Earnings summaries and quarterly performance for Element Solutions.

Executive leadership at Element Solutions.

Benjamin H. Gliklich

Chief Executive Officer

Carey Dorman

Chief Financial Officer

John Capps

Executive Vice President, General Counsel and Company Secretary

Matthew Liebowitz

Executive Vice President, Strategy and Head of Industrial & Specialty

Richard Fricke

Executive Vice President, Head of Electronics

Board of directors at Element Solutions.

Research analysts who have asked questions during Element Solutions earnings calls.

Bhavesh Lodaya

BMO Capital Markets

9 questions for ESI

John Ezekiel Roberts

Mizuho Securities

9 questions for ESI

Peter Osterland

Truist Securities

8 questions for ESI

Josh Spector

UBS Group

6 questions for ESI

Christopher Parkinson

Wolfe Research

5 questions for ESI

Jonathan Tanwanteng

CJS Securities

5 questions for ESI

Michael Harrison

Seaport Research Partners

5 questions for ESI

Chris Parkinson

Wolfe Research, LLC

4 questions for ESI

Frank Mitsch

Fermium Research

4 questions for ESI

David Silver

CL King & Associates

3 questions for ESI

Matthew Deyoe

Bank of America

3 questions for ESI

Aleksey Yefremov

KeyBanc Capital Markets

2 questions for ESI

Alexi Misconish

KeyBanc Capital Markets

2 questions for ESI

Duffy Fischer

Goldman Sachs

2 questions for ESI

Joshua Spector

UBS

2 questions for ESI

Mike Harrison

Seaport Research Partners

2 questions for ESI

Rock Hoffman Blasko

Bank of America

2 questions for ESI

Alekski Ufremo

KeyBanc Capital Markets

1 question for ESI

Duffy Fisher

Goldman Sachs Group Inc.

1 question for ESI

Hakim Stample

Bank of America

1 question for ESI

James Cannon

UBS Securities

1 question for ESI

John Quentin

CJS Securities

1 question for ESI

Michael Leithead

Barclays

1 question for ESI

Steve Byrne

Bank of America

1 question for ESI

Recent press releases and 8-K filings for ESI.

- Element Solutions reported 2025 as a record year and anticipates high single-digit overall organic growth for 2026, driven by a strategic shift in its electronics end-market exposure towards B2B electronics, high-performance computing, and data centers.

- The company has strengthened its portfolio through recent acquisitions of EFC Gases and Micromax, expanding capabilities in areas like semiconductor fabrication and electronic inks.

- Key product lines, including Cuprion, are advancing, with the first external product qualification milestone achieved in Q1 2026 and an expectation of real revenue and EBITDA contribution in 2027, targeting $100 million in revenue by 2030.

- Element Solutions maintains stable gross and EBITDA margins due to its asset-light model where 80% of cost of goods are variable raw materials with pass-through mechanisms. The company's leverage is 3x, projected to decrease to 2.5x by the end of 2026, providing capacity for opportunistic M&A.

- Element Solutions (ESI) reported 2025 as a record year and a strong start to 2026, driven by strategic acquisitions like EFC Gases and Micromax, which enhance its electronics portfolio and exposure to fast-growing end markets such as semiconductor fabrication and data centers.

- The company anticipates high single-digit overall organic growth for 2026, expecting to outgrow the broader PCB market (projected 6% growth) and semiconductor market by 5+ points, despite an expected softer smartphone market.

- Key product developments include Cuprion, which achieved its first external product qualification milestone in Q1 2026 and aims for $100 million in revenue by 2030, and Argomax, expanding its high-thermal applications from electric vehicles (EVs) to data centers.

- ESI maintains stable gross and EBITDA margins due to its asset-light model and pass-through raw material costs, with current leverage at 3 turns and a target to reach 2.5 times by the end of 2026, allowing for future opportunistic M&A.

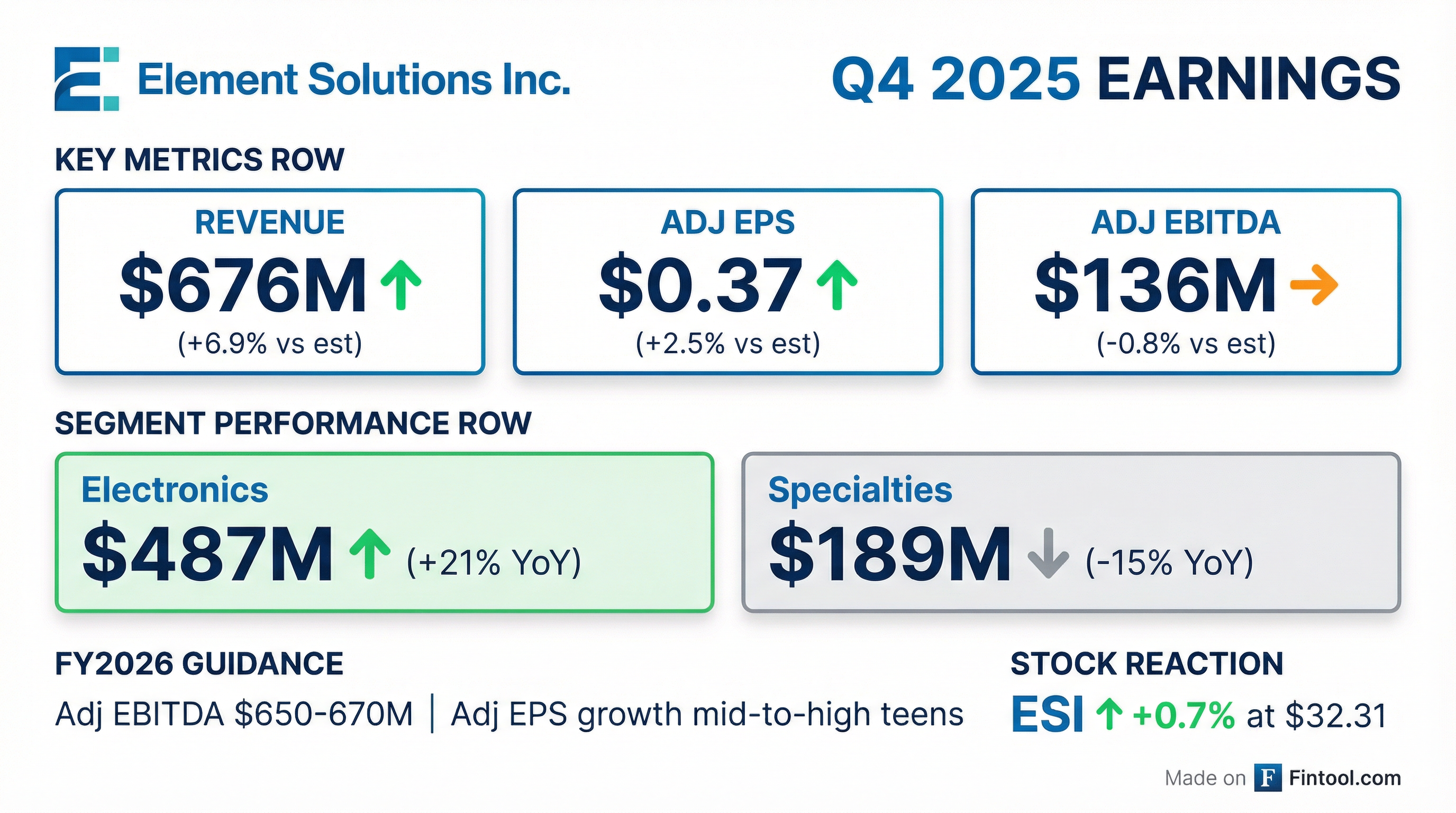

- Element Solutions reported record full-year 2025 net sales of $2,551 million, adjusted EBITDA of $548 million, and adjusted EPS of $1.49. For Q4 2025, net sales were $676 million, adjusted EBITDA was $136 million, and adjusted EPS was $0.37.

- The company achieved 10% Electronics Organic Net Sales Growth in 2025, outpacing market growth, driven by AI and data center investments, while Specialties organic growth was 1% for FY 2025.

- Element Solutions provided full-year 2026 guidance for Adjusted EBITDA between $650 million and $670 million and Adjusted EPS between $1.70 and $1.75.

- The company completed the EFC acquisition for $369 million on January 2, 2026, and the Micromax acquisition for approximately $500 million on February 2, 2026, with their contributions reflected in the 2026 guidance.

- As of December 31, 2025, the net debt to adjusted EBITDA ratio was 1.8x, with an expectation to reduce it to approximately 2.5x by the end of 2026.

- Element Solutions achieved a record year in 2025, reporting adjusted EBITDA of $548 million and adjusted EPS of $1.49. The Electronics segment was a key driver, with 10% organic revenue growth for the full year, accelerating to 13% in Q4 2025 due to strong demand from data center and high-performance computing markets.

- For 2026, the company provided Adjusted EBITDA guidance of $650 million to $670 million, which includes contributions from the recently acquired MacDermid (Micromax) and ESI Gases and Advanced Materials businesses. This guidance implies high single-digit organic adjusted EBITDA growth and mid- to high-teens adjusted EPS growth.

- In 2025, Element Solutions divested its graphics business and announced the acquisitions of MacDermid and ESI Gases and Advanced Materials in Q4, both closing in early 2026. Micromax (MacDermid) contributed approximately $40 million of EBITDA in 2025, and ESI is expected to contribute approximately $30 million in 2026.

- The company's focus for 2026 includes integrating the new acquisitions and scaling capacity for new products such as Kuprion, where the pipeline of demand currently exceeds initial production capacity.

- Element Solutions achieved a record year in 2025, reporting adjusted EPS of $1.49 and adjusted EBITDA of $548 million, which represents 7% constant currency growth.

- Net sales for 2025 reached $2.6 billion, growing 6% organically, primarily driven by 10% organic growth in the Electronics segment due to strength in AI and data center markets.

- The company provided 2026 Adjusted EBITDA guidance of $650 million-$670 million, which includes expected contributions from the recently acquired Micromax and EFC Gases and Advanced Materials.

- Element Solutions generated $256 million of adjusted free cash flow in 2025 and anticipates approximately $75 million in capital expenditures for 2026.

- Element Solutions achieved record adjusted EBITDA of $548 million and record adjusted EPS of $1.49 for the full year 2025, with net sales growing 6% organically to $2.6 billion.

- The company's Electronics segment demonstrated strong performance, with 10% organic net sales growth in 2025, primarily driven by demand from AI and data center markets.

- For 2026, Element Solutions anticipates Adjusted EBITDA to be in the range of $650 million to $670 million, which is expected to result in adjusted EPS growth in the mid- to high-teens.

- Strategic actions in 2025 included the divestiture of the graphics business and the acquisitions of Micromax and EFC Gases and Advanced Materials, with the latter two expected to contribute approximately $70 million in EBITDA in 2026.

- Element Solutions Inc reported record adjusted EBITDA of $548 million for the full year 2025, an increase of 2% over 2024, and provided 2026 full year guidance for adjusted EBITDA between $650 million and $670 million.

- Full year 2025 net sales increased 4% to $2.55 billion, with organic net sales growing 6%. The Electronics business achieved double-digit organic growth, which accelerated in the fourth quarter of 2025.

- The company completed the divestiture of MacDermid Graphics Solutions for approximately $320 million in February 2025 and subsequently completed two acquisitions in early 2026: EFC Gases & Advanced Materials for approximately $369 million and Micromax for approximately $500 million.

- Element Solutions returned $77.8 million to stockholders in cash dividends during 2025 and repurchased 1.2 million shares for $25.0 million, with approximately $556 million remaining under its stock repurchase program at December 31, 2025.

- Element Solutions Inc reported full-year 2025 net sales of $2.55 billion, an increase of 4% on a reported basis, and Adjusted EBITDA of $548 million, with adjusted EPS of $1.49.

- For the fourth quarter of 2025, net sales increased 8% to $676 million and Adjusted EBITDA rose 5% to $136 million, resulting in adjusted EPS of $0.37.

- The company introduced 2026 full-year guidance for Adjusted EBITDA in the range of $650 million to $670 million and anticipates adjusted EPS growth in the mid to high teens.

- Strategic activities included the divestiture of MacDermid Graphics Solutions for approximately $320 million in February 2025 and the repurchase of 1.2 million shares for $25.0 million during 2025.

- In early 2026, Element Solutions completed the acquisitions of EFC Gases & Advanced Materials for approximately $369 million and Micromax for approximately $500 million.

- Element Solutions Inc (ESI) completed its previously announced acquisition of Micromax on February 2, 2026.

- The acquisition was funded through a $450 million add-on to ESI’s existing senior secured term loan B due 2030.

- ESI also entered into a new 5-year $500 million revolving credit facility, upsizing its prior revolving facility by $125 million and extending its maturity to 2031.

- Micromax achieved high-single digit organic revenue growth in 2025.

- Element Solutions Inc (ESI) has completed its previously announced acquisition of Micromax.

- The acquisition was funded through a $450 million add-on to ESI’s existing senior secured term loan B due 2030.

- As part of the financing, the Company also entered into a new 5-year $500 million revolving credit facility, upsizing its prior facility by $125 million and extending its maturity to 2031.

- Micromax is experiencing positive momentum, with high-single digit organic revenue growth in 2025.

Quarterly earnings call transcripts for Element Solutions.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more