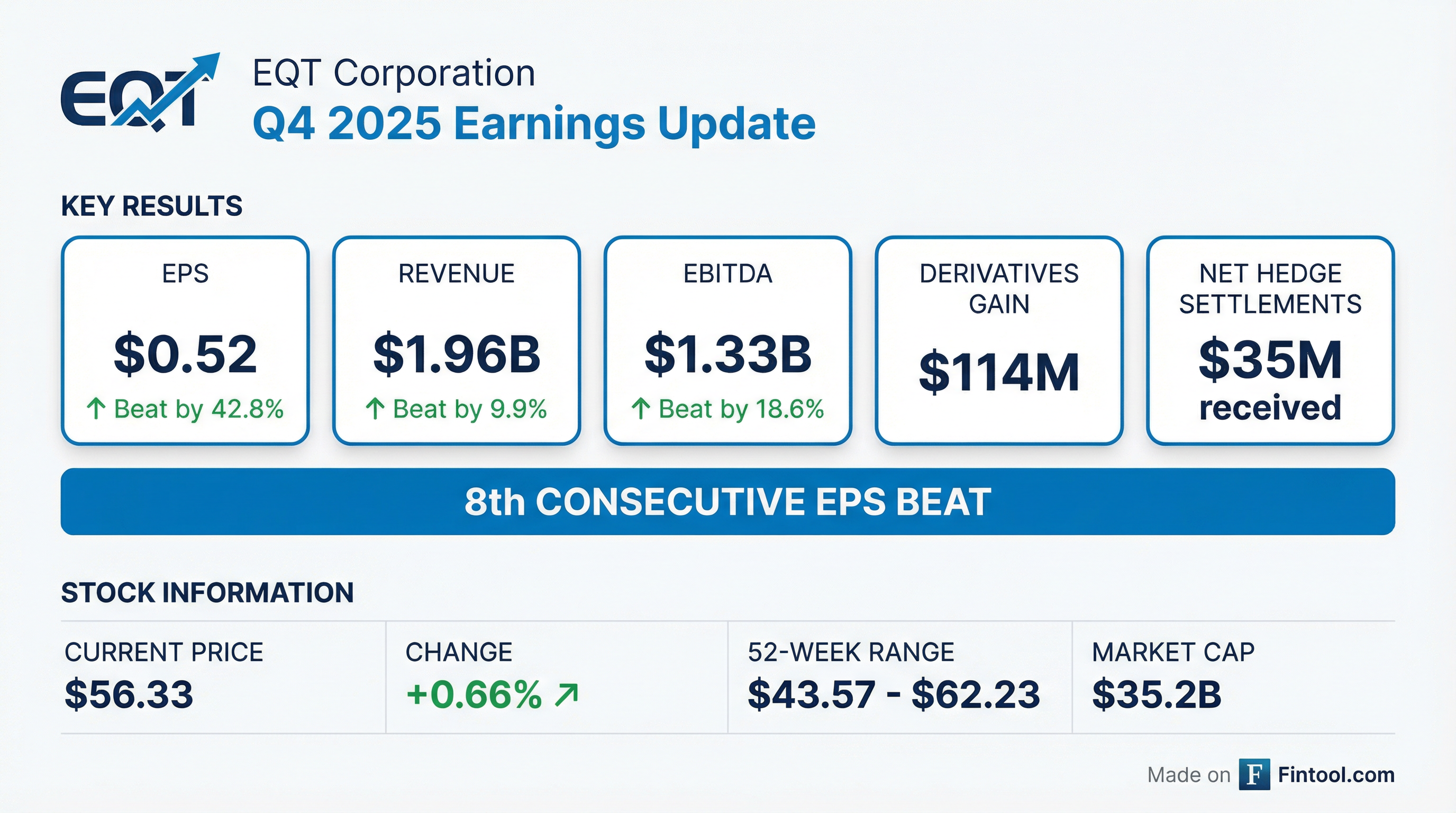

Earnings summaries and quarterly performance for EQT.

Executive leadership at EQT.

Board of directors at EQT.

Daniel J. Rice IV

Director

Dr. Kathryn J. Jackson

Director

Frank C. Hu

Director

Hallie A. Vanderhider

Director

John F. McCartney

Director

Lee M. Canaan

Director

Robert F. Vagt

Director

Thomas F. Karam

Independent Chair of the Board

Vicky A. Bailey

Director

Research analysts who have asked questions during EQT earnings calls.

Neil Mehta

Goldman Sachs

8 questions for EQT

Arun Jayaram

JPMorgan Chase & Co.

7 questions for EQT

Betty Jiang

Barclays

5 questions for EQT

Doug Leggate

Wolfe Research

5 questions for EQT

Jacob Roberts

TPH & Co.

5 questions for EQT

Kalei Akamine

Bank of America

5 questions for EQT

Phillip Jungwirth

BMO Capital Markets

5 questions for EQT

David Deckelbaum

TD Cowen

4 questions for EQT

Devin Mcdermott

Morgan Stanley

4 questions for EQT

Roger Read

Wells Fargo & Company

4 questions for EQT

Scott Hanold

RBC Capital Markets

4 questions for EQT

Josh Silverstein

UBS Group

3 questions for EQT

Kaleinoheaokealaula Akamine

Bank of America

3 questions for EQT

Kevin MacCurdy

Pickering Energy Partners

3 questions for EQT

Bert Donnes

William Blair

2 questions for EQT

Bertrand Donnes

Truist Securities

2 questions for EQT

Bob Brackett

Bernstein Research

2 questions for EQT

Douglas George Blyth Leggate

Wolfe Research

2 questions for EQT

Joshua Silverstein

UBS Group AG

2 questions for EQT

Lloyd Byrne

Jefferies LLC

2 questions for EQT

Neal Dingmann

Truist Securities

2 questions for EQT

Nitin Kumar

Mizuho Securities USA

2 questions for EQT

Noel Parks

Tuohy Brothers

2 questions for EQT

Sam Margolin

Wells Fargo & Company

2 questions for EQT

Chen Anis

Dexus Capital

1 question for EQT

Jake Roberts

TPH&Co.

1 question for EQT

John Abbott

Wolfe Research

1 question for EQT

John Annis

Texas Capital Bank

1 question for EQT

John Ennis

Texas Capital

1 question for EQT

Michael Scialla

Stephens Inc.

1 question for EQT

Scott Gruber

Citigroup

1 question for EQT

Recent press releases and 8-K filings for EQT.

- EdgeConneX, an EQT Infrastructure portfolio company, plans to acquire a site from Lyten in Skellefteå, Sweden, to develop a data center campus with up to 1 gigawatt of capacity for AI and cloud workloads.

- The project, pending regulatory approval, would be primarily powered by renewable energy, positioning it among Europe’s largest sustainable digital infrastructure hubs.

- EQT underscores the expansion as part of its strategy to build resilient digital infrastructure in the Nordics and enhance Sweden’s AI competitiveness.

- Skellefteå’s municipal leadership welcomes the investment, citing benefits for long-term regional growth and innovation.

- $750 million of free cash flow in Q4, exceeding consensus by $200 million, and net debt reduced to $7.7 billion, with Q1 2026 debt projected below $6 billion

- 2.275–2.375 TCFE production guided for 2026, with maintenance capex of $2.07–2.21 billion, $600 million allocated to high-return growth projects, and expected 2026 FCF of $3.5 billion (or over $4 billion before growth spending)

- 2025 operational efficiencies drove 13% lower well cost per lateral foot year-over-year (6% below forecast) and marketing optimization delivered over $200 million in FCF uplift

- Hedging for 2026 includes approximately 40% of Q1 volumes at an average floor/ceiling of $4.30/$6.30 per MMBtu, with ~20% hedged in Q2–Q4

- Delivered $2.5 billion of free cash flow in 2025; per-unit LOE was ~15% below expectations and ~50% below peers, with NYMEX natural gas at $3.40/MMBtu for the year.

- Initiating 2026 guidance of 2.275–2.375 TCFE production, $2.07–2.21 billion maintenance capex, and projecting $6.5 billion EBITDA and $3.5 billion free cash flow (>$4 billion pre-growth), with >$16 billion cumulative FCF over five years.

- Exercised option to acquire additional stakes in Mountain Valley Pipeline Mainline and Boost, funding $115 million to boost ownership to ~53%, at ~9× Adjusted EBITDA and a 12% IRR.

- Winter Storm Fern performance: MVP flowed ~2.12 Bcf/d (6% above nameplate), backstopping 14 GW of power, while Transco Station 165 spot prices exceeded $130/MMBtu.

- In 2025, EQT generated $2.5 billion of free cash flow at $3.40/MMBtu NYMEX prices, driven by operational outperformance including 15% higher-than-expected base production uplift and 13% lower well costs per lateral foot.

- EQT increased its ownership in MVP Mainline and MVP Boost to ~53% by funding $115 million, reflecting a 9x EV/EBITDA purchase at a 12% IRR under 20-year contracts.

- For 2026, EQT guides production of 2.275–2.375 TCFE, maintenance capex of $2.07–2.21 billion, and allocates $600 million of post-dividend free cash flow to high-return growth projects, targeting $6.5 billion Adjusted EBITDA and $3.5 billion free cash flow.

- Total debt is nearing $5 billion, with leverage set to decline; levered breakeven is approximately $2.20/MMBtu, positioning EQT to continue debt reduction and opportunistic investments.

- Adjusted EBITDA of $1,509 million and Free Cash Flow of $744 million in Q4; delivered ~$2.5 billion of FCF in 2025, beating consensus by ~$500 million.

- Q4 sales volumes of 609 Bcfe, average realized price of $3.44/Mcfe, operating costs of $1.10/Mcfe, with CAPEX of $655 million.

- Ended 2025 with net debt of ~$7.7 billion and expect to reduce to sub-$6 billion by Q1 2026.

- Increased ownership in MVP Mainline and Boost to ~53% for $115 million; 2026 outlook: ~$3.5 billion FCF and ~$4.7 billion net debt.

- 2026 guidance: 2,275–2,375 Bcfe sales volumes, $1.07–$1.21/Mcfe operating costs, $2.07–$2.21 billion maintenance CAPEX and $580–$640 million growth CAPEX.

- EQT reported Q4 2025 production of 609 Bcfe, capital expenditures of $655 million, net cash from operating activities of $1,125 million, and free cash flow attributable of $744 million.

- For full year 2025, total sales volume was 2,382 Bcfe, net cash provided by operating activities was $5,126 million, and free cash flow attributable was $2,503 million.

- The company exited Q4 with net debt of $7.7 billion, and projects net debt to be below $6 billion by the end of Q1 2026.

- 2026 guidance includes production of 2,275–2,375 Bcfe, maintenance capital expenditures of $2,070–$2,210 million, and free cash flow of approximately $3.5 billion, with net debt expected to exit at $4.7 billion.

- Proved reserves increased 7% year-over-year to 28.0 Tcfe, with a PV-10 value of $26 billion at SEC pricing.

- 4Q 2025 production of 609 Bcfe; capital expenditures of $655 M; free cash flow attributable to EQT of $744 M

- FY 2025 sales volume of 2,382 Bcfe; net income attributable to EQT of $2.04 B; free cash flow attributable to EQT of $2.50 B

- 2026 guidance: production of 2,275–2,375 Bcfe; maintenance CapEx of $2,070–2,210 M; projected free cash flow of ~$3.5 B

- Increased Mountain Valley Pipeline ownership from ~49% to ~53% via a $115 M acquisition, implying a 9× adjusted EBITDA multiple and 12% IRR

- EQT-backed Zelestra and Meta signed a long-term PPA for the 176 MWdc Skull Creek Solar Plant in Texas, supporting Meta’s 100% clean energy goals.

- The partnership now encompasses seven US PPAs totaling 1.2 GWdc of solar capacity, all scheduled to be operational by 2028.

- Zelestra’s 81 MWdc Jasper County Solar Project in Indiana has reached full commercial operations, marking the first plant in the collaboration to go online.

- Two additional projects began construction in late 2025, with the remainder slated for groundbreaking in 2026.

- Global Infrastructure Partners (GIP) and EQT are in advanced talks to jointly acquire AES Corp., with a potential agreement expected in the coming weeks.

- AES’s generation portfolio spans 32 GW—approximately 50% renewable—across 15 countries, serving over 2.5 million utility customers and reporting $12.09 billion in revenue.

- The company has a market capitalization of about $10.5 billion and an enterprise value of roughly $43 billion, and is exploring strategic options after prior takeover interest.

- AES faces financial headwinds, including a debt-to-equity ratio of 7.98, a current ratio of 0.72, and declining operating (14.78%) and net margins (8.74%).

- $114 million total gain on derivatives expected for Q4 2025

- $35 million net cash settlements received on derivatives, including $44 million received on NYMEX natural gas hedges and $(9) million paid on basis and liquids hedges

- $45 million of premiums paid for derivatives that settled during the period

- Preliminary figures are subject to change; final amounts will be disclosed in EQT’s Form 10-K or corresponding earnings release for the period ended December 31, 2025

Fintool News

In-depth analysis and coverage of EQT.

Quarterly earnings call transcripts for EQT.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more