Earnings summaries and quarterly performance for M/I HOMES.

Executive leadership at M/I HOMES.

Board of directors at M/I HOMES.

Research analysts who have asked questions during M/I HOMES earnings calls.

Alan Ratner

Zelman & Associates

9 questions for MHO

Also covers: BZH, CCS, DHI +9 more

BH

Buck Horne

Raymond James Financial, Inc.

9 questions for MHO

Also covers: AMH, CLPR, DHI +9 more

JM

Jay McCanless

Wedbush Securities

9 questions for MHO

Also covers: BLDR, BZH, CCS +20 more

Kenneth Zener

Seaport Research Partners

9 questions for MHO

Also covers: BLD, CCS, DHI +7 more

AB

Alex Barron

Housing Research Center

4 questions for MHO

Also covers: BZH, CCS, DHI +9 more

Recent press releases and 8-K filings for MHO.

M/I Homes Reports Q4 and Full-Year 2025 Results, Highlights Strong Financial Position

MHO

Earnings

Share Buyback

Guidance Update

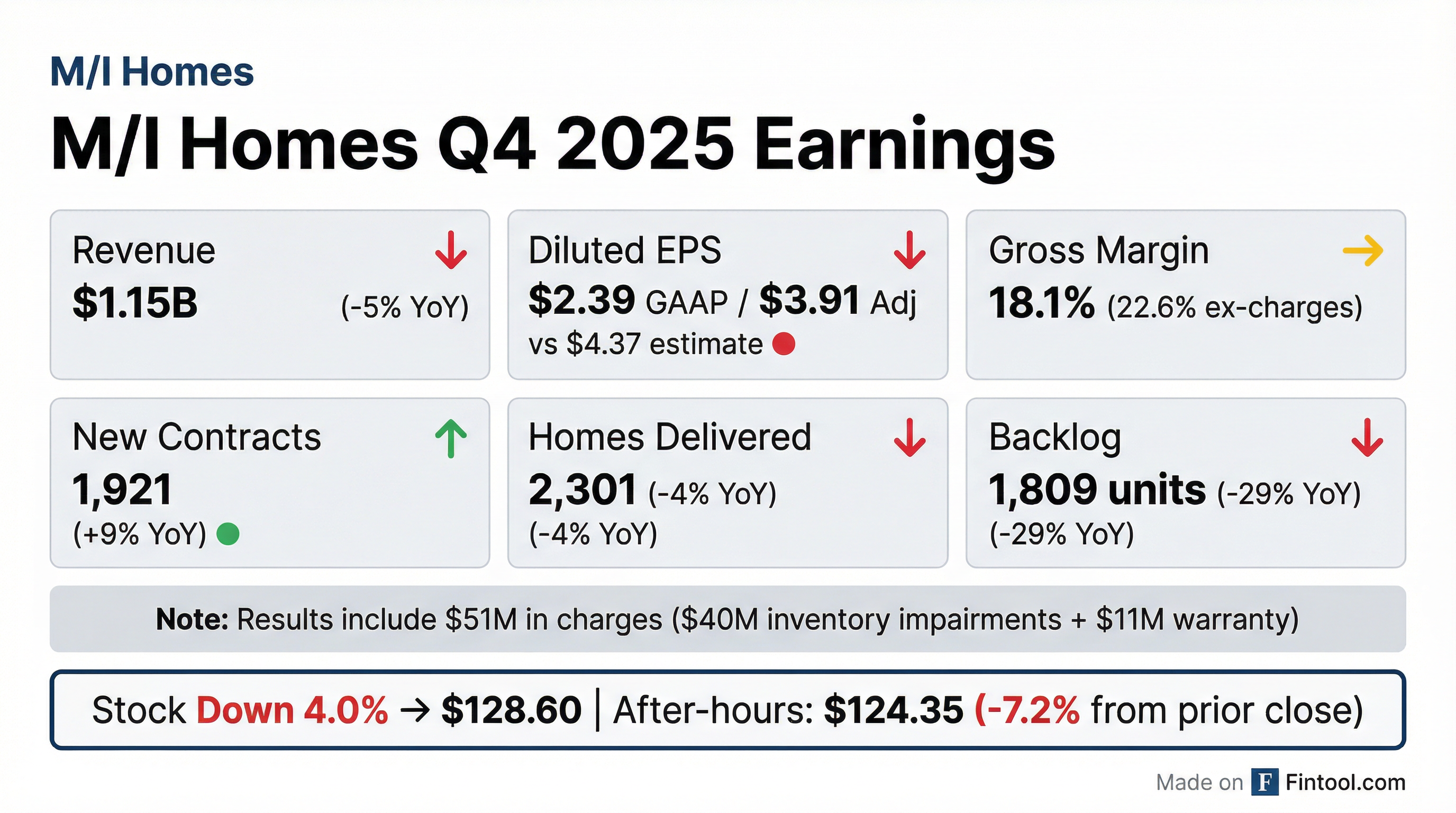

- M/I Homes reported Q4 2025 revenue of $1.1 billion, a 5% decrease year-over-year, and full-year 2025 revenue of $4.4 billion.

- Diluted earnings per share for Q4 2025 were $2.39, down from $4.71 in Q4 2024, with full-year 2025 EPS at $14.74, a 25% decrease from $19.71 in 2024.

- The company concluded 2025 in its best financial condition in its 50-year history, holding $689 million in cash and achieving a net debt-to-capital ratio of zero.

- M/I Homes repurchased $50 million of shares in Q4 2025 and a total of $200 million for the full year, with $220 million remaining under its repurchase authority.

- For 2026, the company anticipates an average community count about 5% higher than 2025 and aims to close more homes than in 2025.

Jan 28, 2026, 3:30 PM

MHO Reports Q4 and Full Year 2025 Results

MHO

Earnings

Guidance Update

Share Buyback

- M/I Homes reported full year 2025 revenue of $4.4 billion and net income of $403 million, or $14.74 per share, despite challenging economic conditions.

- The company ended 2025 in strong financial condition with $689 million in cash, zero borrowings under its revolving credit facility, a debt-to-capital ratio of 18%, and a net debt-to-cap ratio of zero.

- Operational highlights include 8,921 homes delivered in 2025, a 9% year-over-year increase in new contracts during Q4 2025, and an average community count increase of 6% in 2025, with an expectation for 5% higher in 2026.

- Gross margins for the full year 2025 (excluding charges) were 24.4%, a decrease of 220 basis points from 2024, primarily due to higher incentives and lot costs. The company also recorded $51 million in charges in Q4 2025, mainly from inventory impairments in entry-level communities.

Jan 28, 2026, 3:30 PM

M/I Homes Reports Q4 and Full-Year 2025 Results

MHO

Earnings

Guidance Update

Share Buyback

- M/I Homes reported full-year 2025 revenue of $4.4 billion and net income of $403 million, or $14.74 per share, with pre-tax income (excluding charges) of nearly $590 million.

- For Q4 2025, new contracts increased 9% year-over-year, though revenue decreased 5% to $1.1 billion, and earnings per diluted share were $2.39.

- The company ended 2025 in strong financial condition with $689 million in cash, zero borrowings under its revolving credit facility, and a net debt-to-capital ratio of zero.

- Full-year gross margins, excluding charges, were 24.4%, down 220 basis points from 2024, primarily due to higher incentives and lot costs.

- M/I Homes expects its average 2026 community count to be about 5% higher than 2025 and remains optimistic about demand in early 2026, though margins are expected to remain under pressure.

Jan 28, 2026, 3:30 PM

M/I Homes Reports Fourth Quarter and Year-End 2025 Results

MHO

Earnings

Share Buyback

Demand Weakening

- For the fourth quarter ended December 31, 2025, M/I Homes reported a 5% decline in revenue to $1.1 billion and net income of $64 million ($2.39 per diluted share).

- For the full year 2025, revenue decreased 2% to $4.4 billion, with net income of $403 million ($14.74 per diluted share).

- The company repurchased $50 million of stock in Q4 2025 and $202 million for the full year, ending 2025 with record shareholders' equity of $3.2 billion and a homebuilding debt to capital ratio of 18%.

- New contracts increased 9% to 1,921 in Q4 2025, while homes delivered decreased 4% to 2,301. The cancellation rate improved to 10% in Q4 2025 from 14% in the prior year's fourth quarter.

Jan 28, 2026, 12:51 PM

M/I Homes Reports Fourth Quarter and Full Year 2025 Results

MHO

Earnings

Share Buyback

Demand Weakening

- M/I Homes reported full-year 2025 net income of $403 million ($14.74 per diluted share) on $4.4 billion in revenue, compared to $563.7 million ($19.71 per diluted share) and $4.5 billion in 2024.

- For the fourth quarter of 2025, net income was $64 million ($2.39 per diluted share) on $1.1 billion in revenue, a decrease from $133.5 million ($4.71 per diluted share) and $1.2 billion in the fourth quarter of 2024.

- The company repurchased $202 million of stock for the full year 2025 and ended the year with record shareholders' equity of $3.2 billion and a homebuilding debt to capital ratio of 18%.

- New contracts for the fourth quarter of 2025 increased 9% to 1,921, while full-year new contracts decreased 4% to 8,199.

Jan 28, 2026, 12:30 PM

M/I Homes Announces New Share Repurchase Authorization

MHO

Share Buyback

- M/I Homes, Inc. announced a new share repurchase authorization, allowing the company to purchase up to $250 million of its common shares.

- This new authorization replaces a prior one that had $80 million of remaining availability as of November 11, 2025.

- The authorization has no expiration date and the timing and amount of any purchases will be determined at management's discretion.

Nov 12, 2025, 9:15 PM

MHO Reports Q3 2025 Results with Solid Pre-Tax Income and Record Equity

MHO

Earnings

Demand Weakening

Share Buyback

- MHO reported Q3 2025 pre-tax income of $140 million and earnings per diluted share of $3.92, with total revenue decreasing 1% to $1.1 billion.

- Gross margins were 23.9%, a decline of 320 basis points year-over-year, primarily due to the cost of mortgage rate buy-downs used to incentivize sales in a challenging market.

- The company closed a record 2,296 homes in Q3 2025, a 1% increase year-over-year, while new home sales (contracts) decreased 6% to 1,908 homes.

- MHO ended the quarter with a record $3.1 billion in equity, $734 million in cash, and a strong debt-to-capital ratio of 18%, having also increased its credit facility to $900 million.

Oct 22, 2025, 2:30 PM

MHO Reports Q3 2025 Financial Results Amidst Challenging Market

MHO

Earnings

Demand Weakening

Share Buyback

- MHO reported Q3 2025 revenue of $1.1 billion, a 1% decrease compared to the prior year, with pre-tax income of $140 million (12% of revenue) and a gross margin of 24%.

- The company closed a record 2,296 homes in Q3 2025, a 1% increase year-over-year, although new contracts (homes sold) decreased by 6% to 1,908 units.

- Despite continued challenging market conditions and a "choppy uneven demand environment," MHO is primarily using mortgage rate buy-downs to incentivize sales, which is the main reason for the decline in gross margins.

- MHO's balance sheet remains strong, ending Q3 2025 with record equity of $3.1 billion, a debt-to-capital ratio of 18%, and $734 million in cash.

- The mortgage and title operations achieved a record 93% capture rate and generated $16.6 million in pre-tax income, marking a 28% increase from Q3 2024.

Oct 22, 2025, 2:30 PM

M/I Homes Reports Q3 2025 Results

MHO

Earnings

Share Buyback

Demand Weakening

- M/I Homes, Inc. reported net income of $106.5 million or $3.92 per diluted share for the third quarter of 2025, on revenue of $1.1 billion, which declined 1% compared to the prior year.

- Homes delivered increased 1% to a third-quarter record of 2,296 units, while new contracts decreased 6% to 1,908 during the same period.

- As of September 30, 2025, shareholders' equity reached a record $3.1 billion, with book value per share increasing to a record high of $120.

- The company repurchased $50 million of common stock and maintained a strong financial position, including a homebuilding debt-to-capital ratio of 18% and a net debt-to-capital ratio of negative 1%.

Oct 22, 2025, 11:30 AM

M/I Homes Amends Credit Agreement, Increasing Commitments and Extending Maturity

MHO

Debt Issuance

- M/I Homes, Inc. executed a Seventh Amendment to its unsecured revolving credit facility on September 18, 2025, increasing commitments from $650.0 million to $900.0 million and extending the maturity to September 18, 2030.

- The amended facility includes an accordion feature, allowing for an increase in maximum borrowing availability to $1.05 billion.

- The amendment also reduced the SOFR margin to 150 basis points from 175 basis points and decreased the commitment fee by 5 basis points to 25 basis points, both subject to leverage ratio adjustments.

- As of June 30, 2025, there were no borrowings outstanding and $88.5 million in letters of credit outstanding under the Credit Agreement.

Sep 19, 2025, 11:48 AM

Quarterly earnings call transcripts for M/I HOMES.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more