Earnings summaries and quarterly performance for NOVARTIS.

Research analysts who have asked questions during NOVARTIS earnings calls.

James Quigley

Goldman Sachs

8 questions for NVS

Peter Verdult

Citigroup Inc.

7 questions for NVS

Simon Baker

Redburn Atlantic

7 questions for NVS

Florent Cespedes

Bernstein

6 questions for NVS

Matthew Weston

UBS Group AG

6 questions for NVS

Richard Vosser

JPMorgan Chase & Co.

6 questions for NVS

Seamus Fernandez

Guggenheim Partners

6 questions for NVS

Thibault Boutherin

Morgan Stanley

6 questions for NVS

Graham Parry

Bank of America Corporation

5 questions for NVS

Rajesh Kumar

HSBC

4 questions for NVS

Emmanuel Papadakis

Deutsche Bank

3 questions for NVS

Kerry Holford

Berenberg

3 questions for NVS

Michael Leuchten

Jefferies

3 questions for NVS

Sachin Jain

Bank of America

3 questions for NVS

Steve Scala

Cowen

3 questions for NVS

Emily Field

Barclays

2 questions for NVS

James Gordon

JPMorgan Chase & Co.

2 questions for NVS

Michael Lyson

Jefferies Financial Group Inc.

2 questions for NVS

Richard Foster

JPMorgan Chase & Co.

2 questions for NVS

Richard Parkes

BNP Paribas Exane

2 questions for NVS

Sachin Dean

Bank of America Corporation

2 questions for NVS

Shirley Tan

Barclays PLC

2 questions for NVS

Steven Scala

TD Cowen

2 questions for NVS

Steven Skiena

The Toronto-Dominion Bank

2 questions for NVS

Eric Le Berrigaud

Stifel

1 question for NVS

Etzer Darout

BMO Capital Markets

1 question for NVS

Graham Parry

Bank of America

1 question for NVS

Harry Sephton

UBS

1 question for NVS

Jo Walton

UBS

1 question for NVS

Mark Purcell

Morgan Stanley

1 question for NVS

Michael Nedelcovych

TD Cowen

1 question for NVS

Naresh Chouhan

Intrinsic Health

1 question for NVS

Peter Welford

Jefferies

1 question for NVS

Shirley Chen

Barclays

1 question for NVS

Timothy Anderson

BofA Securities

1 question for NVS

Recent press releases and 8-K filings for NVS.

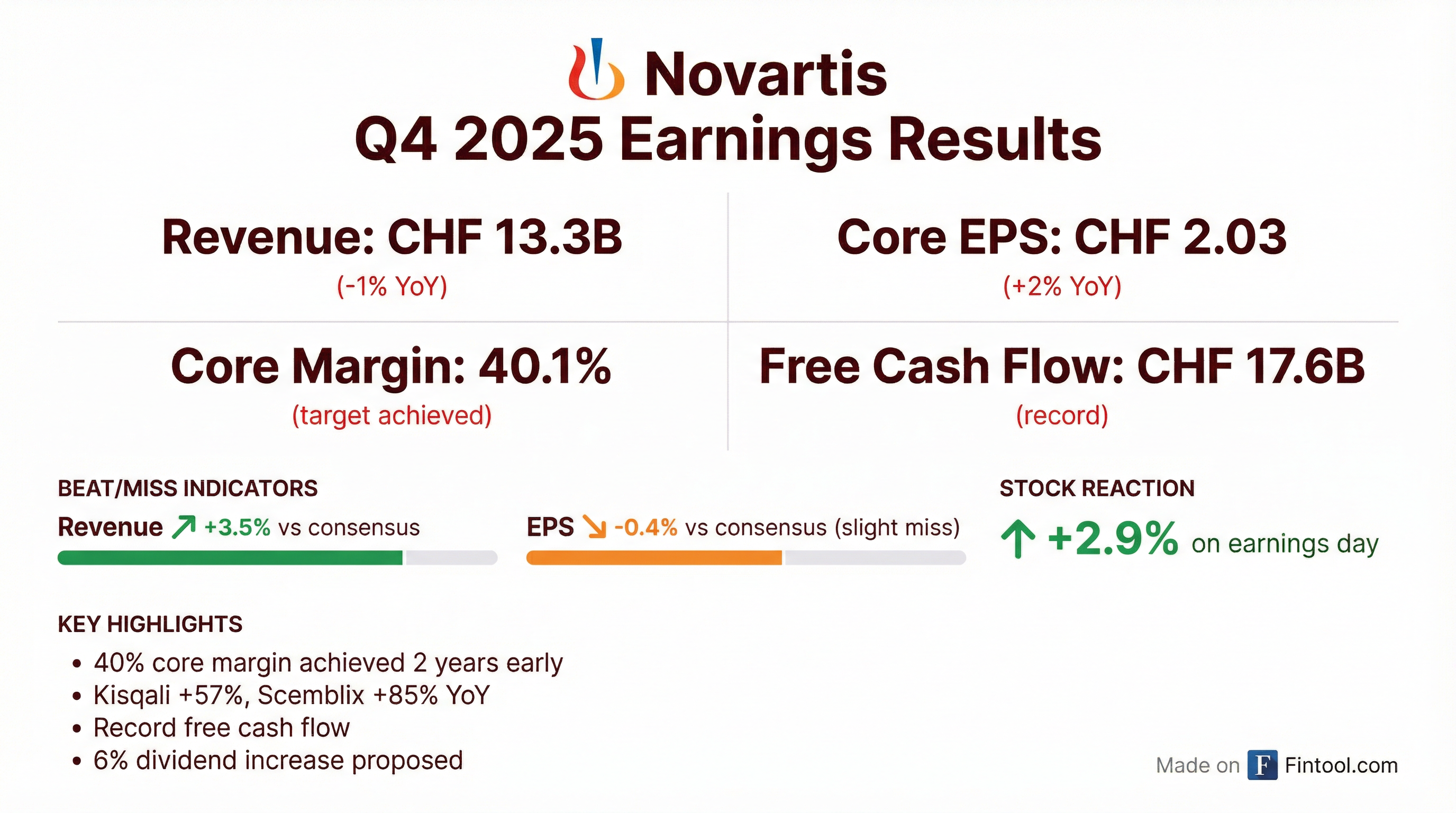

- Novartis delivered strong full-year 2025 results, with sales up 8% and core operating income up 14%, achieving its 40.1% core margin goal two years ahead of schedule.

- Key growth brands significantly contributed to performance, including Kisqali (up 57% to CHF 4.8 billion), Kesimpta (up 36% to $4.4 billion), and Scemblix (up 85%).

- For 2026, the company expects low single-digit sales growth and a low single-digit decline in core operating income, anticipating a stronger second half after initial impacts from generic entries.

- Novartis maintains confidence in a 5%-6% sales CAGR for the 2025-2030 period and aims to return to 40%+ core margin by 2029.

- The company also announced a CFO transition, with Harry Kirsch stepping down and Mukul Mehta taking over in mid-March.

- Novartis delivered high single-digit growth in 2025, with full-year sales up 8% and core operating income up 14%, achieving a 40.1% core margin two years ahead of plan.

- For Q4 2025, sales declined 1% and core operating income increased 1%, impacted by gross-to-net adjustments and Entresto LOE, though underlying Q4 sales growth would have been positive 3% excluding these adjustments.

- The company achieved its upgraded full-year 2025 guidance and expects a 5%-6% sales CAGR from 2025-2030, driven by strong performance from key growth brands such as Kisqali (up 57% full year), Kesimpta (up 36% full year), Scemblix (up 85% full year), and Pluvicto (up 42% constant currency full year).

- Novartis is proposing a dividend of CHF 3.70 per share, representing a 6% increase, marking its 29th consecutive dividend increase.

- Harry Kirsch will transition from his role as Chief Financial Officer, with Mukul Mehta taking over in mid-March 2026.

- Novartis delivered strong full-year 2025 financial results, with 8% sales growth, 14% core operating income growth, $8.98 core EPS (up 17%), and CHF 17.6 billion in free cash flow (up 8%), achieving a 40.1% core margin.

- For 2026, the company expects low single-digit sales growth and a low single-digit decline in core operating income, primarily due to the impact of US generic entries and a 1-2 percentage point core margin dilution from the Avidity deal. The year is anticipated to have a weaker first half followed by a stronger second half.

- The company continues its commitment to shareholder returns, proposing a CHF 3.70 per share dividend (a 6% increase and its 29th consecutive increase) and having CHF 7.7 billion remaining in its CHF 10 billion share buyback program.

- Key product updates include the US approval of Itvisma, which has a total sales potential of $3 billion+ and is expected to ramp up quickly over the next 2-3 years. Additionally, Pelabresib showed strong Phase 3 data, leading to an agreement with the EU to file in 2026.

- Harry Kirsch will be stepping down as CFO, with Mukul Mehta taking over the role.

- Novartis reported full year 2025 net sales of USD 54.5 billion, an 8% increase (8% cc), with core operating income up 14% (cc) to USD 21.9 billion and core EPS of USD 8.98, up 17% (cc).

- Free cash flow for full year 2025 was USD 17.6 billion, an 8% increase, while Q4 2025 free cash flow decreased by 54% to USD 1.7 billion.

- The company provided 2026 guidance expecting net sales to grow low single-digit and core operating income to decline low single-digit, incorporating the impact of an agreement with the US government on drug prices.

- In 2025, Novartis repurchased 77.6 million shares for USD 8.9 billion and proposed a dividend of CHF 3.70 per share for 2025, an increase of 5.7%. Net debt increased to USD 21.9 billion at December 31, 2025.

- Novartis reported strong financial performance, with 7% sales growth and 15% core operating income growth, achieving a 38.7% core operating margin by 2024 and generating $16 billion in free cash flow through Q3 2025.

- The company provided long-term guidance, targeting high single-digit growth for 2024-2025, 5%-6% growth to 2030, and aiming for a 40% core operating margin by 2029.

- Novartis is pursuing a pure-play medicines strategy, underpinned by a deep pipeline featuring 14 in-market blockbusters and 15 submission-enabling readouts in the next two years. Notable assets like Kisqali are now projected for $10 billion+ peak sales, and Scemblix for $4 billion+.

- Capital allocation priorities include consistently growing dividends, completing a $10 billion share buyback this year, and strategic bolt-on acquisitions such as the proposed acquisition of Avidity.

- Novartis reported strong financial performance, achieving a 38.7% core operating margin in 2024 and generating $16 billion in free cash flow in both the last year and through Q3 2025.

- The company provided long-term guidance of high single-digit growth for 2024-2025 and 5%-6% growth to 2030, with an expectation of 1%-2% short-term margin dilution in 2026 from the Avidity acquisition, aiming to return to a 40% core margin by 2029.

- Novartis highlighted a robust pipeline with 14 in-market blockbusters and 15 submission-enabling readouts in the next two years , with key products like Kisqali now projected as a $10 billion plus medicine and Pluvicto with a $5 billion plus outlook.

- Capital allocation priorities include investing in organic growth, value-creating bolt-ons, consistently growing dividends, and completing a $15 billion share buyback program, with $10 billion expected to be ongoing this year.

- Novartis reported strong financial performance, with 7% sales and 15% core operating income growth, achieving a 38.7% core operating margin by 2024, and generated $16 billion in free cash flow last year and through Q3 2025.

- The company projects 5%-6% growth to 2030, aiming for $60 billion-$80 billion in revenue by the mid-next decade, and anticipates returning to a 40% core operating margin by 2029 after a 1%-2% short-term dilution in 2026 from the Avidity acquisition.

- Novartis is committed to capital allocation through value-creating bolt-ons, including the proposed acquisition of Avidity, consistently growing its dividend, and completing a $10 billion share buyback.

- The pipeline features 14 in-market blockbusters and several drugs with multi-billion-dollar peak sales potential, including Kisqali ($10 billion+), Scemblix ($4 billion+), Itivisma, Remibrutinib, and Ianalumab, with Pelabresib expected to be filed in Europe in 2026.

- Novartis has entered a global licensing and collaboration agreement with China-based biotechnology company SciNeuro Pharmaceuticals.

- Novartis gains exclusive worldwide rights to SciNeuro’s de novo amyloid-beta antibody program, which uses a proprietary blood-brain barrier shuttle to enhance brain delivery for Alzheimer's disease.

- The agreement is valued at approximately $1.7 billion, including a $165 million upfront payment, research funding, up to $1.5 billion in development/regulatory/commercial milestones, and tiered royalties.

- The collaboration aims to address the unmet need in Alzheimer’s disease, with completion anticipated in the first half of 2026.

- Novotech has appointed Dr. Anand Tharmaratnam as its new CEO, effective January 1, 2026.

- Dr. Tharmaratnam has served as a Novotech board member since 2021 and brings nearly three decades of experience in the international CRO sector.

- The previous CEO, Dr. John Moller, stepped down at the end of 2025 after a nine-year tenure, and is expected to return to Novotech's Board of Directors in 2026.

- This appointment follows Novotech's successful fundraising in March 2025, which attracted new investors GIC and Temasek, alongside continued support from TPG.

- Monte Rosa Therapeutics reported positive interim data from its Phase 1 clinical study of MRT-8102, a NEK7-directed molecular glue degrader for inflammatory conditions.

- In subjects with elevated cardiovascular disease (CVD) risk, MRT-8102 demonstrated an 85% reduction in C-reactive protein (CRP) levels after four weeks, with 94% of participants achieving CRP values below 2 mg/L.

- The study observed a favorable safety profile with mild to moderate adverse events and no increased infection risk.

- The company plans to initiate a Phase 2 ASCVD study in 2026 and anticipates results from the expanded GFORCE-1 study in H2 2026.

Quarterly earnings call transcripts for NOVARTIS.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more