Earnings summaries and quarterly performance for MOTORCAR PARTS OF AMERICA.

Executive leadership at MOTORCAR PARTS OF AMERICA.

Board of directors at MOTORCAR PARTS OF AMERICA.

Research analysts who have asked questions during MOTORCAR PARTS OF AMERICA earnings calls.

Derek Soderberg

Cantor Fitzgerald

6 questions for MPAA

Also covers: AMPX, ARRY, ECX +9 more

DS

Derek Soderbergh

Cantor Fitzgerald

3 questions for MPAA

Also covers: IMMR, LGN, SES

BN

Brian Nagel

Oppenheimer & Co. Inc.

2 questions for MPAA

Also covers: ASO, AZO, BBY +19 more

William Dezellem

Tieton Capital Management

2 questions for MPAA

Also covers: ACIC, ADTN, BGSF +15 more

Carolina Jolly

Gabelli Funds

1 question for MPAA

Also covers: GPC, MYE, SMP +1 more

Recent press releases and 8-K filings for MPAA.

Motorcar Parts of America Reports Q3 2026 Results and Revises Fiscal 2026 Guidance

MPAA

Earnings

Guidance Update

Demand Weakening

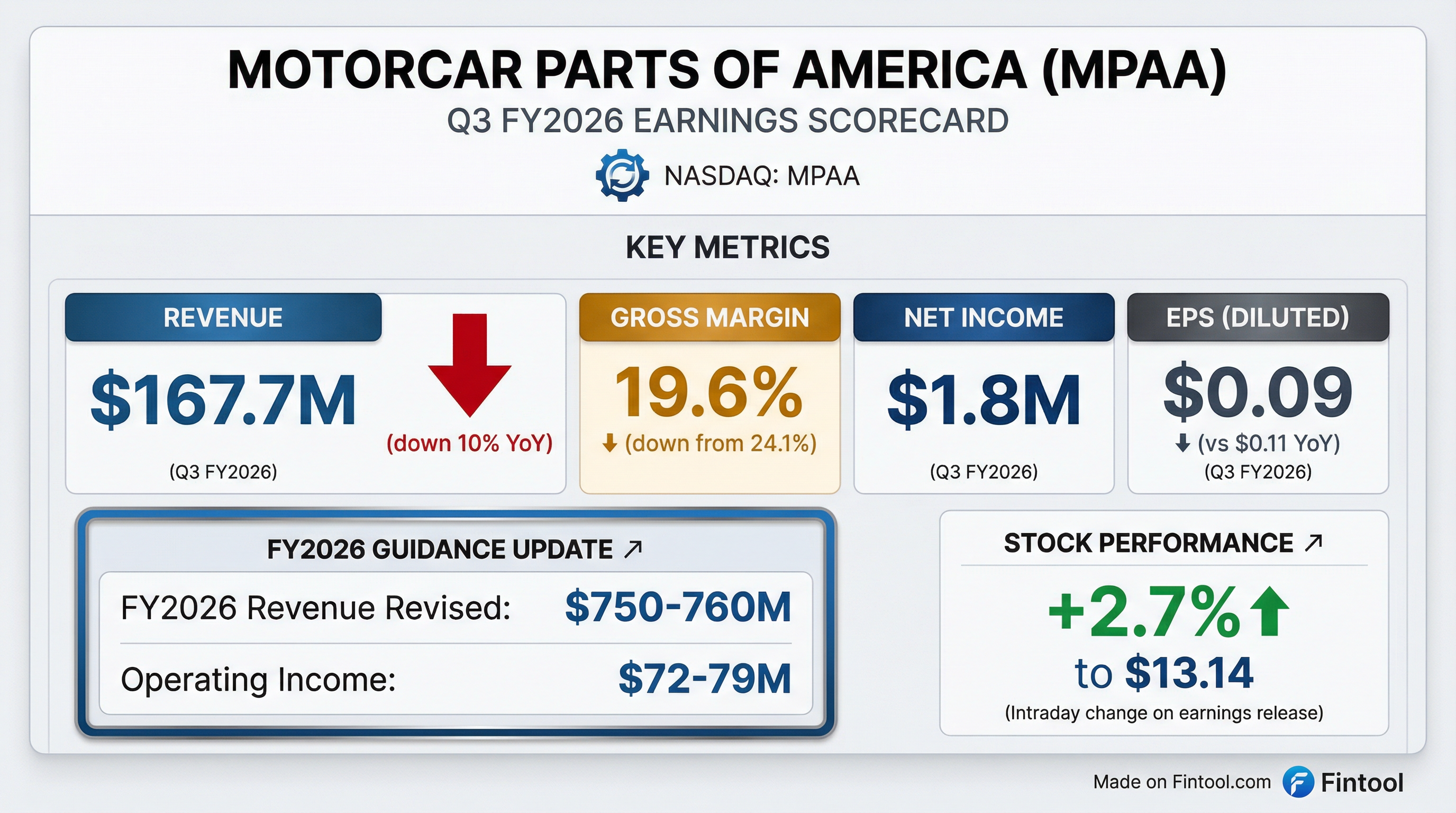

- Motorcar Parts of America's Q3 2026 results were less than expected due to reduced purchases from a large customer, which also led to a revision of fiscal 2026 sales guidance to between $750 million-$760 million and operating income to between $72 million and $79 million.

- The company's gross margin for Q3 2026 was 19.6%, an increase sequentially from 18.0% in Q1 and 19.3% in Q2, and is expected to continue improving in Q4.

- For the nine-month period, cash generated was $23.7 million, and net bank debt decreased by $10.9 million to $70.5 million, resulting in a net bank debt to EBITDA ratio of 0.84 as of December 31, 2025.

- MPAA repurchased 669,472 shares for $8.4 million at an average price of $12.47 during the nine-month period.

- The company is exploring strategic alternatives for its EV Emulator business, which is considered a non-core asset due to its focus on the OE side rather than MPAA's aftermarket focus.

Feb 9, 2026, 6:00 PM

Motorcar Parts of America Reports Q3 2026 Results and Revises Fiscal 2026 Guidance

MPAA

Earnings

Guidance Update

M&A

- Motorcar Parts of America reported Q3 2026 results that were less than expected, primarily due to reduced purchases from a large customer, although ordering activity is now recovering.

- The company revised its fiscal 2026 sales guidance down to between $750 million-$760 million and operating income to between $72 million and $79 million.

- Gross margin for Q3 2026 was 19.6%, a decrease from 24.1% a year prior, but is anticipated to improve sequentially in the fourth quarter.

- MPAA generated $23.7 million in cash for the nine-month period, leading to a $10.9 million reduction in net bank debt to $70.5 million as of December 31, 2025, and repurchased $8.4 million in shares.

- The company is exploring strategic alternatives for its non-core EV Emulator business to capitalize on its proprietary technology.

Feb 9, 2026, 6:00 PM

Motorcar Parts of America Reports Q3 2026 Results and Revises FY2026 Guidance

MPAA

Guidance Update

Demand Weakening

Share Buyback

- Motorcar Parts of America's Q3 2026 results were less than expected due to reduced purchases from a large customer, though ordering activity is now recovering.

- The company revised its fiscal 2026 sales guidance down to between $750 million-$760 million and expects operating income between $72 million and $79 million, primarily due to a $50 million impact from the customer's store closures and distribution center consolidation.

- MPAA is exploring strategic alternatives for its non-core EV Emulator business to capitalize on its proprietary technology.

- The company maintains strong liquidity of approximately $146 million as of December 31, 2025, and has reduced net bank debt by $10.9 million to $70.5 million during the nine-month period, achieving a net bank debt to EBITDA ratio of 0.84.

- For the nine-month period, MPAA repurchased 669,472 shares for $8.4 million at an average price of $12.47.

Feb 9, 2026, 6:00 PM

Motorcar Parts of America Reports Fiscal Q3 2026 Results and Revises Full-Year Guidance

MPAA

Earnings

Guidance Update

Share Buyback

- Motorcar Parts of America reported fiscal Q3 2026 net sales of $167.7 million and net income of $1.8 million ($0.09 per diluted share), primarily impacted by an approximately $17 million sales decrease from a large customer.

- For the fiscal 2026 nine-month period, net sales increased 2.4% to $577.5 million, and the company generated approximately $23.7 million in cash, reducing net bank debt by $10.9 million to $70.5 million.

- The company revised its fiscal 2026 sales guidance to between $750 million and $760 million and repurchased 381,562 shares for $5.0 million during Q3 2026.

Feb 9, 2026, 1:00 PM

Motorcar Parts of America Reports Fiscal Q3 2026 Results and Revises Full-Year Guidance

MPAA

Earnings

Guidance Update

Share Buyback

- Motorcar Parts of America, Inc. reported fiscal Q3 2026 net sales of $167.7 million, a decrease from $186.2 million in the prior year, primarily due to a $17 million sales reduction from a large customer. Net income for the quarter was $1.8 million, or $0.09 per diluted share, down from $2.3 million, or $0.11 per diluted share, a year ago.

- For the nine-month period ended December 31, 2025, net sales increased 2.4% to $577.5 million, and the company reported net income of $2.7 million, or $0.13 per diluted share, compared to a net loss of $18.7 million, or $0.95 per share, in the prior year.

- The company revised its fiscal 2026 sales guidance to between $750 million and $760 million and operating income to between $72 million and $79 million, reflecting the impact of reduced ordering from the large customer.

- During fiscal Q3 2026, the company repurchased 381,562 shares for $5.0 million at an average price of $13.10, with $25.1 million remaining under its authorized share repurchase program. Net bank debt decreased by $10.9 million to $70.5 million as of December 31, 2025.

Feb 9, 2026, 12:58 PM

Motorcar Parts of America Reports Q2 2026 Financial Results

MPAA

Earnings

Guidance Update

Share Buyback

- Motorcar Parts of America reported net sales of $221.5 million for the Fiscal 2026 second quarter, an increase of 6.4%, and $409.8 million for the six-month period, up 8.4%. The company posted a net loss of $2.1 million ($0.11 per share) for Q2 2026, but achieved a net income of $893,000 ($0.04 per diluted share) for the six-month period.

- The company generated $21.9 million in cash from operating activities during Q2 2026 and $31.9 million for the six-month period. This contributed to a net bank debt reduction of $17.7 million in Q2 and $24.6 million for the six months, bringing the total net bank debt to $56.7 million as of September 30, 2025.

- MPAA repurchased 90,114 shares for $1.4 million at an average price of $15.41 during Q2 2026, and a total of 287,910 shares for $3.4 million at an average price of $11.65 for the six-month period.

- The company confirmed its guidance for Fiscal 2026, anticipating continued organic growth driven by favorable long-term industry trends, including the rising average age of U.S. light vehicles to 12.8 years and an increase in vehicles on the road to 293.5 million.

Nov 10, 2025, 6:00 PM

Motorcar Parts of America Reports Fiscal Second Quarter 2026 Results

MPAA

Earnings

Share Buyback

Revenue Acceleration/Inflection

- Motorcar Parts of America, Inc. reported record net sales of $221.5 million for the fiscal second quarter ended September 30, 2025, an increase of 6.4 percent from the prior year. For the six-month period, net sales reached a record $409.8 million, up 8.4 percent.

- The company recorded a net loss of $2.1 million, or $0.11 per share, for the fiscal second quarter 2026. This is an improvement compared to a net loss of $3.0 million, or $0.15 per share, in the prior year. For the six-month period, net income was $893,000, or $0.04 per diluted share, a significant improvement from a net loss of $21.0 million, or $1.07 per share, a year ago.

- Gross profit for the fiscal second quarter was a record $42.7 million, increasing 3.5 percent from the prior year. For the six-month period, gross profit also reached a record $76.6 million.

- The company generated $21.9 million in cash from operating activities during the fiscal second quarter and reduced net bank debt by $17.7 million to $56.7 million.

- During the fiscal second quarter 2026, 90,114 shares were repurchased for $1.4 million at an average price of $15.41.

Nov 10, 2025, 12:58 PM

CSW Industrials Completes MARS Parts Acquisition

MPAA

M&A

New Projects/Investments

- CSW Industrials completed the acquisition of Motors & Armatures Parts (MARS Parts) on November 4, 2025, for approximately $650 million in cash.

- The acquisition expands CSW's product portfolio in the profitable HVAC/R end market by adding motors, capacitors, and other electrical components, aligning with CSW's strategy to leverage existing distribution and grow market share.

- The cash purchase price represents 10.4x pro-forma trailing twelve-month (TTM) EBITDA adjusted for identified synergies, and approximately 12.4x MARS Parts’ estimated adjusted TTM EBITDA of $52.3 million.

- The transaction was funded using a $600 million Syndicated Term Loan A and borrowings under an extended $700 million revolving credit facility.

Nov 4, 2025, 6:00 PM

Motorcar Parts of America Highlights Strong Financials and Growth Initiatives

MPAA

Guidance Update

New Projects/Investments

Share Buyback

- Motorcar Parts of America (MPAA) reported a 14.7% EBIT margin in Q3 and expects $385 million in free cash flow at the midpoint of its latest guidance, representing over a 10% free cash flow yield on its $3.3 billion equity cap. The company also noted its gross margins are back to the low 20s and it has less than half a turn of debt on EBITDA , with strong liquidity.

- The company is expanding its product lines, with the brake business growing to a couple hundred million and potentially making them the second-largest player. Its diagnostic business is also projected to become a $100 million business.

- MPAA operates with a capital-light model, spending less than 3% of sales on CapEx. It has been actively buying back shares, with an average purchase price around $9.19 , and plans an Investor Day in 2026 to provide a strategic refresh and update.

Nov 3, 2025, 9:30 PM

CSW Industrials to Acquire Motors & Armatures Parts

MPAA

M&A

New Projects/Investments

Debt Issuance

- CSW Industrials has entered into a definitive agreement to acquire Motors & Armatures Parts (MARS Parts) for $650 million in cash, with a potential earn-out of up to $20 million based on revenue targets.

- The acquisition is valued at approximately 10.5x identified synergies-adjusted Trailing Twelve Month (TTM) EBITDA or 12.5x TTM adjusted EBITDA at close, based on MARS Parts' estimated adjusted TTM EBITDA of $51.8 million.

- This transaction is expected to be immediately accretive to CSW's EPS and EBITDA, with the acquired business projected to achieve an EBITDA margin run rate of at least 30% within 12 months of closing.

- The acquisition expands CSW's product portfolio in the HVAC/R end market, strategically complementing its Contractor Solutions business by adding products focused on repair.

- CSW plans to fund the acquisition using a combination of a Syndicated Term Loan A and borrowings under its existing $700 million revolving credit facility, aiming to maintain a leverage target of approximately 2.0x EBITDA upon closing.

Oct 1, 2025, 12:30 PM

Quarterly earnings call transcripts for MOTORCAR PARTS OF AMERICA.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more