Earnings summaries and quarterly performance for Grupo Cibest.

Research analysts who have asked questions during Grupo Cibest earnings calls.

Andrés Soto

Santander Investment Securities Inc.

7 questions for CIB

Also covers: BAP, BCH, IFS

Brian Flores

Citigroup Inc.

7 questions for CIB

Also covers: BAP, BBAR, BBD +6 more

YF

Yuri Fernandes

JPMorgan Chase & Co.

7 questions for CIB

Also covers: AVAL, BAP, BBD +13 more

Carlos Gomez-Lopez

HSBC

5 questions for CIB

Also covers: BAP, BBAR, BBD +9 more

Ernesto Gabilondo

Bank of America Merrill Lynch

5 questions for CIB

Also covers: BAP, BCH, BMA +4 more

TL

Tito Labarta

Goldman Sachs

4 questions for CIB

Also covers: BAP, BBAR, BBD +14 more

LS

Lindsey Shema

The Goldman Sachs Group, Inc.

3 questions for CIB

Also covers: BAP, BCH, BMA +2 more

Alonso Aramburú

BTG Pactual

2 questions for CIB

Also covers: BAP, BMA, BSAC +2 more

Carlos Gomez

HSBC

2 questions for CIB

Also covers: BAP, BBAR, BMA +4 more

DV

Daniel Vaz

Banco Safra

2 questions for CIB

Also covers: BAP, BBD, BSBR +5 more

Recent press releases and 8-K filings for CIB.

Grupo SURA Reports Adjusted Net Income of COP 7.3 Trillion for 2025 and Provides 2026 ROE Guidance

CIB

Earnings

Dividends

Guidance Update

- Grupo SURA reported annual net income of COP 3.8 trillion for 2025, which would have been COP 7.3 trillion excluding the one-off impairment charge from the Banistmo divestment, resulting in an adjusted ROE of 17.2%.

- The company announced a proposed dividend of COP 4.3 trillion, equivalent to COP 4,512 per share, to be paid in four installments starting April 1st, and has executed 32% of its share buyback program, representing approximately 8.6 million shares as of December 31st.

- Digital businesses Nequi and Wompi reached breakeven in Q4 2025, with Nequi's loan portfolio growing 174% to COP 1.6 trillion. Nequi is expected to become a separate entity by Q3 or Q4 2026.

- The sale of Banistmo for an all-cash consideration of $1.4 billion triggered a COP 3.4 trillion non-cash net impairment charge related to goodwill.

- For 2026, Grupo SURA provides an ROE guidance of 18% to 18.5%, corresponding to a net income of COP 7.3 trillion (excluding Banistmo and its equity impact). The guidance incorporates an effective tax rate of approximately 35%.

4 days ago

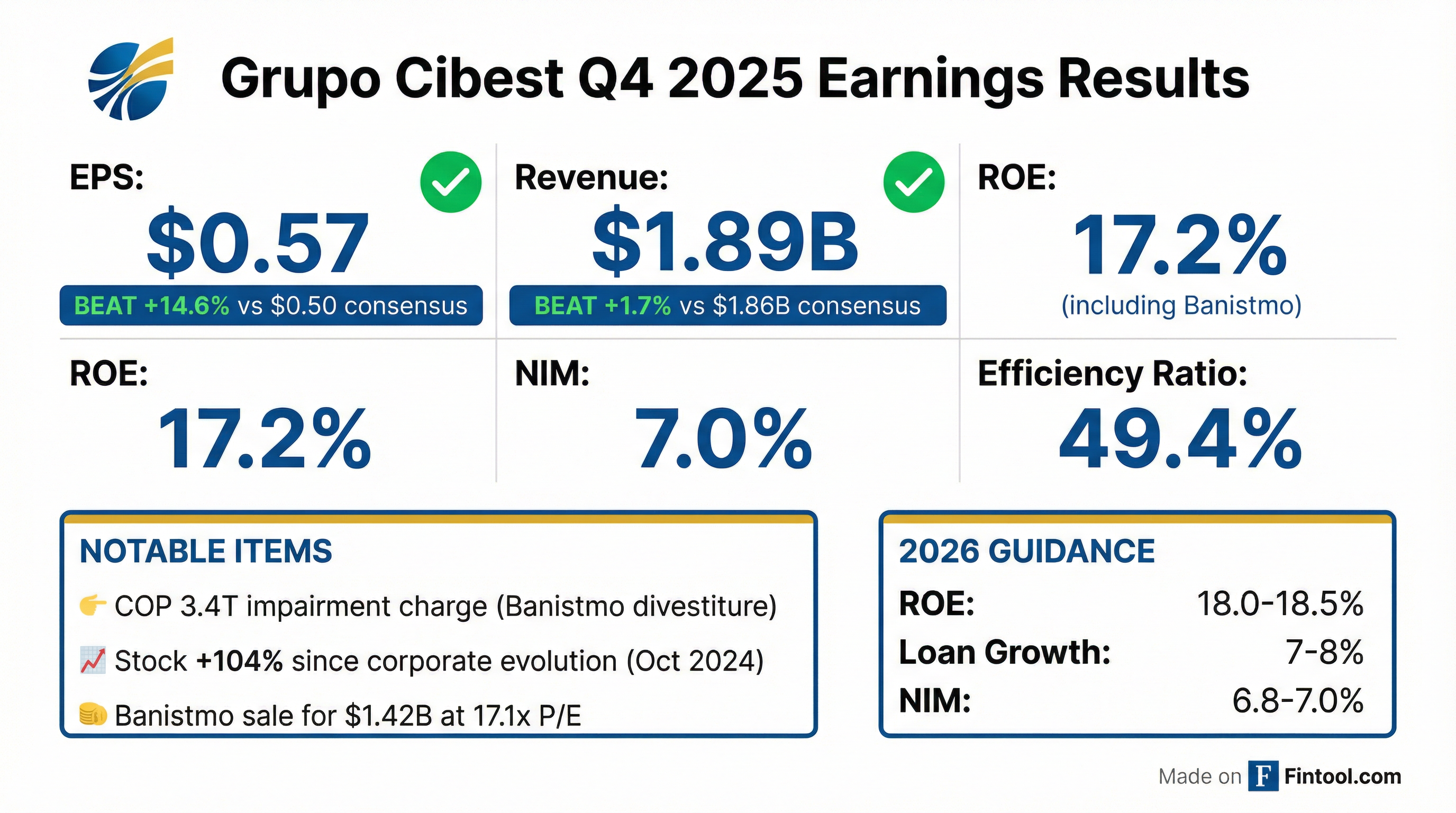

Grupo Cibest Reports Q4 2025 Results, Details Banistmo Divestment and 2026 Guidance

CIB

Earnings

M&A

Guidance Update

- Grupo Cibest's Q4 2025 results were impacted by a one-time, non-cash impairment charge of COP $3.4 Trillion related to the Banistmo divestment. Despite this, the company outperformed its 17% ROE guidance for 2025 when excluding one-off items.

- The sale of 100% of Banistmo shares for US $1,418 Million was announced, with the all-cash transaction expected to close in the second half of 2026.

- As of Q4 2025, 31.9% of the total share buyback program amount has been repurchased, contributing to significant share performance increases since its July 16, 2025 launch, with CIB up 144%.

- The company issued 2026 guidance, projecting Loan Growth of 7%-8%, a Return on Equity (ROE) of 18.0% - 18.5%, and a Net Interest Margin (NIM) of 6.8% - 7.0%.

4 days ago

Grupo Cibest Reports Q4 and Full-Year 2025 Results, Provides 2026 Guidance

CIB

Earnings

Guidance Update

M&A

- Grupo Cibest reported annual net income of COP 3.8 trillion and a Return on Equity (ROE) of 9.1% for 2025. Excluding a COP 3.4 trillion non-cash impairment charge related to the Banistmo divestment, net income would have been COP 7.3 trillion and ROE 17.2%.

- The company's digital businesses, Nequi and Wompi, achieved breakeven in Q4 2025.

- A dividend of COP 4.3 trillion, equivalent to COP 4,512 per share, was proposed for shareholder approval, marking a 14.6% annual dividend growth. The share buyback program has executed 32% of the total authorized amount as of December 31, representing approximately 8.6 million shares.

- For 2026, Grupo Cibest anticipates loan growth between 7% and 8%, a Net Interest Margin (NIM) of 6.8% to 7%, a cost of risk between 1.6% and 1.8%, and an ROE ranging from 18% to 18.5%.

4 days ago

Grupo SURA Reports Q4 2025 Results, Exceeds Guidance Excluding One-Off Impact, and Provides 2026 Outlook

CIB

Earnings

Guidance Update

Share Buyback

- Grupo SURA reported annual net income of COP 3.8 trillion and a ROE of 9.1% for 2025. Excluding a one-off impairment charge from the Banistmo divestment, net income would have been COP 7.3 trillion with a ROE of 17.2%.

- The company's digital businesses, Nequi and Wompi, reached breakeven in the fourth quarter of 2025.

- A dividend of COP 4.3 trillion, equivalent to COP 4,512 per share, was proposed for shareholder approval, reflecting 14.6% annual dividend growth.

- As of December 31, 2025, 32% of the total authorized share buyback program has been executed, representing approximately 8.6 million shares.

- For 2026, Grupo SURA forecasts loan growth of 7%-8%, a Net Interest Margin (NIM) between 6.8% and 7%, and a Return on Equity (ROE) between 18% and 18.5%. The company plans significant capital investments in its digital subsidiaries, including COP 600 billion in Nequi and COP 50 billion in Wenia and Wompi.

4 days ago

Grupo Cibest Reports Q4 2025 Financial Results Amidst Banistmo Sale

CIB

Earnings

M&A

Accounting Changes

- Grupo Cibest reported a net loss of COP 1.8 trillion and a Return on Equity (ROE) of -17.71% for Q4 2025, primarily due to a COP 3.4 trillion impairment of goodwill from the sale of Banistmo S.A..

- The company announced the sale of 100% of Banistmo S.A. on December 18, 2025, for US$1.418 billion, leading to its classification as a Discontinued Operation.

- Excluding the impact of the Banistmo sale, the profit for Q4 2025 would have represented an ROE of 15.03% for the quarter and 17.21% for the year.

- The gross loan portfolio decreased by 8.44% quarter-on-quarter to COP 256 trillion, and deposits decreased by 5.99% to COP 264 trillion in 4Q25, largely due to the reclassification of Banistmo's assets and liabilities.

- The consolidated net interest margin (NIM) remained stable at 6.16% in 4Q25 compared to 3Q25.

4 days ago

Grupo Cibest S.A. Announces Sale of Banistmo S.A.

CIB

M&A

- Grupo Cibest S.A. has entered into an agreement to sell 100% of the shares of Banistmo S.A. to Inversiones Cuscatlán Centroamérica S.A.

- The agreed sale price for Banistmo S.A. is USD $1.418 billion.

- This price represents a Price/Earnings ratio of 17.1x and a Price/Book Value ratio of 1.2x for the last twelve months as of September 30, 2025.

- Valores Banistmo is not included in this transaction and will continue to be a key component of Grupo Cibest’s capital markets products.

Dec 18, 2025, 11:03 PM

Grupo Cibest S.A. Reports Q3 2025 Financial Results and Share Buyback Update

CIB

Earnings

Share Buyback

M&A

- Grupo Cibest S.A. released its quarterly report for the fiscal quarter ended September 30, 2025, on November 14, 2025.

- The company reported net income attributable to equity holders of the Parent Company of COP 2,144,103 million for Q3 2025, representing a 19.7% increase compared to Q2 2025. Basic and diluted earnings per share for Q3 2025 were COP 2,247.

- Net interest income totaled COP 5,302 billion in Q3 2025, an increase of 1.5% compared to Q2 2025 and 2.9% compared to Q3 2024. The consolidated Net Interest Margin (NIM) increased by 2 basis points in the quarter, rising from 6.57% to 6.59%.

- A share buyback program for COP 1.35 trillion was approved on June 9, 2025, with 26.7% of the approved amount executed as of September 30, 2025, resulting in the repurchase of 7,252,194 shares.

- Grupo Cibest became the parent company of Bancolombia and other subsidiaries following a partial spin-off formalized on May 12, 2025, with its shares becoming tradable on May 19, 2025.

Nov 14, 2025, 9:21 PM

Grupo Cibest Reports Strong Q3 2025 Financial Results with Significant Net Income and ROE Growth

CIB

Earnings

Share Buyback

Guidance Update

- Grupo Cibest reported strong Q3 2025 financial results, with Net Income of 2.1 COP Trillion and a Return on Equity (ROE) of 20.4%. Net income increased 42.8% year-over-year and 19.7% quarter-over-quarter.

- The company demonstrated improved operational efficiency, achieving an Efficiency Ratio of 48.5% in Q3 2025. Loan growth was 0.1% quarter-over-quarter and 3.9% year-over-year, with consumer loans gaining traction.

- Solid progress on the share buyback program continued, with 7,252,194 shares repurchased, which is noted to enhance ROE and valuation metrics. Additionally, Nequi reported positive net income in September, marking a key milestone towards sustained profitability.

- For the full year 2025, Grupo Cibest anticipates loan growth of approximately 3.5%, a Net Interest Margin (NIM) of around 6.5%, and an ROE of approximately 17%.

Nov 7, 2025, 2:00 PM

Grupo Bancolombia Reports Strong Q3 2025 Results with Significant Net Income and ROE Growth, Nequi Nears Breakeven

CIB

Earnings

Guidance Update

New Projects/Investments

- Grupo Bancolombia's net income posted a strong 20% growth quarterly and 43% growth annually in Q3 2025, leading to a Return on Equity (ROE) increase to 20.4%. The company's ROE is projected to be around 17% for 2025 and between 16%-17% for 2026.

- Nequi continued to demonstrate strong momentum in Q3 2025, adding 1.2 million active users and is expected to reach its first full breakeven quarter by Q1 2026. Its loan book expanded 2.3x annually, and it maintains a sound deposit balance of COP 5.5 trillion.

- Asset quality improved, with net provisions amounting to COP 800 billion, representing a 24% quarterly drop and close to a 48% annual contraction. The quarterly analyzed cost of risk declined to 1.2%, its lowest level in the past year. The cost of risk is expected to be in the range of 1.5%-1.7% for 2025 and 1.6%-1.8% for 2026.

- Loan growth for 2025 has been revised to approximately 3.5% (or around 6% net of FX). Preliminary projections for 2026 indicate loan growth of approximately 7%, with consumer loans expected to grow around 10%.

- Operating expenses decreased 2.4% during Q3 2025, and operational efficiency is projected to be around 50% for 2025 and 2026. The company also highlighted the initial progress of its share buyback strategy.

Nov 7, 2025, 2:00 PM

Grupo Bancolombia Reports Strong Q3 2025 Results with Increased Profitability and Nequi Milestone

CIB

Earnings

Share Buyback

Guidance Update

- Grupo Bancolombia reported strong Q3 2025 results, with net income growing 20% quarterly and 43% year-over-year, and Return on Equity (ROE) expanding by 288 basis points to 20.4%.

- The company's asset quality continued to improve, with net provisions dropping 24% quarterly and nearly 48% annually to COP 800 billion, resulting in a quarterly analyzed cost of risk of 1.2%.

- Nequi achieved a positive net income in September and is anticipated to reach sustained profitability by Q1 2026, with plans for it to separate from Bancolombia as a standalone entity in the second semester of 2026.

- The share buyback program, launched in mid-July, has completed approximately 27% of the authorized COP 1.35 trillion repurchase amount as of September 30, involving about 7.3 million shares.

- The company provided ROE guidance of around 17% for 2025 and 16-17% for 2026, and revised its 2025 year-end loan growth outlook to approximately 3.5% (or 6% net of FX).

Nov 7, 2025, 2:00 PM

Quarterly earnings call transcripts for Grupo Cibest.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more