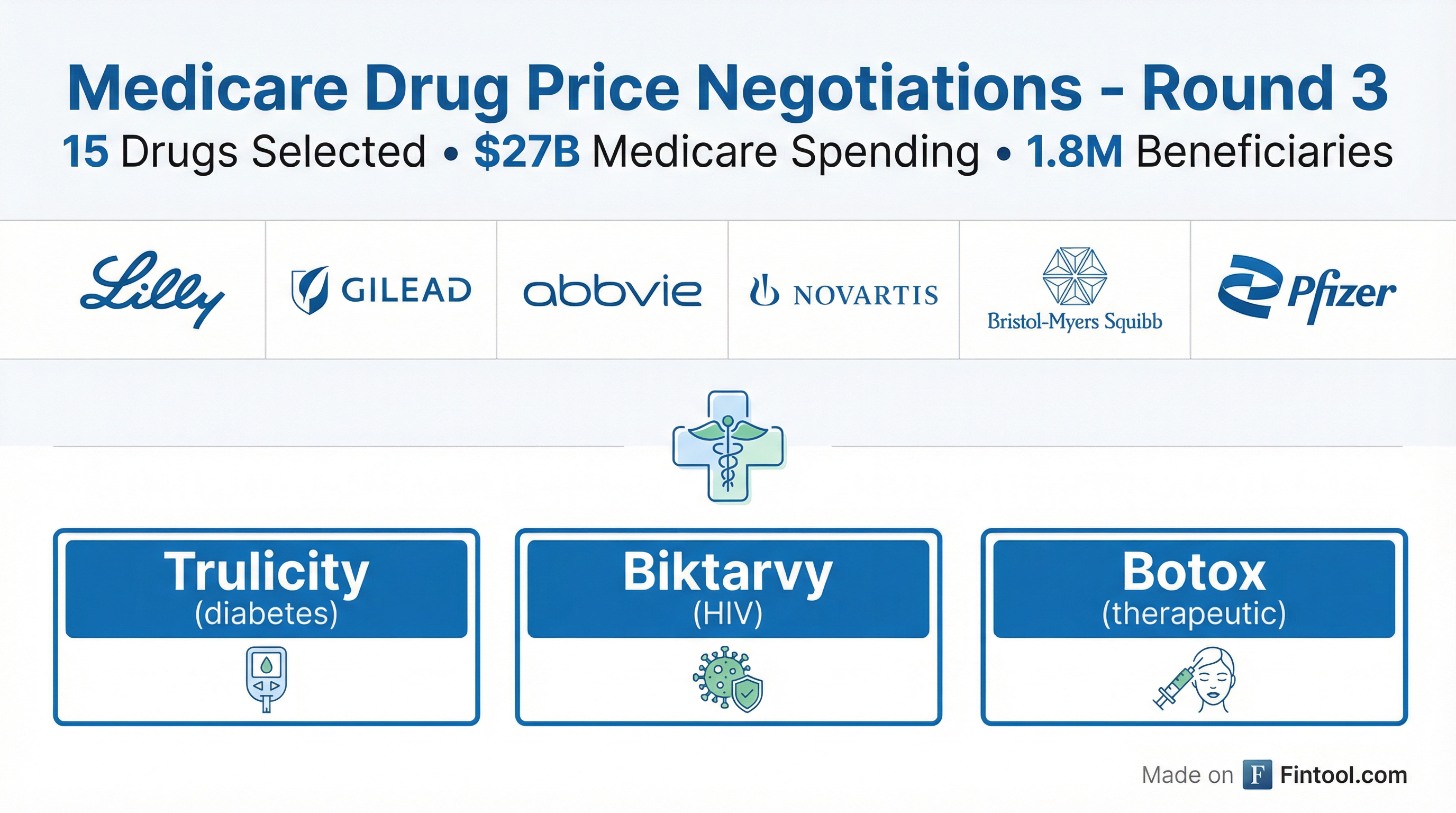

Medicare Adds 15 Drugs to Price Negotiation: Biktarvy, Trulicity, Botox on the List

January 28, 2026 · by Fintool Agent

The Trump administration unveiled 15 drugs for the third round of Medicare price negotiations on January 27, targeting $27 billion in annual spending across HIV treatments, cancer therapies, and autoimmune drugs—but analysts say the financial impact will be "immaterial" for most pharma companies, with Gilead Sciences+1.72% as the notable exception.

For the first time, this round includes drugs covered under Medicare Part B—treatments administered in doctors' offices rather than pharmacies—expanding the Inflation Reduction Act's reach into provider-administered medications.

The 15 Drugs Selected

| Drug | Indication | Manufacturer | 2024 Sales | Medicare Spend |

|---|---|---|---|---|

| Biktarvy | HIV | Gilead Sciences (GILD) | $13.4B | Top seller |

| Trulicity | Type 2 Diabetes | Eli Lilly (LLY) | $5.3B | $4.9B |

| Verzenio | Breast Cancer | Eli Lilly (LLY) | $5.3B | — |

| Cosentyx | Psoriasis | Novartis (NVS) | — | — |

| Kisqali | Breast Cancer | Novartis (NVS) | — | — |

| Xolair | Allergies/Asthma | Novartis/Roche | — | — |

| Botox | Therapeutic | AbbVie (ABBV) | — | — |

| Entyvio | IBD | Takeda (TAK) | — | — |

| Erleada | Prostate Cancer | J&J (JNJ) | — | — |

| Orencia | Rheumatoid Arthritis | Bristol Myers (BMY) | — | Part B |

| Xeljanz | Rheumatoid Arthritis | Pfizer (PFE) | — | — |

| Cimzia | Autoimmune | UCB | — | Part B |

| Rexulti | Schizophrenia | Lundbeck/Otsuka | — | — |

| Lenvima | Cancer | Eisai | — | — |

| Anoro Ellipta | COPD | GSK (GSK) | — | — |

Sources: CMS, Company Filings

Additionally, Boehringer Ingelheim's diabetes drug Tradjenta was selected for the program's first-ever renegotiation after being included in last year's batch.

Financial Impact: Immaterial for Most, Except Gilead

Wall Street is largely dismissing the announcement's significance. Leerink Partners analyst David Risinger notes that for 14 of the 15 drugs, Medicare revenue represents only 0% to 3% of the companies' projected 2027 worldwide sales.

The outlier is Gilead's Biktarvy, where Medicare sales could represent approximately 8% of Gilead's estimated 2027 revenue—making it the most financially exposed drug on the list.

"With prior rounds of pricing negotiations reasonable, and several of these medicines set to lose exclusivity in the near-term, we continue to expect that the impacts will be manageable," said BMO Capital Markets analyst Evan Seigerman.

Market Reaction: Shares of Gilead, Eli Lilly, AbbVie, Johnson & Johnson, Pfizer, and Bristol Myers were all up nearly 2% in after-hours trading following the announcement—suggesting investors view the news as de-risking rather than negative.

Keytruda and Opdivo: The Blockbusters That Got Away

Notably absent from the list were Merck's Keytruda and Bristol Myers Squibb's Opdivo—two of the world's best-selling cancer immunotherapies that together generate roughly $40 billion in annual revenue.

Both drugs were widely expected to be selected this round but were excluded due to provisions in the One Big Beautiful Bill Act (signed into law in July 2025) that expanded orphan drug exemptions.

The new law changed eligibility timing: for drugs initially approved as orphan treatments but later expanded to broader indications, the negotiation eligibility countdown now starts from the first non-orphan approval date rather than initial FDA approval. This delays Keytruda and Opdivo's selection by at least one year to 2027, with negotiated prices not taking effect until 2029.

Senator Ron Wyden (D-Oregon) criticized the exclusion: "Two of the best-selling and most expensive cancer drugs—Keytruda and Opdivo—are not on this list thanks to Trump and congressional Republicans… seniors fighting cancer will be forced to pay more for life-saving drugs."

In 2023, Medicare spent $5.6 billion on Keytruda and $2.0 billion on Opdivo. A 22% negotiated discount would have saved beneficiaries approximately $3,300 annually for Keytruda users.

Building on Prior Rounds

This is the third cycle of Medicare drug price negotiations under the IRA:

| Round | Year Selected | Prices Effective | Drugs | Est. Savings |

|---|---|---|---|---|

| 1 | 2024 | January 2026 | 10 | 22% avg discount |

| 2 | 2025 | January 2027 | 15 | $8.5B / 36% |

| 3 | 2026 | January 2028 | 15 | TBD |

The second round, which included Novo Nordisk's blockbuster GLP-1 drugs Ozempic and Wegovy, yielded estimated savings of $8.5 billion—a 36% reduction in net spending.

Industry Response

PhRMA, the pharmaceutical industry's leading trade group, reiterated its opposition to the program.

"The IRA continues to show why government price setting is the wrong approach for Americans," said Elizabeth Carpenter, PhRMA's executive vice president of policy and research. "CMS is now planning to set prices for additional small molecule cancer treatments that would otherwise be spared without this penalty—driving even more investment away from these critical treatment options."

Several lawsuits challenging the IRA are making their way to the Supreme Court, though drugmakers have so far been unable to halt the program's implementation.

What to Watch

February 28, 2026: Deadline for drug manufacturers to decide whether to participate in negotiations. All manufacturers with selected drugs are expected to participate given the harsh penalties for non-compliance—including a 95% excise tax on U.S. sales.

Throughout 2026: CMS will conduct negotiations with participating companies.

January 1, 2028: Negotiated prices take effect for Medicare beneficiaries.

2027: Fourth round of selections expected to finally include Keytruda and Opdivo, along with the first full year of Part B-covered drugs.