Earnings summaries and quarterly performance for Empire State Realty Trust.

Executive leadership at Empire State Realty Trust.

Anthony E. Malkin

Chief Executive Officer

Christina Chiu

President

Jackie Renton

Chief Operating Officer of Real Estate

Ryan Kass

Chief Revenue Officer of Real Estate and Director of Leasing

Stephen V. Horn

Executive Vice President, Chief Financial Officer & Chief Accounting Officer

Thomas P. Durels

Executive Vice President, Real Estate

Board of directors at Empire State Realty Trust.

Research analysts who have asked questions during Empire State Realty Trust earnings calls.

Blaine Heck

Wells Fargo Securities

6 questions for ESRT

Dylan Burzinski

Green Street Advisors, LLC

5 questions for ESRT

John Kim

BMO Capital Markets

5 questions for ESRT

Steve Sakwa

Evercore ISI

4 questions for ESRT

Manus Ebbecke

Evercore ISI

2 questions for ESRT

Michael Griffin

Citigroup Inc.

2 questions for ESRT

Seth Bergey

Citi

2 questions for ESRT

Dylan Brzezinski

Green Street

1 question for ESRT

Jamie Feldman

Wells Fargo & Company

1 question for ESRT

Nick Joseph

Citigroup Inc.

1 question for ESRT

Nick Tristan

Citi

1 question for ESRT

Regan Sweeney

BMO Capital Markets

1 question for ESRT

Recent press releases and 8-K filings for ESRT.

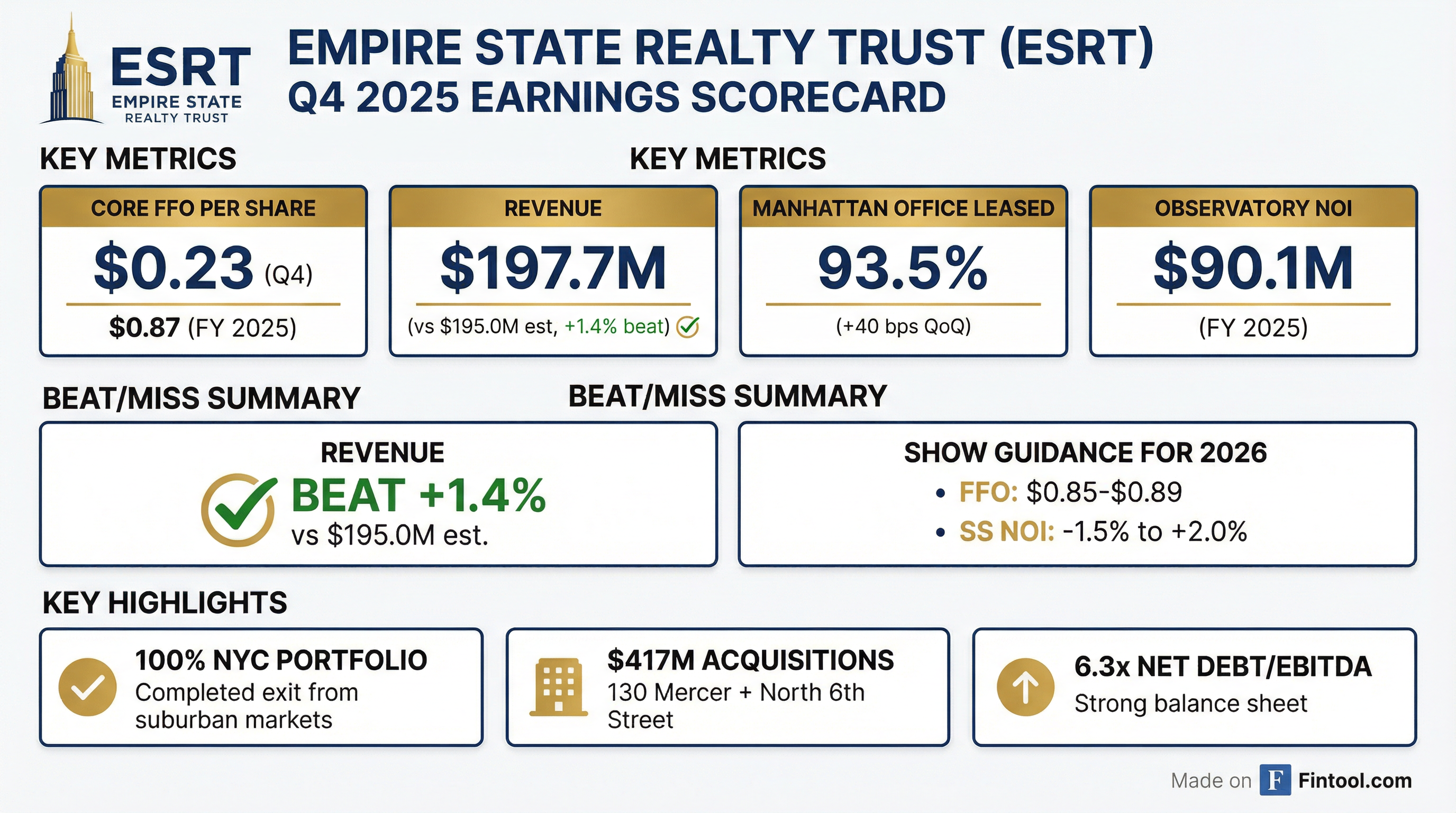

- Empire State Realty Trust (ESRT) reported full-year 2025 core FFO of $0.87 per diluted share and Q4 2025 core FFO of $0.23 per diluted share.

- The company achieved strong leasing momentum in 2025, leasing over 1 million sq ft for the year, with its office portfolio 93.5% leased and 6.4% positive mark-to-market lease spreads in Manhattan office for Q4.

- ESRT completed strategic capital recycling, including the acquisition of 130 Mercer for $386 million and the disposition of Metro Center, transitioning to a 100% New York City portfolio.

- For 2026, ESRT projects core FFO to range from $0.85 to $0.89 per diluted share and same-store property cash NOI growth between -1.5% and +2%, with year-end commercial occupancy expected to be 90%-92%.

- In Q4 2025, ESRT repurchased $6 million of shares at an average price of $6.73, contributing to a full-year total of $8 million in share repurchases.

- Empire State Realty Trust (ESRT) reported full-year 2025 core FFO of $0.87 per diluted share and Q4 2025 core FFO of $0.23 per diluted share.

- The company leased 1,000,000 sq ft for the year, with its office portfolio 93.5% leased, marking its 18th consecutive quarter of positive Mark-to-Market lease spreads in the Manhattan office portfolio.

- ESRT completed $417 million in all-cash acquisitions in 2025, including 130 Mercer for $386 million, as part of its transition to a 100% New York City portfolio.

- The company maintains a strong balance sheet with 6.3x net debt to Adjusted EBITDA and no unaddressed debt maturities until March 2027.

- For 2026, ESRT provided core FFO guidance of $0.85-$0.89 per diluted share and expects to reduce run rate G&A by 5%-10% by year-end 2026.

- Empire State Realty Trust reported Core FFO per share of $0.23 for Q4 2025 and $0.87 for the full year 2025, with 2026 FFO guidance set at $0.85-$0.89.

- The company completed its full exit from commercial suburban markets, transitioning to a NYC pure-play REIT by acquiring $417 million of well-located NYC office and retail assets in 2025.

- ESRT maintained a strong balance sheet with net debt to adjusted EBITDA of 6.3x and executed $8 million in share buybacks during 2025.

- The Manhattan office portfolio was 93.5% leased at the end of Q4 2025, with +6.4% positive mark-to-market on leases, marking the 18th consecutive quarter of positive spreads.

- Key management changes included the promotion of Christina Chiu to President and Steve Horn to CFO in 2024, and Ryan Kass and Jackie Renton to Co-Heads of Real Estate in 2025.

- Empire State Realty Trust (ESRT) reported full-year 2025 core FFO of $0.87 per diluted share and provided 2026 core FFO guidance of $0.85-$0.89 per diluted share.

- The company completed its portfolio transformation to 100% New York City assets, executing $417 million in all-cash acquisitions in 2025, including the $386 million purchase of 130 Mercer in December 2025, and disposing of its final suburban asset.

- ESRT demonstrated strong operational performance with 1 million sq ft leased in 2025, an office portfolio that is 93.5% leased, and 18 consecutive quarters of positive mark-to-market lease spreads in its office portfolio.

- The company completed $420 million in financings in Q4 2025, resulting in no unaddressed debt maturities until March 2027.

- Empire State Realty Trust (ESRT) announced long-term renewals totaling 68,120 square feet with T.J. Maxx for 46,437 square feet at 250 W. 57th Street and J.P. Morgan Chase for 21,683 square feet at One Grand Central Place.

- The T.J. Maxx renewal is effective Q4 2025, and the J.P. Morgan renewal is effective Q1 2026.

- These renewals reinforce the strength and stability of ESRT’s Midtown portfolio.

- One Grand Central Place, located across from Grand Central, also recently secured a 14,430-square-foot retail lease with Sora in October 2025 and an office expansion by iCapital to 219,928 square feet in February 2025.

- As of year-end 2025, ESRT's portfolio comprises approximately 7.6 million rentable square feet of office and 0.8 million rentable square feet of retail.

- Empire State Realty Trust (ESRT) announced two renewal leases and one expansion with Burlington Stores, Inc. and Nespresso in Q4 2025.

- Burlington Stores, Inc. expanded its space by 35,629 square feet and renewed its lease for a total of 206,392 square feet at 1400 Broadway.

- Nespresso renewed its lease for 41,835 square feet at 111 W. 33rd Street.

- Empire State Realty Trust (ESRT) reported its financial results for the fourth quarter and full year 2025, and provided its outlook for 2026. Key per share metrics are detailed in the table below :

| Metric | Q4 2025 | FY 2025 | FY 2026 (Low) | FY 2026 (High) |

|---|---|---|---|---|

| Net Income Per Fully Diluted Share ($USD) | $0.12 | $0.25 | N/A | N/A |

| Core FFO Per Fully Diluted Share ($USD) | $0.23 | $0.87 | $0.85 | $0.89 |

- The company completed $417 million of all-cash acquisitions in 2025, including the $386.0 million acquisition of 130 Mercer Street, and disposed of its last suburban office asset, Metro Center, transitioning its commercial portfolio to 100% New York City.

- ESRT repurchased approximately $6.0 million of common stock in Q4 2025 and $8.1 million for the full year 2025, and issued $175 million of senior unsecured notes.

- Empire State Realty Trust reported Net Income Per Fully Diluted Share of $0.12 for the fourth quarter of 2025 and $0.25 for the full year 2025, with Core FFO Per Fully Diluted Share of $0.23 for the fourth quarter and $0.87 for the full year 2025.

- The company completed $417 million of all-cash acquisitions of well-located, high-quality assets in 2025, including the $386.0 million acquisition of 130 Mercer Street. ESRT also exited its suburban commercial assets, transitioning to a 100% NYC commercial portfolio.

- For the fourth quarter of 2025, the total commercial portfolio occupancy was 90.3%, and the company signed 458,473 rentable square feet of commercial leases, with office blended leasing spreads at +6.4%.

- ESRT provided a 2026 outlook, projecting Core FFO Per Fully Diluted Share between $0.85 and $0.89, commercial occupancy at year-end between 90% and 92%, and Same-Store Property Cash NOI (excluding lease termination fees) between -1.5% and +2.0%.

- ES Bancshares, Inc. reported net income of $660 thousand and $0.10 per diluted common share for the fourth quarter ended December 31, 2025.

- The company's book value per share increased to $7.34 at December 31, 2025, marking its seventh consecutive quarter of growth.

- For the full year 2025, net income totaled $2.9 million, a significant increase from $1.1 million for the year ended December 31, 2024.

- The net interest margin for the three months ended December 31, 2025, was 2.77%, a slight decrease from 2.79% in the prior linked quarter.

- Total assets decreased by 3.2% to $616.3 million at December 31, 2025, compared to $636.7 million at December 31, 2024.

- Empire State Realty Trust (ESRT) reported Core FFO per share of $0.23 for Q3 2025 and reaffirmed its 2025 FFO guidance at $0.83-$0.86.

- The Manhattan office portfolio's occupancy increased sequentially by 80 basis points to 90.3%, with 93.1% leased, and achieved +3.9% positive mark-to-market for the 17th consecutive quarter.

- The ESB Observatory's Q3 NOI decreased by 10.6% year-over-year, impacted by lower demand from its pass program business, but its 2025 NOI guidance remains unchanged at $90-$94 million.

- ESRT maintains a strong balance sheet with 5.6x net debt to adjusted EBITDA and $0.8 billion in liquidity, and in October, announced the issuance of $175 million of 5.47% senior unsecured notes due in 2031.

Quarterly earnings call transcripts for Empire State Realty Trust.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more