Earnings summaries and quarterly performance for Backblaze.

Executive leadership at Backblaze.

Board of directors at Backblaze.

Research analysts who have asked questions during Backblaze earnings calls.

Jeff Van Rhee

Craig-Hallum Capital Group LLC

6 questions for BLZE

Ittai Kidron

Oppenheimer & Company

5 questions for BLZE

Jason Ader

William Blair & Company

5 questions for BLZE

Eric Martinuzzi

Lake Street Capital Markets

4 questions for BLZE

Ethan Widell

B. Riley Securities

3 questions for BLZE

Rustam Kanga

Citizens Capital Markets and Advisory

3 questions for BLZE

Maxwell Michaelis

Lake Street Capital Markets

2 questions for BLZE

Mike Cikos

Needham & Company, LLC

2 questions for BLZE

Simon Leopold

Raymond James

2 questions for BLZE

Zach Cummins

B. Riley Securities

2 questions for BLZE

Jeffrey Hopson

Needham & Company

1 question for BLZE

Michael Cikos

Needham & Company

1 question for BLZE

Nathan Whitehill

B. Riley Securities

1 question for BLZE

Victor Chiu

Raymond James

1 question for BLZE

Recent press releases and 8-K filings for BLZE.

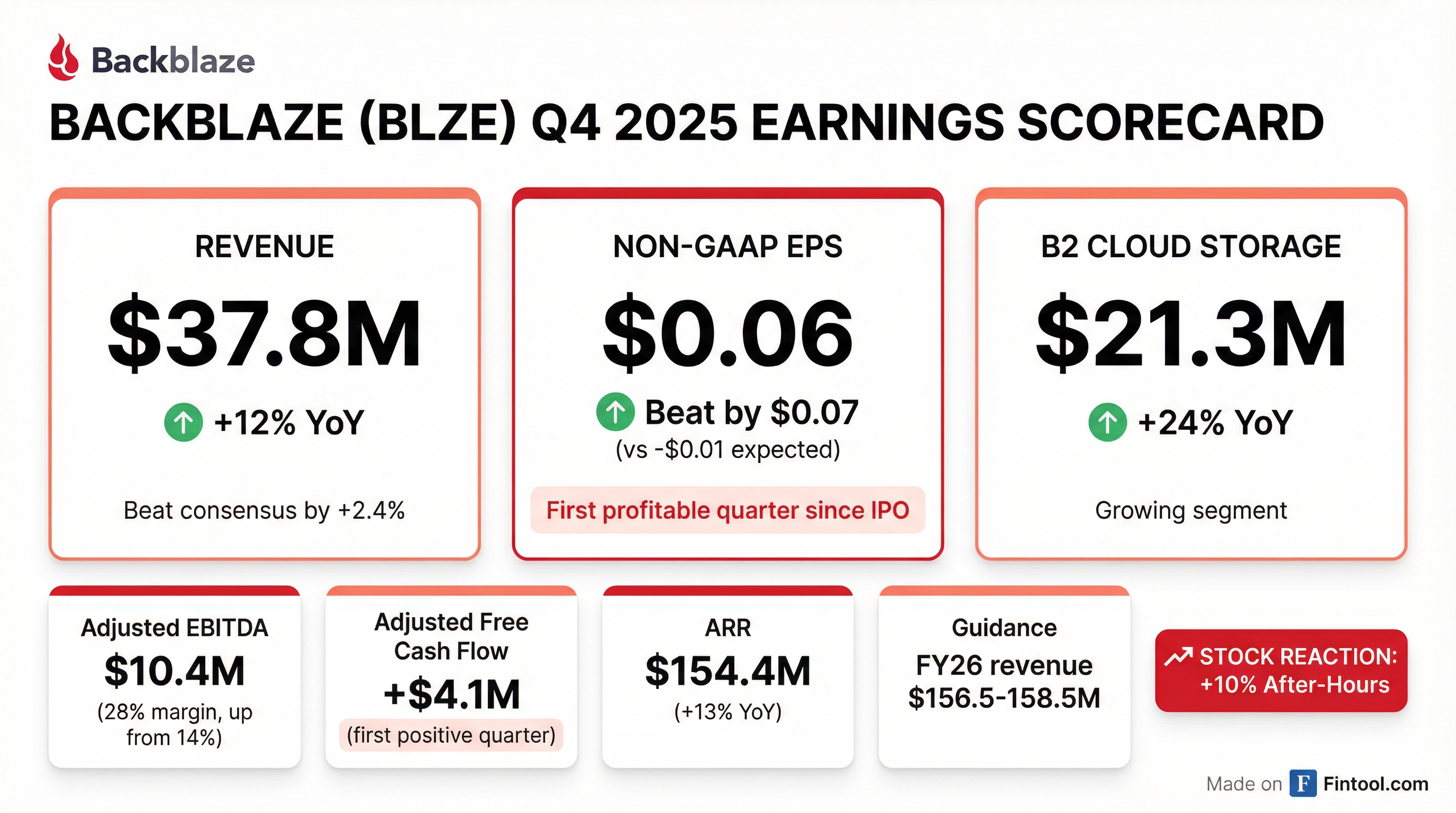

- Backblaze reported Q4 2025 total revenue of $37.8 million, with B2 Cloud Storage revenue growing 24% year-over-year to $21.3 million.

- The company achieved significant profitability milestones in Q4 2025, with an Adjusted EBITDA Margin of 28% and a positive Adjusted Free Cash Flow Margin of 11%.

- Backblaze provided Q1 2026 revenue guidance of $37.6 million to $38.0 million and full-year 2026 revenue guidance of $156.5 million to $158.5 million.

- Operational highlights include record direct sales bookings in Q4, a 60% year-over-year increase in RPO to $66 million, and growth to 168 customers generating over $50,000 in ARR by Q4 2025.

- The company is strategically focused on the AI opportunity, securing multiple neocloud customers, including an 8-figure, $15M+ TCV Neocloud Win, and introducing a new B2 Neo Solution.

- Backblaze reported Q4 2025 revenue of $37.8 million and achieved positive Adjusted Free Cash Flow of $4 million, marking its first profitability as a public company.

- For the full year 2025, total company revenue grew 14% year-over-year, with B2 Cloud Storage growing 26%.

- The company provided full-year 2026 revenue guidance of $156.5 million-$158.5 million and anticipates Adjusted Free Cash Flows to be roughly neutral for the year.

- Backblaze launched B2 Neo, a white label storage offering for NeoClouds, and secured its largest contract to date, an 8-figure deal with over $50 million in Total Contract Value with a publicly traded NeoCloud company.

- The Computer Backup business is projected to decline 5% year-over-year in 2026.

- Backblaze reported Q4 2025 revenue of $37.8 million and achieved adjusted free cash flow profitability for the first time as a public company, with +$4 million in adjusted free cash flow and a 28% adjusted EBITDA margin.

- For the full year 2025, total company revenue grew 14% year-over-year, with B2 Cloud Storage growing 26%.

- The company secured its largest contract in history, valued at over $50 million in total contract value (TCV) for its B2 Neo offering, contributing to a 60% year-over-year increase in RPO to $66 million.

- Backblaze provided Q1 2026 revenue guidance of $37.6 million to $38 million and full-year 2026 revenue guidance of $156.5 million to $158.5 million, with B2 revenue growth expected to be approximately 20% for the full year.

- Strategic initiatives include leveraging the AI opportunity with the new B2 Neo white-label offering and growing its base of larger customers, with 168 customers generating over $50,000 in ARR, up 35% year-on-year.

- Backblaze reported Q4 2025 revenue of $37.8 million and achieved Adjusted Free Cash Flow profitability for the first time as a public company, with $4 million in Adjusted Free Cash Flow. For the full year 2025, total company revenue grew 14% year-over-year, with B2 Cloud Storage growing 26%.

- The company provided Q1 2026 revenue guidance of $37.6 million-$38 million and full year 2026 revenue guidance of $156.5 million-$158.5 million, with full year Adjusted Free Cash Flow expected to be roughly neutral.

- Backblaze closed its largest contract in company history with over $50 million in Total Contract Value, which is expected to contribute over 300 basis points to B2 revenue growth in 2027.

- The company launched B2 Neo, a high-performance white label storage offering specifically designed for NeoClouds, and ended the year with 168 customers generating over $50,000 in ARR each, representing a 35% year-on-year increase in this cohort.

- Backblaze reported Q4 2025 revenue of $37.8 million, an increase of 12% year-over-year (YoY), with B2 Cloud Storage revenue growing 24% YoY to $21.3 million. Full-year 2025 revenue reached $145.8 million, up 14% YoY.

- The company achieved adjusted free cash flow positivity in Q4 2025 for the first time since going public, reaching $4.1 million, and Adjusted EBITDA for the quarter was $10.4 million, or 28% of revenue.

- Backblaze closed its first eight-figure TCV neocloud agreement and launched B2 Neo, a neocloud-specific storage offering.

- For Q1 2026, the company expects revenue between $37.6 million to $38.0 million and an Adjusted EBITDA margin between 18% to 20%.

- Backblaze reported Q4 2025 revenue of $37.8 million, an increase of 12% year-over-year, with B2 Cloud Storage revenue growing 24% to $21.3 million. For the full year 2025, revenue reached $145.8 million, up 14% year-over-year.

- The company achieved adjusted EBITDA of $10.4 million (28% of revenue) in Q4 2025 and $31.8 million (22% of revenue) for the full year 2025, showing significant year-over-year improvements.

- Backblaze achieved adjusted free cash flow positivity for the first time since going public in Q4 2025, with $4.1 million compared to $(4.5) million in Q4 2024.

- Annual Recurring Revenue (ARR) grew 13% year-over-year to $154.4 million in Q4 2025, with B2 Cloud Storage ARR increasing 27% to $88.9 million. The company also closed its first eight-figure TCV neocloud agreement and launched B2 Neo.

- For Q1 2026, revenue is expected to be between $37.6 million and $38.0 million, with an adjusted EBITDA margin between 18% and 20%. Full-year 2026 revenue is projected to be $156.5 million to $158.5 million, with an adjusted EBITDA margin between 19% and 21%.

- BLZE reported Q3 2025 revenue of $31.8 million, marking a 27% year-over-year growth.

- Adjusted EBITDA for Q3 2025 reached $7.3 million, with a 23% margin.

- The company generated $7.3 million in Free Cash Flow during Q3 2025.

- BLZE provided updated guidance for Q4 2025, projecting revenue between $37.3 million and $37.9 million and an Adjusted EBITDA Margin of 20% to 22%. The Full Year 2025 revenue guidance is $145.4 million to $146.0 million, with an Adjusted EBITDA Margin of 18% to 20%.

- Backblaze provided Q3 2025 revenue guidance of $36.7 to $37.1 million and an Adjusted EBITDA Margin of 17% to 19%.

- The company raised its full-year 2025 revenue guidance to $145 to $147 million (from a previous range of $144 to $146 million) and expects an Adjusted EBITDA Margin of 17% to 19%.

- B2 Cloud Storage revenue growth accelerated to 29% year-over-year in Q2 2025, with a target of 30%+ B2 growth in Q4 2025.

- Growth is significantly fueled by AI, with 3 of the top 10 customers being AI companies and 40x year-over-year growth in data stored by AI customers in Q2 2025.

- BLZE secured a new $20 million line of credit and approved a cash-neutral stock buyback program of up to $10 million.

- Backblaze reported Q3 2025 revenue and adjusted EBITDA margin above the high end of guidance, with overall company revenue growing 14% year over year and B2 Cloud Storage growing 28%. For Q4 2025, revenue is projected between $37.3 million and $37.9 million, with B2 growth expected to be 25% to 28%, and the company remains on track to be adjusted free cash flow positive.

- The company repurchased $1.2 million of shares in Q3 as part of a modest share repurchase program to manage equity dilution.

- Backblaze is implementing a "phase two" go-to-market transformation to drive stronger growth, increase execution velocity, and improve predictability, funded by a restructuring that is considered a reinvestment.

- The number of customers with $50,000+ Annual Recurring Revenue (ARR) increased by 41% year-over-year in Q3.

- Backblaze reported Q3 2025 revenue of $37.2 million, an increase of 14% year-over-year, with B2 Cloud Storage revenue growing 28% year-over-year to $20.7 million.

- The company achieved a net loss of $3.8 million and non-GAAP net income of $1.9 million for Q3 2025, a significant improvement from a net loss of $12.8 million and non-GAAP net loss of $4.1 million in Q3 2024. Adjusted EBITDA reached $8.4 million, or 23% of revenue, up from $3.7 million or 12% in Q3 2024.

- Backblaze's Annual Recurring Revenue (ARR) increased 13% year-over-year to $147.2 million, with B2 Cloud Storage ARR growing 26% year-over-year to $81.8 million.

- For the full year 2025, the company raised its Adjusted EBITDA margin guidance to 18%-20% (from 17%-19%) and narrowed its revenue outlook to $145.4 million to $146.0 million. The CEO also stated the company is on track to be free-cash-flow positive in Q4.

Quarterly earnings call transcripts for Backblaze.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more