Earnings summaries and quarterly performance for ITT.

Executive leadership at ITT.

Luca Savi

Chief Executive Officer and President

Bartek Makowiecki

Senior Vice President, Chief Strategy Officer and President, Industrial Process

Davide Barbon

Senior Vice President and President, Motion Technologies and Asia Pacific

Emmanuel Caprais

Senior Vice President and Chief Financial Officer

Emrana Sheikh

Senior Vice President and Chief Human Resources Officer

Lori Marino

Senior Vice President, Chief Legal Officer, Chief Compliance Officer & Secretary

Michael Guhde

Senior Vice President and President, Connect & Control Technologies

Board of directors at ITT.

Christopher O'Shea

Director

Donald DeFosset Jr.

Director

Douglas DelGrosso

Director

Kevin Berryman

Director

Maggie Chu

Director

Mary Laschinger

Director

Nazzic Keene

Director

Rebecca McDonald

Director

Sharon Szafranski

Director

Timothy Powers

Chairman of the Board

Research analysts who have asked questions during ITT earnings calls.

Jeffrey Hammond

KeyBanc Capital Markets

7 questions for ITT

Damian Karas

UBS

6 questions for ITT

Joseph Giordano

TD Cowen

6 questions for ITT

Michael Halloran

Baird

6 questions for ITT

Sabrina Abrams

Bank of America

6 questions for ITT

Vladimir Bystricky

Citigroup

5 questions for ITT

Nathan Jones

Stifel

4 questions for ITT

Joe Ritchie

Goldman Sachs

3 questions for ITT

Joseph Ritchie

Goldman Sachs

3 questions for ITT

Matt Summerville

D.A. Davidson & Co.

3 questions for ITT

Scott Davis

Melius Research

3 questions for ITT

Adam Farley

Stifel Financial Corp.

2 questions for ITT

Amit Mehrotra

UBS

2 questions for ITT

Bradley Hewitt

Wolfe Research

2 questions for ITT

Matthew Summerville

D.A. Davidson

2 questions for ITT

Mike Halloran

Robert W. Baird & Co. Incorporated

2 questions for ITT

Nathan Jones

Stifel, Nicolaus & Company, Incorporated

2 questions for ITT

Vladimir Bystricky

Citi

2 questions for ITT

Andrew Obin

Bank of America

1 question for ITT

Brad Hewitt

Wolfe Research, LLC

1 question for ITT

Michael Anastasiou

Cowen and Company

1 question for ITT

Vlad Bystricki

Citi

1 question for ITT

Recent press releases and 8-K filings for ITT.

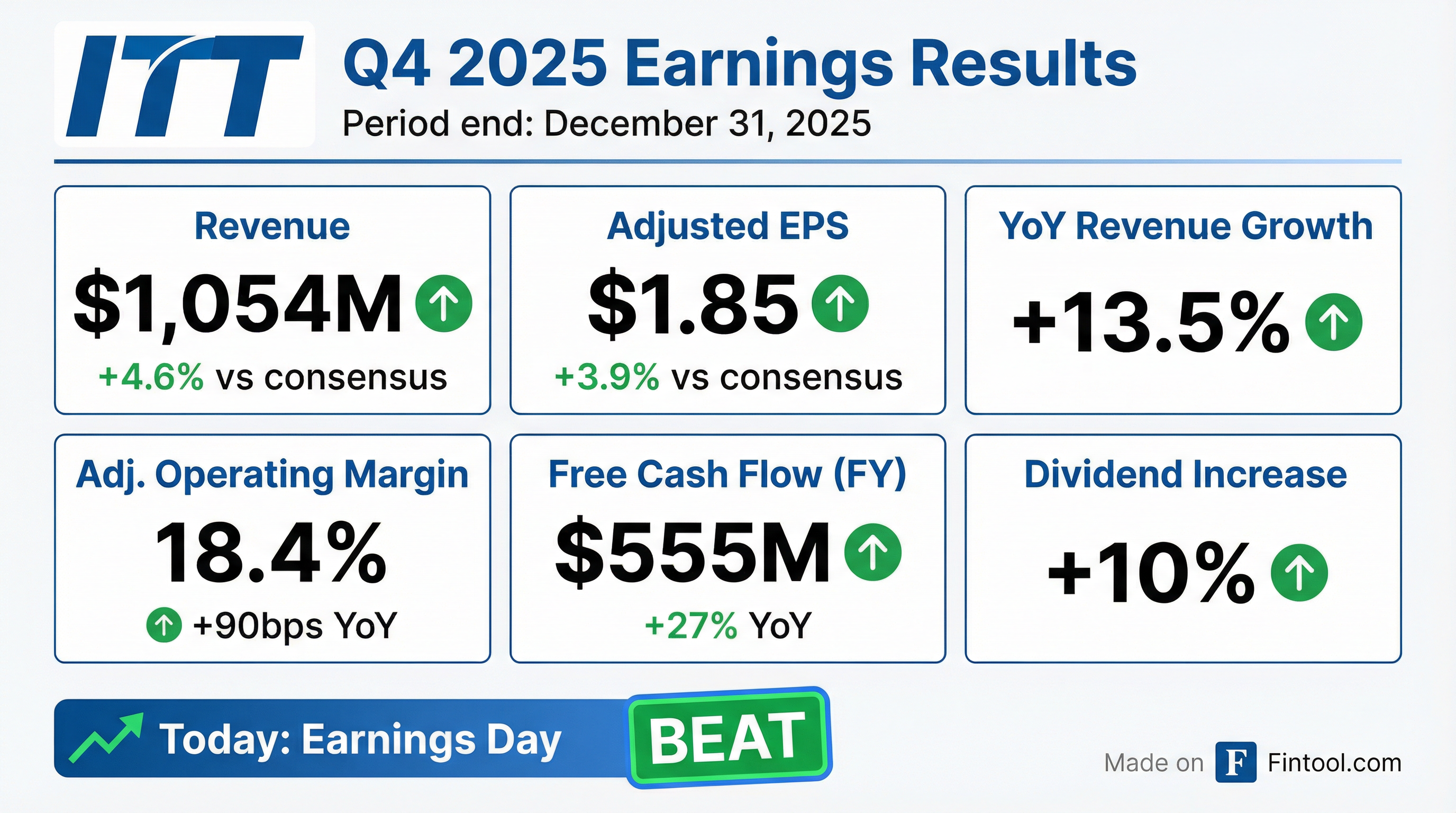

- For full-year 2025, ITT reported revenue growth of 8% (5% organically) and EPS growth of 14%.

- In Q4 2025, revenue surpassed $1 billion for the first time, increasing 13% (9% organically), with EPS reaching $1.85.

- The pending SPX Flow acquisition is expected to close in March 2026 and generate net single-digit EPS accretion for full-year 2026.

- For Q1 2026, ITT anticipates total revenue growth of approximately 11% (5% organically) and EPS of $1.70 at the midpoint, excluding the SPX Flow acquisition.

- A renewed multi-year contract with Boeing includes a high double-digit price adjustment, which is expected to significantly improve aerospace profitability.

- ITT reported strong financial performance for Q4 2025, with revenue exceeding $1 billion for the first time, growing 13% (9% organic), and EPS of $1.85, up 23%. For the full year, revenue grew 8% (5% organic), and EPS increased 14%.

- In 2025, the company's free cash flow grew 27% to over $550 million, achieving a 14% free cash flow margin, and $500 million was deployed for share repurchases.

- The pending SPX FLOW acquisition is on track to close in March and is anticipated to generate a net single-digit EPS accretion for full-year 2026.

- For Q1 2026, ITT expects total revenue growth of approximately 11% (5% organically) and projected EPS of $1.70 at the midpoint, representing a 29% increase when excluding the impact of the December equity offering.

- The full-year 2026 outlook (excluding SPX FLOW) forecasts mid-single-digit organic revenue growth and at least 50 basis points of margin expansion.

- ITT reported strong financial results for Q4 and full-year 2025, with Q4 revenue increasing 13% to $1,054 million and full-year revenue growing 8% to $3,939 million.

- Adjusted EPS also saw significant growth, reaching $1.85 in Q4 (up 23.3%) and $6.72 for the full year (up 14.3%).

- The company generated $555 million in free cash flow for fiscal year 2025, representing a 14.1% margin and 114% conversion.

- Orders increased 10% for the full year to over $4 billion, with a 15% rise in Q4, contributing to a $1.9 billion backlog.

- ITT is on track to close the $4.8 billion SPX FLOW acquisition in Q1 2026, which is expected to provide single-digit EPS accretion in 2026. The company also provided a Q1 2026 Adjusted EPS outlook of $1.68 to $1.72.

- ITT reported strong Q4 2025 results, with revenue exceeding $1 billion for the first time (up 13% total, 9% organic) and EPS of $1.85 (up 23%). For full year 2025, revenue grew 8% and EPS grew 14%, with free cash flow increasing 27% to over $550 million.

- The company issued Q1 2026 guidance for approximately 11% total revenue growth (5% organic) and EPS of $1.70 at the midpoint (up 29% excluding equity offering impact). For full year 2026, ITT expects mid-single-digit organic revenue growth and at least 50 basis points of margin expansion.

- The SPX Flow acquisition is on track to close in March, with an anticipated net single-digit EPS accretion in full year 2026. SPX Flow demonstrated strong 2025 performance, including mid-teens order growth and high teens backlog growth.

- ITT finalized a multi-year contract renewal with Boeing, featuring a high double-digit price adjustment that is expected to significantly improve aerospace profitability for the CCT segment.

- ITT Inc. reported Q4 2025 adjusted earnings per share (EPS) of $1.85 and full year 2025 adjusted EPS of $6.72. The company achieved Q4 revenue growth of 13% (9% organic) and full year revenue growth of 8% (5% organic).

- The company demonstrated strong cash flow generation, with full year operating cash flow of $669 million (17% margin) and free cash flow of $555 million (14% free cash flow margin), marking a 27% increase in free cash flow year-over-year.

- ITT Inc. announced a 10% increase in its quarterly dividend to $0.386 per share for the first quarter of 2026, payable on April 6, 2026.

- For Q1 2026, the company expects revenue growth of roughly 11% (5% organic) and adjusted EPS between $1.68 and $1.72. This outlook does not include the impact of the pending SPX FLOW acquisition, which is anticipated to close in Q1 2026.

- ITT reported Q4 2025 EPS of $1.64 and Adjusted EPS of $1.85, with revenue growth of 13% (9% organic).

- For the full year 2025, the company achieved EPS of $6.11 and Adjusted EPS of $6.72, alongside 8% revenue growth (5% organic) and a 27% increase in free cash flow to $555 million.

- The company announced a 10% increase in its quarterly dividend to $0.386 per share, payable on April 6, 2026.

- ITT provided Q1 2026 guidance for EPS between $1.67 and $1.71 and Adjusted EPS between $1.68 and $1.72, with expected revenue growth of approximately 11% (5% organic).

- The announced acquisition of SPX FLOW is expected to close in Q1 2026, which is anticipated to accelerate ITT's strategic shift towards higher-growth, higher-margin businesses.

- On December 16, 2025, ITT Inc. announced that Moody's, S&P Global Ratings, and Fitch Ratings reaffirmed its investment grade credit ratings with a stable outlook.

- This reaffirmation follows the announcement of ITT's agreement to acquire SPX FLOW and the successful closing of its $1.31 billion underwritten public offering of common stock.

- Moody's affirmed ITT's senior unsecured rating at Baa1 and commercial paper rating at Prime-2, S&P Global Ratings affirmed its BBB issuer credit rating and A-2 short-term rating, and Fitch Ratings affirmed its BBB+ long-term Issuer Default Rating and F1 short-term rating.

- ITT's Chief Financial Officer stated the company's commitment to deleveraging fast and reducing leverage below 2x within two years post-acquisition.

- ITT Inc. priced an underwritten public offering of 7,000,000 shares of its common stock at $167.00 per share.

- The underwriters' option to purchase an additional 1,050,000 shares was exercised in full on December 9, 2025.

- The offering closed on December 10, 2025, generating approximately $1.31 billion in net proceeds after deducting underwriting discounts and commissions and other offering expenses.

- The net proceeds are intended to fund a portion of the previously announced acquisition of SPX FLOW, Inc..

- ITT Inc. announced the closing of its underwritten public offering of 8,050,000 shares of common stock on December 10, 2025.

- The offering, which included the full exercise of the underwriters' option to purchase additional shares, was priced at $167.00 per share.

- The net proceeds from the offering were approximately $1.31 billion, intended to fund a portion of the previously announced acquisition of SPX FLOW, Inc..

- ITT Inc. announced the pricing of an underwritten public offering of 7,000,000 shares of its common stock at a public offering price of $167.00 per share.

- The company also granted the underwriters a 30-day option to purchase up to an additional 1,050,000 shares of its common stock.

- ITT estimates the net proceeds from the offering will be approximately $1.14 billion.

- The net proceeds are intended to fund a portion of the previously announced acquisition of SPX FLOW, Inc..

- The offering is expected to close on December 10, 2025.

Quarterly earnings call transcripts for ITT.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more