Earnings summaries and quarterly performance for Apple Hospitality REIT.

Executive leadership at Apple Hospitality REIT.

Justin G. Knight

Chief Executive Officer

Elizabeth S. Perkins

Senior Vice President and Chief Financial Officer

Glade M. Knight

Executive Chairman

Jeanette A. Clarke

Senior Vice President and Chief Capital Investments Officer

Karen C. Gallagher

Senior Vice President and Chief Operating Officer

Matthew P. Rash

Senior Vice President, Chief Legal Officer and Secretary

Nelson G. Knight

President, Real Estate and Investments

Rachel S. Labrecque

Senior Vice President and Chief Accounting Officer

Board of directors at Apple Hospitality REIT.

Research analysts who have asked questions during Apple Hospitality REIT earnings calls.

Austin Wurschmidt

KeyBanc Capital Markets Inc.

7 questions for APLE

Chris Darling

Green Street

7 questions for APLE

Michael Bellisario

Robert W. Baird & Co.

7 questions for APLE

Jay Kornreich

Wedbush Securities

6 questions for APLE

Aryeh Klein

BMO Capital Markets

4 questions for APLE

Kenneth Billingsley

Compass Point Research & Trading LLC

4 questions for APLE

Ari Klein

BMO Capital Markets

3 questions for APLE

Cooper Clark

Wells Fargo

3 questions for APLE

Jack Armstrong

Wells Fargo

3 questions for APLE

Dori Kesten

Wells Fargo & Company

2 questions for APLE

Ken Billingsley

Compass Point

2 questions for APLE

Rich Hightower

Barclays

2 questions for APLE

Daniel Hogan

Baird

1 question for APLE

Floris Gerbrand van Dijkum

Compass Point Research & Trading, LLC

1 question for APLE

Floris van Dijkum

Compass Point Research & Trading

1 question for APLE

Joshua Friedland

KeyBanc Capital Markets

1 question for APLE

Michael Herring

Green Street Advisors, LLC

1 question for APLE

Tyler Batory

Oppenheimer & Co. Inc.

1 question for APLE

Recent press releases and 8-K filings for APLE.

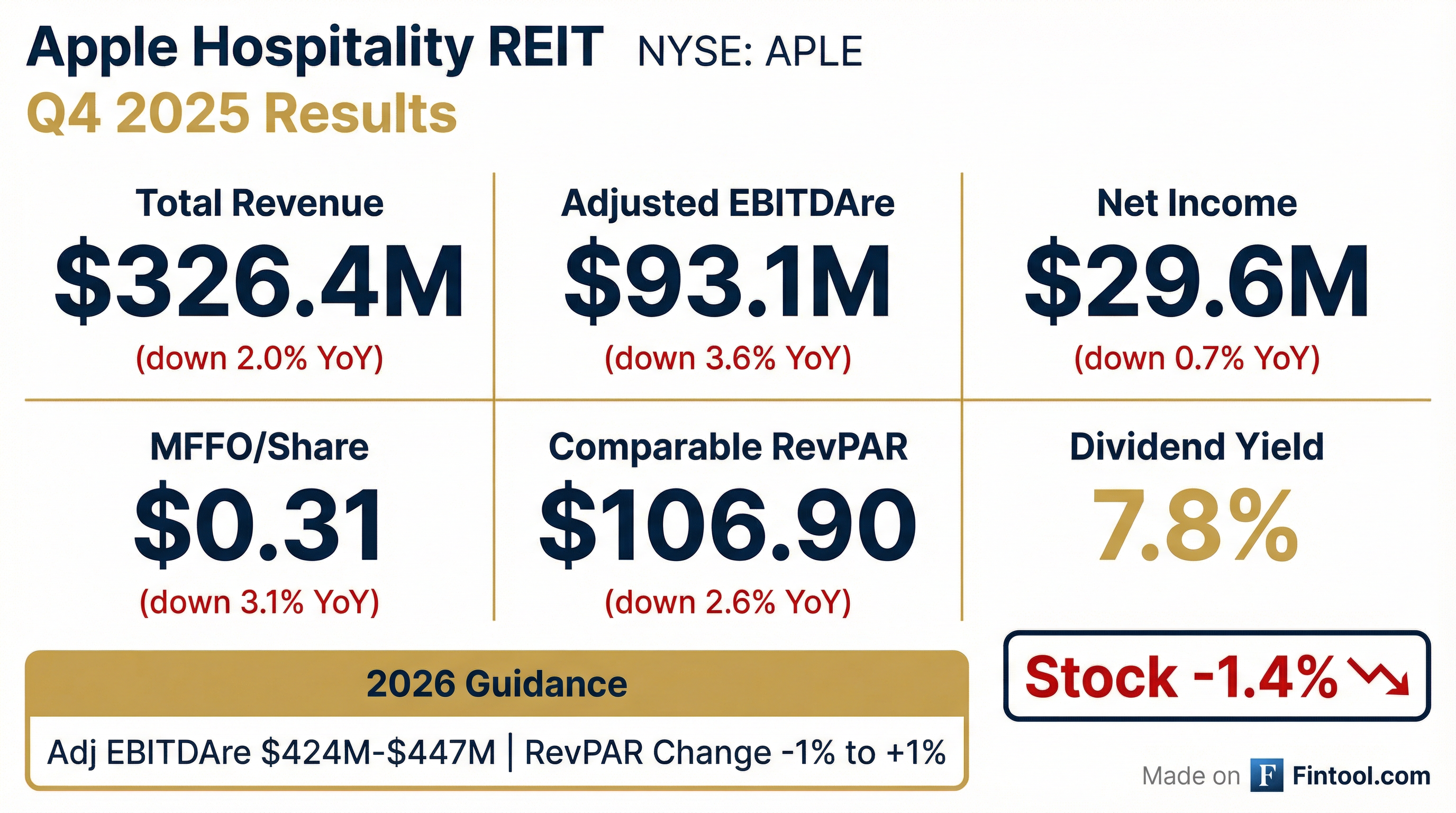

- For the full year 2025, Apple Hospitality REIT, Inc. reported $1.4 Billion in Revenue and $1.52 MFFO per share. In Q4 2025, Comparable Hotels RevPAR was $106.90, with Occupancy at 70.4% and ADR at $151.89.

- The company paid $240.4 Million in distributions in 2025 and repurchased approximately 4.6 million common shares for $58.3 million during the year ended December 31, 2025. The annualized distribution is $0.96 per common share, representing an 8.2% annual yield as of January 31, 2026.

- As of December 31, 2025, the company maintained a strong balance sheet with $595 million in available liquidity and 35% Net Total Debt to Total Capitalization. 64% of outstanding debt was fixed or hedged, and 207 hotels were unencumbered.

- In 2025, Apple Hospitality REIT, Inc. acquired two hotels and sold seven hotels, with three additional hotels under contract for purchase. Preliminary results for January 2026 indicate a 1.5% decline in Comparable Hotels RevPAR compared to January 2025.

- Apple Hospitality REIT reported full year 2025 comparable hotels RevPAR of $118, a 1.6% decrease from the prior year, with EBITDA of $474 million and an EBITDA margin of 34.3%. MFFO for the year was approximately $1.52 per share, and total distributions paid were approximately $1.01 per share.

- For 2026, the company forecasts net income between $133 million and $160 million, comparable hotels RevPAR change between -1% and +1%, and Adjusted EBITDAre between $424 million and $447 million.

- Strategic initiatives include plans to reinvest between $80 million and $90 million in capital expenditures in 2026 and the completion of the transition of 13 Marriott-managed hotels to franchise in January 2026 to drive operational synergies.

- Apple Hospitality REIT reported FY 2025 comparable hotels RevPAR of $118, down 1.6% year-over-year, and Adjusted EBITDAre of approximately $444 million, down 5.1% compared to 2024.

- For 2026, the company forecasts net income between $133 million and $160 million and comparable hotels RevPAR change between -1% and +1%.

- In January 2026, the company completed the transition of 13 Marriott-managed hotels to franchise, aiming for incremental operational synergies, increased flexibility, and marketability for potential dispositions.

- The company noted continued strength in leisure travel in 2025 but faced impacts from policy uncertainty and a pullback in government travel. January 2026 comparable hotels RevPAR declined 1.5% due to challenging comparisons and winter storms, though management is optimistic about 2026 with potential benefits from the FIFA World Cup 2026.

- Apple Hospitality REIT reported Adjusted EBITDAre of $93 million for Q4 2025 and $444 million for the full year, with FFO per share of $0.31 for Q4 and $1.52 for the full year.

- For 2026, the company projects net income between $133 million and $160 million, comparable hotels' RevPAR change between -1% and +1%, and Adjusted EBITDAre between $424 million and $447 million.

- In 2025, the company sold seven hotels for approximately $73 million and repurchased 4.6 million common shares for approximately $58 million.

- The company paid total distributions of $0.24 per common share in Q4 2025, and $1.01 per share for the full year 2025.

- For the full year 2025, Apple Hospitality REIT, Inc. reported net income of $175,364 thousand, an 18.1% decrease from 2024, and Modified Funds From Operations (MFFO) of $361,133 thousand, down 7.0%.

- The company's Comparable Hotels RevPAR for full year 2025 was $117.95, a 1.6% decline from 2024, with Comparable Hotels Adjusted Hotel EBITDA at $474,234 thousand, down 6.4%.

- As of December 31, 2025, the company's total debt to total capitalization, net of cash and cash equivalents, was 35.5% , and it paid $1.01 per common share in distributions for the full year 2025.

- During 2025, the company acquired two hotels for $117.0 million and sold seven hotels for $73.3 million.

- For 2026, the company anticipates net income between $133 million and $160 million and a Comparable Hotels RevPAR Change between (1.00%) and 1.00%.

- Apple Hospitality REIT reported net income of $175,364 thousand and net income per share of $0.74 for the full year ended December 31, 2025, representing decreases of 18.1% and 16.9% respectively from 2024.

- For the full year 2025, Comparable Hotels RevPAR was $117.95, a 1.6% decline compared to 2024.

- During 2025, the company acquired two hotels for approximately $117.0 million and sold seven hotels for approximately $73.3 million, while investing $88 million in capital improvements and distributing $240,425 thousand to shareholders.

- For 2026, the company anticipates net income between $133 Million and $160 Million and Comparable Hotels RevPAR Change between (1.00%) and 1.00%.

- Apple Hospitality REIT's Board of Directors declared a regular monthly cash distribution of $0.08 per common share.

- The distribution is payable on March 16, 2026, to shareholders of record as of February 27, 2026.

- Based on the common stock closing price of $12.27 on February 13, 2026, the annualized distribution of $0.96 per common share represents an annual yield of approximately 7.8%.

- Apple Hospitality REIT, Inc. (APLE) announced on December 22, 2025, the acquisition of the 260-room Motto by Hilton Nashville Downtown for approximately $98.2 million, or $378,000 per key.

- This acquisition expands the company's portfolio to 217 hotels with 29,580 guest rooms across 37 states and the District of Columbia.

- The newly acquired hotel is in the Nashville CBD/Downtown submarket, which had a RevPAR of approximately $211 for the trailing twelve months ended October 31, 2025, 110% above industry RevPAR and 79% above the Company's RevPAR for the same period.

- Apple Hospitality REIT acquired the 260-room Motto by Hilton Nashville Downtown for approximately $98.2 million, or $378,000 per key.

- This acquisition expands the company's portfolio to 217 hotels with 29,580 guest rooms and increases its exposure to the Nashville market.

- The Nashville CBD/Downtown submarket's revenue per available room (RevPAR) was approximately $211 for the trailing twelve months ended October 31, 2025, which was approximately 110% above industry RevPAR and 79% above the Company's RevPAR for the same period.

- Apple Hospitality REIT, Inc. reported Q3 2025 Comparable Hotels RevPAR of $124.01, Occupancy of 76.2%, and ADR of $162.68, representing year-over-year decreases of 1.8%, 1.2%, and 0.6% respectively.

- Modified Funds From Operations (MFFO) per share for Q3 2025 was $0.42, a 6.7% decrease from Q3 2024.

- The company repurchased approximately 3.8 million common shares for an aggregate of approximately $48.3 million year-to-date through October 2025, at a weighted-average market purchase price of approximately $12.73 per common share.

- As of September 30, 2025, the company had $698 million in available liquidity and a Net Debt to TTM EBITDA ratio of 3.3x.

Quarterly earnings call transcripts for Apple Hospitality REIT.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more