Anthropic's Legal Plugin Triggers Carnage in Software Stocks: RELX, Thomson Reuters, SAP Hammered

February 3, 2026 · by Fintool Agent

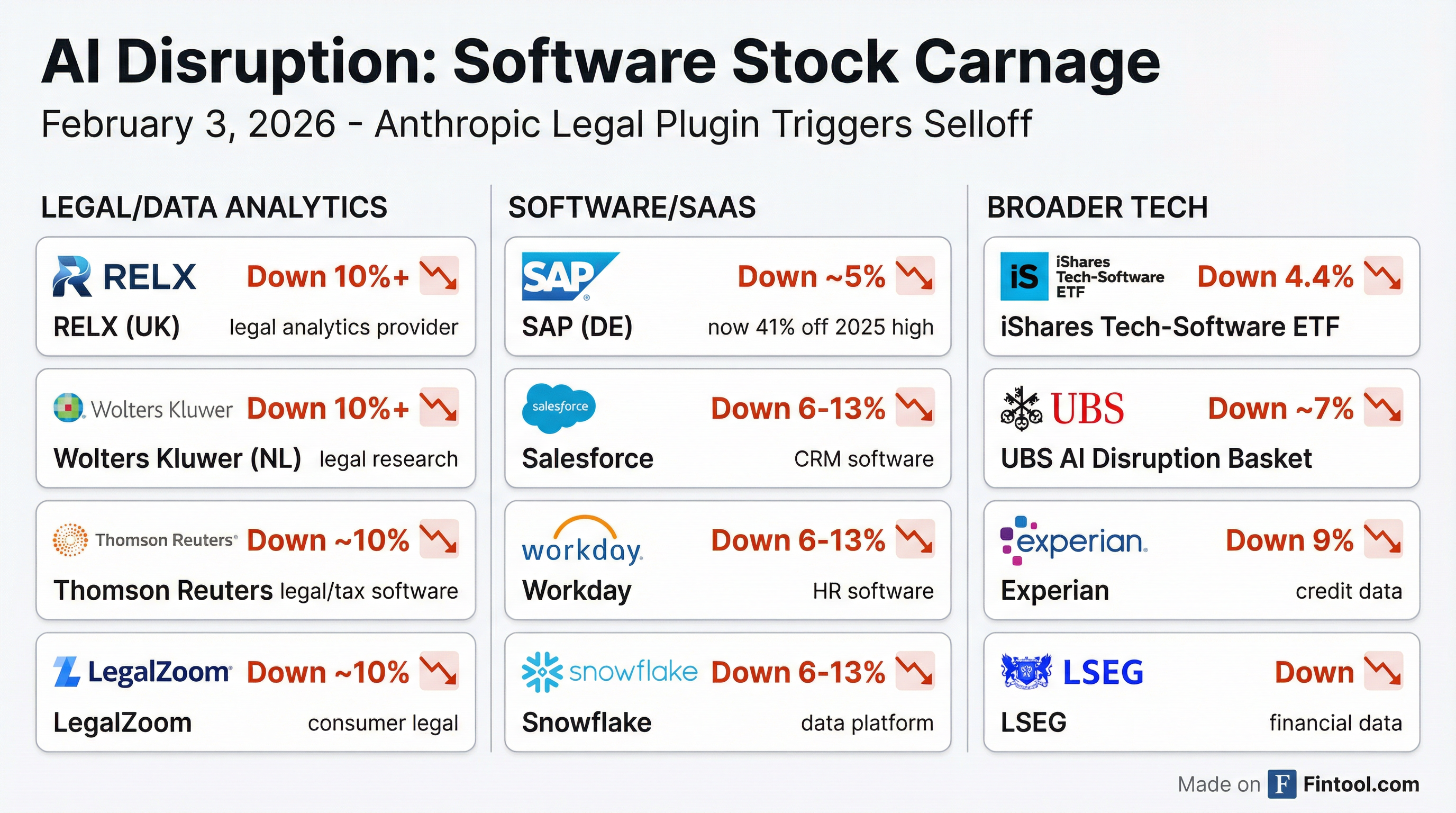

Relx and Wolters Kluwer both plunged more than 10% on Tuesday after Anthropic unveiled a legal plugin for its Claude Cowork AI assistant, sparking fresh fears that generative AI could commoditize the specialized software and data analytics businesses that underpin billions of dollars in enterprise spending.

The selloff rippled across continents. Thomson Reuters tumbled roughly 10%. LegalZoom fell more than 10%. FactSet Research Systems slid around 10%. The iShares Expanded Tech-Software Sector ETF (IGV) dropped as much as 4.4%, while a UBS Group basket of European stocks deemed at risk of AI disruption fell nearly 7%.

RELX shares have now almost halved from their peak last February—the once-celebrated "AI beneficiary" turned cautionary tale in less than twelve months.

The Trigger: Claude Goes After the Legal Industry

Anthropic's legal plugin, released Sunday as part of its Cowork agentic AI platform, can perform contract review, flag risks, triage NDAs, track compliance, and generate templated legal responses—tasks that form the core revenue base of companies like RELX's LexisNexis and Thomson Reuters' Westlaw.

"Plugins bundle skills, connectors, slash commands, and sub-agents that make Claude work like a domain expert for specific roles and teams," Anthropic said in its announcement. The legal plugin joins a suite of 11 open-source plugins spanning sales, finance, data analysis, marketing, and customer support.

For investors, the implications are stark: AI labs are no longer content to sell APIs to software companies—they're coming for their customers directly.

A Pattern of Disruption

Tuesday's carnage follows a familiar playbook. Last year, Openai sent shockwaves through the software industry when it demonstrated internal workplace tools built on its models. In January, Anthropic launched Claude for Healthcare & Life Sciences, rattling healthcare IT stocks. Then came Claude Cowork itself, which caused Salesforce, Workday, Intuit, and Snowflake to fall 6-13% in a single week.

"While headline risk is not new, we believe the velocity of innovation and announcements from the model providers could continue to weigh on the broader software landscape throughout 2026," RBC Capital Markets analysts wrote.

Germany's Sap, once Europe's most valuable company, is now down more than 41% from its 2025 high after its cloud revenue forecast missed expectations last week, wiping about $40 billion off its market value in one day. Tuesday's 4.9% decline added to the damage.

The Bull Case: Incumbents Have Deep Moats

Not everyone is panicking. William Blair analyst Arjun Bhatia called the market reaction "overdone."

"Claude Cowork adds yet another sentiment headwind to public software stocks, but not a fundamental headwind," Bhatia wrote. "Traditional enterprise software companies remain protected by data scale, platform breadth and workflows that general-purpose agents cannot easily replicate."

Thomson Reuters CEO Stephen Hasker has been making a similar argument on earnings calls, pointing to the company's trusted content and deep domain expertise as competitive advantages AI labs can't easily replicate.

"The thing that's uncertain is the broader pace of change management within the professional services that we serve," Hasker said on the company's Q4 2024 earnings call. "Some are moving very quickly. Some are more cautious."

Thomson Reuters has been investing aggressively in its own AI capabilities. CoCounsel, its AI legal assistant, has been integrated across Westlaw and Practical Law. GenAI adoption now sits at about 18% of the company's ACV book of business—up from previous quarters. Westlaw Precision AI ACV penetration is above 40%.

| Metric | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 |

|---|---|---|---|---|

| Revenue ($B) | $1.91 | $1.90 | $1.79 | $1.78 |

| EBITDA Margin | 29.8% | 32.0% | 27.0% | 26.8% |

| GenAI Adoption (% of ACV) | 18% | 18%+ | Growing | Growing |

Thomson Reuters Recent Quarterly Performance

The Bear Case: No Software Is "AI-Proof" Anymore

The optimists may be underestimating the pace of AI improvement. Anthropic's plugins launch with ready-to-use capabilities that required significant engineering to build—and they're available today for $20/month (Claude Pro) or $100/month (Max).

"We've viewed vertical software as one pocket of software that is likely to be viewed as 'AI-proof' (for now), given the deep domain, regulatory nuance, and workflow expertise required to be successful," RBC's note stated. "That said, recently announced Claude for Healthcare & Life Sciences suggests the AI bear narrative contagion could spread to some vertical names."

The concern is that AI labs like Anthropic and OpenAI have a structural advantage: they're training on the same legal documents, case law, and compliance frameworks that power RELX and Thomson Reuters—and they're getting better at using that knowledge faster than incumbents can adapt.

A Morgan Stanley index tracking 15 SaaS firms was down 15% through January 18. Mizuho Securities analyst Jordan Klein captured the mood: "Many buy-siders see no reasons to own software, no matter how cheap or beaten down the stocks get... They assume zero catalysts for a re-rate exist right now."

Who's Most Exposed?

The companies at greatest risk share common characteristics: high-margin subscription businesses built on content aggregation, search, and basic analytics—functions that generative AI can increasingly replicate.

High Risk:

- RELX / LexisNexis: Legal research and case law synthesis—precisely what Claude's legal plugin targets

- Wolters Kluwer: Legal, tax, and compliance content—overlaps heavily with AI capabilities

- LegalZoom: Consumer legal services—most vulnerable to AI commoditization

Medium Risk:

- Thomson Reuters: Strong AI investments via CoCounsel provide some protection, but legal/tax core faces pressure

- FactSet: Financial data aggregation—AI can increasingly synthesize similar insights

- Advertising agencies (WPP, Publicis, Omnicom): Creative and media planning AI tools advancing rapidly

Lower Risk (for now):

- Adobe: Deep creative workflow integration with Firefly AI; harder to displace

- Salesforce: CRM data lock-in and customer relationships provide moat

- Workday: HR/finance systems require deep enterprise integration

Adobe has been executing a different playbook—infusing AI across its flagship applications rather than waiting for disruption. "Simply put, Adobe is the operating system for creative work," CEO Shantanu Narayen said on the company's Q3 2025 call. The company's AI-first products exceeded $250 million in ARR, with Firefly services consumption growing 32% quarter-over-quarter.

| Company | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 | Q4 2025 |

|---|---|---|---|---|---|

| Adobe Revenue ($B) | - | $5.71 | $5.87 | $5.99 | $6.19 |

| Adobe EBITDA Margin | - | 41.7% | 39.5% | 39.8% | 39.5% |

Adobe Recent Quarterly Performance

What to Watch

The software industry is at an inflection point. Three questions will determine who survives:

1. Can incumbents out-innovate AI labs? Thomson Reuters, Adobe, and Salesforce are all investing billions in AI. But they're competing against companies (Anthropic, OpenAI) whose sole focus is AI advancement and who have access to virtually unlimited capital.

2. Will enterprise customers switch? The real test isn't whether Claude's legal plugin works—it's whether law firms and corporate legal departments will trust a $20/month AI tool over a $50,000/year enterprise contract. Change management, risk aversion, and regulatory requirements favor incumbents, but only up to a point.

3. How fast will AI improve? A year ago, the idea of AI handling contract review at enterprise scale seemed distant. Today, it's a product. The velocity of improvement may be the single biggest variable.

For now, the market is voting with its feet—and that vote says software's AI premium has become an AI penalty.