Earnings summaries and quarterly performance for Xylem.

Executive leadership at Xylem.

Board of directors at Xylem.

Research analysts who have asked questions during Xylem earnings calls.

Deane Dray

RBC Capital Markets

8 questions for XYL

Scott Davis

Melius Research

7 questions for XYL

Andy Kaplowitz

Citigroup Inc.

4 questions for XYL

Michael Halloran

Baird

4 questions for XYL

Mike Halloran

Robert W. Baird & Co. Incorporated

4 questions for XYL

Nathan Jones

Stifel

4 questions for XYL

Nathan Jones

Stifel, Nicolaus & Company, Incorporated

4 questions for XYL

Andrew Buscaglia

BNP Paribas

3 questions for XYL

Andrew Kaplowitz

Citigroup

2 questions for XYL

Joseph Giordano

TD Cowen

2 questions for XYL

William Griffin

Barclays

2 questions for XYL

William Grippin

UBS Group AG

2 questions for XYL

Brett Linzey

Mizuho Securities

1 question for XYL

Brian Lee

Goldman Sachs Group, Inc.

1 question for XYL

Bryan Blair

Oppenheimer

1 question for XYL

Jake Levinson

Melius Research LLC

1 question for XYL

Mark W. Strouse

J.P. Morgan Chase & Co.

1 question for XYL

Michael

TD Cowen

1 question for XYL

Saree Boroditsky

Jefferies

1 question for XYL

Tyler Bisset

Goldman Sachs

1 question for XYL

Recent press releases and 8-K filings for XYL.

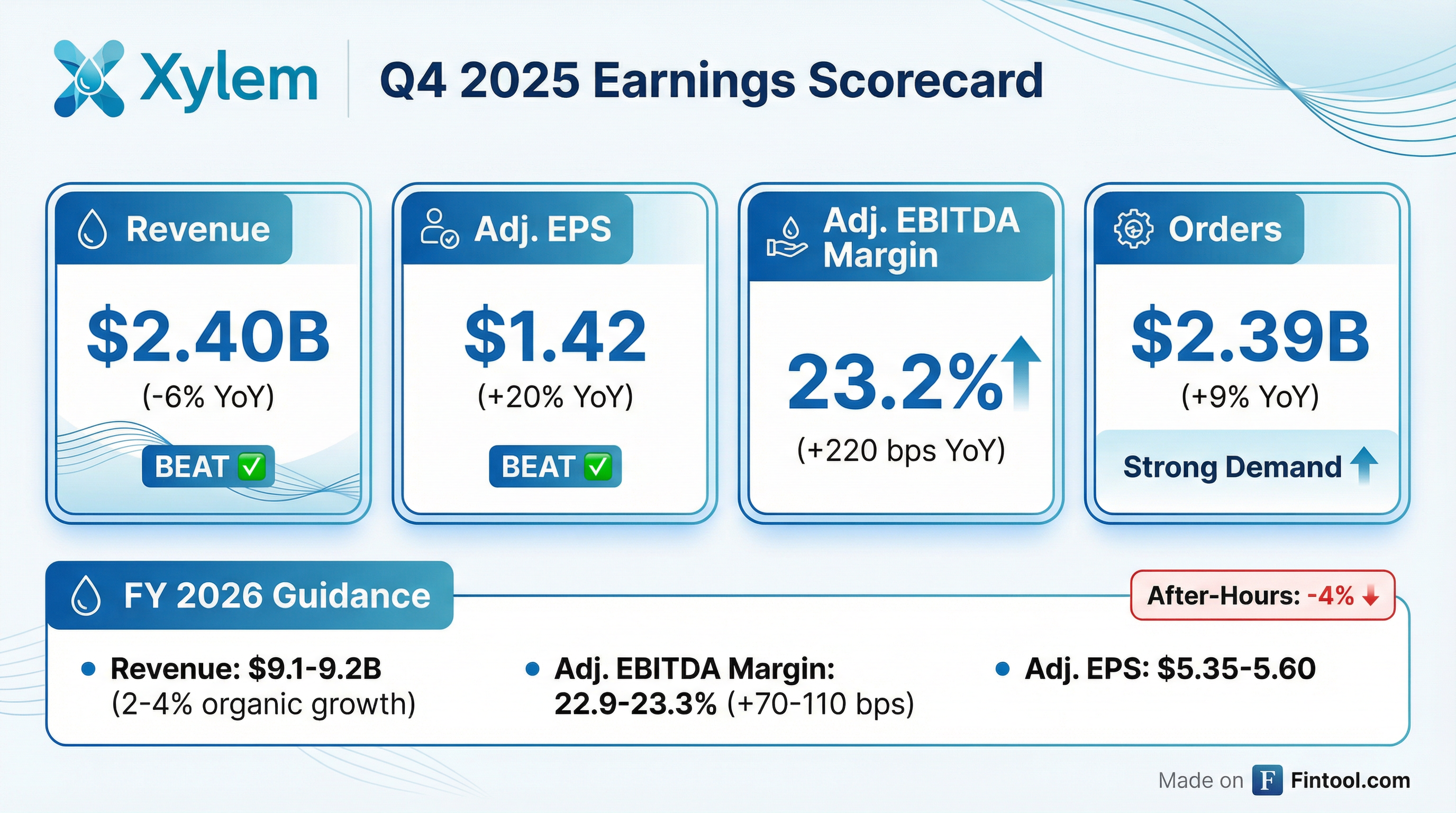

- Xylem’s board approved a $1.5 billion no-expiration share repurchase program (≈4.8% of outstanding shares), reflecting confidence after generating $873 million LTM levered free cash flow and reporting Q4 results of $1.42 EPS on $2.4 billion revenue.

- The company issued FY2026 EPS guidance of $5.350–$5.560, alongside a recent net margin of 10.59% and ROE of 11.11%.

- Analyst sentiment is mixed, with consensus tilting toward a “Moderate Buy” (target near $158), price targets ranging from $135–$166, and TipRanks AI assigning an Outperform rating.

- At a $128.26 share price, Xylem trades below several fair-value estimates, suggesting potential upside if margins and growth improve.

- The Board of Directors authorized a new $1.5 billion share repurchase program, effective immediately.

- Repurchases may be made opportunistically in the open market or via privately negotiated transactions and can be suspended or discontinued at any time.

- The program underscores Xylem’s confidence in its strategy and strong cash flow, while supporting a balanced capital allocation approach that funds growth and returns capital to shareholders.

- Record Q4 and FY 2025 performance: Q4 revenue up 4%, full-year revenue up 5%; Q4 EBITDA margin 23.2% (+220 bps) and full-year 22.2% (+160 bps); Q4 EPS $1.42 (+20%); backlog $4.6 B; orders +7% in Q4, +2% for the year.

- Segment results: MCS orders +22% and revenue +10% with 20.2% EBITDA margin; Water Infrastructure flat revenue with +510 bps margin; Applied Water revenue +3% with +60 bps margin; WSS revenue +4% with 23.9% margin.

- 2026 guidance: full-year revenue of $9.1–9.2 B (+1%–3%), organic +2%–4%; EBITDA margin 22.9%–23.3%; EPS $5.35–5.60; Q1 revenue +1%–2% (flat organic), margin ~20.5%–21%, EPS $1.06–1.11.

- Strong balance sheet and capital allocation: net debt/adj. EBITDA 0.2×; prioritizing core investment, ~$1 B/year in M&A (with $250 M deployed in H2 2025), and opportunistic share buybacks at low leverage.

- Delivered strong Q4 2025: revenue +4%, orders +7%, backlog $4.6 B, EBITDA margin 23.2%, EPS $1.42 (+20%)

- Full-year 2025: revenue +5%, EBITDA margin 22.2%, net debt/EBITDA 0.2×, free cash flow -2%

- 2026 outlook: revenue $9.1–9.2 B (+1–3% reported, +2–4% organic), EBITDA margin 22.9–23.3%, EPS $5.35–5.60; Q1 EPS $1.06–1.11

- Xylem delivered record Q4 and full-year revenue, with Q4 revenue up 4% and full-year revenue up 5%, orders +7% in Q4, and a backlog of $4.6 B.

- Q4 EBITDA margin expanded 220 bps to 23.2%, full-year margin up 160 bps to 22.2%; Q4 EPS reached a record $1.42 (+20% YoY); net debt/EBITDA at 0.2×.

- 2026 guidance: revenue $9.1–9.2 B (+1–3% reported, +2–4% organic), EBITDA margin 22.9–23.3%, EPS $5.35–$5.60; Q1 EPS $1.06–$1.11.

- 2026 faces a ~2% top-line headwind from accelerated 80/20 simplification, and the divestiture of the international metering business is expected to close end-Q1.

- Q4 2025 orders were $2.39 B, up 9% y/y with 7% organic growth.

- Q4 2025 revenue reached $2.40 B, up 6% y/y with 4% organic growth.

- Adjusted EPS was $1.42, vs. $1.18 in Q4 2024.

- FY 2026 guidance: revenue of $9.1–9.2 B, organic growth 2–4%, adj. EBITDA margin 22.9–23.3%, adj. EPS $5.35–5.60.

- Q4 EPS of $1.42, record revenue and EBITDA, with a $4.6 billion backlog and 9% year-over-year order growth led by Measurement & Control Solutions.

- Management guided 2026 revenue of $9.1 billion–$9.2 billion and adjusted EPS of $5.35–$5.60, both slightly below consensus, driving a ~6–10% stock decline.

- For full-year 2025, Xylem reported ~$9.0 billion in revenue (up ~6%) and $5.08 adjusted EPS (up ~19%).

- Quarterly dividend raised by 8% to $0.43 per share, payable in March.

- Xylem’s Q4 orders of $2.4 billion (up 9% reported, 7% organically) and revenue of $2.4 billion (up 6% reported, 4% organically) reflected strong execution.

- Q4 GAAP EPS was $1.37 (up 2%), with adjusted EPS at $1.42 (up 20%).

- Full-year 2025 revenue reached $9.0 billion (up 6% reported, 5% organically), with GAAP EPS of $3.92 (up 7%) and adjusted EPS of $5.08 (up 19%).

- For 2026, Xylem guides revenue of $9.1–$9.2 billion (2–4% organic growth) and adjusted EPS of $5.35–$5.60, and declared a Q1 dividend of $0.43 per share (up 8%).

- Fourth-quarter revenue of $2.4 billion, up 6% reported and 4% organically; Q4 EPS of $1.37, up 2%, and adjusted EPS of $1.42, up 20%

- Full-year 2025 revenue of $9.0 billion, up 6% reported and 5% organically; FY EPS of $3.92, up 7%, and adjusted EPS of $5.08, up 19%

- 2026 guidance: revenue of $9.1–$9.2 billion, up 2–4% organically, and adjusted EPS of $5.35–$5.60

- Declared Q1 2026 dividend of $0.43 per share, an 8% increase, payable March 24, 2026

- A joint study by Xylem and Global Water Intelligence projects that AI’s annual water demand will rise by 129%—equivalent to 30 trillion liters—by 2050, driven by surging infrastructure needs as AI spending nears $2 trillion in 2026.

- The additional water demand is attributed to electricity generation (≈54%), semiconductor manufacturing (≈42%) and data center expansion (≈4%).

- Global water systems currently treat 320 trillion liters of wastewater and lose about 100 trillion liters due to aging infrastructure—resources that could be recovered through targeted reuse and infrastructure investments to offset AI-driven growth.

- Nearly 40% of existing data centers are in high water-stress regions, underscoring the need for local solutions and partnerships; for example, a collaboration in Mexico City and Monterrey with Amazon and Xylem will save 1.3 billion liters annually through smart leak-detection and analytics.

Quarterly earnings call transcripts for Xylem.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more