Earnings summaries and quarterly performance for Xerox Holdings.

Executive leadership at Xerox Holdings.

Board of directors at Xerox Holdings.

Research analysts who have asked questions during Xerox Holdings earnings calls.

AB

Ananda Baruah

Loop Capital Markets LLC

6 questions for XRX

Also covers: BURU, CRUS, DDD +15 more

Erik Woodring

Morgan Stanley

5 questions for XRX

Also covers: AAPL, CDW, CRCT +19 more

Michael Cadiz

Citigroup

2 questions for XRX

Also covers: CRCT, NTAP, PSTG

SC

Samik Chatterjee

JPMorgan Chase & Co.

2 questions for XRX

Also covers: AAPL, ANET, APH +33 more

Maya Neuman

Morgan Stanley

1 question for XRX

Also covers: CDW, CRCT, HPQ +4 more

PT

Priyanka Thapa

J.P. Morgan

1 question for XRX

Also covers: FFIV, JAMF, KEYS

Recent press releases and 8-K filings for XRX.

Xerox Secures $450 Million IP-Backed Financing with TPG

XRX

Debt Issuance

New Projects/Investments

M&A

- Xerox has formed a joint venture with TPG to hold, manage, and monetize certain intellectual property assets, and has secured $450 million in aggregate financing led by TPG Credit.

- The financing consists of $405 million of senior secured term loans and $45 million in Class A units, with proceeds distributed to Xerox for general corporate purposes, including augmenting liquidity and supporting its reinvention and integrations such as Lexmark.

- Louie Pastor, Xerox president and chief operating officer, stated that this financing "strengthens our balance sheet and completes the liquidity-enhancing actions" that began in the fall.

- This transaction is intended as a structural step to provide Xerox with flexibility to address its capital structure over time, potentially for debt repayment or redemptions, despite the company still facing profitability and margin challenges.

Feb 17, 2026, 2:26 PM

Xerox Forms Joint Venture, Raises $450 Million

XRX

Debt Issuance

New Projects/Investments

Guidance Update

- Xerox Holdings Corporation announced the formation of a new joint venture with TPG, structured as an intellectual property holding and licensing entity.

- The Joint Venture raised $450 million in financing, consisting of senior secured term loans and preferred equity, with the proceeds distributed to Xerox for general corporate purposes, including augmenting liquidity and addressing its capital structure.

- Xerox contributed certain intellectual property assets, including the Xerox brand trademarks, to the Joint Venture and entered into a long-term license agreement to preserve its ability to use the IP.

- Under the license agreement, Xerox will pay a 2.0% royalty fee of specified consolidated revenue generated from the Contributed IP to the Joint Venture, payable quarterly.

- This financing is expected to strengthen Xerox's balance sheet and support its long-term strategy, with an expectation of more than $200 million in operating income growth in 2026.

Feb 17, 2026, 2:23 PM

Xerox Forms Joint Venture with TPG, Raises $450 Million

XRX

Debt Issuance

New Projects/Investments

Guidance Update

- Xerox Holdings Corporation has formed a new joint venture with TPG, structured as an intellectual property holding and licensing entity to manage, protect, and monetize certain Xerox IP assets.

- The joint venture raised $450 million in financing, consisting of senior secured term loans and preferred equity, with proceeds distributed to Xerox.

- Xerox plans to use these proceeds for general corporate purposes, including strengthening its balance sheet, augmenting liquidity, accelerating its Reinvention strategy (which includes the Lexmark integration), and opportunistically addressing its capital structure.

- The company expects more than $200 million in operating income growth in 2026.

Feb 17, 2026, 2:17 PM

Xerox distributes pro rata warrants to shareholders

XRX

- Xerox Holdings Corporation distributed warrants to its eligible securityholders on February 12, 2026, as part of a previously announced pro rata warrant distribution.

- Holders of record of Xerox common stock as of February 9, 2026, received one (1) Warrant for every two (2) shares of common stock held, with an exercise price of $8.00 per share.

- The warrants can be exercised with cash or by using designated outstanding Xerox debt securities and are set to expire at 5:00 p.m. New York City time on February 11, 2028, unless an early expiration price condition is met.

- This action is intended to strengthen the balance sheet, improve the capital structure, enhance liquidity, and accelerate deleveraging.

Feb 12, 2026, 1:09 PM

Xerox Distributes Pro Rata Warrants

XRX

- Xerox Holdings Corporation distributed warrants to purchase shares of its common stock on February 12, 2026, to eligible securityholders of record as of February 9, 2026.

- The distribution ratio was one (1) Warrant for every two (2) shares of common stock held, with an exercise price of $8.00 per share.

- Warrants can be exercised with cash or by using designated Xerox debt securities and are set to expire on February 11, 2028, unless an early expiration price condition is met.

- This action is intended to enhance shareholder value, accelerate deleveraging, strengthen the balance sheet, and improve the company's capital structure.

Feb 12, 2026, 12:56 PM

Xerox Holdings Corporation Reports Q4 and Full-Year 2025 Results and Provides 2026 Guidance

XRX

Earnings

Guidance Update

Debt Issuance

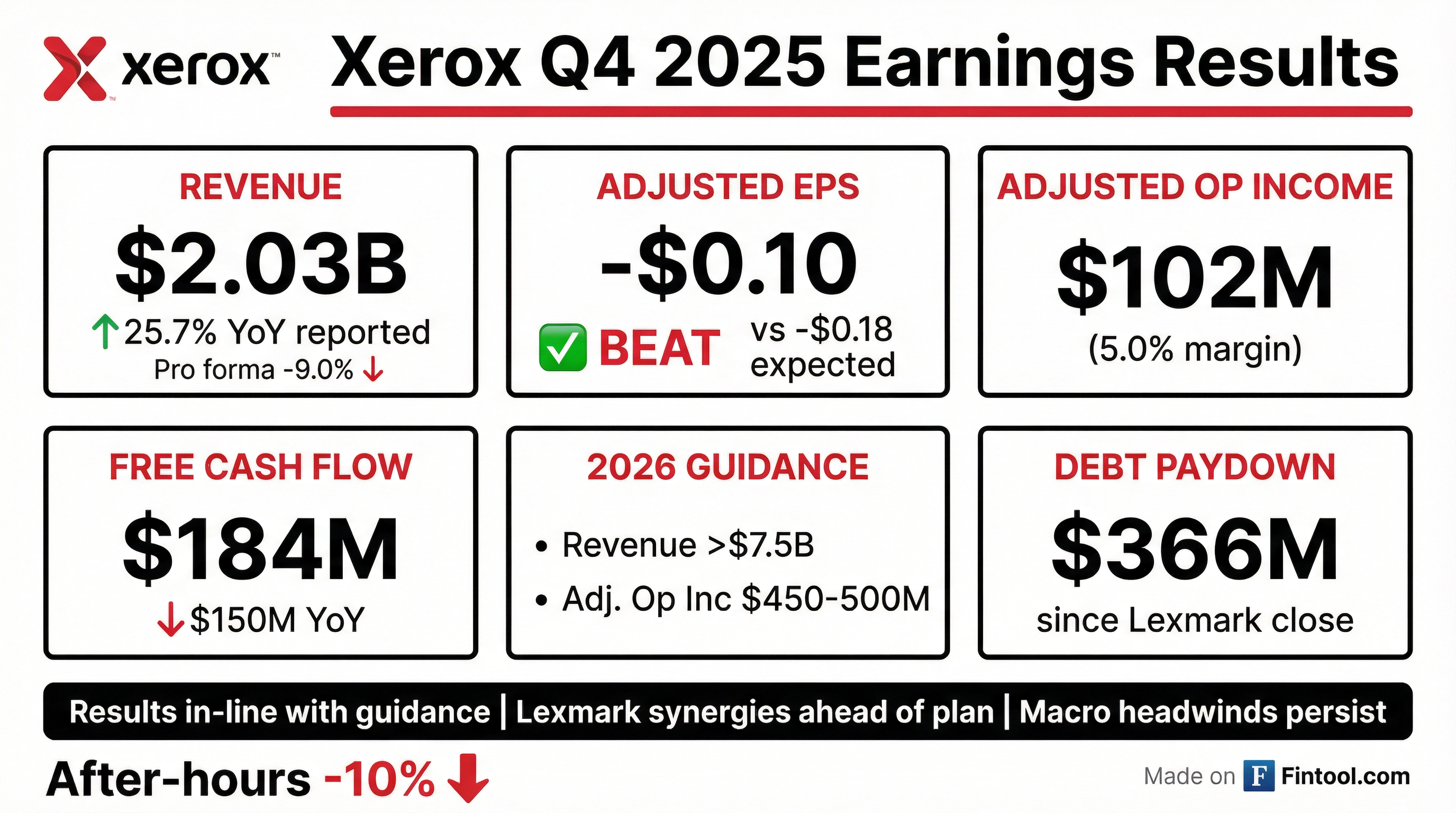

- Xerox Holdings Corporation reported Q4 2025 revenue of $2.03 billion, an increase of approximately 26% in actual currency due to the Lexmark and ITsavvy acquisitions, although pro forma revenue declined 9%. Adjusted loss per share for the quarter was $0.10, and free cash flow was $184 million.

- For the full year 2025, revenue reached $7.02 billion, with an adjusted loss per share of $0.60 and free cash flow of $133 million.

- The company provided 2026 guidance, projecting revenue to be greater than $7.5 billion (approximately 7% growth), adjusted operating income between $450 million and $500 million (an increase of over $200 million versus 2025), and free cash flow of approximately $250 million.

- Macroeconomic headwinds, including a recent spike in DRAM prices, are expected to persist, but Xerox anticipates improving trends in 2026, driven by integration synergies from Lexmark and ITsavvy, and reinvention savings.

- A special pro rata distribution of warrants was announced for holders of common stock, preferred stock, and convertible notes, aimed at rewarding shareholders and enabling immediate leverage reduction.

Jan 29, 2026, 1:00 PM

Xerox Reports Q4 and Full-Year 2025 Results, Provides 2026 Guidance

XRX

Earnings

Guidance Update

M&A

- Xerox reported Q4 2025 revenue of $2.03 billion, an increase of 26% in actual currency, though pro forma revenue declined 9%. For the full year 2025, revenue reached $7.02 billion, with an adjusted loss per share of $0.60 and free cash flow of $133 million.

- The company provided 2026 guidance, projecting revenue greater than $7.5 billion (approximately 7% growth), adjusted operating income between $450 million-$500 million (an increase of over $200 million), and free cash flow of approximately $250 million.

- Xerox is targeting at least $300 million in cumulative run rate gross cost synergies from the Lexmark acquisition and over $1 billion in profit improvement from its reinvention program. Net debt decreased by $366 million since the Lexmark transaction, and a special pro rata distribution of warrants was announced to enhance balance sheet flexibility.

- Macroeconomic headwinds continue, and a recent spike in DRAM prices is expected to impact costs, particularly for the IT solutions business, with a larger effect anticipated in the second half of 2026. Chuck Butler was also appointed as the new Chief Financial Officer.

Jan 29, 2026, 1:00 PM

Xerox Reports Q4 and Full-Year 2025 Results, Issues 2026 Guidance

XRX

Earnings

Guidance Update

M&A

- For the full year 2025, Xerox reported revenue of $7.02 billion, an adjusted operating margin of 3.5%, and free cash flow of $133 million.

- In Q4 2025, revenue reached $2,028 million, with an adjusted operating margin of 5.0% and an adjusted earnings per share of ($0.10).

- For the full year 2025, adjusted earnings per share was ($8.25) and GAAP loss per share was ($0.60).

- Xerox issued full-year 2026 guidance, projecting revenue above $7.5 billion in constant currency, adjusted operating income of $450-500 million, and free cash flow of ~$250 million. The company anticipates >$1 billion in identified gross savings/profit improvement from its Reinvention program and Lexmark integration, contributing to an expected $250-300 million in gross cost reductions for 2026.

Jan 29, 2026, 1:00 PM

Xerox Holdings Corporation Reports Q4 and Full Year 2025 Results, Provides 2026 Outlook

XRX

Earnings

Guidance Update

M&A

- Xerox Holdings Corporation reported Q4 2025 revenue of $2.03 billion, an increase of approximately 26% in actual currency, primarily driven by the Lexmark and ITsavvy acquisitions, though pro forma revenue declined 9%. The company recorded an adjusted loss per share of $0.10 and generated $184 million in free cash flow for the quarter.

- For the full year 2025, revenue reached $7.02 billion, an increase of approximately 13% in actual currency, with an adjusted loss per share of $0.60 and $133 million in free cash flow.

- For 2026, Xerox anticipates revenue greater than $7.5 billion (approximately 7% growth), adjusted operating income between $450 million and $500 million (an increase of over $200 million), and approximately $250 million in free cash flow.

- The company is focused on realizing benefits from the Lexmark and ITsavvy acquisitions, leveraging AI for operational efficiencies, and prioritizing debt reduction to a medium-term target of approximately 3x trailing 12 months EBITDA. A special pro rata distribution of warrants to shareholders was also announced.

Jan 29, 2026, 1:00 PM

Xerox Holdings Corporation Announces Q4 and Full-Year 2025 Results and 2026 Guidance

XRX

Earnings

Guidance Update

M&A

- Xerox Holdings Corporation reported Q4 2025 revenue of $2.03 billion, a 25.7% increase year-over-year, and a GAAP net loss of $(73) million or $(0.60) per share.

- For the full year 2025, revenue reached $7.02 billion, up 12.9%, with a GAAP net loss of $(1.03) billion or $(8.25) per share.

- The company provided 2026 guidance, projecting revenue above $7.5 billion, adjusted operating income between $450 million and $500 million, and free cash flow of approximately $250 million.

- Strategic progress includes the Lexmark integration advancing ahead of plan, reaffirming a $300 million integration synergy target, and $366 million of debt paid down since the Lexmark acquisition on July 1, 2025.

Jan 29, 2026, 11:35 AM

Fintool News

In-depth analysis and coverage of Xerox Holdings.

Quarterly earnings call transcripts for Xerox Holdings.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more