Earnings summaries and quarterly performance for BrightView Holdings.

Executive leadership at BrightView Holdings.

Board of directors at BrightView Holdings.

Research analysts who have asked questions during BrightView Holdings earnings calls.

Bob Labick

CJS Securities

7 questions for BV

Greg Palm

Craig-Hallum Capital Group LLC

7 questions for BV

Jeffrey Stevenson

Loop Capital Markets LLC

6 questions for BV

Stephanie Moore

Jefferies

4 questions for BV

Andrew J. Wittmann

Robert W. Baird & Co.

3 questions for BV

Harold Antor

Jefferies Financial Group Inc.

3 questions for BV

Keen Fai Tong

Goldman Sachs Group Inc.

3 questions for BV

Timothy Mulrooney

William Blair & Company

3 questions for BV

Gregory Parrish

Morgan Stanley

2 questions for BV

Tim Mulrooney

William Blair

2 questions for BV

Toni Kaplan

Morgan Stanley

2 questions for BV

Alexander EM Hess

JPMorgan Chase & Co.

1 question for BV

Andy Whitman

Baird

1 question for BV

Andy Wittman

Robert W. Baird & Co.

1 question for BV

Benjamin Luke McFadden

William Blair & Company L.L.C.

1 question for BV

Carl Reichardt

BTIG, LLC

1 question for BV

George Tong

Goldman Sachs

1 question for BV

Luke McFadden

William Blair & Company

1 question for BV

Yehuda Silverman

Morgan Stanley

1 question for BV

Zack Pacheco

Loop Capital Markets

1 question for BV

Recent press releases and 8-K filings for BV.

- BrightView Landscapes has announced a significant expansion of its partnership with The Villages®, Florida’s premier residential and recreation community.

- The company has increased its managed golf portfolio at The Villages from approximately 20% to more than 50% of the Community Development District’s 400 golf holes.

- This expansion means BrightView now oversees upwards of 20 nine-hole golf courses across The Villages.

- BrightView also added highly regarded agronomist Reagan Hejl, Ph.D., to its golf leadership team to enhance support for The Villages.

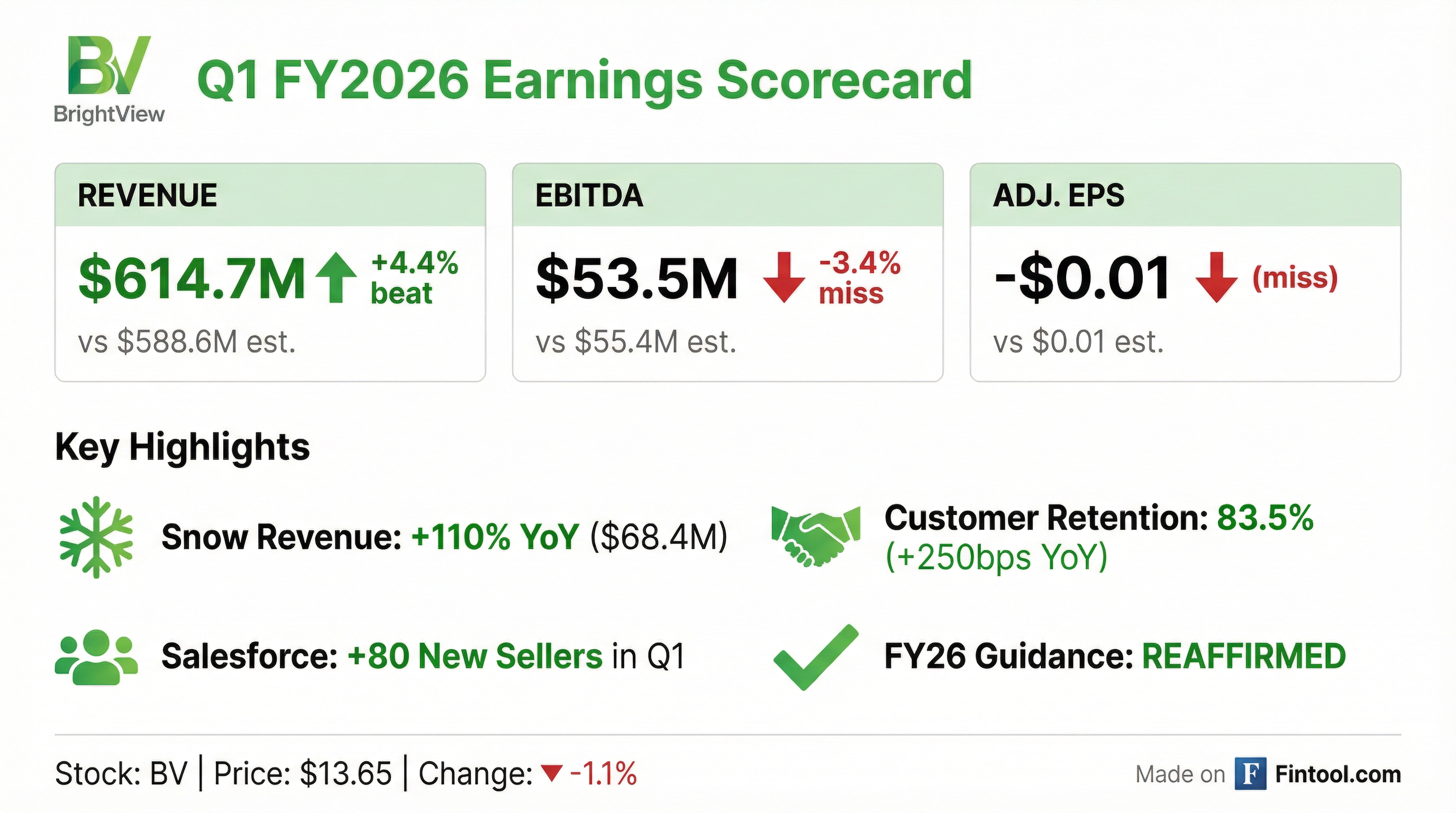

- BrightView reported Q1 2026 total revenue of $615 million, a 3% increase, primarily driven by heightened snowfall and continued improvement in underlying land metrics, and achieved another quarter of Adjusted EBITDA growth.

- Strategic investments included adding 80 incremental sellers in Q1 2026, contributing to an approximate 20% increase in the sales force since early 2025, alongside a fleet refresh. These initiatives have led to an approximate 30% improvement in employee turnover over two years and a 450 basis point improvement in customer retention as of Q1 2026.

- The company's land contract book of business grew by approximately 2%, marking three consecutive quarters of positive net new sales due to improved customer retention and new sales efforts.

- BrightView reiterated its 2026 guidance for revenue, EBITDA, and free cash flow, projecting a return to land revenue growth and a third consecutive year of record adjusted EBITDA.

- Capital allocation included increasing the share repurchase authorization to $150 million and executing $14 million in share repurchases in Q1 2026, reflecting management's view of the stock's undervaluation.

- BV reported revenue growth and improved Adjusted EBITDA for Q1 FY26 compared to the prior year, driven by strong performance in Snow services.

- The company reaffirmed its full-year FY26 guidance for both Total Revenue and Adjusted EBITDA, anticipating a third consecutive record EBITDA year.

- Operational improvements include enhanced customer retention of ~83.5% and significant salesforce investments with +80 new sellers in Q1 FY26, positioning the company for future growth in Land services.

- BV maintains a fortified balance sheet with no long-term maturities until 2029, and its Total Net Financial Debt to Adjusted EBITDA ratio remained stable at 2.4x as of December 31, 2025.

| Metric | Dec 31, 2024 | Q1 2025 | Sep 30, 2025 | Dec 31, 2025 | Q1 2026 |

|---|---|---|---|---|---|

| Total Revenue ($MMs) | N/A | $599.2 | N/A | N/A | $614.7 |

| Total Adjusted EBITDA ($MMs) | N/A | $52.1 | N/A | N/A | $53.5 |

| Total Net Financial Debt ($MMs) | $766.1 | N/A | $802.9 | $844.2 | N/A |

| Total Net Financial Debt to Adjusted EBITDA ratio (x) | 2.3 | N/A | 2.3 | 2.4 | N/A |

- BrightView (BV) reported Q1 2026 total revenue of $615 million, a 3% increase year-over-year, driven by heightened snowfall and improved underlying land metrics, and delivered Adjusted EBITDA growth.

- The company reiterated its 2026 guidance for revenue, EBITDA, and free cash flow, expecting a return to land growth and a third consecutive year of record adjusted EBITDA.

- Strategic investments included adding 80 incremental sellers in Q1 2026, contributing to a 20% increase in revenue-generating resources over last year, and increasing the share repurchase authorization to $150 million, leading to $14 million in share repurchases in Q1.

- Operational improvements continued with customer retention improving by approximately 450 basis points to 83.5% as of Q1 2026, and employee turnover declining by approximately 30% over two years.

- BrightView (BV) reported a 3% growth in total revenue and improved EBITDA in Q1 2026, while reaffirming its 2026 guidance for a third consecutive year of record adjusted EBITDA and a return to land growth.

- The company continued its strategic investments, adding 80 incremental sellers in Q1 2026, contributing to a 20% increase in its sales force since early 2025.

- Operational improvements led to customer retention increasing by approximately 450 basis points to 83.5% as of Q1 2026, and employee turnover improving by approximately 30% over two years.

- BV increased its share repurchase authorization to $150 million and executed $14 million in share repurchases in Q1 2026, doubling the quarterly average from 2025, due to the perceived undervaluation of its stock.

- BrightView Holdings, Inc. reported net service revenues increased 2.6% year-over-year to $614.7 million for the first quarter ended December 31, 2025.

- Adjusted EBITDA increased $1.4 million year-over-year to $53.5 million, achieving an Adjusted EBITDA margin of 8.7%.

- The company's net loss expanded to $15.2 million for the quarter.

- BrightView reaffirmed its fiscal year 2026 guidance, projecting total revenue between $2.670 billion and $2.730 billion and Adjusted EBITDA between $363 million and $377 million.

- During the quarter, the company repurchased 1.1 million shares of common stock.

- BrightView Holdings reported net service revenues of $614.7 million for the first quarter of fiscal 2026, a 2.6% increase year-over-year, with Adjusted EBITDA rising 2.7% to $53.5 million.

- The company's net loss expanded to $15.2 million in Q1 Fiscal 2026, compared to a net loss of $10.4 million in the prior year period.

- BrightView reaffirmed its fiscal year 2026 guidance, projecting total revenue between $2.670 billion and $2.730 billion and Adjusted EBITDA between $363 million and $377 million.

- Net cash provided by operating activities decreased 40.3% to $36.1 million, and Adjusted Free Cash Flow became an outflow of $(15.4) million for the first quarter of fiscal 2026.

- The company repurchased 1.1 million shares of common stock during the quarter.

- BrightView reported record Adjusted EBITDA of $352 million and a 13.2% margin for fiscal year 2025, representing an 8% increase in EBITDA and 150 basis point margin expansion year-over-year.

- The company increased its share repurchase authorization from $100 million to $150 million, indicating a belief that its current valuation is dislocated from its progress and future opportunities.

- For fiscal year 2026, BrightView expects revenue in the range of $2.67 billion to $2.73 billion, Adjusted EBITDA between $363 million and $377 million, and Adjusted free cash flow between $100 million and $115 million.

- Strategic investments in fiscal 2025 included hiring approximately 100 new sellers and investing over $300 million in fleet refresh over the past two years, contributing to an improvement in customer retention to approximately 83%.

- BrightView plans to prioritize share repurchases over M&A, as its stock is perceived to be undervalued (trading around 7x EBITDA) compared to potential acquisition targets (8x-10x).

- BV reported FY 2025 Adjusted EBITDA of $352.3 million, representing an approximate 8% increase compared to the prior year, accompanied by a 150 basis point margin expansion.

- The company provided FY 2026 guidance, projecting Total Revenue between $2.670 billion and $2.730 billion, Adjusted EBITDA between $363 million and $377 million, and Adjusted Free Cash Flow between $100 million and $115 million.

- On November 19, 2025, BV announced an increase in its share repurchase authorization to $150 million. During the fourth fiscal quarter of 2025, the company repurchased 513,163 shares at an average price of $14.62.

- The Leverage ratio for FY 2025 remained stable at 2.3x, consistent with FY 2024.

- BrightView (BV) reported record adjusted EBITDA of $352 million and a 13.2% margin for fiscal year 2025, an 8% increase in EBITDA and 150 basis point margin expansion year over year.

- For fiscal year 2026, the company issued guidance projecting revenue between $2.67 billion and $2.73 billion, adjusted EBITDA between $363 million and $377 million, and adjusted free cash flow between $100 million and $115 million.

- Operational highlights include customer retention improving by 400 basis points since October 2023 to approximately 83%, and significant reductions in frontline employee turnover.

- Strategic investments in fiscal year 2025 included adding approximately 100 new sellers and over $300 million in fleet refresh, reducing the average age of core production vehicles to five years and mowers to one year.

- The company increased its share repurchase authorization from $100 million to $150 million, reflecting confidence in its valuation and growth outlook.

Quarterly earnings call transcripts for BrightView Holdings.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more