Earnings summaries and quarterly performance for MURPHY OIL.

Executive leadership at MURPHY OIL.

Eric M. Hambly

President and Chief Executive Officer

Daniel R. Hanchera

Senior Vice President, Business Development

E. Ted Botner

Executive Vice President, General Counsel and Corporate Secretary

Thomas J. Mireles

Executive Vice President and Chief Financial Officer

Board of directors at MURPHY OIL.

Claiborne P. Deming

Chair of the Board

Elisabeth W. Keller

Director

Jeffrey W. Nolan

Director

Laura A. Sugg

Director

Lawrence R. Dickerson

Director

Michelle A. Earley

Director

R. Madison Murphy

Director

Robert B. Tudor, III

Director

Robert N. Ryan, Jr.

Director

Research analysts who have asked questions during MURPHY OIL earnings calls.

Carlos Escalante

Wolfe Research

6 questions for MUR

Leo Mariani

ROTH MKM

6 questions for MUR

Paul Cheng

Scotiabank

6 questions for MUR

Charles Meade

Johnson Rice & Company L.L.C.

5 questions for MUR

Neil Mehta

Goldman Sachs

5 questions for MUR

Arun Jayaram

JPMorgan Chase & Co.

4 questions for MUR

Phillip Jungwirth

BMO Capital Markets

3 questions for MUR

Betty Jiang

Barclays

2 questions for MUR

Chris Whittaker

Evercore

2 questions for MUR

Neal Dingmann

Truist Securities

2 questions for MUR

Timothy Rezvan

KeyBanc Capital Markets Inc.

2 questions for MUR

Tim Rezvan

KeyBanc Capital Markets

2 questions for MUR

Chris Baker

Evercore ISI

1 question for MUR

Devin Mcdermott

Morgan Stanley

1 question for MUR

Geoff Jay

Daniel Energy Partners

1 question for MUR

Jeff Jain

VL Energy Partners

1 question for MUR

Joshua Silverstein

UBS Group AG

1 question for MUR

Margaret Drefke

Goldman Sachs

1 question for MUR

Wei Jiang

Barclays

1 question for MUR

Recent press releases and 8-K filings for MUR.

- Murphy Oil Corporation announced that its Caracal-1X exploration well in Block CI-102 offshore Côte d’Ivoire will be plugged and abandoned as a dry hole after encountering hydrocarbon shows.

- The well reached a total depth of 8,534 feet (2,601 meters).

- Murphy, which holds a 90 percent working interest in Block CI-102, remains committed to proceeding with the Bubale-1X well in Block CI-709, targeting a different geological play.

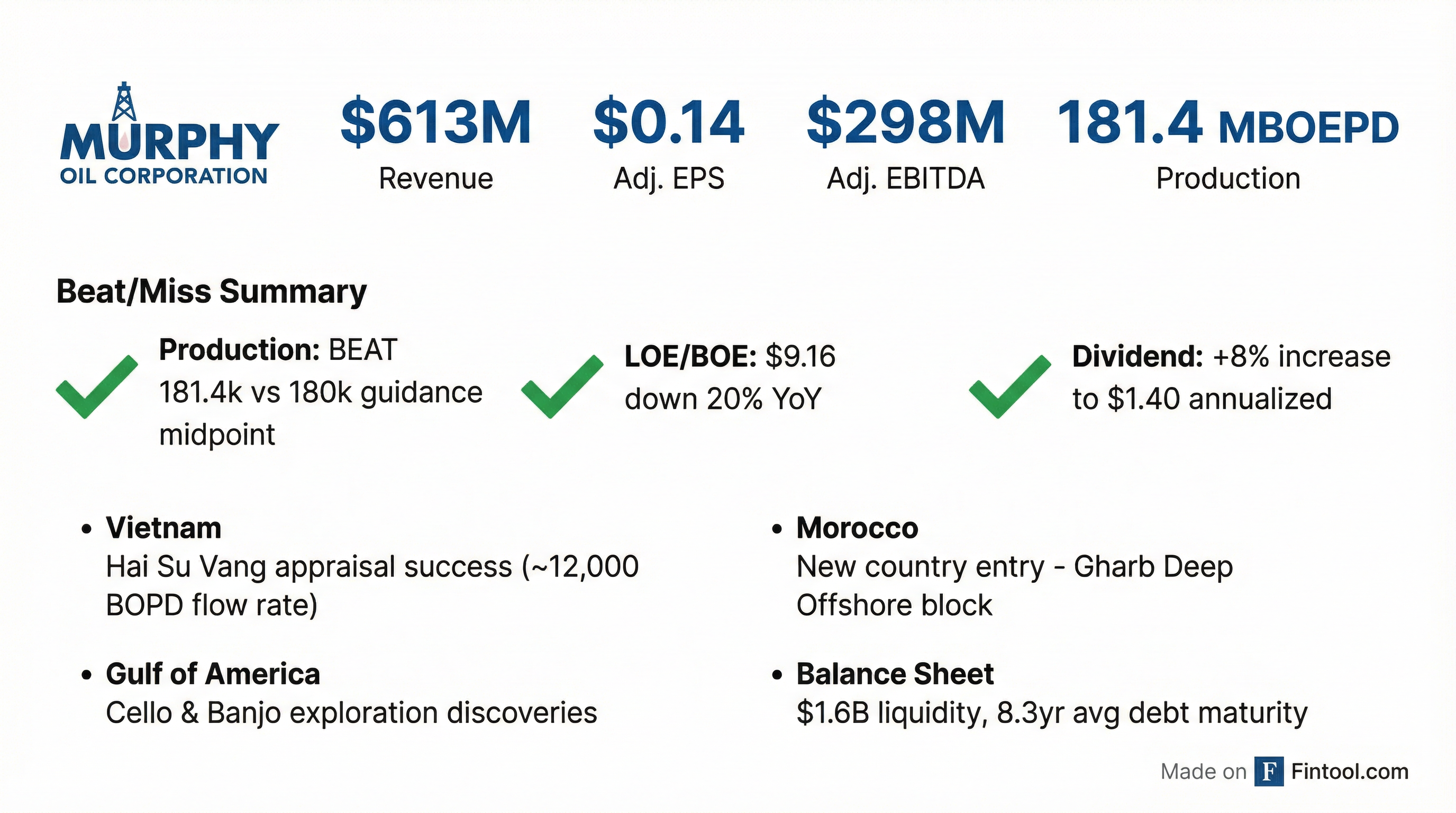

- Murphy Oil Corporation achieved strong execution in 2025, with production exceeding guidance, a 20% reduction in lease operating expenses, and an 80% exploration success rate, highlighted by a successful appraisal at Hai Su Vang in Vietnam.

- For 2026, net production is projected to be lower at 171,000 barrels of oil equivalents per day compared to 182,000 BOE/day in 2025, primarily due to Tupper Montney gas volumes, though the cash flow impact is expected to be muted.

- The company is making strategic investments in 2026 including two appraisal wells in Vietnam, two exploration wells in Côte d'Ivoire, and expanding its exploration portfolio into offshore Morocco and the Gulf of America, with first oil from the Lac Da Vang development expected in Q4 2026.

- Long-term growth is anticipated from Vietnam, with the Hai Su Vang and Lac Da Vang fields collectively projected to produce 30,000-50,000 net BOE per day in the early 2030s, with first oil from Hai Su Vang targeted for 2031.

- For 2025, Murphy's production exceeded guidance, lease operating expenses were reduced by 20% year-over-year, and capital expenditures were below guidance. The company achieved a 103% overall reserve replacement on proved reserves.

- Murphy projects 2026 net production to be 171,000 barrels of oil equivalents per day, a decrease from 182,000 barrels of oil equivalents per day in 2025, primarily due to lower Tupper Montney natural gas volumes. Lease operating expenses are expected to remain in the $10-$12 per barrel range.

- The company plans strategic investments in development, exploration, and appraisal activities in the Gulf of America, Vietnam, and Côte d'Ivoire. This includes two additional appraisal wells at Hai Su Vang (Vietnam) in H1 2026, with first oil targeted for 2031 , and the Lac Da Vang (Vietnam) development with first oil in Q4 2026. Murphy also expanded its exploration portfolio into offshore Morocco and acquired seven new blocks in the Gulf of America.

- Murphy Oil Corporation reported strong execution in 2025, exceeding production guidance, reducing lease operating expenses by 20% year-over-year, and achieving an 80% success rate in exploration efforts.

- For 2026, net production is projected to be lower at 171,000 barrels of oil equivalents per day, down from 182,000 barrels of oil equivalents per day in 2025, primarily due to Tupper Montney natural gas volumes and higher royalties.

- The company is making strategic investments in 2026, including the Lac Da Vang development in Vietnam with first oil in Q4 2026 and a peak in late 2027 or early 2028, and further appraisal at Hai Su Vang in Vietnam, which found 429 feet of net oil pay and is expected to achieve first oil around 2031 with peak production by 2033.

- Murphy achieved 103% overall reserve replacement on proved reserves in 2025, maintaining reserves around 700 million barrels for over a decade.

- Murphy Oil Corporation reported FY 2025 production of 182 MBOEPD and 4Q 2025 revenue of $582 Million. Year-end 2025 proved reserves were 715 MMBOE, representing an 11-year proved reserve life.

- The company generated $300 MM in Free Cash Flow for FY 2025 and returned $286 MM to shareholders , including an 8% increase in quarterly dividend to $1.40 / share annualized. A $550 MM share repurchase program is also authorized.

- Financial flexibility was enhanced in January 2026 with the upsizing of the revolving credit facility to $2.0 BN and the issuance of $500 MM of 2034 notes to refinance existing debt. As of December 31, 2025, liquidity stood at ~$2.3 billion with a leverage of 1.0x.

- For FY 2026, Murphy Oil Corporation provided production guidance of 167,000 - 175,000 BOEPD and accrued CAPEX guidance of $1.2 - $1.3 BN. The Lac Da Vang Development in Vietnam is targeting first oil in 4Q 2026.

- Murphy Oil reported Q4 2025 net income of $11.9 million ($0.08/share) on $624.6 million in revenue, a 6.9% decrease from the prior year. For full-year 2025, the company posted net income of $104.2 million and achieved 103% reserve replacement.

- The company returned $286 million to shareholders in 2025 and raised its quarterly dividend 8% to $0.35 per share, payable March 2, 2026.

- Murphy Oil plans $1.2–$1.3 billion in capital expenditures for fiscal 2026.

- Analysts maintain a Neutral/Hold rating on the stock, citing weakening profitability trends and valuation concerns, despite a 17.9% operating margin and a Beneish M-Score of -2.58 suggesting no earnings manipulation.

- Murphy Oil Corporation reported full year 2025 adjusted net income of $197.0 million and generated approximately $300 million in free cash flow, returning $286 million to shareholders through dividends and share repurchases.

- For 2025, the company's total net production was 182,294 BOEPD , and preliminary year-end proved reserves stood at 715 MMBOE, maintaining an 11-year reserve life.

- The company provided 2026 production guidance of 167,000 to 175,000 BOEPD and capital expenditure guidance of $1,200 to $1,300 million.

- Subsequent to the fourth quarter, Murphy increased its quarterly cash dividend by 8 percent to $0.35 per share and entered a new country with a Petroleum Agreement in Morocco.

- Murphy Oil Corporation achieved an average production of 182 thousand barrels of oil equivalent per day (MBOEPD) in 2025, generated $1.2 billion in cash from continuing operations, and returned $286 million to shareholders. The company also reduced lease operating expense per barrel of oil equivalent (LOE/BOE) by 20 percent to $10.89 in 2025.

- For the fourth quarter of 2025, Murphy reported net income of $11.9 million, adjusted EBITDA of $298.1 million, and adjusted free cash flow of $35.5 million.

- Full year 2025 capital expenditures were $1,157 million, and the company projects a 2026 capital plan of $1.2 billion to $1.3 billion. Total production is anticipated to decrease to 171 MBOEPD in 2026 from 182 MBOEPD in 2025.

- Murphy announced exploration discoveries in the Gulf of America and a successful appraisal well in Vietnam, and strengthened its balance sheet by upsizing its revolving credit facility to $2.00 billion and issuing $500 million of 2034 notes.

- Murphy Oil Corporation reported net income attributable to Murphy of $11.9 million for Q4 2025 and $104.2 million for the full year 2025.

- The company's total net production was 181,431 BOEPD in Q4 2025 and 182,294 BOEPD for the full year 2025.

- Preliminary year-end 2025 proved reserves stood at 715 MMBOE, maintaining an 11-year reserve life with a 103 percent reserve replacement.

- Murphy returned $286 million to shareholders in 2025 through dividends and stock repurchases, and increased its quarterly cash dividend by eight percent for 2026.

- For 2026, the company provided guidance of 167,000 to 175,000 BOEPD for total net production and $1,200 million to $1,300 million for capital expenditures.

- Murphy Oil Corporation completed an offering of $500,000,000 aggregate principal amount of 6.500% Notes due 2034 on January 23, 2026.

- The notes bear an interest rate of 6.500% per annum, payable semiannually on February 15 and August 15, beginning August 15, 2026, and will mature on February 15, 2034.

- The company intends to use the net proceeds to redeem its 5.875% notes due 2027 and 6.375% notes due 2028, repay outstanding borrowings under its revolving credit facility, and for general corporate purposes.

- The notes are redeemable by the company, in whole or in part, at applicable redemption prices, with specific terms for redemptions prior to and on or after February 15, 2029.

Quarterly earnings call transcripts for MURPHY OIL.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more