Earnings summaries and quarterly performance for Atlas Energy Solutions.

Executive leadership at Atlas Energy Solutions.

Board of directors at Atlas Energy Solutions.

Research analysts who have asked questions during Atlas Energy Solutions earnings calls.

Derek Podhaizer

Piper Sandler Companies

4 questions for AESI

Eddie Kim

Barclays

3 questions for AESI

Jim Rollyson

Raymond James Financial

3 questions for AESI

Michael Scialla

Stephens Inc.

3 questions for AESI

Ati Modak

Goldman Sachs

2 questions for AESI

David Smith

Truist Securities

2 questions for AESI

Douglas Becker

Capital One

2 questions for AESI

James Rollyson

Raymond James Financial, Inc.

2 questions for AESI

Jeff LeCorgne

TPH&Co.

2 questions for AESI

John Daniel

Daniel Energy Partners

2 questions for AESI

Keith MacKey

RBC Capital Markets

2 questions for AESI

Kurt Hallead

The Benchmark Company

2 questions for AESI

Sean Mitchell

Daniel Energy Partners

2 questions for AESI

Stephen Gengaro

Stifel

2 questions for AESI

Donald Crist

Johnson Rice & Company, L.L.C.

1 question for AESI

Don Crist

Johnson Rice & Company L.L.C.

1 question for AESI

Edward Kim

TD Cowen

1 question for AESI

Jeff LeBlanc

TPH&Co.

1 question for AESI

Joshua Jayne

Daniel Energy Partners

1 question for AESI

Neil Mehta

Goldman Sachs

1 question for AESI

Saurabh Pant

Bank of America

1 question for AESI

Stephen Gengaro

Stifel Financial Corp.

1 question for AESI

Recent press releases and 8-K filings for AESI.

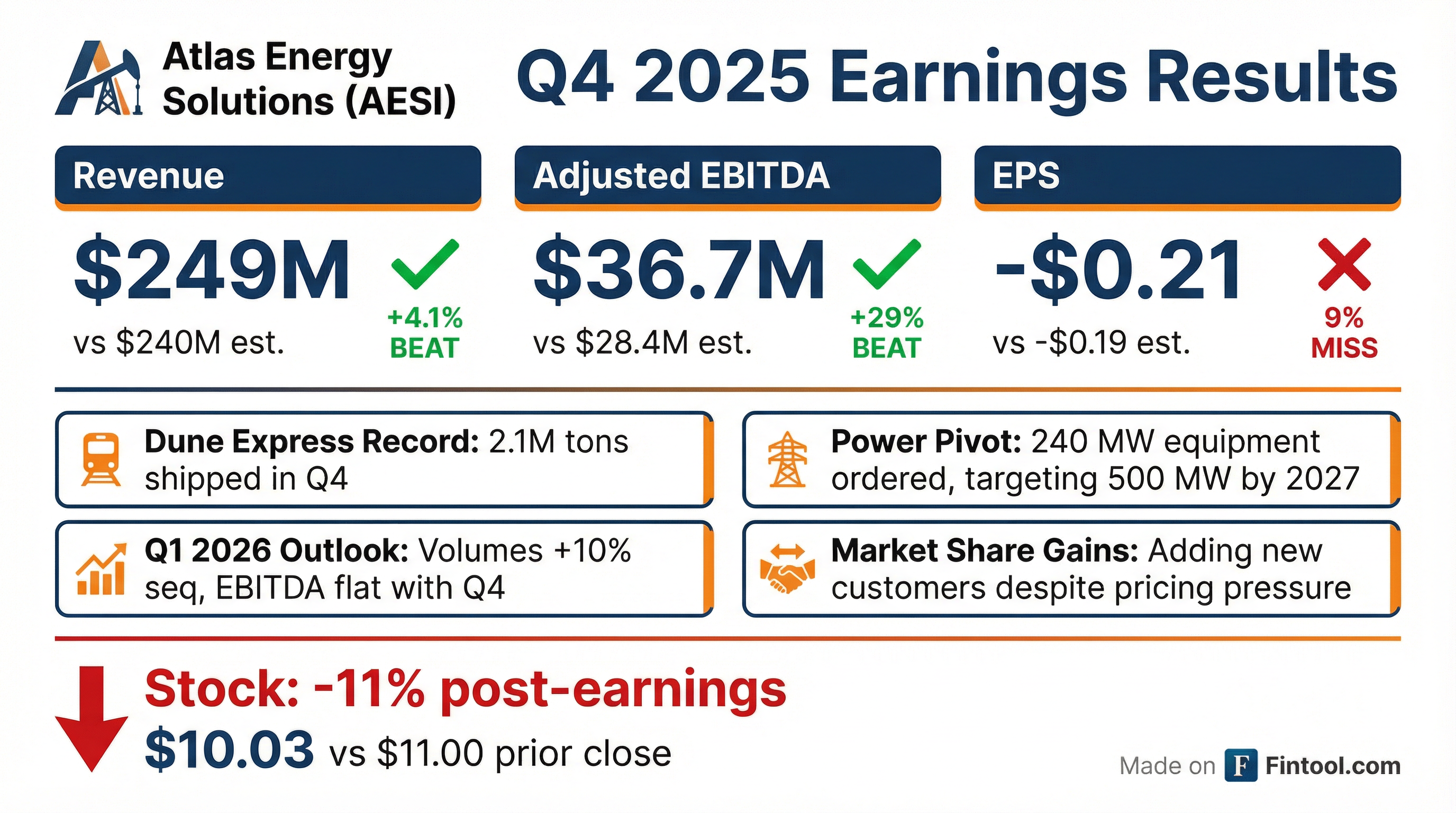

- Atlas Energy Solutions reported Q4 2025 revenue of $249 million and Adjusted EBITDA of $36.7 million, with full-year 2025 revenue reaching $1.1 billion and Adjusted EBITDA of $221.7 million.

- The company is aggressively expanding its power solutions business, having ordered 240 megawatts of power generation equipment for delivery starting in H2 2026 and targeting over 500 megawatts deployed by 2027. They are transitioning to a Power-as-a-Service model with long-term contracts.

- For Q1 2026, sales volume in the sand and logistics business is projected to increase by approximately 10% sequentially, with an average sales price of about $18 per ton, though a winter storm is expected to reduce Q1 EBITDA by approximately $6 million.

- Atlas successfully executed its $20 million annualized cost savings target and anticipates significant improvements in plant operating expenses with the commissioning of two new Twinkle dredges in Q2 2026.

- Atlas Energy Solutions reported Q4 2025 revenue of $249 million and Adjusted EBITDA of $36.7 million, representing a 15% margin. For the full year 2025, revenue reached $1.1 billion and Adjusted EBITDA was $221.7 million, achieving a 20% margin.

- The company is significantly expanding its power business, having ordered 240MW of power generation equipment in November 2025, with deliveries starting in the second half of 2026 and energization targeted for Q1 2027. Atlas aims to deploy more than 500MW across its fleet by 2027.

- For Q1 2026, sales volumes are expected to increase approximately 10% sequentially, with the average sand sales price projected at approximately $18 per ton. Q1 EBITDA is anticipated to be approximately flat with Q4 levels, partly due to a $6 million negative impact from a winter storm.

- The Dune Express achieved record shipments of approximately 2.1 million tons in Q4 2025 and is expected to deliver over 10 million tons in 2026. Atlas also successfully executed its target of $20 million in annualized cost savings.

- Atlas (AESI) reported Q4 2025 revenue of $249 million and Adjusted EBITDA of $36.7 million, with full-year 2025 figures at $1.1 billion revenue and $221.7 million Adjusted EBITDA.

- The company is aggressively expanding its power solutions segment, having ordered 240 megawatts of generation equipment and targeting 500 megawatts deployed by 2027 for behind-the-meter projects, which are expected to yield unlevered IRRs in the high teens.

- In its sand and logistics business, Q4 2025 volumes were 5.3 million tons, with the Dune Express achieving record shipments of 2.1 million tons.

- For Q1 2026, sand and logistics sales volume is expected to increase by approximately 10% sequentially, though a winter storm is projected to reduce Q1 EBITDA by $6 million.

- Total cash capital spending for 2026 is estimated at $55 million, with an additional $190 million in progress payments for power assets to be financed through a lease facility.

- Atlas Energy Solutions Inc. reported $1.1 billion in revenue, a net loss of ($50.3) million, and $221.7 million in Adjusted EBITDA for the year ended December 31, 2025.

- For the fourth quarter of 2025, the company recorded $249.4 million in revenue, a net loss of ($22.2) million, and $36.7 million in Adjusted EBITDA.

- Total volumes for the year ended December 31, 2025, were 21.6 million tons, with 5.9 million tons shipped via Dune Express.

- The company is actively evaluating over 2 GW of potential power opportunities and targets approximately 500 MWs of power generation capacity to be deployed in 2027.

- For the first quarter of 2026, Atlas Energy Solutions expects EBITDA to be flat with fourth-quarter results, primarily due to lower realized sand pricing and a $6 million negative impact from severe winter weather in January.

- Atlas Energy Solutions (AESI) reported Q3 2025 revenues of $259.6 million and adjusted EBITDA of $40.2 million, resulting in a net loss of $23.7 million or $0.19 per share.

- The company has temporarily suspended its dividend to protect its balance sheet and fund "game-changing" opportunities in its power business, which require significant capital.

- AESI is aggressively expanding its power generation platform, targeting over 400 megawatts deployed by early 2027, and has placed an order for more than 240 megawatts of new assets, with an opportunity pipeline approaching 2 gigawatts.

- For its core sand and logistics business, the company initiated a $20 million annual cost savings program and expects Q4 2025 volumes to decline sequentially to approximately 4.8 million tons.

- Total accrued CapEx for Q3 2025 was $30.5 million, with the full-year 2025 budget remaining at $115 million; 2026 CapEx is expected to be lower than 2025 levels.

- Atlas Energy Solutions Inc. reported total revenue of $259.6 million and Adjusted EBITDA of $40.2 million for the third quarter ended September 30, 2025.

- The company announced the suspension of its quarterly common stock dividend to safeguard its balance sheet and capitalize on transformative growth opportunities, especially in its power platform.

- An organizational efficiency initiative was instituted, targeting $20 million in annualized cost savings.

- Despite an exceptionally weak West Texas completions market and softer customer demand, the company is targeting over 400 megawatts (MW) of power generation capacity deployed by early 2027.

Quarterly earnings call transcripts for Atlas Energy Solutions.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more