Earnings summaries and quarterly performance for Enphase Energy.

Executive leadership at Enphase Energy.

Board of directors at Enphase Energy.

Research analysts who have asked questions during Enphase Energy earnings calls.

Brian Lee

Goldman Sachs Group, Inc.

8 questions for ENPH

Colin Rusch

Oppenheimer & Co. Inc.

8 questions for ENPH

Christine Cho

Goldman Sachs Group

7 questions for ENPH

Julien Dumoulin-Smith

Jefferies

7 questions for ENPH

Praneeth Satish

Wells Fargo

7 questions for ENPH

Maheep Mandloi

Mizuho Financial Group

6 questions for ENPH

Philip Shen

ROTH MKM

6 questions for ENPH

Dylan Nassano

Wolfe Research

5 questions for ENPH

Mark W. Strouse

J.P. Morgan Chase & Co.

4 questions for ENPH

Vikram Bagri

Citigroup Inc.

4 questions for ENPH

Austin Moeller

Canaccord Genuity

3 questions for ENPH

Chris Dendrinos

RBC Capital Markets

3 questions for ENPH

Dimple Gosai

Bank of America

3 questions for ENPH

Eric Stine

Craig-Hallum Capital Group LLC

3 questions for ENPH

Kashy Harrison

Piper Sandler

3 questions for ENPH

Andrew Percoco

Morgan Stanley

2 questions for ENPH

David Benjamin

Mizuho Securities USA LLC

2 questions for ENPH

Gus Richard

Northland Capital Markets

2 questions for ENPH

Joseph Osha

Guggenheim Partners

2 questions for ENPH

Moses Sutton

BNP Paribas

2 questions for ENPH

Phil Shen

ROTH Capital

2 questions for ENPH

David Arcaro

Morgan Stanley

1 question for ENPH

Dushyant Ailani

Jefferies

1 question for ENPH

Gordon Johnson

GLJ Research

1 question for ENPH

Jeffrey Osborne

TD Cowen

1 question for ENPH

Jordan Levy

Truist Securities

1 question for ENPH

Pavel Molchanov

Raymond James

1 question for ENPH

Recent press releases and 8-K filings for ENPH.

- SolSource Solutions and TriBeam Financial launched Propel, a streamlined third-party ownership product for residential solar and battery financing, integrating SolSource’s TPO platform with TriBeam’s low-cost loan origination capabilities.

- Enphase Energy serves as the exclusive provider of domestic-content inverters and batteries, along with Enphase Care O&M services, Solargraf design tools, and safe-harbor support.

- Propel offers fixed payment long-term PPAs or leases with no hidden fees or escalators, passes tax credit benefits to homeowners, and permits system ownership after five years.

- Greentech Renewables supplies national distribution and installer support, TriBeam’s Concert Finance streamlines point-of-sale lending, and Chris Couture has been appointed SolSource CEO to lead national expansion.

- Pomerantz LLP filed a class action lawsuit against Enphase Energy, Inc. and certain officers on behalf of investors who purchased Enphase securities between April 22, 2025 and October 28, 2025, alleging violations of Sections 10(b) and 20(a) of the Exchange Act.

- The complaint alleges Enphase overstated its ability to manage channel inventory and to mitigate the impact of the Residential Clean Energy Credit (Section 25D) termination, thereby overstating its financial and operational prospects.

- On October 28, 2025, Enphase reported Q3 2025 results and warned of a weak Q4 due to elevated channel inventory and the credit expiration, prompting a 15.15% stock price drop to $31.14 on October 29, 2025.

- Investors have until April 20, 2026 to seek appointment as Lead Plaintiff.

- A class action lawsuit (docket 26-cv-01380) was filed on Feb 24, 2026 in the Northern District of California against Enphase Energy and certain officers, covering securities purchased from April 22 to October 28, 2025; lead plaintiff motions are due by April 20, 2026.

- Plaintiffs allege Enphase overstated its channel inventory management and its ability to mitigate the termination of the 25D residential clean energy tax credit, thereby overstating its financial and operational prospects.

- On October 28, 2025, Enphase reported Q3 2025 results and warned of elevated channel inventory impacting Q4 battery shipments and the 25D credit expiration hurting Q1 2026 revenues; the stock fell 15.15% to close at $31.14 on October 29.

- On February 19, 2026, Pomerantz LLP filed a securities class action against Enphase Energy and certain officers in the Northern District of California, covering purchases from April 22 to October 28, 2025.

- The complaint alleges Enphase overstated its channel inventory management, ability to mitigate the termination of the 25D tax credit, and its financial prospects, making public statements materially misleading.

- In its Q3 2025 earnings on October 28, 2025, Enphase warned of weak Q4 shipments and a revenue hit in Q1 2026 due to elevated inventory and the 25D credit expiration.

- Following the earnings release, Enphase's stock fell 15.15% ($5.56) to $31.14 on October 29, 2025.

- Enphase introduced Power Control software for IQ9™ and IQ8™ microinverter-based small commercial solar systems to help installers cut costs, simplify interconnection, and unlock stalled projects.

- The solution lets installers set aggregate export limits directly in the Enphase Installer App, requiring an IQ® Gateway Commercial 2 or Commercial Pro with CTs or a DTS-310 remote meter.

- Enphase is one of the few suppliers with California Energy Commission–listed power control configurations, enabling non-export and limited-export setups without extra third-party hardware.

- The company began production shipments of its GaN-based IQ9™ Commercial Microinverters for three-phase 480Y/277 V grids, expanding its integrated hardware-plus-software commercial platform.

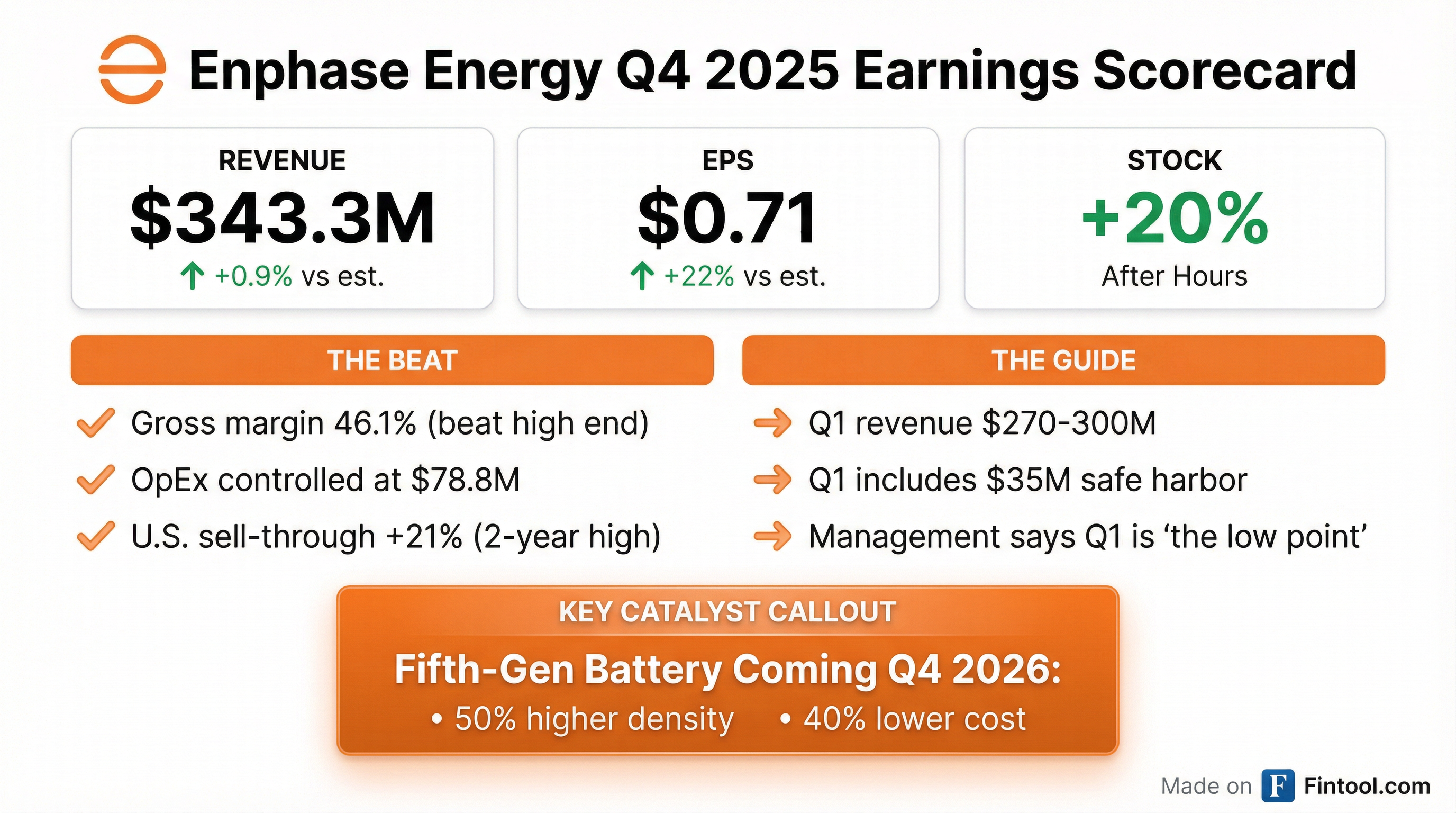

- Revenue of $343.3 million and non-GAAP EPS of $0.71 for Q4 topped Street views, despite year-over-year declines.

- GAAP profit of $38.7 million ($0.29/share) beat expectations but fell from $62.2 million ($0.45) a year earlier.

- Q1 revenue guidance of $270 – 300 million (midpoint $285 million) exceeded analyst forecasts, underpinning the 22% after-hours surge.

- Unit sales plunged 34.9% to 1.31 million, while operating margin slid to 6.5% from 14.3% a year ago, highlighting near-term pressures.

- Liquidity remains solid (current ratio 2.04, quick ratio 1.88), but debt/equity at 1.22 and an Altman Z-Score near 2.29 signal potential caution.

- Revenue of $343.3 M, shipments of 682.6 MW of microinverters and 150.1 MWh of IQ batteries, including $20.3 M in safe harbor sales.

- Q4 non-GAAP gross margin declined to 46.1% (GAAP 44.3%), down from 49.2% in Q3, with a 5.1% tariff headwind.

- Cash, equivalents & marketable securities totaled $1.51 B; $337 M net PTC receivable; planning to repay $632.5 M of convertible notes due March 2026.

- Q1 2026 guidance: revenue $270–300 M (∼90% booked), GAAP gross margin 40–43%, non-GAAP gross margin 42–45%.

- CEO emphasized upcoming 5th gen battery, IQ9 GaN microinverters and IQ EV Charger launches to drive cost improvements and offset tariffs.

- Enphase reported Q4 revenue of $343.3 million, shipping 682.6 MW DC of microinverters and 150.1 MWh of IQ batteries; non-GAAP gross margin was 46.1% and non-GAAP EPS $0.71 (GAAP EPS $0.29).

- For Q1 2026, the company guided revenue of $270–300 million (including 120 MWh of IQ batteries and ~$35 million of safe harbor revenue) with GAAP gross margin of 40–43% and non-GAAP gross margin 42–45%.

- The balance sheet ended Q4 with $1.51 billion in cash and equivalents; management will use cash to settle a $632.5 million convertible note due March 1, 2026, and retains $269 million of share repurchase authorization.

- Continued product innovation: rolled out PowerMatch software (up to 40% performance boost), began shipping IQ9 3P commercial microinverters (50,000 units ordered for Q1) and IQ EV Charger 2, and plans Q3 2026 pilots for its 5th-generation battery.

- Revenue of $343.3 M, shipped 682.6 MW DC of microinverters and 150.1 MWh of batteries; generated free cash flow of $37.8 M.

- Non-GAAP gross margin of 46.1% and GAAP gross margin of 44.3%; non-GAAP EPS of $0.71 and GAAP EPS of $0.29 in Q4.

- Q1 2026 revenue guidance of $270 M–$300 M (includes ~$35 M of safe harbor revenue); non-GAAP gross margin expected at 42%–45%.

- Product rollouts included shipping IQ9 3P commercial microinverters and IQ EV Charger 2, with fifth-generation battery pilots planned for Q3 2026.

- Revenue of $343.3 million in Q4 2025; GAAP gross margin of 44.3% and non-GAAP gross margin of 46.1%

- GAAP net income of $38.7 million (diluted EPS $0.29) and non-GAAP net income of $93.4 million (diluted EPS $0.71)

- Free cash flow of $37.8 million; ending cash, cash equivalents and marketable securities of $1.51 billion

- Shipments of ~1.55 million microinverters (682.6 MW DC) and 150.1 MWh of IQ Batteries in Q4 2025

- Q1 2026 guidance: revenue of $270–300 million; GAAP gross margin 40–43%; non-GAAP gross margin 42–45%

Quarterly earnings call transcripts for Enphase Energy.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more