Earnings summaries and quarterly performance for Madison Square Garden Entertainment.

Executive leadership at Madison Square Garden Entertainment.

Board of directors at Madison Square Garden Entertainment.

Brian G. Sweeney

Director

Charles P. Dolan

Director

Claire D. Sweeney

Director

Donna M. Coleman

Director

Frederic V. Salerno

Director

Marianne Dolan Weber

Director

Martin Bandier

Director

Paul J. Dolan

Director

Quentin F. Dolan

Director

Ryan T. Dolan

Director

Thomas C. Dolan

Director

Research analysts who have asked questions during Madison Square Garden Entertainment earnings calls.

Peter Henderson

BofA Securities

6 questions for MSGE

Cameron Mansson-Perrone

Morgan Stanley

5 questions for MSGE

David Karnovsky

JPMorgan Chase & Co.

5 questions for MSGE

Stephen Laszczyk

Goldman Sachs

5 questions for MSGE

Brandon Ross

LightShed Partners

3 questions for MSGE

David Joyce

Seaport Research Partners

3 questions for MSGE

Peter Supino

Wolfe Research

3 questions for MSGE

Jack DiDonato

Wolfe Research

2 questions for MSGE

Antares Tobelem

Stifel

1 question for MSGE

Recent press releases and 8-K filings for MSGE.

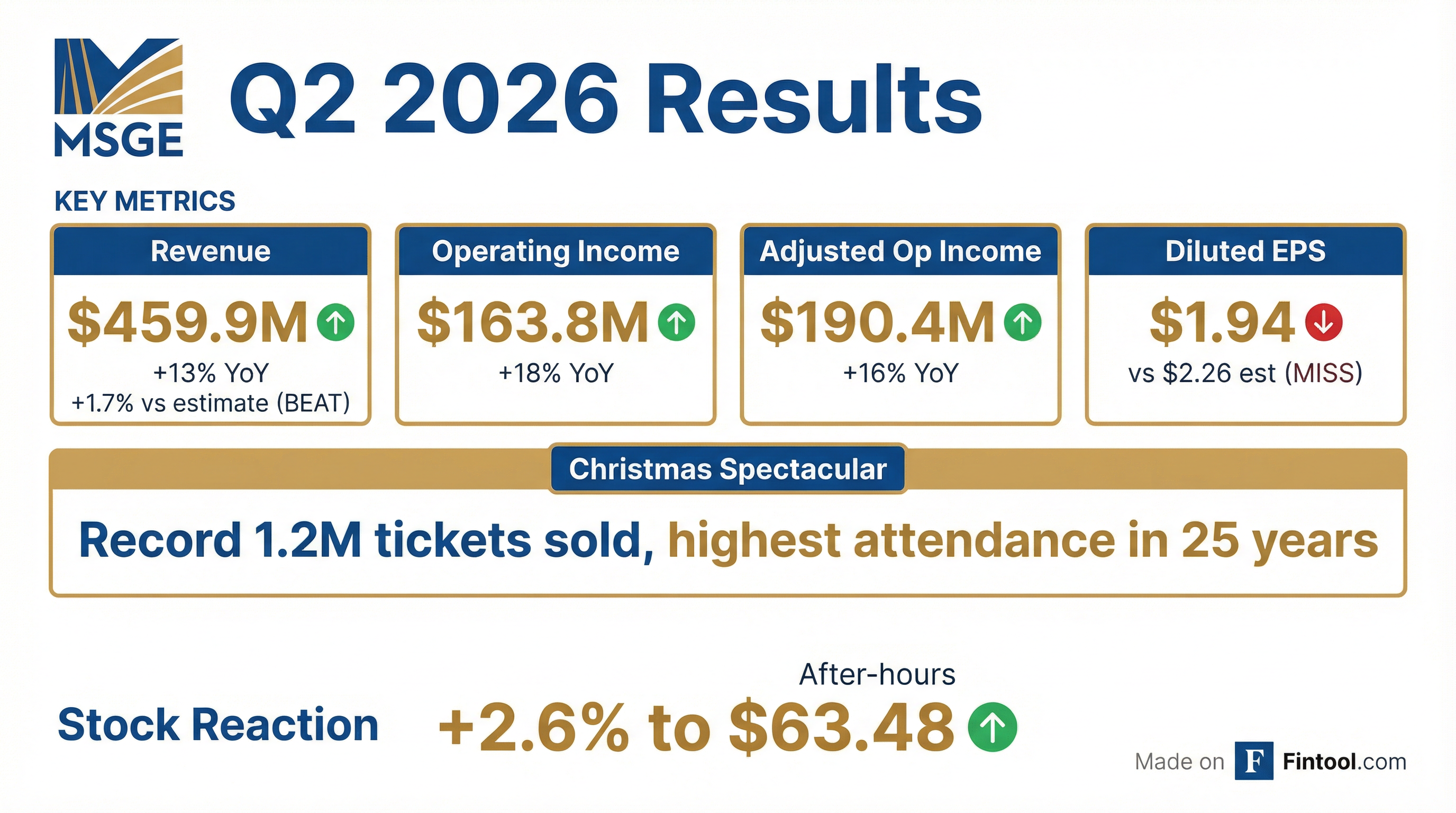

- Madison Square Garden Entertainment Corp. (MSGE) reported revenues of $459.9 million, a 13% increase year-over-year, and adjusted operating income of $190.4 million, a 16% increase for the fiscal second quarter of 2026.

- The Christmas Spectacular production generated approximately $195 million in total revenue from over 1.2 million tickets sold across 215 paid performances, achieving its highest attendance in 25 years.

- The company anticipates strong concert growth, with The Garden pacing well ahead for fiscal 2027, including a 30-night Harry Styles residency and a 9-show Bon Jovi residency.

- MSGE repurchased $25 million of Class A common stock fiscal year to date and has $45 million remaining under its current buyback authorization.

- Madison Square Garden Entertainment Corp. (MSGE) reported Q2 Fiscal 2026 revenues of $460 million and adjusted operating income of $190 million, both representing double-digit percentage increases year-over-year.

- The Christmas Spectacular generated approximately $195 million in total revenue for its 2025 holiday season run, with over 1.2 million tickets sold (its highest attendance in 25 years) and a mid-single-digit percentage increase in per-show revenue compared to fiscal 2025.

- Concert bookings at The Garden are pacing up strongly for the remainder of fiscal 2026 and are well ahead for the first half of fiscal 2027, driven by events such as a 30-night Harry Styles residency and multi-night runs from Bon Jovi and Rush.

- The company continues to observe strong consumer demand across its venues, with the majority of concerts sold out and record-high food, beverage, and merchandise per caps for the Christmas Spectacular. MSGE also has $45 million remaining under its current share buyback authorization.

- Madison Square Garden Entertainment Corp. (MSGE) reported Q2 FY2026 revenues of $459.9 million, a 13% increase year-over-year, and adjusted operating income of $190.4 million, up 16% compared to the prior year quarter.

- The Christmas Spectacular achieved a record-setting season, generating approximately $195 million in total revenue from 215 paid performances and selling over 1.2 million tickets, marking its highest attendance in 25 years.

- Concert bookings at The Garden are pacing strongly for the remainder of fiscal 2026 and are well ahead for fiscal 2027, including a 30-night Harry Styles residency starting in August 2026, which is expected to be a meaningful contributor to concert growth.

- As of December 31, MSGE held $157 million in unrestricted cash and had $594 million in debt; the company repurchased $25 million of stock fiscal year-to-date and has $45 million remaining under its current buyback authorization.

- SG&A expenses were elevated in Q2 FY2026 due to $4 million in executive management transition costs and a $2 million one-time expense true-up, with an additional $8 million severance expense anticipated in Q3 FY2026 before normalization by Q4 FY2026.

- Madison Square Garden Entertainment Corp. reported revenues of $459.9 million for the fiscal second quarter ended December 31, 2025, an increase of 13% compared to the prior year quarter.

- Operating income grew by 18% to $163.8 million, and adjusted operating income increased by 16% to $190.4 million for the quarter.

- The Christmas Spectacular production achieved record-setting revenues and sold over 1.2 million tickets, marking its highest attendance in 25 years.

- Net income for Q2 2026 was $92.7 million, with diluted earnings per share of $1.94.

- The Executive Chairman and CEO noted strong momentum across the business and expects robust growth in both revenue and adjusted operating income for the fiscal year.

- Madison Square Garden Entertainment Corp. reported revenues of $459.9 million for the fiscal second quarter ended December 31, 2025, an increase of 13% compared to the prior year quarter.

- Operating income rose by 18% to $163.8 million, and adjusted operating income increased by 16% to $190.4 million for the fiscal second quarter 2026.

- The Christmas Spectacular production achieved record-setting revenues and sold over 1.2 million tickets, marking its highest attendance in 25 years.

- The company's Executive Chairman and CEO, James L. Dolan, indicated strong momentum across the business and stated that they remain on track for robust growth in both revenue and adjusted operating income for the fiscal year.

- Madison Square Garden Entertainment Corp. (MSGE) reported revenues of $158.3 million for the fiscal 2026 first quarter, marking a 14% increase compared to the prior year quarter.

- Adjusted Operating Income (AOI) for Q1 2026 was $7.1 million, an increase of $5.2 million from the prior year quarter.

- The company repurchased approximately $25 million of its Class A common stock during the quarter, with $45 million remaining under its current buyback authorization.

- Operational highlights include a record number of concerts at Madison Square Garden in Q1 2026 and 215 planned performances for the Christmas Spectacular, up from 200 last year, with advanced ticket revenues pacing up double digits.

- Madison Square Garden Entertainment Corp. reported revenues of $158.3 million for the fiscal first quarter ended September 30, 2025, representing a 14% increase compared to the prior year quarter.

- For Q1 2026, the company's operating loss was $29.7 million, an increase of $11.3 million from the prior year, while adjusted operating income rose to $7.1 million, an increase of $5.2 million.

- The increase in revenues was primarily driven by higher revenues from entertainment offerings, including an increase in concerts and other live entertainment and sporting events, as well as higher food, beverage, and merchandise sales.

- During the fiscal first quarter of 2026, the company repurchased approximately $25 million of its Class A common stock, bringing total share repurchases since its April 2023 spin-off to approximately $205 million.

- The Executive Chairman and CEO stated confidence in driving solid growth in both revenue and adjusted operating income in fiscal 2026.

- Madison Square Garden Entertainment Corp. (MSGE) reported fiscal 2026 first quarter revenues of $158.3 million, an increase of 14% compared to the prior year quarter.

- The company's adjusted operating income for the quarter was $7.1 million, an increase of $5.2 million from the prior fiscal year first quarter.

- During the fiscal 2026 first quarter, MSGE repurchased approximately $25 million of its Class A common stock, bringing total share repurchases since its 2023 spin-off to approximately $205 million.

- The fiscal 2026 first quarter was highlighted by a new record for the number of concerts in any quarter at the Madison Square Garden Arena.

- Executive Chairman and CEO James L. Dolan expressed confidence in driving solid growth in both revenue and adjusted operating income in fiscal 2026.

- Madison Square Garden Entertainment Corp. (MSGE) repurchased 623,271 shares of its Class A common stock for approximately $25 million at an average price of $40.11 per share between August 20, 2025, and September 11, 2025, funded by cash on hand.

- Since its spin-off in April 2023, MSGE has repurchased a total of approximately $205 million worth of shares.

- The company has approximately $45 million remaining under its existing share repurchase authorization.

Quarterly earnings call transcripts for Madison Square Garden Entertainment.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more