Earnings summaries and quarterly performance for EQUITY LIFESTYLE PROPERTIES.

Executive leadership at EQUITY LIFESTYLE PROPERTIES.

Board of directors at EQUITY LIFESTYLE PROPERTIES.

Research analysts who have asked questions during EQUITY LIFESTYLE PROPERTIES earnings calls.

Eric Wolfe

Citi

12 questions for ELS

John Kim

BMO Capital Markets

12 questions for ELS

Michael Goldsmith

UBS

12 questions for ELS

Wesley Golladay

Robert W. Baird & Co.

10 questions for ELS

Jamie Feldman

Wells Fargo & Company

9 questions for ELS

Steve Sakwa

Evercore ISI

9 questions for ELS

Jana Galan

Bank of America

8 questions for ELS

Jason Wayne

Barclays

8 questions for ELS

Brad Heffern

RBC Capital Markets

7 questions for ELS

David Segall

Green Street

7 questions for ELS

Omotayo Okusanya

Deutsche Bank AG

5 questions for ELS

David Siegel

Green Street Advisors

3 questions for ELS

Anthony Hau

Truist Securities

2 questions for ELS

James Feldman

Wells Fargo

2 questions for ELS

Jana Gallen

Bank of America

2 questions for ELS

John Pawlowski

Green Street

2 questions for ELS

Samir Khanal

Bank of America

2 questions for ELS

Amadeo Ocasana

Deutsche Bank

1 question for ELS

Brad Heffer

RBC

1 question for ELS

Cooper Clark

Wells Fargo

1 question for ELS

Jason Conley

Barclays

1 question for ELS

Joshua Dennerlein

BofA Securities

1 question for ELS

Keegan Carl

Wolfe Research, LLC

1 question for ELS

Mason P. Guell

Robert W. Baird & Co. Incorporated

1 question for ELS

Michael Bilerman

Wells Fargo & Company

1 question for ELS

Nicholas Joseph

Citigroup

1 question for ELS

Peter Abramowitz

Jefferies

1 question for ELS

Thomas Asakiana

Deutsche Bank AG

1 question for ELS

Wesley Gallaudet

Bayer

1 question for ELS

Recent press releases and 8-K filings for ELS.

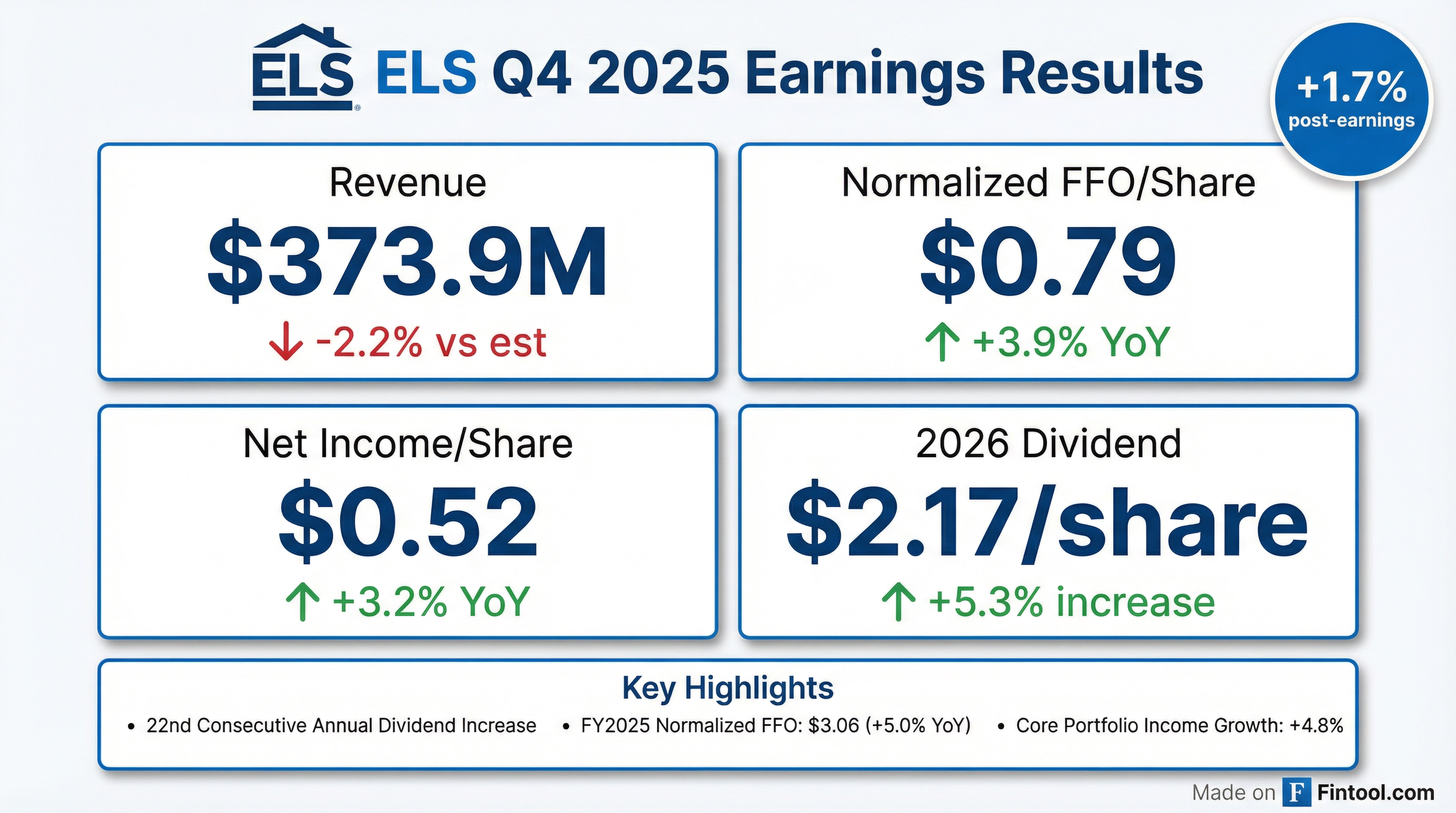

- ELS reported full-year 2025 normalized FFO per share of $3.06, a 5% increase from the prior year, and core NOI growth of 4.8%.

- For 2026, ELS provided initial guidance for normalized FFO of $3.17 per share at the midpoint, representing 3.7% growth.

- The board approved a 5.3% increase in the annual dividend rate to $2.17 per share, marking the 22nd consecutive year of annual dividend growth.

- The company's balance sheet is strong with debt to EBITDARE of 4.5 times and interest coverage of 5.7 times, with no secured debt maturing before 2028.

- Core property operating expenses increased 1% for the full year 2025, with 2026 guidance projecting 2.7%-3.7% growth.

- Equity LifeStyle Properties (ELS) reported strong full-year 2025 results, with 4.8% growth in Net Operating Income (NOI) and a 5% increase in normalized FFO per share.

- For full-year 2026, ELS anticipates normalized FFO growth of 3.7% and has approved an annual dividend rate of $2.17 per share, marking a 5.3% increase.

- The company's business model is supported by annual rental streams comprising over 90% of revenue, with core community-based rental income increasing 5.5% in 2025.

- ELS maintains a solid balance sheet with a debt to EBITDARE of 4.5 times and interest coverage of 5.7 times, and expects approximately $100 million of discretionary capital in 2026 after meeting obligations.

- Equity LifeStyle Properties reported strong full-year 2025 results, with normalized FFO per share increasing 5% and Net Operating Income (NOI) growing 4.8%.

- For full-year 2026, the company provided guidance for normalized FFO of $3.17 per share (midpoint) and anticipates core NOI growth between 5.1% and 6.1%.

- The board approved a 2026 annual dividend rate of $2.17 per share, marking a 5.3% increase and the 22nd consecutive year of annual dividend growth.

- The company noted that transaction activity for acquisitions remains constrained, leading to a focus on internal growth, operations, and expansions.

- Equity LifeStyle Properties, Inc. reported Normalized FFO per Common Share and OP Unit of $0.79 for Q4 2025, an increase from $0.76 in Q4 2024. For the full year 2025, Normalized FFO per Common Share and OP Unit was $3.06, a 5.0% increase compared to $2.91 in 2024.

- The company's Board of Directors approved setting the annual dividend rate for 2026 at $2.17 per share, representing a 5.3% increase over the 2025 rate.

- For the full year 2026, Equity LifeStyle Properties, Inc. provided guidance for Normalized FFO per Common Share and OP Unit between $3.12 and $3.22.

- In 2025, the company added 362 expansion sites and recorded 439 new home sales.

- Equity LifeStyle Properties (ELS) reported Net Income per Common Share of $0.52 for the quarter ended December 31, 2025, and $2.01 for the full year 2025.

- Normalized Funds from Operations (FFO) per Common Share was $0.79 for Q4 2025 and $3.06 for the full year 2025.

- The company provided 2026 full-year guidance, projecting Normalized FFO per Common Share between $3.12 and $3.22.

- ELS's Board of Directors approved a 5.3% increase in the annual dividend rate for 2026, setting it at $2.17 per share.

- For the year ended December 31, 2025, ELS added 362 expansion sites and sold 439 new homes.

- Clarion Partners has acquired Sancerre at Atlee Station, a Class A senior living community in Mechanicsville, VA, marking its first senior housing acquisition.

- As part of the transaction, Clarion Partners formed a strategic partnership with Experience Senior Living (ESL), which will continue to manage and operate the community.

- Sancerre at Atlee Station, which opened in September 2023, achieved 90% occupancy by October 2024.

- For Q2 2025, Equity LifeStyle Properties reported normalized FFO of $0.69 per share , with year-to-date normalized FFO per share growth of 5.7%. Core Net Operating Income (NOI) increased 6.4% in Q2 2025 and 5% year-to-date.

- The company maintained its full-year 2025 normalized FFO guidance at $3.06 per share at the midpoint, which represents an estimated 0.9% growth compared to 2024.

- The Manufactured Housing (MH) portfolio, which accounts for approximately 60% of total revenue, experienced 5.5% revenue growth in Q2 2025 and maintained over 94% occupancy. However, the RV and Marina annual revenue guidance was reduced due to higher attrition, particularly impacting 20 properties in the North and Northeast.

- Equity LifeStyle Properties' balance sheet remains strong, with a debt to EBITDAre of 4.5 times and interest coverage of 5.6 times, providing access to over $1 billion in capital as of Q2 2025.

- ELS operates a high-quality portfolio of manufactured home communities, RV resorts, campgrounds, and marinas across North America, and is a S&P 400 company with an enterprise value of $16.6 billion.

- Q1 2025 performance shows robust growth with core property operating revenues up 2.9%, MH base rental income up 5.5%, and RV/marina annual base rental income up 4.1%.

- The presentation confirms full-year 2025 guidance with Normalized FFO per share between $3.01 and $3.11 and an approved annual dividend rate increase to $2.06 per share.

- Officer appointments: Marguerite Nader was named Vice Chairman while continuing as CEO, and Patrick Waite was promoted to President, effective April 29, 2025.

- Annual meeting results: The meeting saw shareholder votes that elected board members, ratified Ernst & Young LLP as the auditor, and approved executive compensation on a non-binding advisory basis.

- Dividend declaration: The company declared a Q2 2025 dividend of $0.515 per share, with a payment date set for July 11, 2025.

- Q1 2025 Financial Results: Normalized FFO per common share increased by 6.7% to $0.83 with full-year guidance of $3.06 per share, while net income per common share was $0.57 (down 3.0% YoY)

- Core Operating Performance: The core portfolio achieved 3.8% NOI growth, with rental revenues up 2.9% and core income increased by 3.8%

- MH Segment Highlights: Overall occupancy held at 94% and homeowner occupancy at 97%, despite the loss of approximately 170 occupied sites due to hurricanes

- MH Base & New Home Sales: Base rental income grew by 5.5% with 117 new home sales at an average price of approximately $81,000

- Other Revenue Metrics: Core RV and marina annual base rental income increased by 4.1%, and property & casualty insurance premiums decreased by 6.1%

- Financial Flexibility: The balance sheet remains resilient with a weighted average debt maturity of 8.4 years and access to $1 billion in capital

Quarterly earnings call transcripts for EQUITY LIFESTYLE PROPERTIES.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more