Earnings summaries and quarterly performance for MPLX.

Research analysts who have asked questions during MPLX earnings calls.

John Mackay

Goldman Sachs Group, Inc.

9 questions for MPLX

Manav Gupta

UBS Group

9 questions for MPLX

Michael Blum

Wells Fargo & Company

7 questions for MPLX

Jeremy Tonet

JPMorgan Chase & Co.

6 questions for MPLX

Keith Stanley

Wolfe Research, LLC

6 questions for MPLX

Theresa Chen

Barclays PLC

6 questions for MPLX

Burke Sansiviero

Wolfe Research, LLC

2 questions for MPLX

Elvira Scotto

RBC Capital Markets

2 questions for MPLX

Neal Dingmann

Truist Securities

2 questions for MPLX

Berg Sansavero

Wolfe Research

1 question for MPLX

Indraneel Mitra

Bank of America

1 question for MPLX

Neel Mitra

Bank of America

1 question for MPLX

Recent press releases and 8-K filings for MPLX.

- MPLX LP issued $1,000,000,000 aggregate principal amount of 5.300% Senior Notes due 2036 and $500,000,000 aggregate principal amount of 6.100% Senior Notes due 2056.

- The underwriting agreement for these notes was dated February 5, 2026, and the supplemental indentures were dated February 12, 2026.

- Interest payments for both series of notes will commence on October 1, 2026, with subsequent payments on April 1 and October 1 each year.

- MPLX LP priced an offering of $1.5 billion in aggregate principal amount of unsecured senior notes.

- The offering consists of $1.0 billion of 5.300% senior notes due 2036 and $500 million of 6.100% senior notes due 2056.

- The net proceeds from this offering are intended to repay MPLX's outstanding $1.5 billion aggregate principal amount of 1.750% senior notes due March 2026 at maturity.

- The closing of the offering is expected to occur on February 12, 2026.

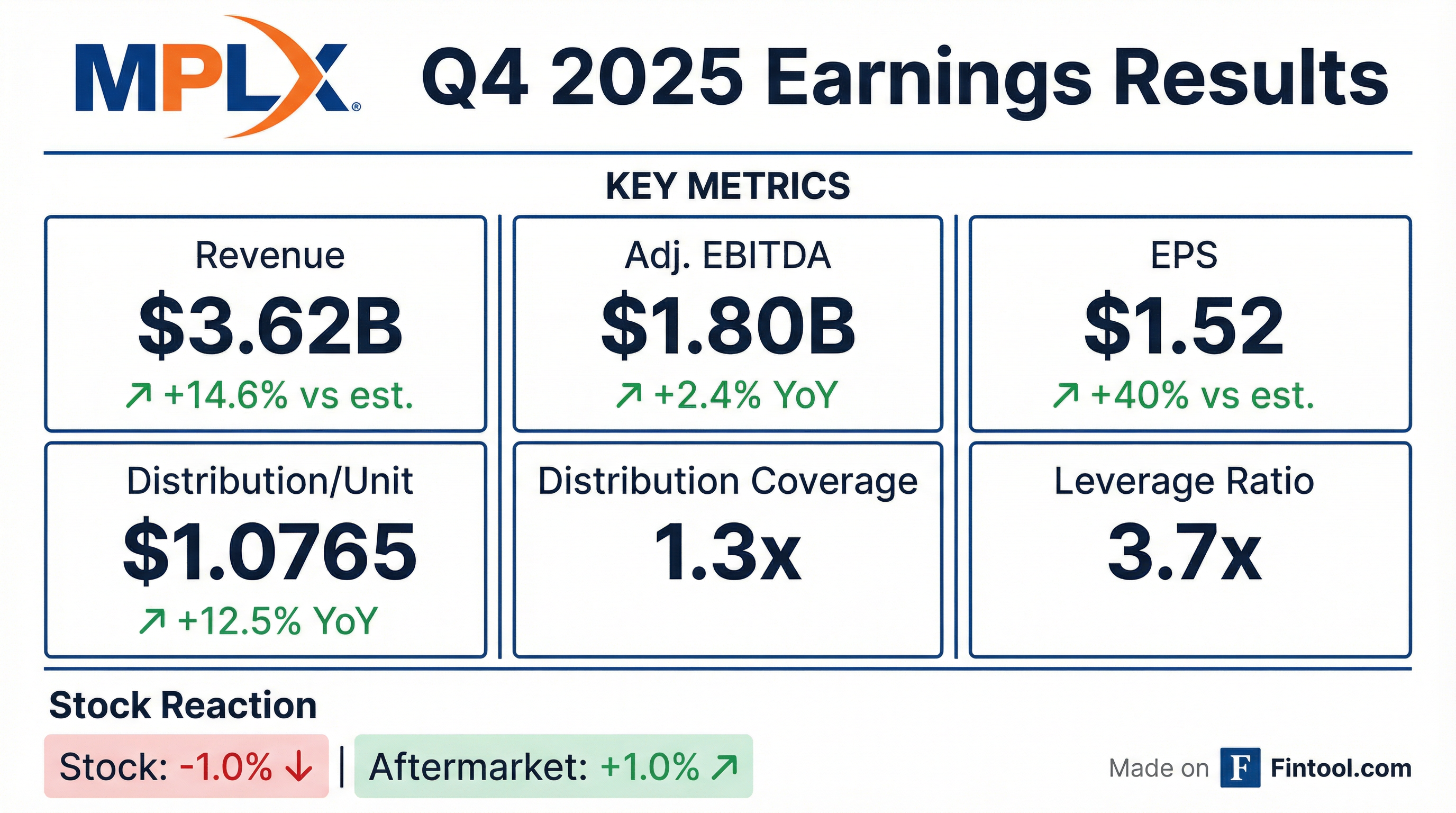

- MPLX reported full-year 2025 Adjusted EBITDA of $7.0 Billion and Distributable Cash Flow of $5.8 Billion.

- The company increased its quarterly distribution by 12.5% and returned $4.4 Billion to unitholders in 2025, which included $400 Million in unit repurchases.

- For 2026, MPLX has a capital outlook of $2.7 Billion, with approximately $2.4 Billion dedicated to growth projects.

- The Consolidated Total Debt to LTM Adjusted EBITDA Ratio stood at 3.7x at the end of 2025.

- MPLX reported Q4 2025 Adjusted EBITDA of $1.8 billion, a 2% increase from the prior year, and achieved just over $7 billion in Adjusted EBITDA for the full year 2025, marking its fourth consecutive year of mid-single-digit Adjusted EBITDA growth.

- The company increased its distribution by 12.5% in 2025, bringing total capital returns to unit holders to $4.4 billion, and expects to maintain this level of distribution growth for two more years.

- MPLX plans to invest $2.4 billion in 2026, with 90% directed towards natural gas and NGL services, focusing on projects in the Permian and Marcellus expected to generate mid-teens returns.

- Key projects include the $320 million Secretariat II processing plant (expected online in the second half of 2028), the Harmon Creek III complex (expected completion in Q3 2026), and a 400,000 barrel per day LPG export terminal JV (expected online in 2028).

- MPLX expects 2026 growth to exceed 2025 and anticipates supporting mid-single-digit EBITDA growth in 2027, while maintaining a strong balance sheet with leverage not exceeding 4.0x and distribution coverage above 1.3 times.

- MPLX reported Q4 2025 Adjusted EBITDA of $1.8 billion, a 2% increase year-over-year, and full-year 2025 Adjusted EBITDA of just over $7 billion.

- The company announced a $2.4 billion capital plan for 2026 and projects 12.5% distribution growth for two more years, following a similar increase in 2025.

- MPLX anticipates growth in 2026 to exceed 2025 and expects mid-single-digit EBITDA growth in 2027, driven by new assets and increased throughput.

- Significant projects include the $320 million Secretariat II processing plant (expected H2 2028) and the Harmon Creek III complex (expected Q3 2026).

- The company aims to maintain a leverage ratio not above 4.0x and an annual distribution coverage not below 1.3 times.

- MPLX reported Adjusted EBITDA of just over $7 billion for the full year 2025, marking its fourth consecutive year of mid-single-digit, three-year Adjusted EBITDA growth CAGR. For Q4 2025, Adjusted EBITDA increased 2% to $1.8 billion, while Distributable Cash Flow decreased 4% to $1.4 billion.

- The company returned $4.4 billion to unitholders in 2025, including a 12.5% increase in its distribution, and expects this level of distribution growth for two more years. MPLX ended Q4 2025 with a cash balance of $2.1 billion and aims to maintain leverage at or below 4.0x.

- MPLX plans to invest $2.4 billion in its 2026 capital plan, with 90% allocated to natural gas and NGL services in the Permian and Marcellus, targeting mid-teens returns. Key projects include the Secretariat II processing plant (online H2 2028), Bengal pipeline expansion (online Q4 2026), a 400,000 barrel per day LPG export terminal JV (online 2028), and Harmon Creek III complex (online Q3 2026).

- The company anticipates growth in 2026 to exceed 2025 and expects mid-single-digit EBITDA growth in 2027 as new assets come online and ramp up.

- MPLX LP reported full-year 2025 net income attributable to MPLX of $4.9 billion and adjusted EBITDA of $7.0 billion. For the fourth quarter of 2025, net income was $1,193 million and adjusted EBITDA was $1,804 million.

- The company returned $4.4 billion to unitholders in full-year 2025, including $400 million in common unit repurchases, and announced a fourth-quarter 2025 distribution of $1.0765 per common unit.

- MPLX announced a 2026 organic growth capital plan of $2.4 billion, part of a total $2.7 billion capital spending outlook for 2026, primarily focused on natural gas and NGL value chains to drive mid-single digit adjusted EBITDA growth.

- Key new and ongoing investments include the Secretariat II gas processing plant (expected H2 2028), Marcellus Gathering System Expansion (expected H1 2028), and Gulf Coast Fractionators and LPG Export Terminal (anticipated 2028-2029).

- MPLX reported full-year 2025 net income attributable to MPLX of $4.9 billion and adjusted EBITDA of $7.0 billion.

- For the full year 2025, the company made growth investments of $5.5 billion and returned $4.4 billion to unitholders.

- In the fourth quarter of 2025, net income attributable to MPLX was $1,193 million and adjusted EBITDA was $1,804 million.

- MPLX announced a 2026 organic growth capital plan of $2.4 billion, primarily focused on natural gas and NGL investments, which are expected to drive mid-single digit adjusted EBITDA growth.

- The company declared a fourth-quarter 2025 distribution of $1.0765 per common unit and maintained a leverage ratio of 3.7x at year-end 2025.

- MPLX reported strong fourth-quarter 2025 results, with GAAP EPS of $1.17 and revenue of $3.25 billion, representing a 6.2% year-over-year increase.

- For Q4 2025, the company generated $1.804 billion in adjusted EBITDA and $1.417 billion of distributable cash flow, contributing to a full-year 2025 distributable cash flow of $5.8 billion.

- MPLX returned more than $4 billion to unitholders in 2025 and announced a Q4 distribution of $1.0765 per common unit.

- The company plans to invest $2.4 billion in organic growth capital through 2026, focusing on natural gas and NGL value chains to support mid-single-digit adjusted EBITDA growth.

- The board of directors of MPLX LP has declared a quarterly cash distribution of $1.0765 per common unit for the fourth quarter of 2025, which is $4.31 on an annualized basis.

- This distribution will be paid on Feb. 17, 2026, to common unitholders of record as of Feb. 9, 2026.

- For non-U.S. investors, 100% of the Partnership's distributions are considered attributable to income effectively connected with a U.S. trade or business and are subject to federal income tax withholding at the highest applicable effective tax rate.

Quarterly earnings call transcripts for MPLX.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more