Earnings summaries and quarterly performance for DuPont de Nemours.

Executive leadership at DuPont de Nemours.

Lori Koch

Chief Executive Officer

Antonella Franzen

Senior Vice President and Chief Financial Officer

Beth Ferreira

President, Diversified Industrials

Christopher Raia

Senior Vice President and Chief Human Resources Officer

Erik Hoover

Senior Vice President and General Counsel

Jeroen Bloemhard

President, Healthcare & Water Technologies

Leland Weaver

President, Water & Protection

Madeleine Barber

Vice President of Tax, Controller and Chief Accounting Officer

Steve Larrabee

Senior Vice President and Chief Information Officer

Board of directors at DuPont de Nemours.

Alexander Cutler

Lead Independent Director

Amy Brady

Director

Edward Breen

Chair of the Board

Eleuthère du Pont

Director

Frederick Lowery

Director

James Lico

Director

Kurt McMaken

Director

Luther Kissam

Director

Ruby Chandy

Director

Research analysts who have asked questions during DuPont de Nemours earnings calls.

John Ezekiel Roberts

Mizuho Securities

9 questions for DD

Scott Davis

Melius Research

9 questions for DD

Arun Viswanathan

RBC Capital Markets

8 questions for DD

Jeffrey Sprague

Vertical Research Partners

8 questions for DD

Michael Sison

Wells Fargo

8 questions for DD

Vincent Andrews

Morgan Stanley

7 questions for DD

John McNulty

BMO Capital Markets

6 questions for DD

Christopher Parkinson

Wolfe Research

5 questions for DD

David Begleiter

Deutsche Bank

5 questions for DD

Frank Mitsch

Fermium Research

5 questions for DD

Josh Spector

UBS Group

5 questions for DD

Patrick Cunningham

Citigroup

5 questions for DD

Chris Parkinson

Wolfe Research, LLC

4 questions for DD

Matthew Deyoe

Bank of America

4 questions for DD

Aleksey Yefremov

KeyBanc Capital Markets

3 questions for DD

C. Stephen Tusa

JPMorgan Chase & Co.

3 questions for DD

Joshua Spector

UBS

3 questions for DD

Michael Leithead

Barclays

3 questions for DD

Steve Byrne

Bank of America

3 questions for DD

Chigusa Katoku

JPMorgan Chase & Co.

2 questions for DD

John Patrick

BMO Capital Markets

2 questions for DD

Rachael Lee

Citigroup

2 questions for DD

Ryan Pirnat

KeyBanc Capital Markets

2 questions for DD

Shigeru Sakato

JPMorgan Chase & Co.

2 questions for DD

Steve Tusa

JPMorgan Chase & Co.

2 questions for DD

Turner Hinrichs

Morgan Stanley

2 questions for DD

Alexandra Yates

KeyBanc Capital Markets

1 question for DD

Bhavesh Lodaya

BMO Capital Markets

1 question for DD

Laurence Alexander

Jefferies

1 question for DD

Michael Joseph Sison

Wells Fargo Securities LLC

1 question for DD

Paul

KeyBanc Capital Markets

1 question for DD

Paul Knight

KeyBanc Capital Markets

1 question for DD

Rachel Leoff

Citi

1 question for DD

Rachel Leon

Citigroup Inc.

1 question for DD

Recent press releases and 8-K filings for DD.

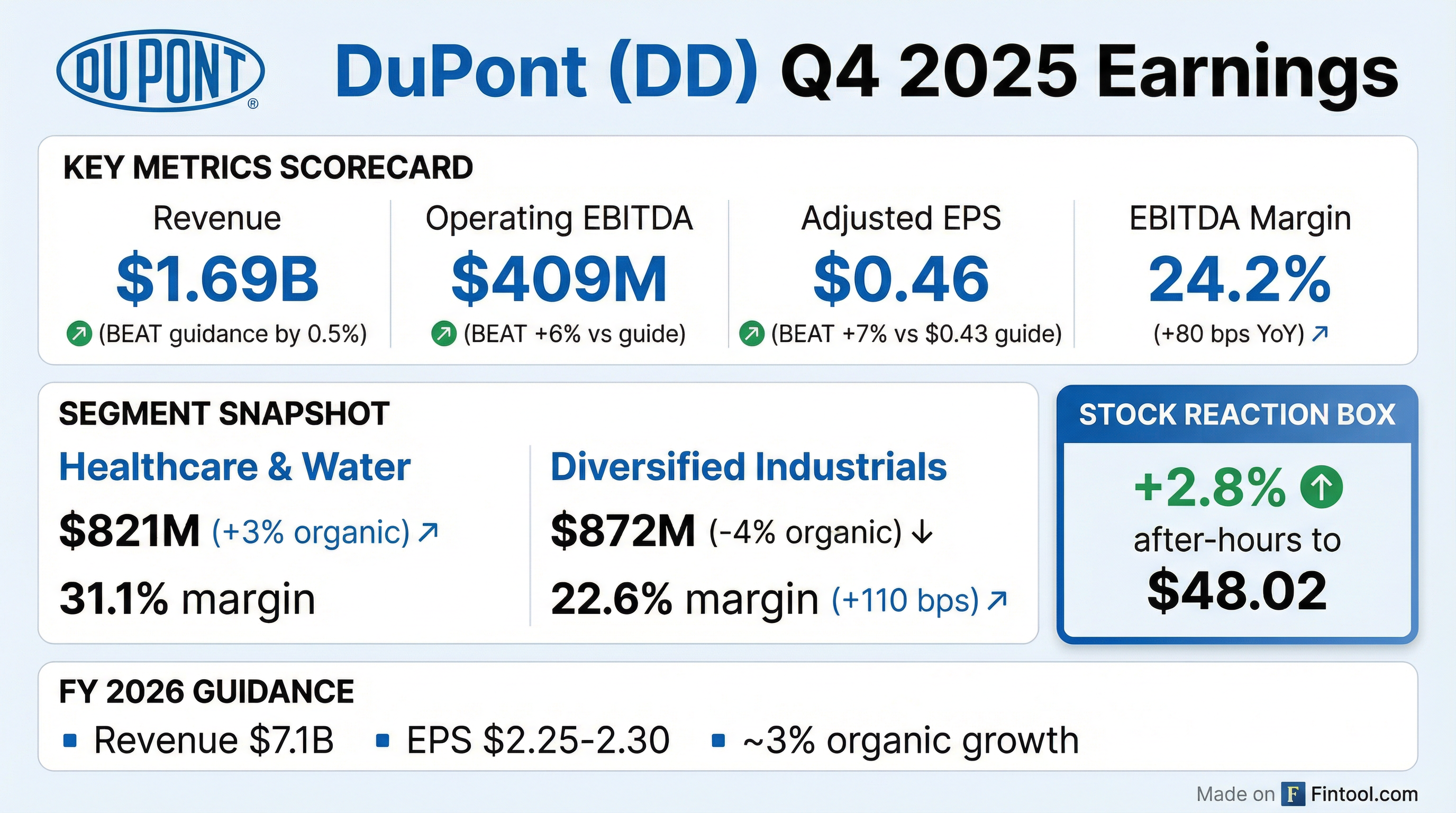

- DuPont delivered Q4 net sales of $1.7 billion (flat yoy), operating EBITDA of $409 million (+4%; margin 24.2%, +80 bps) and adjusted EPS of $0.46 (+18%).

- Full-year 2025 organic sales grew 2%, operating EBITDA rose 6%, margins expanded 100 bps, and adjusted EPS reached $1.68 (+16%).

- The company completed the separation of Qnity Electronics and executed a $500 million accelerated share repurchase under its $2 billion buyback authorization.

- 2026 guidance: net sales of $7.1 billion (+3% organic), operating EBITDA of $1.74 billion (+6-8% yoy; +60-80 bps), adjusted EPS of $2.25–2.30, and free cash flow conversion >90%.

- DuPont’s Q4 net sales totaled $1.7 billion, with a 1% organic sales decline (adjusting for a $30 million order-timing headwind yields ~1% organic growth); operating EBITDA was $409 million (+4% YoY) with a margin of 24.2% (+80 bps), and adjusted EPS was $0.46 (+18%).

- For full year 2025, DuPont achieved 2% organic sales growth, 6% operating EBITDA growth, 100 bps of margin expansion, and adjusted EPS of $1.68 (+16%).

- The company completed the separation of QUNITY Electronics, launched 125 new products generating >$2 billion in sales, and maintained a 30% Vitality Index, underscoring its innovation-driven growth.

- 2026 guidance includes ~3% organic sales growth, 6–8% operating EBITDA increase with 60–80 bps of margin expansion, adjusted EPS of $2.25–$2.30, and >90% free cash flow conversion.

- Q4 net sales of $1.7 billion were flat year-over-year; operating EBITDA rose 4% to $409 million (24.2% margin, +80 bps); adjusted EPS was $0.46, up 18%.

- Full-year 2025 organic sales grew 2%, operating EBITDA increased 6%, margins expanded by 100 bps, and adjusted EPS was $1.68, up 16%.

- For 2026, the company targets about 3% organic sales growth, 60–80 bps of margin expansion, adjusted EPS of $2.25–$2.30, and free cash flow conversion above 90%.

- Launched 125+ new products in 2025 generating over $2 billion in sales and achieving a Vitality Index of 30%.

- Executed a $500 million accelerated share repurchase under a $2 billion buyback authorization and plans continued balanced capital deployment via dividends, repurchases, and M&A.

- DuPont reported Q4 2025 net sales of $1.693 billion, flat YoY, with operating EBITDA of $409 million, up 4% YoY, and a margin expansion of 80 bps to 24.2%.

- Adjusted EPS was $0.46, up 18% year-over-year on higher segment earnings and lower interest expense.

- Transaction-adjusted free cash flow from continuing operations was $228 million, with a conversion rate of 118%.

- Completed the Electronics separation into Qnity on November 1, 2025; aramids divestiture expected around the end of Q1 2026.

- Provided FY 2026 guidance of ~3% organic net sales growth, 60–80 bps EBITDA margin expansion, $2.25–$2.30 adjusted EPS, and >90% free cash flow conversion.

- In Q4 2025, DuPont delivered $1.7 billion net sales (flat YoY), reported a GAAP loss from continuing operations of $(108) million, achieved $409 million operating EBITDA, $0.46 adjusted EPS, and $228 million transaction-adjusted free cash flow.

- For FY 2025, the company posted $6.8 billion net sales (+2% organic), $98 million GAAP income from continuing operations, $1.63 billion operating EBITDA, $1.68 adjusted EPS, and $689 million transaction-adjusted free cash flow.

- DuPont initiated 2026 guidance anticipating Q1 net sales of ~$1.67 billion, operating EBITDA of ~$395 million, adjusted EPS of ~$0.48; and full-year net sales of $7.075–$7.135 billion, operating EBITDA of $1.725–$1.755 billion, adjusted EPS of $2.25–$2.30.

- Net sales flat at $1.7 billion in Q4 2025; GAAP loss from continuing operations of $(108 million), operating EBITDA of $409 million, and transaction-adjusted free cash flow of $228 million.

- Full year 2025 net sales of $6.8 billion (+2% organic), operating EBITDA of $1.63 billion, adjusted EPS of $1.68, and transaction-adjusted free cash flow of $689 million.

- Initiated 2026 guidance: Q1 net sales of ~$1.67 billion, full year net sales of $7.075–7.135 billion; operating EBITDA of ~$395 million in Q1 and $1.725–1.755 billion for the year; adjusted EPS of ~$0.48 in Q1 and $2.25–2.30 for 2026.

- As of Nov. 17, 2025, DuPont received valid tenders of $936.6 million for its 5.419% Notes due 2048, exceeding the $739.3 million maximum, and will accept $739.3 million on a 78.96% prorated basis.

- Payment of $1,000 per $1,000 principal (plus accrued interest) for the accepted notes is scheduled for Nov. 19, 2025.

- Upon completion of this tender and related redemptions, DuPont will have repaid approximately $4.0 billion of senior notes, finalizing its post-Electronics separation capital structure.

- DuPont announced early results of its tender offer to purchase up to $739,256,000 aggregate principal of its 5.419% Notes due 2048.

- As of Nov. 17, 2025, $936,618,000 of the 2048 Notes were validly tendered, resulting in a 78.96% proration factor.

- The company will accept $739,256,000 of the notes on a pro rata basis and settle on Nov. 19, 2025, paying $1,000 per $1,000 principal plus accrued interest.

- The Tender Offer expires on Dec. 3, 2025, and, upon completion along with other maturities and redemptions, DuPont will have repaid approximately $4.0 billion of senior notes to establish its post-Electronics separation capital structure.

- Net sales of $3.1 billion, up 6% organically, with operating EBITDA of $840 million (+6%) and a margin of 27.3% in Q3 2025.

- Delivered transaction-adjusted free cash flow of $576 million with 126% conversion; declared an initial quarterly dividend of $0.20 per share and approved a $2 billion share repurchase authorization (including a $500 million ASR).

- Completed the separation of CUNY, receiving a $4.2 billion “midnight” dividend to be used for debt reduction and targeted capital structure enhancement.

- Raised full-year 2025 guidance to $6.84 billion in net sales, $1.6 billion in operating EBITDA, and $1.66 adjusted EPS; updated pro-forma targets of $1.63 billion EBITDA and $2.02 EPS.

- Net Sales of $3.1 billion (+7%), Operating EBITDA of $840 million (27.3% margin), and Adjusted EPS of $1.09

- Raised FY 2025 Operating EBITDA guidance to ~$1.6 billion and Adjusted EPS guidance to ~$1.66 (vs. $1.43 prior year)

- Announced $2 billion share repurchase authorization with a $500 million ASR launch; declared quarterly dividend in line with payout targets

- Delivered 6% organic sales growth, driven by ElectronicsCo (+10%) and IndustrialsCo (+4%)

- Reached agreement to divest the Aramids business and completed the Qnity spin-off on November 1

Quarterly earnings call transcripts for DuPont de Nemours.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more