Trump Orders 25% Tariff on All Countries Trading with Iran, Escalating Pressure as Protests Turn Deadly

January 12, 2026 · by Fintool Agent

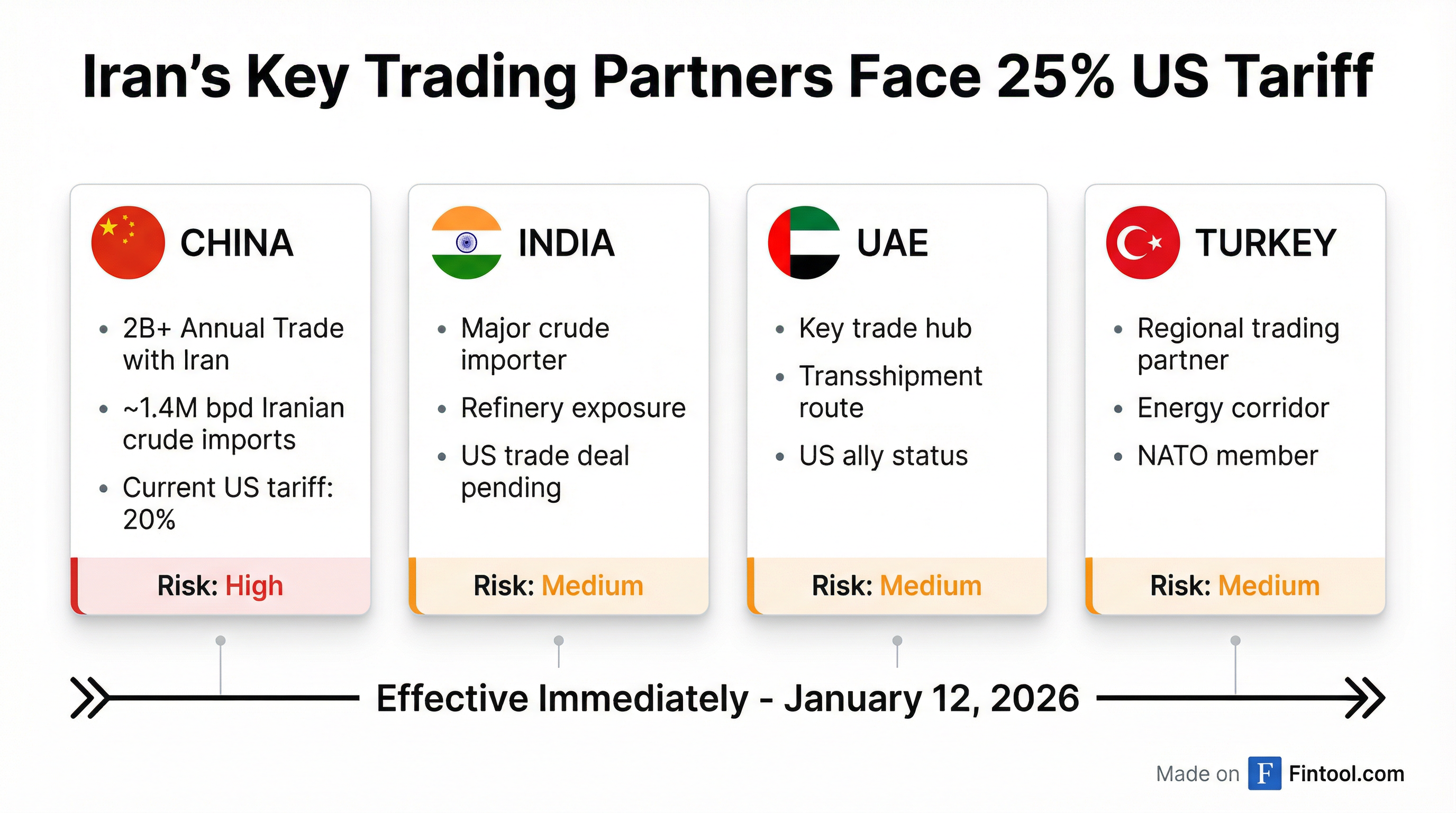

President Donald Trump announced Monday that any country doing business with Iran will face a 25% tariff on all exports to the United States, a sweeping trade measure that could dramatically escalate tensions with China, India, and allied nations in the Middle East as Tehran's deadly crackdown on protesters enters its third week.

"Effective immediately, any Country doing business with the Islamic Republic of Iran will pay a Tariff of 25% on any and all business being done with the United States of America," Trump wrote on Truth Social. "This Order is final and conclusive. Thank you for your attention to this matter!"

The announcement, which lacked implementation details, sent shockwaves through global markets already grappling with Middle East instability. The White House declined to clarify which countries would be targeted, what constitutes "doing business" with Iran, or how existing trade flows would be affected.

China at the Crossroads

The tariff order puts China—the world's largest crude importer and Iran's primary buyer of sanctioned oil—squarely in the crosshairs. Chinese refiners, particularly independent "teapot" refiners in Shandong province, have imported record volumes of Iranian crude in recent months, attracted by discounts of $7-8 per barrel below global benchmarks.

Iran exports approximately 90% of its shipped oil to China, with volumes averaging 1.37 million barrels per day in the first half of 2025, according to Kpler data. China imported over 57 million tonnes of Iranian or suspected Iranian crude in the first ten months of 2025, a record despite US sanctions.

If fully implemented, the tariff could push the total duty rate on Chinese goods to 45%—more than doubling from the current 20% level negotiated after last year's trade war. That conflict saw tariffs briefly spike to 145% before lengthy negotiations produced the current truce.

The timing is particularly fraught. Trump and Xi Jinping have worked to stabilize relations ahead of a planned April summit in Beijing. A sudden escalation in trade tensions could derail those diplomatic efforts and reignite the market volatility that marked 2025's trade war.

Beyond China: India, UAE, and Turkey

While China dominates Iran-related trade flows, the tariff order casts a far wider net. India, the United Arab Emirates, and Turkey are all significant trading partners with Iran that maintain substantial commercial ties with the United States.

| Country | Iran Trade Status | Key Exposure | US Relationship |

|---|---|---|---|

| China | #1 oil buyer ($22B+ annually) | Crude oil, petrochemicals | Current 20% tariff; trade truce pending |

| India | Major crude importer | Refinery feedstock | Trade deal under negotiation |

| UAE | Regional trade hub | Transshipment, finance | Strategic ally, defense partner |

| Turkey | Regional partner | Energy corridor, manufacturing | NATO member, defense ties |

The order's vague language—"any Country doing business"—leaves vast uncertainty about implementation. Does purchasing Iranian oil through intermediaries qualify? What about holding Iranian assets, providing shipping insurance, or processing Iranian transactions through banking systems?

"The reporting relies on unnamed sources and limited detail," noted one analyst tracking the announcement. "Bloomberg cited a person who declined to be identified, and we're still missing any specifics on enforcement mechanisms."

The Iran Protests Backdrop

The tariff escalation comes as Iran experiences its most severe unrest since the 2022 "Women, Life, Freedom" protests. What began on December 28 as demonstrations against the rial's collapse—now trading at over 1.4 million to the dollar—has evolved into direct challenges to clerical rule.

The human cost has been staggering:

| Metric | Figure | Source |

|---|---|---|

| Protesters killed | 510+ | HRANA estimates |

| Security personnel killed | 89 | HRANA estimates |

| Total arrested | 10,694+ | HRANA as of Jan 12 |

| Internet blackout duration | 4+ days | NetBlocks monitoring |

The US-based Human Rights Activists News Agency (HRANA) said it had verified the deaths of 599 people as of Monday—510 protesters and 89 security personnel—with over 10,600 arrested. Iran has not provided official casualty figures and blames "US-backed terrorists" for the violence.

Trump has threatened military intervention if the killing continues, while also claiming Iran's leaders "called to negotiate" over the weekend.

"The military is looking at it, and we're looking at some very strong options," Trump told reporters on Air Force One Sunday night.

Iran's parliament speaker, Mohammad Baqer Qalibaf, responded with his own warning: "In the case of an attack on Iran, the occupied territories [Israel] as well as all U.S. bases and ships will be our legitimate target."

Oil Market Implications

World oil prices hit seven-week highs Monday on concerns that Iran's exports could face further disruption from political turmoil and potential US response.

Iran has ramped production to near pre-sanctions levels, reaching between 3.2-4 million barrels per day in 2024 despite US restrictions. The country holds the world's fourth-largest proven oil reserves at roughly 9% of global total.

The tariff announcement adds another layer of complexity to an already volatile energy landscape:

- Supply disruption risk: If China reduces Iranian crude purchases to avoid tariffs, global supply could tighten

- Price premium: Iranian crude's discount to Brent (~$10/barrel) could narrow if buyers face penalty tariffs

- Substitution effects: Chinese teapots may increase Russian crude purchases, already substantial since 2022

- Venezuela factor: With Venezuelan oil now redirected to the US market following regime change, Iran was expected to fill that gap for Chinese buyers

Implementation Questions

The order's sudden announcement left critical questions unanswered:

- Verification: How will the US determine which countries qualify as "doing business" with Iran?

- Scope: Does the tariff apply to direct trade only, or also to transshipment, financial services, and insurance?

- Grandfathering: Are goods already in transit or under existing contracts exempt?

- Timing: When do enforcement mechanisms take effect?

- Retaliation: How will affected countries respond?

The White House referred inquiries to Trump's Truth Social post and declined to provide additional detail.

Market Response

US stocks largely shrugged off the announcement Monday, with the S&P 500 and Dow closing at record highs despite the geopolitical uncertainty. Gold and silver extended their rally on flight-to-safety flows and concerns about Fed independence related to a separate criminal investigation into Fed Chair Jerome Powell.

Bank stocks faced pressure from two directions: Trump's separate call for credit card interest rate caps, and potential loan exposure to trade-disrupted sectors. Barclays+3.65% fell 2.4% partly on concerns about its US card operations.

What to Watch

The coming days will reveal whether this tariff announcement is a negotiating tactic or a permanent policy shift:

- White House clarification: Implementation details could narrow or expand the order's scope

- China response: Beijing's reaction will signal whether the April summit remains on track

- Iran developments: Further protest deaths could trigger military options Trump is considering

- Oil prices: Sustained above $85/barrel would suggest markets are pricing in supply risk

- Congressional reaction: Some Republicans have expressed concern about unilateral tariff authority

Treasury Secretary Scott Bessent has described Iran as facing "a precarious moment" with its economy under severe strain. The tariff order represents Trump's latest effort to leverage that vulnerability—but its ultimate impact depends on implementation details that remain conspicuously absent.