Retirement business achieved a 40% margin in 2025, exceeding its target, and recorded $28 billion in organic flows, supplemented by $60 billion from the OneAmerica acquisition, which delivered over 30% unlevered returns.

- Voya is investing in its Wealth Management business, which currently generates $200 million in revenues, anticipating over 20% returns and aiming to increase the retirement business's revenue growth to mid-single digits.

- Voya Financial achieved an exceptional year in 2025, generating $775 million in cash and growing combined assets in its Retirement and Investment Management businesses to $1 trillion.

- For the first half of 2026, Voya plans to deploy $300 million for share repurchases, split equally between the first and second quarters, while maintaining flexibility for strategic acquisitions.

- The company is investing in its wealth management business, which currently contributes $200 million in revenues, anticipating 20%+ returns and a shift to mid-single-digit revenue growth for the retirement business over time.

- Voya's Employee Benefits business significantly improved, with pre-tax adjusted operating earnings rising from $40 million in 2024 to over $150 million in 2025, and expects continued improvement in 2026.

- In the Stop Loss segment, Voya implemented a 24% rate increase for the January 2026 block, allowing for stable premiums, and is prioritizing margin over growth to manage market volatility.

- Voya delivered over $1 billion in pre-tax adjusted operating earnings for the full year 2025 and generated $775 million of excess cash, significantly growing earnings across all segments.

- Earnings per share increased 22% to $8.85 for the full year 2025, with Q4 2025 EPS up 39% to $1.94.

- The company achieved record commercial results in Retirement and Investment Management, with Defined Contribution net flows surpassing $28 billion and Investment Management delivering $1 billion in annual net revenue and 4.8% organic growth in 2025.

- Employee Benefits saw significant margin improvement, with adjusted operating earnings reaching $152 million in 2025, a substantial increase from $40 million in the prior year, supported by a 24% rate increase for the January 2026 Stop Loss business.

- Voya anticipates further excess capital improvement in 2026 and views share repurchases as a key element of its value proposition.

- Voya Financial reported over $1 billion in pre-tax adjusted operating earnings and generated $775 million of excess cash in 2025, surpassing targets.

- The company's FY 2025 EPS increased 22% to $8.85, with Q4 2025 EPS up 39% to $1.94.

- The Retirement segment delivered nearly $1 billion in adjusted operating earnings and $28 billion in record Defined Contribution net flows in 2025, while Investment Management achieved record $1 billion in annual net revenue and 4.8% organic growth.

- Employee Benefits adjusted operating earnings significantly improved to $152 million in 2025 from $40 million in the prior year, with Stop Loss actions including a 24% rate increase for the January 2026 business.

- Voya plans to repurchase $150 million of shares in Q1 2026 and anticipates a similar amount in Q2 2026, expressing confidence in continued excess cash generation and margin expansion for 2026.

- Voya Financial reported strong financial results for 2025, with pre-tax adjusted operating earnings exceeding $1 billion and earnings per share increasing 22% to $8.85.

- The company generated $775 million of excess cash in 2025, surpassing its target, and plans to repurchase $150 million of shares in both Q1 and Q2 2026.

- Both Retirement and Investment Management segments achieved record commercial results in 2025; Retirement generated nearly $1 billion in adjusted operating earnings with $28 billion in Defined Contribution net flows, and Investment Management delivered $1 billion in annual net revenue with 4.8% organic growth.

- Employee Benefits significantly improved adjusted operating earnings to $152 million in 2025 from $40 million in the prior year, driven by a 10 percentage point improvement in Stop Loss loss ratios to 84% and a 24% average net effective rate increase for the January 2026 business.

- Voya Financial reported strong financial results for FY 2025, with Adjusted Operating Earnings of $1,038 million and Adjusted Operating EPS of $8.85.

- The company generated robust excess cash of $775 million in FY 2025, exceeding its target, and achieved record commercial results in Retirement and Investment Management, driving combined assets above $1 trillion.

- Employee Benefits margins significantly improved in FY 2025, primarily due to Stop Loss improvements, and the company maintains a strong balance sheet with an RBC Ratio of 413%.

- Voya Financial reported full-year 2025 net income available to common shareholders of $613 million, or $6.29 per diluted share, and after-tax adjusted operating earnings of $861 million, or $8.85 per diluted share.

- The company generated approximately $775 million of excess capital for the full-year 2025, marking a 19% increase over the prior year, and its Retirement and Investment Management AUM collectively surpassed $1 trillion in assets.

- Full-year 2025 saw more than 20% growth in adjusted operating EPS, driven by 17.1% growth in Retirement net revenues and 4.9% growth in Investment Management net revenues, with the latter exceeding $1 billion for the first time.

- Voya Financial returned $200 million to common shareholders through share repurchases in full-year 2025, which contributed to a reduced share count and benefited earnings per share.

- Voya Financial reported full-year 2025 net income available to common shareholders of $613 million ($6.29 per diluted share) and after-tax adjusted operating earnings of $861 million ($8.85 per diluted share).

- For the fourth quarter of 2025, net income available to common shareholders was $136 million ($1.41 per diluted share) and after-tax adjusted operating earnings were $188 million ($1.94 per diluted share).

- The company generated approximately $775 million of excess capital for the full-year 2025, a 19% increase over the prior year, and returned $200 million through share repurchases and $174 million through common stock dividends.

- Voya's Retirement and Investment Management Assets Under Management (AUM) surpassed $1 trillion in 2025, contributing to over 20% growth in adjusted operating EPS for the full year.

- Voya Financial, Inc. reported preliminary Assets Under Management (AUM) for its Investment Management (IM) segment of approximately $360 billion as of December 31, 2025.

- The AUM was composed of $103 billion in equity assets, $153 billion in fixed income - public assets, $86 billion in fixed income - private assets, $15 billion in alternative assets, and $3 billion in money market assets.

- Client assets included $172 billion from Institutional external clients, $151 billion from Retail external clients, and $37 billion from the Company's general account.

- The fourth quarter of 2025 AUM figure reflects a client reclassification of approximately $11 billion from AUM to AUA.

Fintool News

In-depth analysis and coverage of Voya Financial.

Quarterly earnings call transcripts for Voya Financial.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more