Earnings summaries and quarterly performance for THOMSON REUTERS CORP /CAN/.

Research analysts who have asked questions during THOMSON REUTERS CORP /CAN/ earnings calls.

Drew McReynolds

RBC Capital Markets

7 questions for TRI

Toni Kaplan

Morgan Stanley

7 questions for TRI

Aravinda Galappatthige

Canaccord Genuity

6 questions for TRI

Jason Haas

Wells Fargo

6 questions for TRI

Andrew Steinerman

JPMorgan Chase & Co.

5 questions for TRI

Manav Patnaik

Barclays

5 questions for TRI

Doug Arthur

Huber Research

4 questions for TRI

Kevin McVeigh

Credit Suisse Group AG

4 questions for TRI

Maher Yaghi

Scotiabank

4 questions for TRI

Scott Fletcher

CIBC

4 questions for TRI

Stephanie Price

CIBC World Markets

4 questions for TRI

Tim Casey

BMO Capital Markets

4 questions for TRI

Vince Valentini

TD Securities

4 questions for TRI

George Tong

Goldman Sachs

3 questions for TRI

Anna Wu

Goldman Sachs

2 questions for TRI

Brendan Lynch

Barclays

2 questions for TRI

Justin Wembley

J.P. Morgan

2 questions for TRI

Keen Fai Tong

Goldman Sachs Group Inc.

2 questions for TRI

Audey Ashkar

Wells Fargo

1 question for TRI

Douglas Arthur

Huber Research Partners

1 question for TRI

Heather Balsky

Bank of America

1 question for TRI

Joshua Dennerlein

BofA Securities

1 question for TRI

Sami Kassab

Exane BNP Paribas

1 question for TRI

Recent press releases and 8-K filings for TRI.

- Thomson Reuters announced a new US$600 million share repurchase program and a US$605 million return of capital and share consolidation on February 25, 2026.

- The amended Normal Course Issuer Bid (NCIB), effective February 27, 2026, will allow for the repurchase of up to an additional 6 million common shares, increasing the total to 16 million shares (approximately 3.55% of outstanding shares as of August 12, 2025) between August 19, 2025, and August 18, 2026.

- The US$605 million return of capital will be a special cash distribution of approximately US$1.36 per participating share, followed by a share consolidation.

- Shareholders will vote on these proposed transactions at a special meeting on April 28, 2026, with expected completion in early May if approved.

- Thomson Reuters announced a new share repurchase program of up to US$600 million under an amended normal course issuer bid (NCIB), which becomes effective on February 27, 2026. This program allows for the repurchase of up to 16 million common shares, representing approximately 3.55% of outstanding shares as of August 12, 2025, between August 19, 2025, and August 18, 2026.

- The company also plans to return US$605 million to shareholders through a special cash distribution, estimated at approximately US$1.36 in cash per participating share, followed by a share consolidation.

- These return of capital and share consolidation transactions require shareholder approval at a special meeting on April 28, 2026, and court approval, with an expected completion in early May.

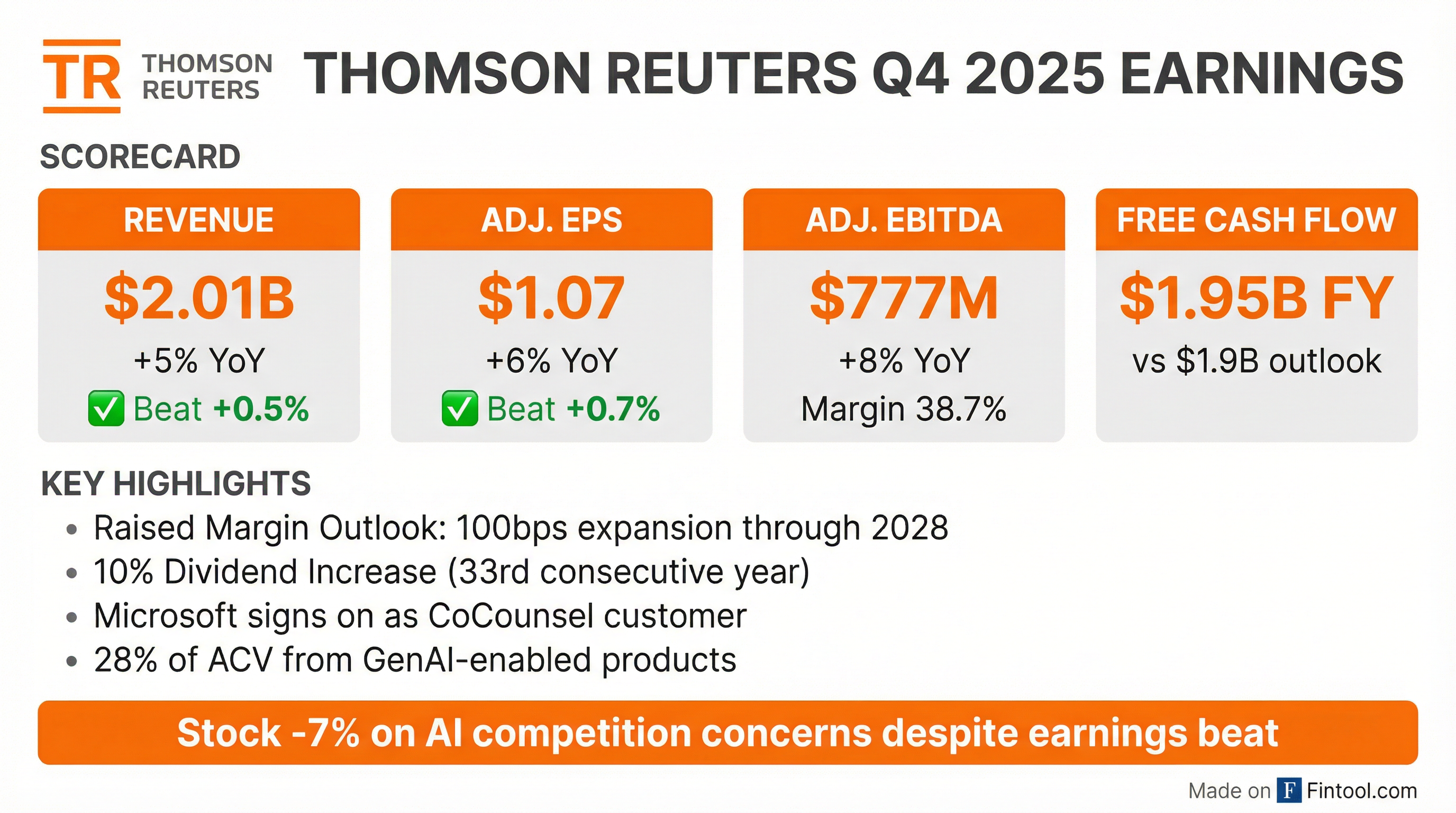

- Thomson Reuters reported strong financial results for full-year 2025, with organic revenue growth of 7%, an Adjusted EBITDA margin of 39.2%, and $1.95 billion in free cash flow. For Q4 2025, organic revenues grew 7%, Adjusted EBITDA increased 8% to $777 million, and Adjusted EPS was $1.07.

- The company reaffirmed its 2026 outlook, forecasting organic revenue growth of 7.5%-8% (including approximately 9.5% for the Big Three), 100 basis points of Adjusted EBITDA margin expansion, and approximately $2.1 billion in free cash flow.

- Thomson Reuters announced a 10% increase in its annual common stock dividend for 2026 to $2.62 per share, marking the 33rd consecutive year of increases. The company completed a $1 billion share repurchase program in 2025 and committed to returning 75% of its 2026 free cash flow to investors, which would require approximately $500 million in share repurchases.

- The company highlighted the successful launch of AI-driven products like Westlaw Advantage and CoCounsel, with 28% of its annualized contract value (ACV) now GenAI-enabled. Internal AI adoption is also driving productivity, with over 85% of employees using AI tools.

- Thomson Reuters reported full-year 2025 organic revenue growth of 7%, with adjusted EBITDA margin expanding by 100 basis points to 39.2%, and $1.95 billion in free cash flow. Adjusted earnings per share for the year was $3.92.

- The company reaffirmed its 2026 outlook, projecting organic revenue growth of 7.5%-8%, a 100 basis point increase in adjusted EBITDA margin, and $2.1 billion in free cash flow.

- Thomson Reuters announced a 10% increase in its annual common stock dividend and committed to returning 75% of its 2026 free cash flow to investors, including approximately $500 million in share repurchases.

- GenAI-enabled products now represent 28% of annual contract value (ACV), up from 15% in Q3 2024, with expectations for continued growth as more products are AI-enabled.

- Thomson Reuters reported strong financial results for Q4 and full-year 2025, with full-year organic revenue growing 7% and Adjusted EBITDA margin expanding by 100 basis points to 39.2%. Free cash flow for 2025 was $1.95 billion, slightly ahead of expectations.

- The company provided a positive outlook for 2026, reaffirming organic revenue growth of 7.5%-8% and expecting 100 basis points of annual EBITDA margin expansion through 2028. Free cash flow is projected to be approximately $2.1 billion in 2026.

- Strategic initiatives in AI are progressing, highlighted by the successful launch of Westlaw Advantage and plans to integrate advanced agentic capabilities into CoCounsel Legal by mid-year. 28% of annualized contract value is now from GenAI-enabled products.

- Thomson Reuters demonstrated a commitment to shareholder returns, announcing a 10% increase in its annual common stock dividend to $2.62 per share for 2026, and completing a $1 billion share repurchase program in 2025. The company also invested $850 million in M&A in 2025.

- Thomson Reuters reported Q4 2025 revenues of $2,009 million, a 5% increase (or 7% organic), and full-year 2025 revenues of $7,476 million, up 3% (or 7% organic).

- Adjusted EBITDA for Q4 2025 rose 8% to $777 million (margin of 38.7%), and for the full year 2025, it reached $2,936 million (margin of 39.2%). Adjusted EPS was $1.07 for Q4 and $3.92 for the full year.

- The company forecasts full-year 2026 organic revenue growth of approximately 7.5% - 8.0% and an adjusted EBITDA margin expansion of approximately 100 basis points from the 39.2% reported in 2025.

- Thomson Reuters announced a 10% increase in its annualized dividend to $2.62 per common share, marking the 33rd consecutive annual increase.

- For the fourth quarter and full year ended December 31, 2025, Thomson Reuters reported strong revenue growth, with total company revenues up 5% (organic up 7%) in Q4 and up 3% (organic up 7%) for the full year.

- The company achieved Adjusted EBITDA of $777 million with a 38.7% margin in Q4 2025 and $2,936 million with a 39.2% margin for FY 2025, alongside Adjusted EPS of $1.07 and $3.92 for the respective periods.

- Thomson Reuters provided a full-year 2026 outlook anticipating organic revenue growth of approximately 7.5% - 8.0% and adjusted EBITDA margin expansion of approximately 100 basis points from 2025's 39.2%.

- The company increased its annualized dividend by 10% to $2.62 per common share, marking the 33rd consecutive annual increase, and completed a $1.0 billion share repurchase program in late October 2025.

- Thomson Reuters is significantly increasing its product innovation, particularly with generative AI, and plans to invest north of $200 million in GenAI for both 2025 and 2026, split roughly 50% operating expense and 50% CapEx.

- The company targets 9.5% revenue growth for its "Big Three" segments in 2026, driven by 3-3.5% price increases, volume, and mix. International organic growth is a key contributor, growing at 16% year to date and expected to accelerate into 2026.

- The Legal segment delivered 9% organic growth in Q3 and forecasts 9% for Q4, with expectations for continued high growth, despite a 20 basis point impact from U.S. federal government downgrades in 2025 and 2026.

- The Tax & Accounting segment is targeting 11%-13% organic revenue growth in 2026, supported by an average price increase of 5%-5.5% in recent years, scaling acquisitions like SafeSend, and the continued strong performance of the de minio business in Brazil.

- Thomson Reuters believes its competitive moats in both Legal (Westlaw) and Tax & Accounting (tax calculation engines) are significantly strengthened by agentic AI, leveraging extensive content and expert training.

- Thomson Reuters Corporation filed a 6-K on November 14, 2025, detailing an Amended and Restated Credit Agreement dated November 10, 2025.

- The Maturity Date for this credit agreement is November 10, 2030.

- The maximum LC Exposure (Letters of Credit) permitted under the agreement is US$180,000,000.

- The company's consolidated financial statements for the fiscal year ended December 31, 2024, and the fiscal quarter ended September 30, 2025, were presented fairly, and no Material Adverse Change has occurred since December 31, 2024.

- Thomson Reuters reported Q3 2025 revenues of $1,782 million, a 3% increase, with organic revenue growth of 7%. The "Big 3" segments achieved 9% organic revenue growth.

- Operating profit increased 43% to $593 million in Q3 2025, driven by an operating gain on the sale of a minority equity interest. Adjusted EBITDA grew 10% to $672 million, with the margin expanding to 37.7%.

- Diluted EPS for Q3 2025 was $0.94, up 40%. For the nine months ended September 30, 2025, diluted EPS decreased 28% to $2.59, primarily due to a significant non-cash tax benefit in the prior-year period.

- The company reaffirmed its 2025 full-year outlook, noting total and organic revenue growth are trending towards the lower end of their ranges. The 2026 financial framework was updated, expecting adjusted EBITDA margin expansion of approximately 100bp and free cash flow of approximately $2.1 billion.

- In Q3 2025, Thomson Reuters repurchased $670 million of common shares and paid $260 million in common share dividends, completing its share repurchase program in late October 2025.

Fintool News

In-depth analysis and coverage of THOMSON REUTERS CORP /CAN/.

Quarterly earnings call transcripts for THOMSON REUTERS CORP /CAN/.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more