Earnings summaries and quarterly performance for Adeia.

Executive leadership at Adeia.

Paul E. Davis

Chief Executive Officer

Dana Escobar

Chief Licensing Officer & General Manager, Semiconductor

Keith A. Jones

Chief Financial Officer

Kevin Tanji

Chief Legal Officer and Corporate Secretary

Mark Kokes

Chief Licensing Officer & General Manager, Media

Board of directors at Adeia.

Research analysts who have asked questions during Adeia earnings calls.

Hamed Khorsand

BWS Financial

5 questions for ADEA

Matthew Galinko

Maxim Group

5 questions for ADEA

Kevin Cassidy

Rosenblatt Securities

4 questions for ADEA

Scott Searle

ROTH MKM

3 questions for ADEA

Madison De Paola

Rosenblatt Securities

1 question for ADEA

Recent press releases and 8-K filings for ADEA.

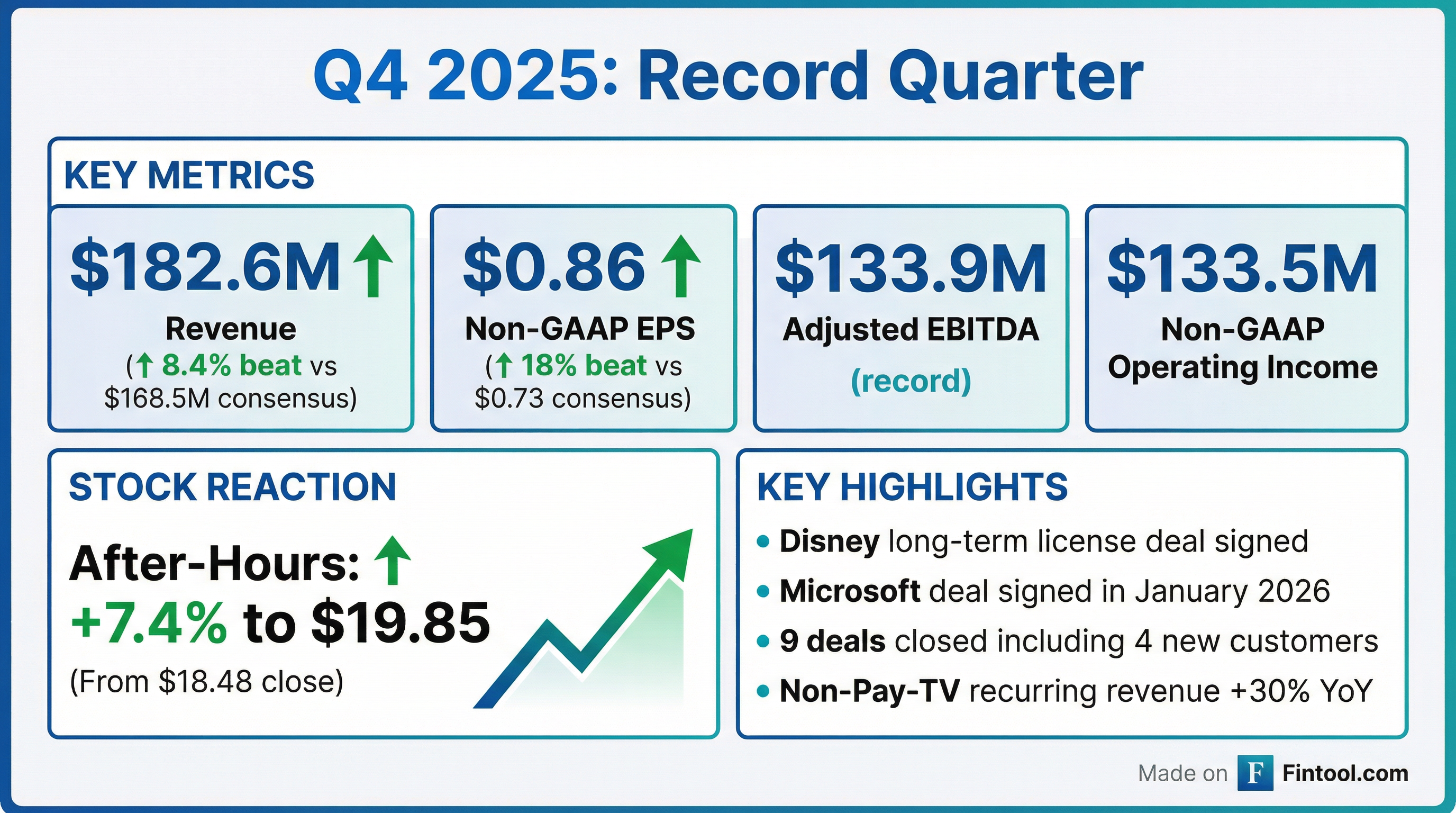

- Adeia reported record annual revenue of $443 million for fiscal year 2025, exceeding the high end of its guidance, and Q4 2025 revenue of $183 million.

- The company secured significant new agreements, including a multi-year license agreement with Microsoft and a major license agreement with Disney, expanding its presence in the OTT market and contributing to a 30% year-over-year growth in non-pay TV recurring revenue in Q4 2025.

- For fiscal year 2026, Adeia provided revenue guidance of $395 million-$435 million and projects an adjusted EBITDA margin of approximately 55%, noting that increased litigation expenses are expected to impact margins.

- In Q4 2025, Adeia generated $60 million in cash from operations, made $21.1 million in debt principal payments, repurchased $10 million in shares, and paid a $0.05 per share cash dividend.

- Adeia reported record annual revenue of $443 million for the full year 2025, exceeding the high end of its guidance, with operating income of $276 million and adjusted EBITDA of $278 million.

- For the fourth quarter of 2025, revenue reached $182.6 million, contributing to an adjusted EBITDA of $133.9 million and a 73% margin.

- The company added a record 12 new customers in 2025, including Disney and Major League Baseball in Q4, and secured a multi-year license agreement with Microsoft early in 2026.

- Adeia provided 2026 revenue guidance of $395 million-$435 million and anticipates an adjusted EBITDA margin of approximately 55% for the full year.

- Strategic efforts to diversify revenue continue, with non-pay TV recurring revenue growing 20% in 2025 and projected to represent 35%-40% of forecasted revenue in 2026.

- Adeia achieved record revenue for both the fourth quarter of 2025, at $182.6 million , and the full year 2025, reaching $443 million , with operating income of $276 million and adjusted EBITDA of $278 million for the full year, all exceeding the high end of guidance.

- The company secured significant new multi-year license agreements, including with Microsoft for its media portfolio and Disney, which was its biggest new customer in Q4 2025.

- For 2026, Adeia provided revenue guidance in the range of $395 million to $435 million , anticipating pay-TV revenue to represent approximately 35%-40% of forecasted revenue, down from a historical average of 50%-60%.

- Adeia continued its balanced capital allocation strategy in 2025, reducing debt by $60 million , repurchasing approximately 718,000 shares for $10 million in Q4 2025 , and paying a cash dividend of $0.05 per share.

- Adeia reported record revenue of $182.6 million for Q4 2025 and $443.4 million for the full year 2025. Non-GAAP adjusted EBITDA reached $133.9 million in Q4 2025 and $277.6 million for FY 2025.

- Key licensing agreements were signed in Q4 2025 with Disney and Major League Baseball (MLB), and a multi-year renewal with Vodafone. A new multi-year license agreement with Microsoft was also signed in January 2026.

- Non-Pay-TV recurring revenue saw a 30% year-over-year growth in Q4 2025.

- In FY 2025, the company paid down $60.4 million of debt, distributed $21.8 million in dividends, and repurchased 1.5 million shares for $20.0 million. The IP portfolio expanded by 13% year-over-year.

- For FY 2026, Adeia projects revenue between $395.0 million and $435.0 million, with Non-GAAP adjusted EBITDA expected to be between $213.4 million and $245.4 million.

- Adeia Inc. reported record fourth-quarter 2025 revenue of $182.6 million and full-year 2025 revenue of $443.4 million, along with record operating income and adjusted EBITDA for both periods.

- The company signed a long-term license agreement with Disney and a new multi-year license agreement with Microsoft in January 2026, enhancing its media portfolio.

- In 2025, Adeia reduced its debt by $60 million and repurchased $20 million of common stock.

- For the full year 2026, Adeia projects revenue between $395.0 million and $435.0 million and adjusted EBITDA between $213.4 million and $245.4 million.

- Adeia Inc. raised its financial outlook for the year ending December 31, 2025, projecting revenue and earnings to significantly exceed prior guidance.

- This revised outlook is primarily driven by the execution of a long-term media IP license agreement with The Walt Disney Company, which also resolves all outstanding litigation between the companies.

- The updated GAAP revenue outlook for 2025 is $425.0 \u2013 $435.0 million, an increase from the prior guidance of $360.0 \u2013 $380.0 million.

- The updated GAAP net income outlook for 2025 is $96.4 \u2013 $113.9 million, compared to the prior guidance of $52.4 \u2013 $71.6 million.

- Operating expenses are also expected to be higher, reflecting increased variable compensation due to anticipated overachievement of performance targets.

- Adeia Inc. has raised its financial outlook for the year ending December 31, 2025, anticipating results to surpass the high end of its previous guidance.

- This positive revision is primarily attributed to strong deal execution, notably the Disney agreement, which significantly boosts revenue expectations.

- The company's updated GAAP revenue guidance for 2025 is $425.0 - $435.0 million, an increase from the prior range of $360.0 - $380.0 million.

- Updated GAAP net income guidance for 2025 is $96.4 - $113.9 million, and Non-GAAP Adjusted EBITDA guidance is $257.1 - $265.1 million.

- Operating expenses are projected to be higher, reflecting increased variable compensation due to the expected overachievement of performance targets.

- Adeia Inc. has entered into a long-term agreement with The Walt Disney Company for access to Adeia’s comprehensive media intellectual property (IP) portfolio.

- This agreement resolves all outstanding litigation between the companies and includes a long-term license covering all Disney's products and services that were the subject of the litigation.

- Adeia's CEO, Paul E. Davis, stated that the deal reflects their commitment to enabling cutting-edge media experiences and validates the significance of their technology in connected entertainment.

- Adeia reported Q3 2025 revenue of $87.3 million, which was in line with expectations.

- The company adjusted its 2025 full-year revenue guidance to $360-$380 million primarily because it has filed patent infringement litigation against AMD, making a license agreement unlikely to close in 2025.

- Non-Pay TV recurring revenue was up 31% year over year for Q3 2025 and has increased 81% since separation.

- Adeia made debt payments of $11.1 million in Q3 2025, contributing to a total of $312 million paid down since separation.

- The company's patent portfolio has grown by over 35% since separation to over 13,000 patent assets.

- ADEA reported Q3 2025 revenue of $87.3 million and made $11.1 million in principal payments towards debt.

- The company secured long-term deals with Altice and a new e-commerce customer, and received a positive ruling in the Videotron case.

- Since its separation, ADEA has signed 20 new and renewal license agreements, expanded its patent portfolios by over 35%, and improved its balance sheet through a balanced capital allocation approach.

- For FY 2025, ADEA projects GAAP revenue between $360.0 million and $380.0 million, and Non-GAAP Adjusted EBITDA between $202.3 million and $218.3 million.

Fintool News

In-depth analysis and coverage of Adeia.

Quarterly earnings call transcripts for Adeia.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more