Earnings summaries and quarterly performance for MALIBU BOATS.

Executive leadership at MALIBU BOATS.

Board of directors at MALIBU BOATS.

Research analysts who have asked questions during MALIBU BOATS earnings calls.

Jaime Katz

Morningstar

7 questions for MBUU

Craig Kennison

Robert W. Baird & Co. Incorporated

5 questions for MBUU

Noah Zatzkin

KeyBanc Capital Markets

4 questions for MBUU

Brandon Rollé

D.A. Davidson

3 questions for MBUU

Eric Wold

B. Riley Securities

3 questions for MBUU

Griffin Bryan

D.A. Davidson & Co.

3 questions for MBUU

Joseph Altobello

Raymond James & Associates, Inc.

3 questions for MBUU

Martin Mitela

Raymond James & Associates, Inc.

3 questions for MBUU

Frederick Wightman

Wolfe Research, LLC

2 questions for MBUU

Kevin Condon

Robert W. Baird & Co. Incorporated

2 questions for MBUU

Michael Albanese

The Benchmark Company, LLC

2 questions for MBUU

Michael Swartz

Truist Securities

2 questions for MBUU

Mike Albanese

EF Hutton

2 questions for MBUU

Ryan Williams

KeyBanc Capital Markets

1 question for MBUU

Recent press releases and 8-K filings for MBUU.

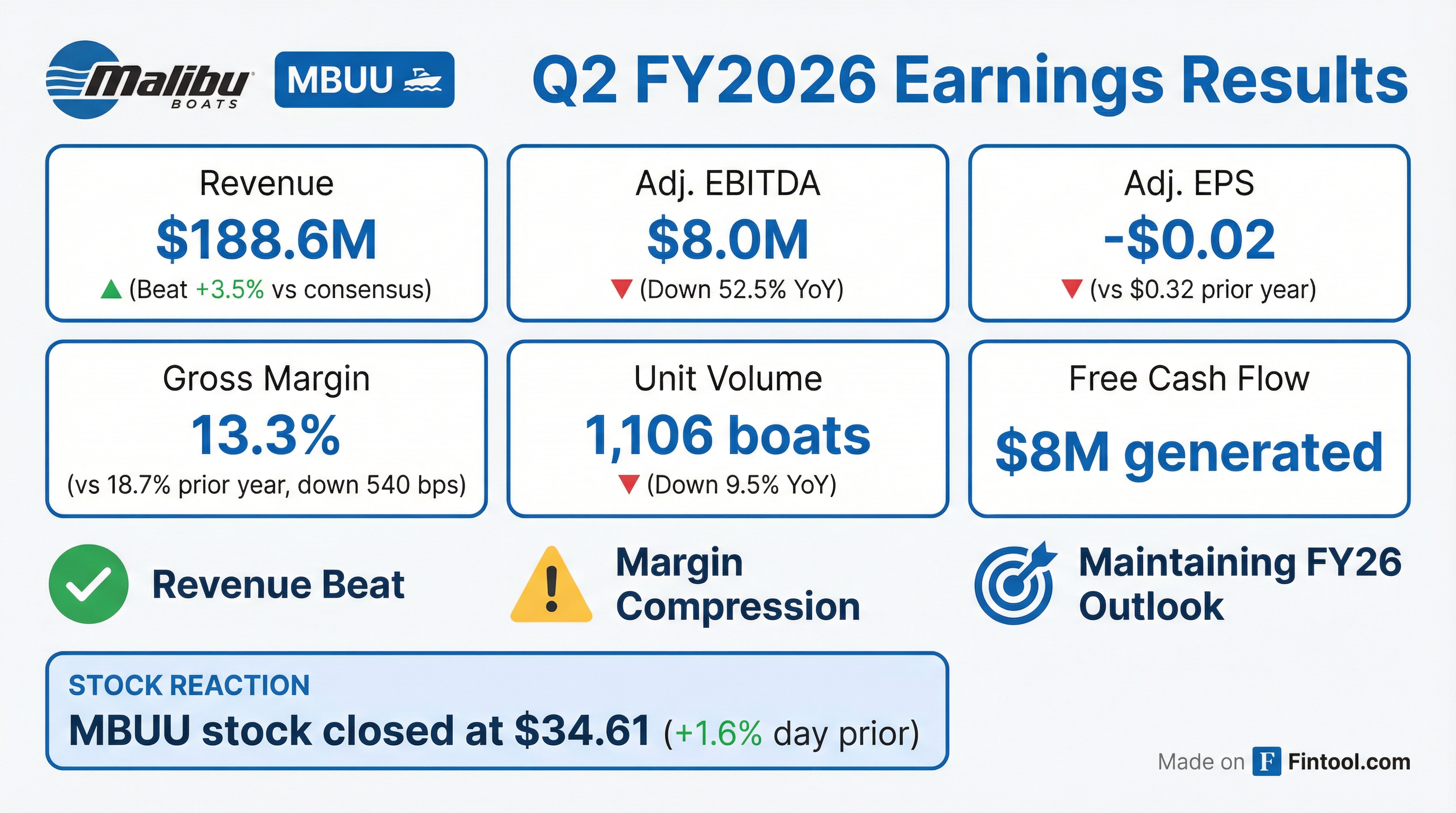

- Malibu Boats reported Q2 2026 net sales of $188.6 million, a 5.8% decrease year-over-year, with Adjusted EBITDA decreasing 52.5% to $8 million and a non-GAAP adjusted net loss per share of $0.02.

- The company provided a full fiscal year outlook expecting sales to be flat to down mid-single digits year-over-year and consolidated Adjusted EBITDA margin in the range of 8%-9%. For Q3 2026, net sales are projected between $198 million and $202 million, with Adjusted EBITDA margins of approximately 8.5%.

- Malibu Boats expanded its share repurchase program to $70 million and repurchased $20.8 million worth of shares during the quarter.

- Despite a challenging retail environment and an expected market decline of mid to high single digits for the fiscal year, the company noted healthy model year 2026 inventory and momentum in its MBI Acceptance financing program, offering rates as low as 3.99%.

- **Malibu Boats (MBUU) reported Q2 FY26 net sales of $188.6 million, a 5.8% decrease year-over-year, primarily due to decreased unit volumes across all segments. **

- **Adjusted EBITDA for Q2 FY26 was $8.0 million, a 52.5% decline year-over-year, resulting in an Adjusted EBITDA Margin of 4.3%. **

- **The company generated $8 million of free cash flow and repurchased $21 million in shares during Q2 FY26. **

- **Malibu Boats maintains its fiscal year 2026 outlook, projecting net sales to be flat to down mid-single digits and Adjusted EBITDA Margin between 8% to 9%. **

- Malibu Boats reported Q2 2026 net sales of $188.6 million, a 5.8% decrease year-over-year, and an adjusted net loss per share of $0.02.

- For the full fiscal year, the company expects sales to be flat to down mid-single digits year-over-year, with an adjusted EBITDA margin of 8%-9%. Q3 net sales are projected to be between $198 million and $202 million.

- The company expanded its share repurchase program to $70 million and repurchased $20.8 million (751,000 shares) during Q2 2026.

- Strategic initiatives, including the MBI Acceptance financing program and a new marine components business, are gaining momentum, while centralized sourcing efforts are anticipated to improve margins in the second half of the fiscal year.

- Malibu Boats reported net sales of $188.6 million for Q2 2026, a 5.8% decrease year-over-year, with adjusted EBITDA at $8 million, down 52.5%, leading to an adjusted net loss per share of $0.02.

- For Q3 2026, the company expects net sales between $198 million and $202 million and adjusted EBITDA margins of approximately 8.5%. The full fiscal year 2026 outlook projects sales to be flat to down mid-single digits year-over-year, with consolidated adjusted EBITDA margins in the 8%-9% range.

- The company generated $8.4 million in free cash flow during Q2 and expanded its share repurchase program to $70 million, executing $20.8 million in share repurchases (751,000 shares) during the quarter.

- Strategic initiatives, including the MBI Acceptance program offering competitive retail financing rates as low as 3.99%, and centralized sourcing efforts, are expected to contribute to margin growth in the latter half of the fiscal year.

- Malibu Boats, Inc. reported a 5.8% decrease in net sales to $188.6 million and a 9.5% decrease in unit volume to 1,106 units for the second quarter fiscal 2026, compared to the prior year period.

- The company's GAAP net income shifted to a net loss of $2.5 million from a net income of $2.4 million in Q2 fiscal 2025, and Adjusted EBITDA decreased 52.5% to $8.0 million.

- Management noted exceeding second-quarter revenue expectations despite a challenging retail environment and choppy demand, while also generating positive free cash flow and completing $21 million in share repurchases during the quarter.

- For the full fiscal year 2026, Malibu anticipates net sales to be flat to down mid-single digits year-over-year, with an Adjusted EBITDA margin ranging from 8%-9%.

- Malibu Boats, Inc. (MBUU) announced on December 19, 2025, that its board of directors authorized an increase to the existing share repurchase program, raising the authorized amount from $50 million to $70 million.

- The expanded program reflects the board’s confidence in the company’s long-term strategy, financial position, and commitment to delivering value to shareholders.

- During the second quarter, the company repurchased $20.7 million of shares under the repurchase program.

- Malibu Boats, Inc. appointed David S. Black as Chief Financial Officer, effective November 13, 2025, succeeding Bruce W. Beckman, who resigned on November 12, 2025.

- Mr. Black, 43, previously served as the Company's Vice President, Finance since November 2023 and interim Chief Financial Officer from April 2023 to November 2023.

- His new compensation package includes an annual base salary of $400,000, eligibility for a target annual cash bonus of up to 75% of his base salary, and a grant of $100,000 in time-based restricted stock units vesting over three years.

- In connection with his departure, Bruce W. Beckman will receive his base salary for one year and continued vesting of equity awards through a consulting term ending December 31, 2025.

- The Company reaffirmed its fiscal year 2026 guidance, anticipating net sales to be flat to down mid-single digits percentage points year-over-year, and an Adjusted EBITDA margin ranging from 8% to 9%.

- Malibu Boats, Inc. (MBUU) has appointed David S. Black as its new Chief Financial Officer, effective immediately, succeeding Bruce W. Beckman, whose resignation was effective November 12, 2025.

- Mr. Black has served in various financial roles at the company since 2017, including Vice President, Finance, interim Chief Financial Officer, Corporate Controller, and Director of Internal Audit.

- The company reaffirmed its fiscal year 2026 guidance, anticipating net sales to be flat to down mid-single digits percentage points year-over-year, and an Adjusted EBITDA margin ranging from 8% to 9%.

- Malibu Boats, Inc. reported net sales of $194.7 million for Q1 FY26, an increase of 13.5% year-over-year, despite ongoing retail softness.

- Adjusted EBITDA increased by 19.1% year-over-year to $11.8 million, and Adjusted Net Income Per Share was $0.15 for Q1 FY26.

- The company's gross margin for Q1 FY26 was 14.3%, a decrease of 210 basis points year-over-year, attributed to higher per unit material and labor costs and increased dealer incentive costs.

- Malibu Boats, Inc. generated positive free cash flow for the quarter and is maintaining its fiscal year 2026 outlook, projecting net sales to be flat to down mid-single digits and an Adjusted EBITDA Margin of 8% to 9%.

- Malibu Boats reported Q1 fiscal year 2026 net sales of $194.7 million, an increase of 13.5% year-over-year, with adjusted EBITDA rising 19.1% to $11.8 million and adjusted EBITDA margin at 6.1%.

- The company's non-GAAP adjusted net income per share was $0.15 for Q1 FY26, and it generated $2.5 million in free cash flow.

- Despite a soft retail environment and elevated dealer inventories, Malibu Boats reiterated its full-year fiscal 2026 guidance, projecting sales to be flat to down mid single digit percentage points and consolidated adjusted EBITDA margins between 8% and 9%.

- For Q2 fiscal year 2026, the company expects sales between $175 million and $185 million and adjusted EBITDA margins ranging from 3% to 5%.

- Strategic initiatives include the launch of MBI Acceptance, a new financing partnership, and the introduction of several new model year 2026 products to drive retail activity.

Quarterly earnings call transcripts for MALIBU BOATS.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more