Earnings summaries and quarterly performance for JELD-WEN Holding.

Executive leadership at JELD-WEN Holding.

Board of directors at JELD-WEN Holding.

Research analysts who have asked questions during JELD-WEN Holding earnings calls.

Susan Maklari

Goldman Sachs Group Inc.

6 questions for JELD

John Lovallo

UBS Group AG

3 questions for JELD

Michael Dahl

RBC Capital Markets

3 questions for JELD

Philip Ng

Jefferies

3 questions for JELD

Anika Dholakia

Barclays PLC

2 questions for JELD

Keith Hughes

Truist Financial Corporation

2 questions for JELD

Matthew Bouley

Barclays PLC

2 questions for JELD

Steven Ramsey

Thompson Research Group

2 questions for JELD

Trevor Allinson

Wolfe Research, LLC

2 questions for JELD

Christopher Kalata

RBC Capital Markets

1 question for JELD

Fiona Shang

Jefferies

1 question for JELD

Jeffrey Stevenson

Loop Capital Markets LLC

1 question for JELD

Jeff Stevenson

Loop Capital Markets

1 question for JELD

Spencer Kaufman

UBS Group AG

1 question for JELD

Recent press releases and 8-K filings for JELD.

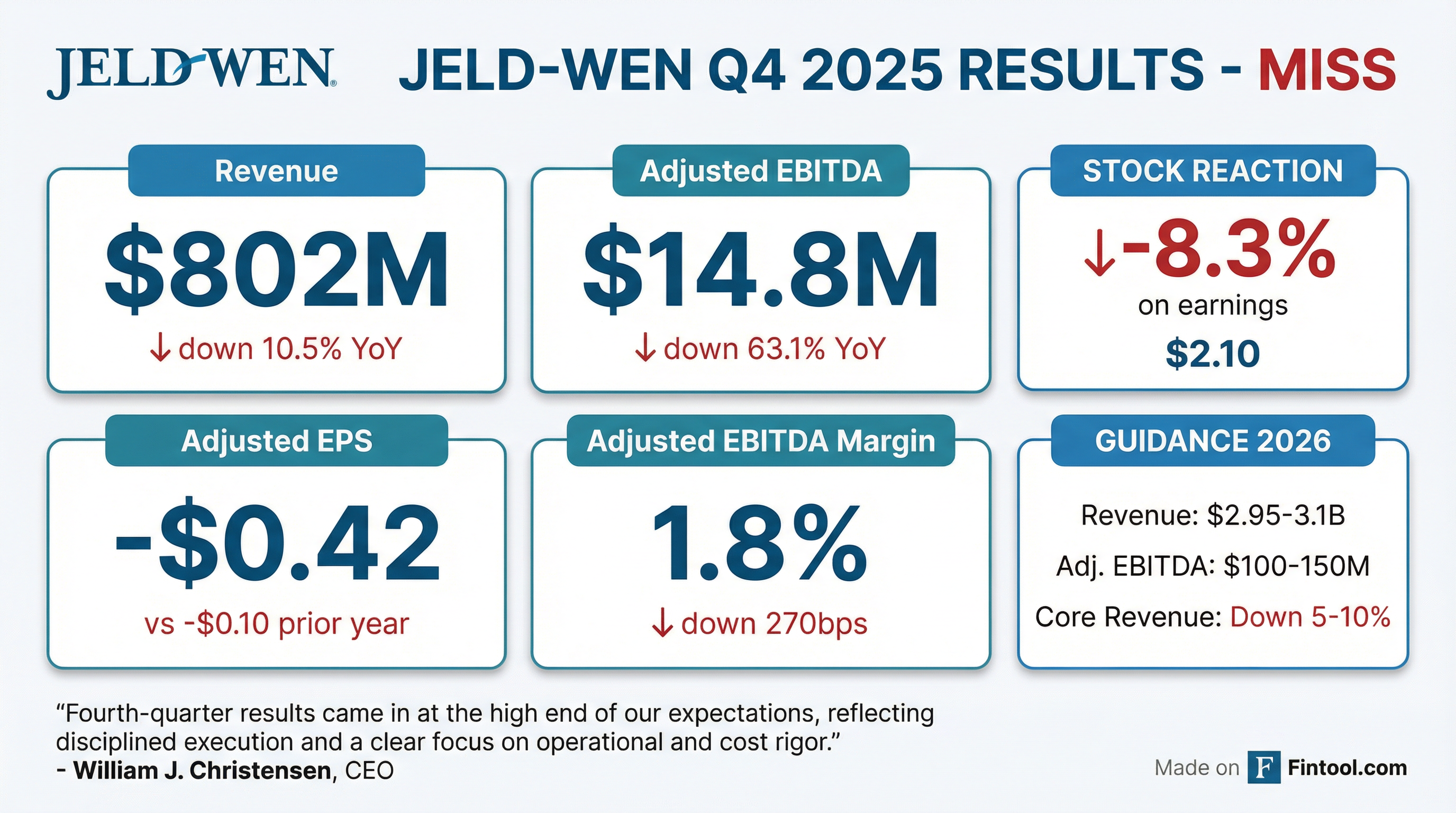

- JELD-WEN Holding reported Q4 2025 sales of $802 million and Adjusted EBITDA of $15 million, with full-year 2025 sales reaching $3.211 billion and Adjusted EBITDA of $120 million.

- The company provided 2026 guidance, expecting Net Revenue of $2.95 billion to $3.1 billion, Adjusted EBITDA of $100 million to $150 million, and Free Cash Flow of approximately ($60 million).

- Volume/mix and price/cost headwinds impacted Q4 2025 earnings, with North America revenue down (18%) year-over-year, while the company is implementing cost discipline and productivity actions to offset these challenges.

- JELD-WEN reported Q4 2025 net revenue of $802 million, a 10% year-over-year decrease, and Adjusted EBITDA of $15 million, down from $40 million in the prior year, reflecting continued soft end markets and lower volume.

- For the full year 2025, the company delivered sales of $3.2 billion and Adjusted EBITDA of $120 million, while reducing full-time positions by approximately 14% or 2,300 people.

- The company provided full-year 2026 guidance, expecting net revenue between $2.95 billion and $3.1 billion and Adjusted EBITDA between $100 million and $150 million.

- JELD-WEN anticipates a free cash flow use of approximately $60 million for 2026, with operating cash flow of about $40 million and capital expenditures of $100 million.

- The company continues to evaluate a strategic review of its European business and other actions to improve liquidity, while implementing a new A3 Operating System to drive operational improvements and better service levels.

- JELD-WEN Holding reported net revenue of $802 million for Q4 2025, a 10% year-over-year decrease, and full-year 2025 sales of $3.2 billion. Adjusted EBITDA for Q4 2025 was $15 million (1.8% of sales), and $120 million for the full year.

- For full-year 2026, the company expects net revenue between $2.95 billion and $3.1 billion and Adjusted EBITDA between $100 million and $150 million. It also anticipates a free cash flow use of approximately $60 million.

- The company's net debt leverage increased to 8.6x at year-end 2025, primarily due to earnings pressure, while maintaining a strong liquidity position with $136 million in cash and $350 million available on its revolver.

- JELD-WEN reduced full-time positions by approximately 14% (2,300 people) in full-year 2025 and is implementing a new A3 Operating System, which has led to significant improvements in service levels and operational consistency, such as at the Kissimmee facility.

- JELD-WEN reported Q4 2025 net revenue of $802 million and adjusted EBITDA of $15 million, contributing to full-year 2025 sales of $3.2 billion and adjusted EBITDA of $120 million.

- The company operated in a very soft macro environment with continued demand pressure, leading to a 14% reduction in full-time positions (approximately 2,300 people) in full year 2025 to align costs with market conditions.

- Net debt leverage increased to 8.6x at year-end 2025 due to earnings pressure, though liquidity remained strong with $136 million in cash and $350 million available on its revolver.

- For full year 2026, JELD-WEN provided guidance of net revenue between $2.95 billion and $3.1 billion and adjusted EBITDA between $100 million and $150 million, reflecting a cautious market outlook and disciplined cost management.

- JELD-WEN reported Q4 2025 net revenues of $802.0 million, a 10.5% decrease, and full-year 2025 net revenues of $3.21 billion, a 14.9% decrease compared to the prior year.

- The company posted a net loss from continuing operations of ($40.1) million or ($0.47) per share for Q4 2025, and a full-year net loss of ($620.1) million or ($7.27) per share, which included $334.6 million in non-cash goodwill impairment charges.

- Adjusted EBITDA from continuing operations for Q4 2025 was $14.8 million, a decrease of ($25.3) million, and for the full year 2025, it was $120.1 million, a decrease of ($155.2) million compared to the prior year.

- For 2026, JELD-WEN is guiding for revenue between $2.95 and $3.1 billion and Adjusted EBITDA between $100 and $150 million, anticipating a (5%) to (10%) decline in Core Revenues due to continued volume pressure.

- JELD-WEN reported net revenues of $802.0 million for the fourth quarter ended December 31, 2025, a 10.5% decrease compared to the same period in the prior year, with a net loss from continuing operations of ($40.1) million and Adjusted EBITDA from continuing operations of $14.8 million.

- For the full year ended December 31, 2025, net revenues were $3.21 billion, a 14.9% decrease year-over-year, with a net loss from continuing operations of ($620.1) million (including $334.6 million in non-cash goodwill impairment charges) and Adjusted EBITDA from continuing operations of $120.1 million.

- The company's Net Debt Leverage increased to 8.6x as of December 31, 2025, up from 3.8x at December 31, 2024.

- For Full Year 2026, JELD-WEN is introducing revenue guidance in the range of $2.95 to $3.1 billion, reflecting an anticipated 5% to 10% decline in Core Revenues. Adjusted EBITDA is expected to be between $100 to $150 million, and operating cash flow is projected to generate approximately $40 million.

- JELD-WEN reported Q3 2025 revenue of $809 million, with core revenue down 10% year-over-year, and Adjusted EBITDA of $44 million. The company experienced negative free cash flow and its net debt leverage increased to 7.4 times.

- Due to further softening in market conditions and degradation in demand trends, JELD-WEN significantly lowered its full-year 2025 outlook, now expecting sales of $3.1-$3.2 billion and Adjusted EBITDA of $105-$120 million.

- In response, the company is implementing an approximately 11% reduction of North America and corporate headcount and has initiated a strategic review of its European business to strengthen the balance sheet and sharpen strategic focus.

- JELD-WEN maintains a strong liquidity position with approximately $100 million in cash and $400 million of revolver availability, totaling approximately $500 million, with no debt maturities until December 2027.

- JELD-WEN reported Q3 2025 sales of $809 million and Adjusted EBITDA of $44 million, resulting in an Adjusted EBITDA Margin of 5.5%. The company also reported an Adjusted Net Loss per share of ($0.20) for the quarter.

- The company updated its 2025 guidance, projecting Net Revenue between $3.1 billion and $3.2 billion, Adjusted EBITDA between $105 million and $120 million, and Free Cash Flow of approximately ($160 million).

- Financial performance was impacted by persisting macroeconomic headwinds, including lower volume/mix in North America (down 13%) and Europe (down 6%), and price/cost challenges.

- Net Debt Leverage increased to 7.4x in Q3 2025, up from 3.8x in Q3 2024, with Free Cash Flow at ($142 million) for the quarter.

- JELD-WEN is undertaking restructuring actions, a strategic review of Europe, and rightsizing North America to redefine its competitive strategy.

- JELD-WEN reported net revenues of $809.5 million for the third quarter ended September 27, 2025, marking a 13.4% decrease compared to the prior year, and a net loss from continuing operations of ($367.6) million, or ($4.30) per share.

- Adjusted EBITDA from continuing operations was $44.4 million in Q3 2025, a decrease of $37.2 million from the same period last year, with an operating loss margin of (25.0%).

- The company announced plans to reduce its North American and Corporate workforce by approximately 11% (850 positions) by year-end 2025 and initiated a strategic review of its European business.

- JELD-WEN lowered its full-year 2025 guidance, now expecting revenues between $3.1 and $3.2 billion and Adjusted EBITDA between $105 and $120 million.

- JELD-WEN reported net revenues of $809.5 million for the third quarter ended September 27, 2025, marking a 13.4% decrease year-over-year, and a net loss from continuing operations of ($367.6) million, or ($4.30) per share.

- Adjusted EBITDA from continuing operations for Q3 2025 was $44.4 million, a decline of ($37.2) million compared to the same period last year, driven by lower sales and negative price/cost.

- The company plans to reduce its North American and Corporate workforce by approximately 11% (around 850 positions) by year-end 2025 and has initiated a strategic review of its European segment.

- JELD-WEN lowered its full-year 2025 revenue guidance to $3.1 to $3.2 billion and its Adjusted EBITDA guidance to $105 to $120 million, reflecting continued pressure from competitive pricing and volume environment.

Quarterly earnings call transcripts for JELD-WEN Holding.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more