Earnings summaries and quarterly performance for Ladder Capital.

Executive leadership at Ladder Capital.

Board of directors at Ladder Capital.

Research analysts who have asked questions during Ladder Capital earnings calls.

Jade Rahmani

Keefe, Bruyette & Woods

8 questions for LADR

Steve Delaney

Citizens JMP Securities, LLC

4 questions for LADR

Steven Delaney

Citizens JMP Capital

3 questions for LADR

Gabe Poggi

Raymond James

2 questions for LADR

John Nickodemus

BTIG

2 questions for LADR

Timothy D'Agostino

B. Riley Securities

2 questions for LADR

Tom Catherwood

BTIG

2 questions for LADR

William Catherwood

BTIG

2 questions for LADR

Christopher Muller

Citizens JMP

1 question for LADR

Matthew Howlett

B. Riley Securities

1 question for LADR

Randolph Binner

B. Riley Financial, Inc.

1 question for LADR

Randy Binner

B. Riley Securities

1 question for LADR

Stephen Laws

Raymond James

1 question for LADR

Recent press releases and 8-K filings for LADR.

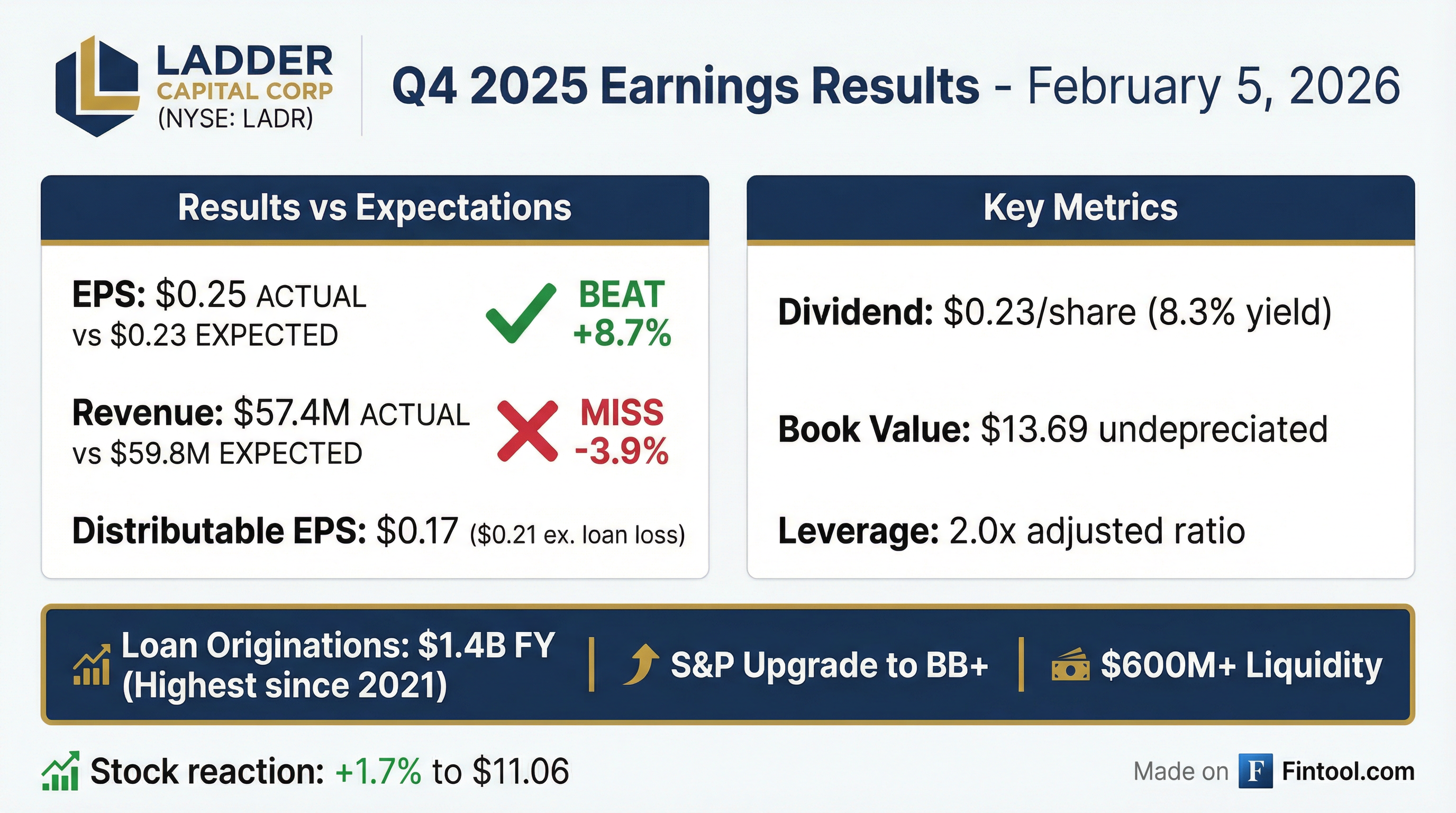

- Ladder Capital reported Q4 2025 distributable earnings of $21.4 million or $0.17 per share, with full-year 2025 distributable earnings reaching $109.9 million.

- In 2025, Ladder achieved investment-grade credit ratings from Moody's (Baa3) and Fitch (BBB-), becoming the only investment-grade rated commercial mortgage REIT, and S&P upgraded them to BB+ in January 2026. This achievement enhanced access to capital markets and lowered funding costs.

- The company originated $1.4 billion in new loans in 2025, including $430 million in Q4 2025, and has already closed $250 million in new loans in early 2026. At year-end 2025, the loan portfolio totaled $2.2 billion.

- Ladder maintained a robust financial position at year-end 2025, with $608 million in liquidity, an adjusted leverage ratio of 2.0 times, and a declared $0.23 per share dividend for Q4 2025. Management plans to focus on growing the loan portfolio and earnings in 2026.

- Ladder Capital reported Q4 2025 distributable earnings of $21.4 million or $0.17 per share, with full-year 2025 distributable earnings of $109.9 million, representing a 7.1% return on equity.

- In 2025, Ladder achieved investment-grade credit ratings from Moody's and Fitch, becoming the only investment-grade rated commercial mortgage REIT, and subsequently issued a $500 million investment-grade unsecured bond at a 5.5% fixed rate.

- The company ended 2025 with $608 million in liquidity, an adjusted leverage ratio of 2.0 times, and 71% of its debt unsecured.

- Ladder originated $1.4 billion in new loans in 2025, including $430 million in Q4 at a weighted average spread of 340 basis points, and plans to grow its loan portfolio to over $6 billion by year-end 2026, targeting an ROE of 9-10%.

- The company also repurchased $10.2 million of common stock in 2025 and declared a $0.23 per share dividend for Q4 2025.

- Ladder Capital reported distributable earnings of $0.17 per share for Q4 2025 (or $0.21 per share adjusted for a realized loan loss) and $109.9 million for the full year 2025, achieving a 7.1% return on equity.

- In 2025, the company achieved investment-grade credit ratings from Moody's (Baa3) and Fitch (BBB-), with S&P upgrading to BB+ in January 2026, which has enhanced access to capital markets and lowered funding costs.

- Ladder originated $1.4 billion in new loans in 2025, the highest annual volume since 2021, with $430 million in Q4 2025 at a weighted average spread of 340 basis points. The loan portfolio totaled $2.2 billion at year-end 2025.

- As of December 31, 2025, Ladder maintained $608 million in liquidity, an adjusted leverage ratio of 2.0 times, and 71% of its debt was unsecured.

- For 2026, the company plans to focus on driving earnings growth by increasing loan originations, aiming to grow the asset base to "a little over $6 billion" and achieve an ROE of 9-10%.

- LADR reported Distributable Earnings of $21.4M and Distributable EPS of $0.17 for Q4 2025, and declared a cash dividend of $0.23 per share.

- The company achieved $433M in new loan originations in Q4 2025, contributing to $1.4B for FY 2025, marking its highest annual originations since FY 2021.

- As of December 31, 2025, LADR reported $5.15B in total assets and maintained an Investment Grade Capital Structure with 71% of total financing from unsecured debt, and IG ratings from Moody's and Fitch.

- LADR ended Q4 2025 with over $600M in total liquidity, an Adjusted Leverage Ratio of 2.0x, and an undepreciated book value per share of $13.69.

- Ladder Capital Corp reported GAAP income before taxes of $15.5 million and diluted EPS of $0.13 for the three months ended December 31, 2025. Distributable earnings for the quarter were $21.4 million, with distributable EPS of $0.17.

- For the full year ended December 31, 2025, the company reported GAAP income before taxes of $67.2 million and diluted EPS of $0.51. Distributable earnings for the year were $109.9 million, with distributable EPS of $0.84.

- CEO Brian Harris stated that 2025 was a pivotal year for Ladder, marked by achieving investment grade credit ratings (Baa3 from Moody's Ratings and BBB- from Fitch Ratings), reducing its cost of capital, and expanding access to the unsecured corporate bond market.

- The company is well-positioned to drive earnings growth and enhance shareholder value in 2026.

- Ladder Capital Corp reported GAAP income before taxes of $15.5 million and diluted EPS of $0.13 for the three months ended December 31, 2025, with distributable earnings of $21.4 million and distributable EPS of $0.17.

- For the full year ended December 31, 2025, the company reported GAAP income before taxes of $67.2 million and diluted EPS of $0.51, alongside distributable earnings of $109.9 million and distributable EPS of $0.84.

- In 2025, Ladder Capital achieved investment grade credit ratings of Baa3 from Moody's Ratings and BBB- from Fitch Ratings (both with stable outlooks), reduced its cost of capital, and expanded access to the unsecured corporate bond market.

- The company declared dividends per share of Class A common stock of $0.23 for the fourth quarter of 2025, bringing the total for the year to $0.92.

- S&P Global Ratings upgraded Ladder Capital Corp's credit rating to 'BB+' from 'BB', with a stable outlook, for its subsidiary issuers, unsecured notes, and issuer credit rating.

- The upgrade was attributed to Ladder's improved leverage profile, strong business diversification, ample liquidity, and a largely unsecured capital structure.

- This development brings Ladder Capital one step closer to achieving investment grade ratings from all three major rating agencies, building on its existing Baa3 from Moody's Ratings and BBB- from Fitch Ratings, both received in 2025.

- Ladder Capital Corp generated distributable earnings of $32.1 million or $0.25 per share in Q3 2025, achieving an 8.3% return on equity.

- The company experienced a significant acceleration in loan originations, with $511 million in new loans across 17 transactions at a weighted average spread of 279 basis points, marking its highest quarterly origination volume in over three years. The loan portfolio grew by approximately $354 million to $1.9 billion.

- Ladder successfully closed its inaugural $500 million five-year investment-grade unsecured bond offering at a rate of 5.5%, which strengthened its balance sheet and is expected to lower borrowing costs. As of quarter-end, 75% of Ladder's debt consists of unsecured corporate bonds.

- The company maintained $879 million in liquidity and repurchased $1.9 million of common stock in Q3 2025, while declaring a $0.23 per share dividend.

- Management expects Q4 loan originations to exceed Q3 production and plans to add $1 billion to $2 billion of assets net to the balance sheet, anticipating improved ROE and earnings by reinvesting from lower-yielding securities into higher-yielding loans.

- Ladder Capital Corp reported distributable earnings of $32.1 million or $0.25 per share for Q3 2025, achieving an 8.3% return on equity.

- The company experienced a significant acceleration in loan originations, with $511 million in new loans across 17 transactions in Q3 2025, marking its highest quarterly volume in over three years and contributing to a $354 million net growth in the loan portfolio to $1.9 billion.

- Ladder successfully closed its inaugural $500 million five-year investment-grade unsecured bond offering at a rate of 5.5%, which strengthened its balance sheet and resulted in 75% of its debt being comprised of unsecured corporate bonds.

- Management expects Q4 loan originations to exceed Q3 production and anticipates growing the loan portfolio by $1 billion to $2 billion net, aiming to shift capital from securities to higher-yielding loans to improve profitability.

- In Q3 2025, Ladder repurchased $1.9 million of common stock and declared a $0.23 per share dividend, which was paid on October 15, 2025.

Quarterly earnings call transcripts for Ladder Capital.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more