Earnings summaries and quarterly performance for CENTRAL GARDEN & PET.

Research analysts who have asked questions during CENTRAL GARDEN & PET earnings calls.

Brian McNamara

Canaccord Genuity - Global Capital Markets

7 questions for CENT

Bob Labick

CJS Securities

5 questions for CENT

Brad Thomas

KeyBanc Capital Markets

5 questions for CENT

Jim Chartier

Monness, Crespi, Hardt & Co., Inc.

5 questions for CENT

William Reuter

Bank of America

5 questions for CENT

Carla Casella

JPMorgan Chase & Co.

4 questions for CENT

Andrea Teixeira

JPMorgan Chase & Co.

3 questions for CENT

Bradley Thomas

KeyBanc Capital Markets Inc.

3 questions for CENT

Hale Holden

Barclays

3 questions for CENT

James Chartier

Monness, Crespi, Hardt & Co., Inc.

3 questions for CENT

William Chappell

Truist Securities

3 questions for CENT

Shovana Chowdhury

JPMorgan Chase & Co.

2 questions for CENT

Willem

CJS Securities

2 questions for CENT

Davis Holcombe

Truist Securities, Inc.

1 question for CENT

Madison Callinan

Canaccord Genuity

1 question for CENT

Mary Ann Neale

Barclays

1 question for CENT

Peter Lukas

CJS Securities

1 question for CENT

Recent press releases and 8-K filings for CENT.

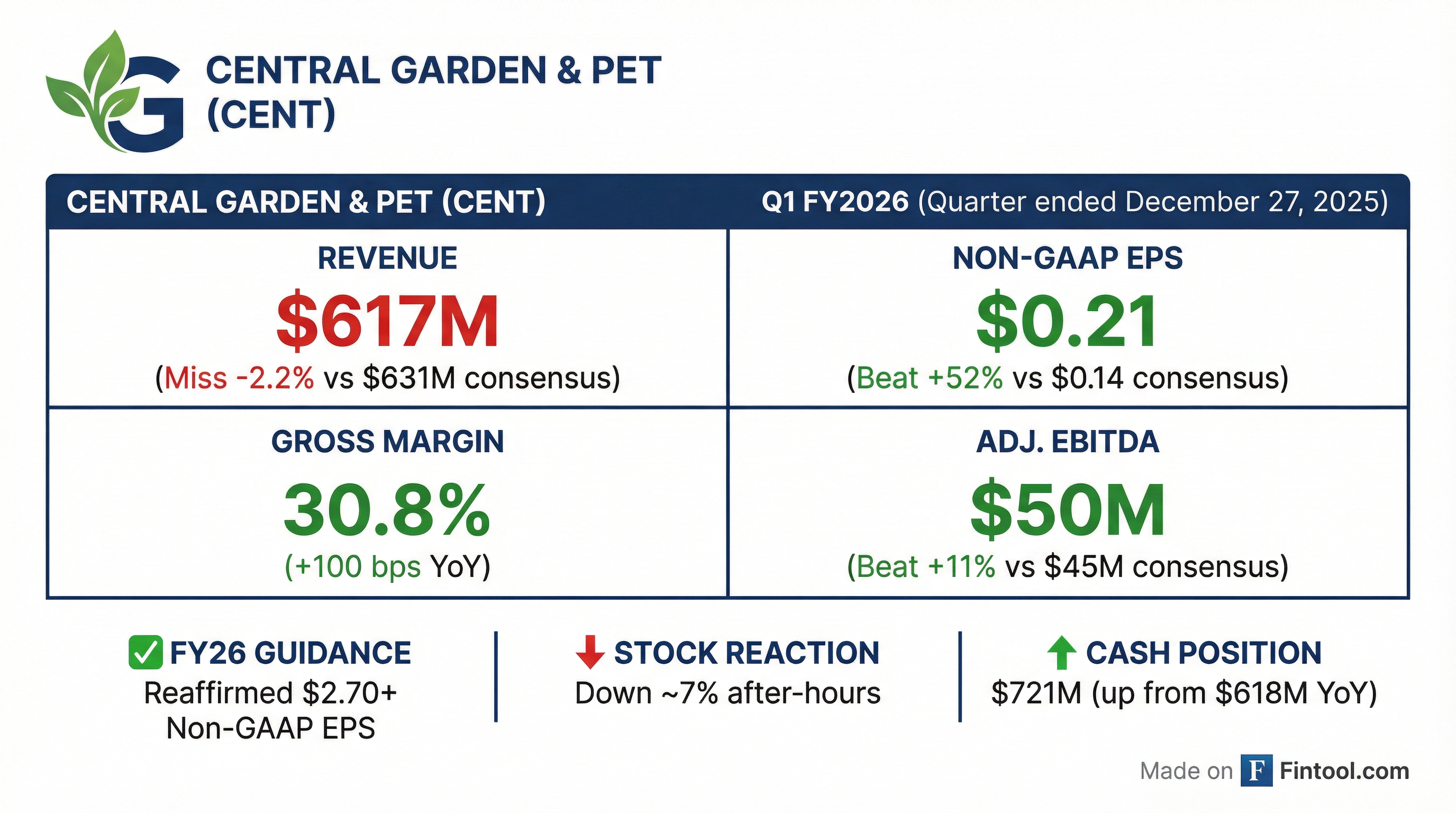

- Central Garden & Pet reported Q1 FY26 Non-GAAP EPS of $0.21, consistent with the prior year, on net sales of $617 million and an improved Non-GAAP gross margin of 30.8%.

- The company reaffirmed its fiscal 2026 non-GAAP EPS guidance of $2.70 or better.

- The Pet segment achieved net sales of $416 million with a Non-GAAP operating margin of 12.1%, while the Garden segment reported net sales of $202 million with a Non-GAAP operating margin of (1.2)% in Q1 FY26.

- Central Garden & Pet improved its cash position, with Cash & Cash Equivalents reaching $721 million in Q1 FY26, and maintained a Gross Leverage Ratio of 2.9x.

- Central Garden & Pet reported net sales of $617 million for Q1 2026, a 6% year-over-year decline, primarily attributed to the timing of retailer spring inventory shipments and ongoing portfolio optimization efforts.

- The company achieved non-GAAP diluted earnings per share of $0.21, consistent with the prior year and exceeding expectations, supported by a 100 basis point expansion in non-GAAP gross margin to 30.8%.

- Management reaffirmed its Fiscal 2026 non-GAAP diluted EPS guidance of $2.70 or better.

- The company is shifting its strategic focus towards a growth mindset, emphasizing innovation, digital capabilities, and M&A, while maintaining a strong balance sheet with $721 million in cash and a net leverage of approximately 1.2 times.

- Central Garden & Pet reported net sales of $617 million for Q1 Fiscal 2026, representing a 6% year-over-year decline, primarily attributed to the timing of retailer spring inventory shipments and ongoing portfolio optimization efforts.

- The company achieved non-GAAP diluted earnings per share of $0.21, consistent with the prior year and above expectations, with non-GAAP gross margin expanding 100 basis points to 30.8%.

- Management reaffirmed its Fiscal 2026 non-GAAP diluted EPS guidance of $2.70 or better.

- The company is shifting its strategic focus towards growth and innovation, including M&A, private label programs, and digital investments, building on its established cost and simplicity agenda.

- During the quarter, Central Garden & Pet completed the acquisition of Champion USA and repurchased approximately 660,000 shares for $18.5 million, with $28 million remaining under its share repurchase authorization.

- Central Garden & Pet reported Q1 Fiscal 2026 net sales of $617 million, representing a 6% year-over-year decline, primarily due to the timing of retailer spring inventory shipments and portfolio optimization efforts.

- The company delivered non-GAAP diluted earnings per share of $0.21 for Q1 Fiscal 2026, consistent with the prior year and above expectations, with non-GAAP gross margin expanding 100 basis points to 30.8%.

- Central Garden & Pet reaffirmed its Fiscal 2026 non-GAAP diluted EPS guidance of $2.70 or better.

- The company is increasingly focusing on a growth mindset, emphasizing innovation and M&A, and completed the acquisition of Champion USA after the quarter-end.

- During Q1 Fiscal 2026, Central Garden & Pet repurchased approximately 660,000 shares for $18.5 million, with $28 million remaining under its share repurchase authorization.

- Central Garden & Pet Company reported net sales of $617 million for Q1 fiscal 2026, a decrease from $656 million in Q1 fiscal 2025.

- GAAP diluted EPS was $0.11 and non-GAAP diluted EPS was $0.21 for Q1 fiscal 2026, compared to $0.21 for both in the prior year.

- The company reaffirmed its outlook for fiscal 2026 non-GAAP diluted EPS of $2.70 or better.

- Gross margin expanded by 110 basis points to 30.9% in Q1 fiscal 2026, compared to 29.8% in the prior year.

- The company repurchased 660,000 shares for $18.5 million during the quarter, with $28 million remaining available for future stock repurchases as of December 27, 2025.

- Central Garden & Pet reported Q1 Fiscal 2026 GAAP diluted EPS of $0.11 and non-GAAP diluted EPS of $0.21, with net sales of $617 million for the quarter ended December 27, 2025. Net sales decreased from the prior year, attributed to portfolio optimization efforts and shipment timing, though gross margin expanded by 110 basis points to 30.9% due to improved productivity.

- The company reaffirmed its fiscal 2026 non-GAAP diluted EPS outlook of $2.70 or better.

- During the quarter, Central Garden & Pet repurchased 660,000 shares for $18.5 million and maintained total debt at $1.2 billion with a gross leverage of 2.9x.

- Central Garden & Pet has acquired the U.S. assets of Champion USA, a cattle fly-control company known for its proprietary JustiFLY® line of products.

- This acquisition expands Central Garden & Pet's footprint in the sustainable livestock fly control market, which is described as a fast-growing segment in animal health.

- Champion USA has served the livestock industry for over 15 years, providing EPA-approved feed-through fly-control solutions and having treated over 50 million head of cattle.

- The transaction closed on December 12, 2025, and Central Garden & Pet will provide additional details during its first quarter earnings call in February.

- Central Garden & Pet acquired the U.S. assets of Champion USA on December 16, 2025.

- Champion USA is a cattle fly-control company known for its proprietary JustiFLY® line of products.

- Champion USA has served the livestock industry for over 15 years, providing EPA-approved feed-through fly-control solutions.

- Central Garden & Pet (NASDAQ: CENT) (NASDAQ: CENTA) announced the acquisition of the U.S. assets of Champion USA on December 16, 2025.

- Champion USA is a cattle fly-control company known for its proprietary JustiFLY® line of products, providing EPA-approved feed-through fly-control solutions to the livestock industry for over 15 years.

- Central Garden & Pet's new CEO, Niko Lahanas, and CFO, Brad Smith (appointed September 2024), have initiated a strategic shift towards a more agile, business unit-led culture, leading to increased optimism and organizational focus.

- The company is prioritizing Mergers & Acquisitions (M&A), holding nearly $900 million in cash for deployment, with a focus on high-growth, high-margin consumables, particularly in the pet segment where cat products are a key white space opportunity. Share buybacks will continue but not accelerate, to preserve capital for M&A.

- Central Garden & Pet anticipates gaining market share in both garden and pet segments in 2026 due to distribution gains. The "Cost & Simplicity" initiative, which has included closing approximately 20 facilities, is expected to continue driving margin expansion and help sustain or modestly expand margins in 2026 despite cost headwinds.

- The pet segment is showing stabilizing demand in dog, small animal, and fish, with growth expected to resume in 2026 or 2027. The garden segment achieved its biggest point-of-sale (POS) ever despite prior choppy weather, and the company is optimistic about top-line growth and bottom-line targets.

Quarterly earnings call transcripts for CENTRAL GARDEN & PET.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more