Earnings summaries and quarterly performance for Weatherford International.

Executive leadership at Weatherford International.

Girish Saligram

President and Chief Executive Officer

Anuj Dhruv

Executive Vice President and Chief Financial Officer

David Reed

Executive Vice President and Chief Commercial Officer

Depinder Sandhu

Executive Vice President, Global Product Lines and Technology

Desmond Mills

Senior Vice President and Chief Accounting Officer

Kristin Ruzicka

Executive Vice President, Chief Human Resources Officer & Sustainability

Richard Ward

Executive Vice President, Global Field Operations

Scott Weatherholt

Executive Vice President, General Counsel and Chief Compliance Officer

Board of directors at Weatherford International.

Research analysts who have asked questions during Weatherford International earnings calls.

Saurabh Pant

Bank of America

8 questions for WFRD

Derek Podhaizer

Piper Sandler Companies

7 questions for WFRD

Doug Becker

Capital One

7 questions for WFRD

Scott Gruber

Citigroup

7 questions for WFRD

James West

Evercore ISI

6 questions for WFRD

Ati Modak

Goldman Sachs

5 questions for WFRD

Joshua Jayne

Daniel Energy Partners

5 questions for WFRD

David Anderson

Barclays PLC

4 questions for WFRD

James Rollyson

Raymond James Financial, Inc.

4 questions for WFRD

Jim Rollyson

Raymond James Financial

4 questions for WFRD

Phillip Jungwirth

BMO Capital Markets

4 questions for WFRD

John Anderson

Barclays

2 questions for WFRD

Josh Silverstein

UBS Group

2 questions for WFRD

Kurt Hallead

The Benchmark Company

2 questions for WFRD

Douglas Becker

Capital One

1 question for WFRD

J. David Anderson

Barclays

1 question for WFRD

Josh Jane

Daniel Energy Partners

1 question for WFRD

Joshua Chan

UBS Group AG

1 question for WFRD

Sean Mitchell

Daniel Energy Partners

1 question for WFRD

Recent press releases and 8-K filings for WFRD.

- Weatherford International plc was awarded a multi-year Integrated Completions contract by TotalEnergies in Denmark on February 12, 2026.

- Under the agreement, Weatherford will provide leading completions products and services to support offshore operations in Denmark.

- This contract builds on Weatherford's long-standing relationship with TotalEnergies and positions the company as a trusted partner for integrated well solutions.

- Girish Saligram, Weatherford's President and CEO, highlighted that the award is a testament to the strength and breadth of their completions portfolio and consistent execution.

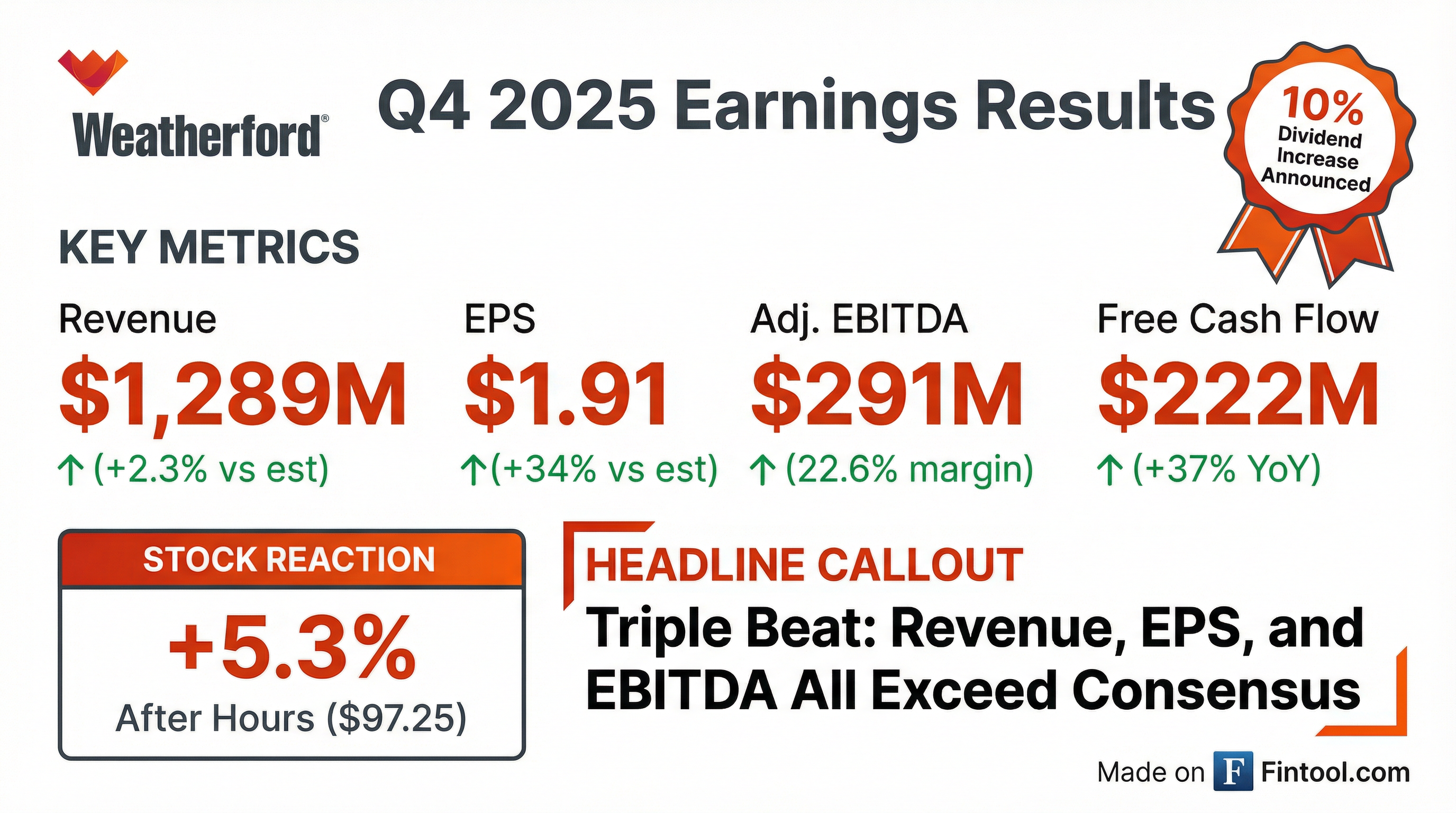

- Weatherford International reported strong Q4 2025 performance with 5% sequential revenue growth, 22.6% adjusted EBITDA margins, and $222 million in adjusted free cash flow, contributing to full year 2025 adjusted free cash flow of $466 million and a 43.7% conversion ratio.

- The company announced a 10% increase in its dividend and returned $173 million to shareholders in 2025, while also reducing gross debt by $161 million and achieving a net leverage ratio of approximately 0.42 times.

- For Q1 2026, revenue is guided to be $1.125 billion-$1.165 billion and adjusted EBITDA $230 million-$240 million. Full year 2026 revenue is expected to be $4.6 billion-$5.05 billion, with adjusted EBITDA between $980 million-$1.12 billion, and CapEx projected at $190 million-$230 million.

- While North America spending is expected to decline and international activity to be flat to slightly down in 2026, the company anticipates a stronger second half of 2026 and a significant uptick in activity starting in 2027.

- Weatherford reported Q4 2025 revenue of $1,289 million and full-year 2025 revenue of $4,918 million.

- For Q4 2025, the company achieved Net Income of $138 million and Basic Earnings per Share of $1.92. Adjusted EBITDA was $291 million, with a 22.6% margin.

- Adjusted Free Cash Flow for Q4 2025 was $222 million, representing a 76.3% conversion , contributing to $466 million for the full year 2025.

- Shareholder returns in Q4 2025 totaled $25 million, comprising $18 million in dividends and $7 million in share repurchases. The Board also approved a 10% increase in quarterly dividends to $0.275 per share.

- The company's net leverage ratio was 0.42x at the end of 2025.

- Weatherford reported strong Q4 2025 adjusted EBITDA margins of 22.6% and $222 million in adjusted free cash flow, contributing to a full-year 2025 adjusted free cash flow of $466 million and a 43.7% conversion ratio.

- The company significantly fortified its balance sheet in 2025, achieving a net leverage ratio of 0.42 times and $1.6 billion in total liquidity.

- Weatherford returned $173 million to shareholders in 2025 through dividends and share repurchases, and announced a 10% increase in its dividend.

- For Q1 2026, the company expects revenues between $1.125 billion and $1.165 billion and adjusted EBITDA between $230 million and $240 million.

- Full-year 2026 guidance projects revenues between $4.6 billion and $5.05 billion, adjusted EBITDA between $980 million and $1.12 billion, and adjusted free cash flow conversion in the low-to-mid 40% range, with CapEx of $190 million-$230 million.

- Weatherford International reported strong Q4 2025 performance, with 5% sequential revenue growth, 22.6% adjusted EBITDA margins, and $222 million in adjusted free cash flow, contributing to a full-year adjusted free cash flow of $466 million.

- The company significantly fortified its balance sheet in 2025, reducing gross debt by $161 million and achieving a net leverage ratio of 0.42 times. Shareholder returns totaled $173 million for the year, and the dividend was increased by 10%.

- For full year 2026, Weatherford expects revenues between $4.6 billion and $5.05 billion and adjusted EBITDA between $980 million and $1.12 billion, with adjusted free cash flow conversion in the low-to-mid 40% range. CapEx is projected to be between $190 million and $230 million.

- Management noted a stabilization in Mexico after a significant revenue decline in 2025, and anticipates a "tale of two halves" for international activity in 2026, with stronger performance expected in the second half.

- Strategic initiatives include continued cost optimization, the implementation of a new ERP system, and product innovations like Modus, which completed over 70 jobs in 2025.

- Weatherford International plc reported Q4 2025 revenue of $1,289 million, an increase of 5% sequentially, and full year 2025 revenue of $4,918 million, an 11% decrease from the prior year.

- For Q4 2025, net income was $138 million with a diluted income per share of $1.91, and adjusted EBITDA was $291 million. Full year 2025 net income was $431 million and adjusted EBITDA was $1,067 million.

- The company generated $268 million in cash from operating activities and $222 million in adjusted free cash flow in Q4 2025. For the full year 2025, cash provided by operating activities was $676 million and adjusted free cash flow was $466 million.

- The Board approved a 10% increase in the quarterly cash dividend to $0.275 per share, payable on March 5, 2026. Total shareholder return for Q4 2025 was $25 million, and for the full year 2025, it was $173 million.

- The CEO noted a strong Q4 performance but expects the overall activity outlook in 2026 to remain soft, particularly in the first half, with growth opportunities materializing in the second half.

- Weatherford International plc reported fourth quarter 2025 revenue of $1,289 million, a 5% sequential increase, and full year 2025 revenue of $4,918 million, an 11% decrease from the prior year.

- Net income for Q4 2025 was $138 million (10.7% margin), increasing 70% sequentially and 23% year-over-year, with diluted income per share of $1.91. Full year 2025 net income was $431 million.

- The company generated $268 million in cash from operating activities and $222 million in adjusted free cash flow in the fourth quarter of 2025.

- The Board approved a 10% increase in the quarterly cash dividend to $0.275 per share, payable on March 5, 2026. Shareholder return for Q4 2025 totaled $25 million, comprising $18 million in dividend payments and $7 million in share repurchases.

- Weatherford International plc declared a quarterly cash dividend of $0.275 per share on its ordinary shares.

- This dividend represents a 10% increase compared to the prior quarterly dividend.

- The dividend is payable on March 5, 2026, to shareholders of record as of February 6, 2026.

- The company's President and CEO noted that the dividend increase reflects the strength of the business, a healthy balance sheet, and strong free cash flow generation.

- Weatherford delivered $99 million in adjusted free cash flow in Q3 2025 and expanded EBITDA margins by over 70 bps despite continued market headwinds.

- The company repurchased approximately $7 million worth of shares in Q3 2025, contributing to $193 million in repurchases over the past five quarters, and paid a $0.25 per share quarterly dividend.

- For Q4 2025, Weatherford expects revenues between $1,245 million and $1,280 million and adjusted EBITDA between $274 million and $287 million, with adjusted free cash flow projected to be flat to slightly up from Q3 levels.

- Weatherford strengthened its balance sheet by expanding its credit facility to $1 billion, issuing $1.2 billion in new senior notes, and tendering for $1.3 billion of existing notes, resulting in approximately $1.6 billion in liquidity and a net leverage ratio of approximately 0.5 times.

- Management anticipates continued market softness for several months, with year-on-year comparisons expected to be down in 2026, but remains cautiously optimistic for improvements in the second half of 2026 driven by offshore activity.

- Weatherford International generated $99 million of adjusted free cash flow in Q3 2025 at a 36.8% conversion and expects Q4 adjusted free cash flow to be flat to slightly up from Q3 levels, contingent on payments from Mexico.

- The company secured significant contracts, including a three-year, $147 million contract with Petrobras in Brazil, and launched over 20 new products and extensions at its Forward 2025 conference.

- WFRD enhanced its liquidity by expanding its credit facility by $280 million to $1 billion and restructured debt, extending maturity by three years and lowering cash interest by approximately $31 million per year.

- The market remains soft with pricing pressure and uncertainty, leading to expected year-on-year comparisons being down in H1 2026, though improvement is hoped for in H2 2026. The company has reduced headcount by over 2,000 and lowered annualized personnel expenses by more than $145 million since Q3 last year.

- For Q4 2025, revenue is guided between $1.245 billion and $1.28 billion, and adjusted EBITDA is expected to be between $274 million and $287 million.

Quarterly earnings call transcripts for Weatherford International.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more