Earnings summaries and quarterly performance for DTE ENERGY.

Executive leadership at DTE ENERGY.

Joi Harris

President and Chief Executive Officer

David Ruud

Vice Chairman and Chief Financial Officer

Gerardo Norcia

Executive Chairman

JoAnn Chavez

Senior Vice President and Chief Legal Officer

Lisa Muschong

Vice President, Corporate Secretary and Chief of Staff

Mark Stiers

President and Chief Operating Officer, DTE Vantage and Energy Trading

Matthew Paul

President and Chief Operating Officer, DTE Electric Company

Robert Richard

President and Chief Operating Officer, DTE Gas Company

Tracy Myrick

Chief Accounting Officer

Trevor Lauer

Vice Chairman and Group President

Board of directors at DTE ENERGY.

Cassandra Santos

Director

Charles McClure Jr.

Director

David Brandon

Director

David Thomas

Director

Deborah Byers

Director

Gail McGovern

Director

Gary Torgow

Director

Mark Murray

Lead Independent Director

Nicholas Akins

Director

Robert Skaggs Jr.

Director

Valerie Williams

Director

Research analysts who have asked questions during DTE ENERGY earnings calls.

David Arcaro

Morgan Stanley

6 questions for DTE

Travis Miller

Morningstar

6 questions for DTE

Durgesh Chopra

Evercore ISI

4 questions for DTE

Jeremy Tonet

JPMorgan Chase & Co.

4 questions for DTE

Andrew Weisel

Scotiabank

3 questions for DTE

Anthony Crowdell

Mizuho Financial Group

3 questions for DTE

Nicholas Campanella

Barclays

3 questions for DTE

Shahriar Pourreza

Guggenheim Partners

3 questions for DTE

Sophie Karp

KeyBanc Capital Markets Inc.

3 questions for DTE

Eva Nagovich

Jefferies

2 questions for DTE

Michael Lonegan

Evercore ISI

2 questions for DTE

Michael Sullivan

Wolfe

2 questions for DTE

Shar Pourreza

Wells Fargo

2 questions for DTE

Agnieszka Storozynski

BofA Securities

1 question for DTE

Julien Dumoulin-Smith

Jefferies

1 question for DTE

Konstantin Lednev

Guggenheim Partners

1 question for DTE

Paul Fremont

Ladenburg Thalmann

1 question for DTE

Paul Zimbardo

Jefferies Financial Group Inc.

1 question for DTE

William Appicelli

UBS

1 question for DTE

Recent press releases and 8-K filings for DTE.

- FY 2025 operating revenues increased to $2,033 million (+$250 million vs. 2024), and net income rose to $296 million (+$37 million).

- Total assets stood at $8,905 million, including $31 million cash; long-term debt was $3,043 million (4.4% avg rate) and short-term borrowings totaled $80 million.

- Maintains strong liquidity with a $300 million unsecured revolver (no drawdowns) and $80 million outstanding commercial paper; debt/capitalization ratio of 0.49×.

- Accrued $25 million for remediation of former manufactured gas plant sites, with recovery under a Michigan rate mechanism.

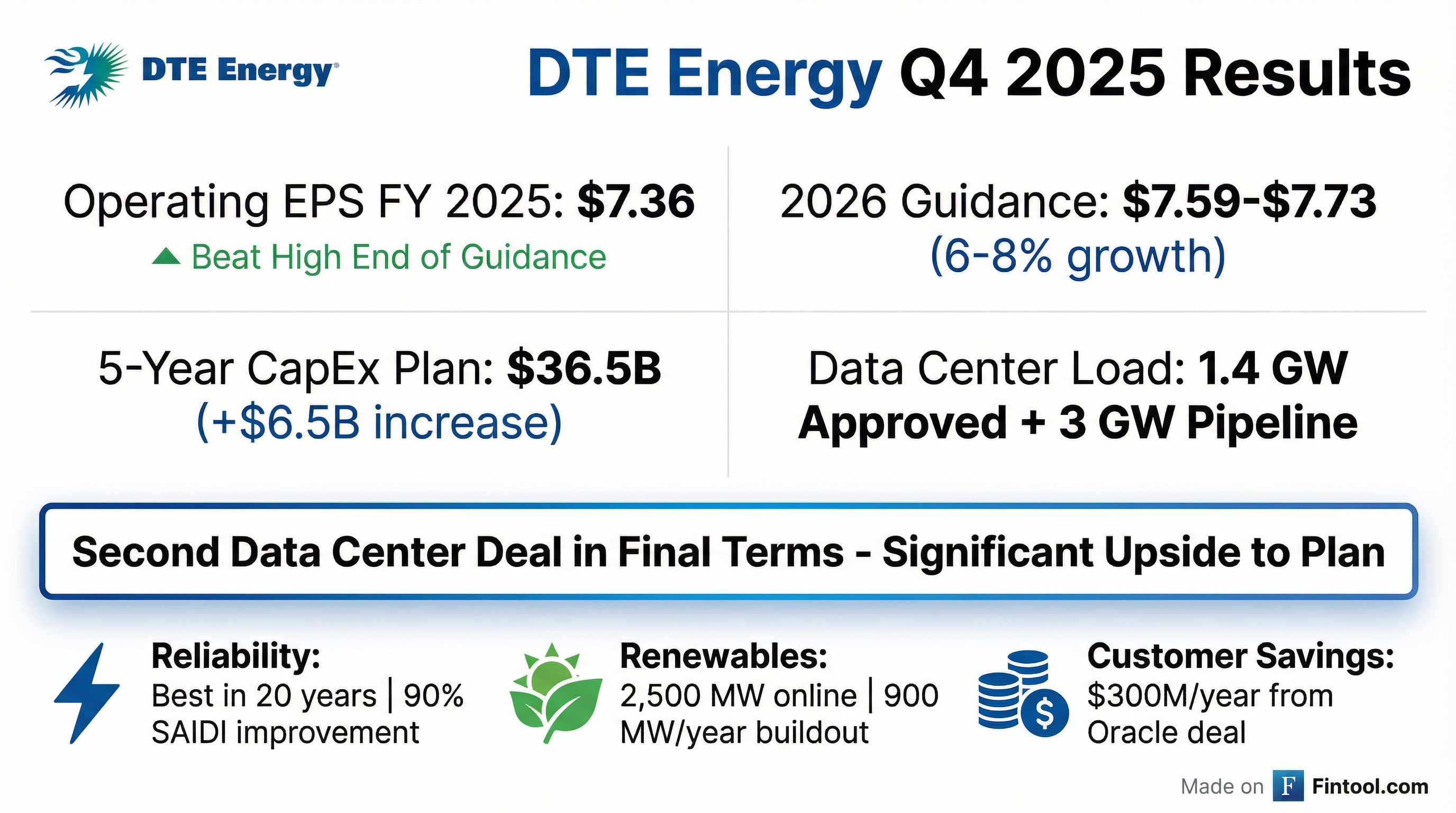

- DTE delivered $7.36 operating EPS and $1.5 billion of operating earnings in 2025, above the high end of its guidance range.

- For 2026, DTE targets $7.59–$7.73 operating EPS (6–8% growth) and expects to achieve the high end driven by RNG tax credits at DTE Vantage.

- Executed a 1.4 GW data center load contract, with an additional 3 GW in advanced discussions; these projects will drive nearly $2 billion of incremental storage investments.

- Raised its five-year capital investment plan by $6.5 billion to $36.5 billion, emphasizing utility modernization, cleaner generation, and data center load growth.

- Delivered $1.5 billion of operating earnings and $7.36 EPS in 2025, above guidance; 2026 operating EPS is guided to $7.59–$7.73 (6–8% growth).

- Five-year capital plan raised by $6.5 billion to $36.5 billion, driven by utility modernization and data center projects; targeting $500–600 million of annual equity issuances through 2028 to fund investments.

- Secured 1.4 GW of new data center load (construction started) and has 3 GW in advanced discussions, with a pipeline of 3–4 GW—projected to drive >8% EPS CAGR in 2027–2030.

- Advanced clean-energy strategy by placing 330 MW of solar in service (plus 745 MW under construction), operating ~2,500 MW of renewables, and progressing a 220 MW battery and 1,300 MW coal-to-gas conversion.

- Enhanced customer affordability: residential bills at <2% of median income (18% below national average) with $300 million of annual benefits from data center growth; provided $125 million in energy assistance and $15 million in donations in 2025.

- DTE delivered operating EPS of $7.36 in 2025, above the high end of its original guidance range.

- The company issued 2026 operating EPS guidance of $7.59–$7.73, implying 6%–8% growth over the 2025 midpoint.

- Its five-year capital investment plan was increased by $6.5 billion to $36.5 billion, focused on utility asset modernization, cleaner generation, and data center support.

- DTE executed a contract for 1.4 GW of new data center load (MPS-approved, construction underway) and is in advanced discussions for over 3 GW more, projected to deliver $300 million of annual customer affordability benefits once fully ramped.

- Record capital investments of $4.3 billion in 2025, including $3.6 billion for electric reliability and clean energy and $661 million for gas system upgrades.

- 2025 net income of $1.5 billion (or $7.03 per diluted share) versus $1.4 billion ($6.77) in 2024; operating EPS of $7.36 versus $6.83 in 2024.

- Secured a landmark 1.4 GW hyperscale data center agreement to power Oracle’s new Michigan facility, with costs fully covered by Oracle to protect existing customers.

- Confirmed 2026 operating EPS guidance of $7.59–$7.73 per share.

- Made record $4.3 billion in 2025 capital investments to enhance reliability and cleaner generation—$3.6 billion in electric and $661 million in gas infrastructure.

- Delivered 2025 net income of $1.5 billion (diluted EPS $7.03) and operating earnings of $1.5 billion (EPS $7.36), both up from 2024.

- Secured a 1.4 GW agreement to power Oracle’s new data center, approved by the Michigan PSC, expected to yield substantial affordability benefits for customers.

- Confirmed 2026 operating EPS guidance of $7.59–$7.73 (6–8% growth).

- On December 19, 2025, DTE Energy Company entered into an Equity Distribution Agreement with a syndicate of investment banks to offer and sell common stock up to an aggregate of $1.5 billion.

- Sales may be conducted on the NYSE via ordinary brokers’ transactions, block trades, or principal purchases by managers, with a commission of up to 2% of gross proceeds per transaction.

- The agreement also authorizes DTE to enter into related forward sale agreements under master forward confirmations, whereby forward purchasers borrow and sell shares equal to the hedged amount, subject to the same $1.5 billion cap.

- 2025 operating EPS guidance set at $7.09–$7.23 and early 2026 outlook of $7.59–$7.73, reflecting 6–8% growth with confidence in achieving the high end of both ranges.

- 5-year capital plan increased by $6.5 billion to $36.5 billion, driven by data center agreements and cleaner generation investments, aiming to shift utility earnings to 93% of total by 2030.

- Executed a 1.4 GW Oracle data center power agreement (including a 19-year PPA and $2 billion of storage investment) and is in late-stage talks for an additional ~3 GW of load.

- Maintains investment-grade credit ratings (S&P BBB, Moody’s Baa2, Fitch BBB) and targets $500–$600 million of annual equity issuances through 2028 to support growth.

- DTE Energy set its 2025 operating EPS guidance at $7.09–$7.23 and provided a 2026 early outlook of $7.59–$7.73, reflecting 6%–8% growth over the 2025 midpoint and expressing confidence in achieving the high end of both ranges.

- The company increased its 5-year capital investment plan by $6.5 billion to $36.5 billion, driven by data center agreements, cleaner generation projects, and reliability upgrades.

- Executed a 19-year, ~1.4 GW data center power supply agreement supporting a $2 billion energy storage investment, which is expected to deliver ~$300 million in annual affordability benefits to existing customers once fully ramped.

- Maintains an investment-grade credit profile (e.g., DTE Energy at BBB/Baa2/BBB) and is targeting ~15% FFO/Debt, with plans for $500–$600 million of annual equity issuances through 2028 to support its growth agenda.

- On October 28, 2025, DTE Electric entered a Primary Supply Agreement with Oracle’s Green Chile Ventures LLC to deliver 1.4 GW of electricity to a new Michigan data center through February 2045, ramping to full delivery by December 2027, with minimum monthly charges and potential early termination fees.

- Simultaneously, DTE Electric executed an Energy Storage Agreement to build and operate 1.4 GW of storage capacity for 15 years (with extension options), with credit support provided by Customer’s parent.

Quarterly earnings call transcripts for DTE ENERGY.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more